Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Imagine you have $1000 you want to invest. There are two stocks available. Swift corporation's stock is currently selling for $100. The stock price

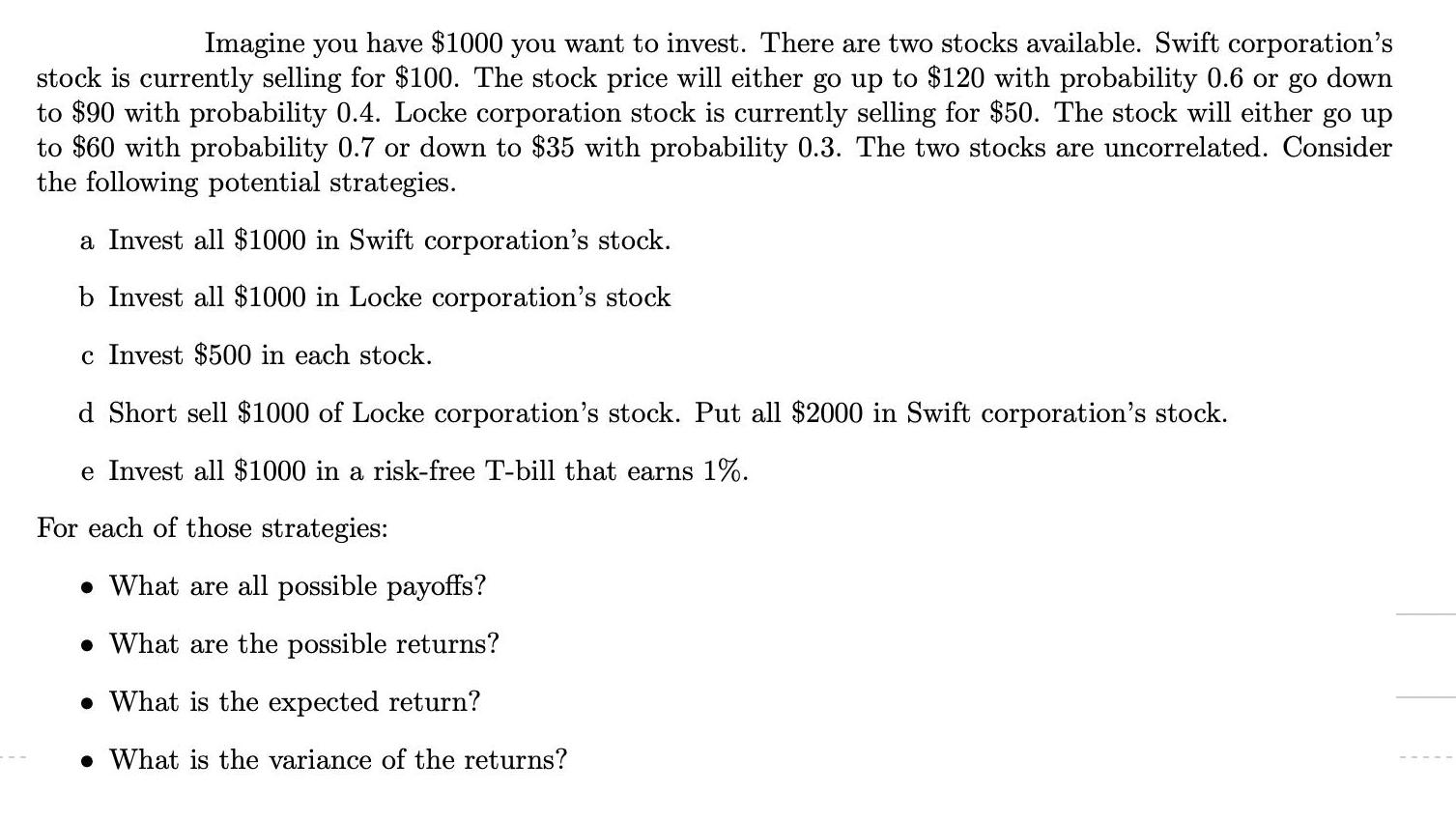

Imagine you have $1000 you want to invest. There are two stocks available. Swift corporation's stock is currently selling for $100. The stock price will either go up to $120 with probability 0.6 or go down to $90 with probability 0.4. Locke corporation stock is currently selling for $50. The stock will either go up to $60 with probability 0.7 or down to $35 with probability 0.3. The two stocks are uncorrelated. Consider the following potential strategies. a Invest all $1000 in Swift corporation's stock. b Invest all $1000 in Locke corporation's stock c Invest $500 in each stock. d Short sell $1000 of Locke corporation's stock. Put all $2000 in Swift corporation's stock. e Invest all $1000 in a risk-free T-bill that earns 1%. For each of those strategies: What are all possible payoffs? What are the possible returns? . What is the expected return? What is the variance of the returns?

Step by Step Solution

★★★★★

3.46 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

Swift Corporation Current price 100 Probability of rising to 120 06 Probability of falling to 90 04 Locke Corporation Current price 50 Probability of rising to 60 07 Probability of falling to 35 03 Th...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started