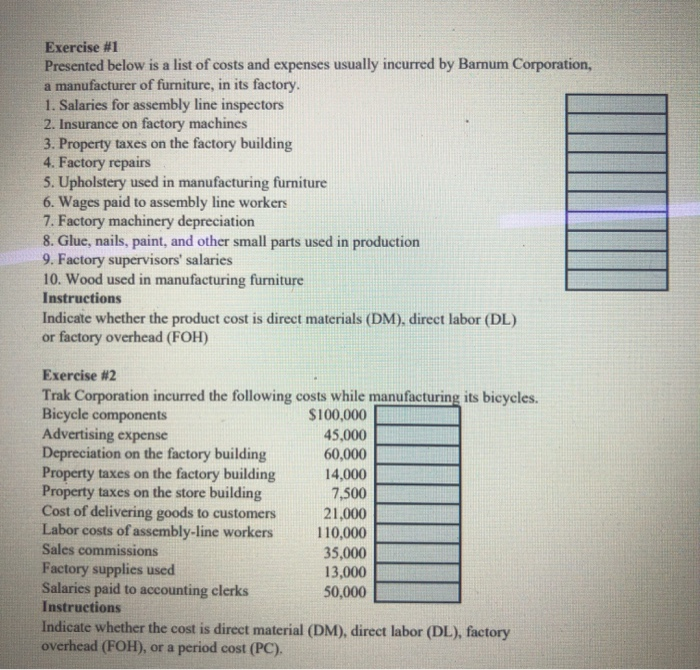

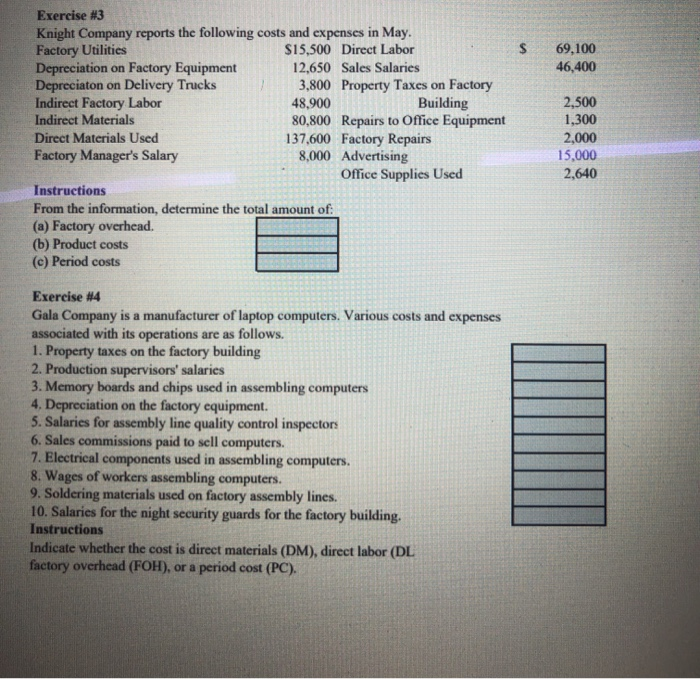

Exercise #1 Presented below is a list of costs and expenses usually incurred by Barum Corporation, a manufacturer of furniture, in its factory. 1. Salaries for assembly line inspectors 2. Insurance on factory machines 3. Property taxes on the factory building 4. Factory repairs 5. Upholstery used in manufacturing furniture 6. Wages paid to assembly line workers 7. Factory machinery depreciation 8. Glue, nails, paint, and other small parts used in production 9. Factory supervisors' salaries 10. Wood used in manufacturing furniture Instructions Indicate whether the product cost is direct materials (DM), direct labor (DL) or factory overhead (FOH) Exercise #2 Trak Corporation incurred the following costs while manufacturing its bicycles. Bicycle components $100,000 Advertising expense 45,000 Depreciation on the factory building 60,000 Property taxes on the factory building 14,000 Property taxes on the store building 7,500 Cost of delivering goods to customers 21,000 Labor costs of assembly-line workers 110,000 Sales commissions 35,000 Factory supplies used 13,000 Salaries paid to accounting clerks 50,000 Instructions Indicate whether the cost is direct material (DM), direct labor (DL), factory overhead (FOH), or a period cost (PC), $ 69,100 46,400 Exercise #3 Knight Company reports the following costs and expenses in May. Factory Utilities $15,500 Direct Labor Depreciation on Factory Equipment 12,650 Sales Salaries Depreciaton on Delivery Trucks 3,800 Property Taxes on Factory Indirect Factory Labor 48,900 Building Indirect Materials 80,800 Repairs to Office Equipment Direct Materials Used 137,600 Factory Repairs Factory Manager's Salary 8,000 Advertising Office Supplies Used Instructions From the information, determine the total amount of (a) Factory overhead. (6) Product costs (c) Period costs 2,500 1,300 2,000 15,000 2,640 Exercise #4 Gala Company is a manufacturer of laptop computers. Various costs and expenses associated with its operations are as follows. 1. Property taxes on the factory building 2. Production supervisors' salaries 3. Memory boards and chips used in assembling computers 4. Depreciation on the factory equipment. 5. Salaries for assembly line quality control inspectors 6. Sales commissions paid to sell computers. 7. Electrical components used in assembling computers. 8. Wages of workers assembling computers. 9. Soldering materials used on factory assembly lines. 10. Salaries for the night security guards for the factory building. Instructions Indicate whether the cost is direct materials (DM), direct labor (DL factory overhead (FOH), or a period cost (PC)