Answered step by step

Verified Expert Solution

Question

1 Approved Answer

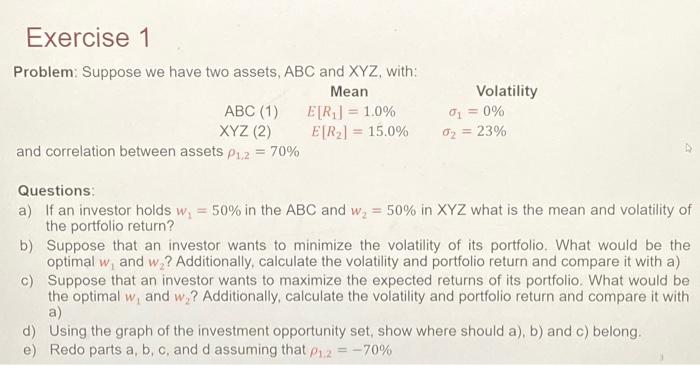

Exercise 1 Problem: Suppose we have two assets, ABC and XYZ, with: Mean E[R] = 1.0% E[R] = 15.0% ABC (1) XYZ (2) and correlation

Exercise 1 Problem: Suppose we have two assets, ABC and XYZ, with: Mean E[R] = 1.0% E[R] = 15.0% ABC (1) XYZ (2) and correlation between assets P1,2 = 70% Questions: a) If an investor holds w the portfolio return? = Volatility 01 0% = 02 = 23% 50% in the ABC and w = 50% in XYZ what is the mean and volatility of b) Suppose that an investor wants to minimize the volatility of its portfolio. What would be the optimal w, and w? Additionally, calculate the volatility and portfolio return and compare it with a) Suppose that an investor wants to maximize the expected returns of its portfolio. What would be the optimal w, and w? Additionally, calculate the volatility and portfolio return and compare it with a) c) d) Using the graph of the investment opportunity set, show where should a), b) and c) belong. e) Redo parts a, b, c, and d assuming that = -70% P1,2

clearly lable each part please. parts A through E

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started