Answered step by step

Verified Expert Solution

Question

1 Approved Answer

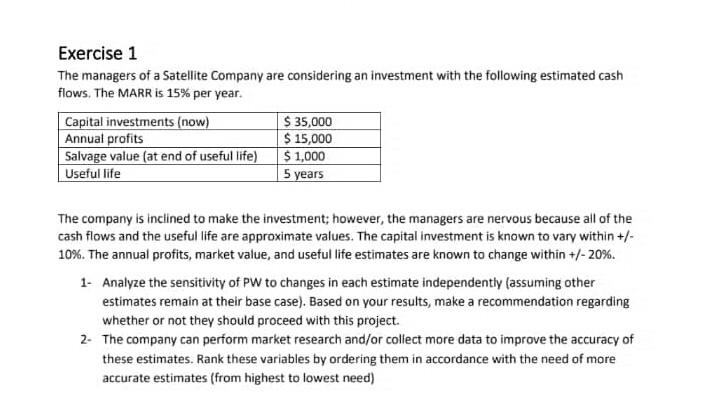

Exercise 1 The managers of a Satellite Company are considering an investment with the following estimated cash flows. The MARR is 15% per year. Capital

Exercise 1 The managers of a Satellite Company are considering an investment with the following estimated cash flows. The MARR is 15% per year. Capital investments (now) $ 35,000 Annual profits $ 15,000 Salvage value (at end of useful life) $1,000 Useful life 5 years The company is inclined to make the investment; however, the managers are nervous because all of the cash flows and the useful life are approximate values. The capital investment is known to vary within +/- 10%. The annual profits, market value, and useful life estimates are known to change within +/-20%. 1. Analyze the sensitivity of PW to changes in each estimate independently (assuming other estimates remain at their base case). Based on your results, make a recommendation regarding whether or not they should proceed with this project. 2- The company can perform market research and/or collect more data to improve the accuracy of these estimates. Rank these variables by ordering them in accordance with the need of more accurate estimates (from highest to lowest need)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started