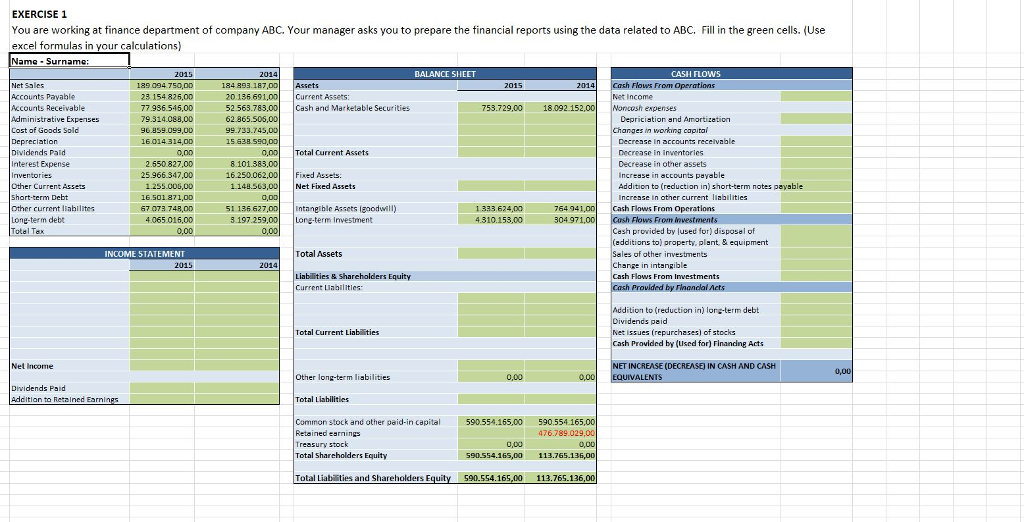

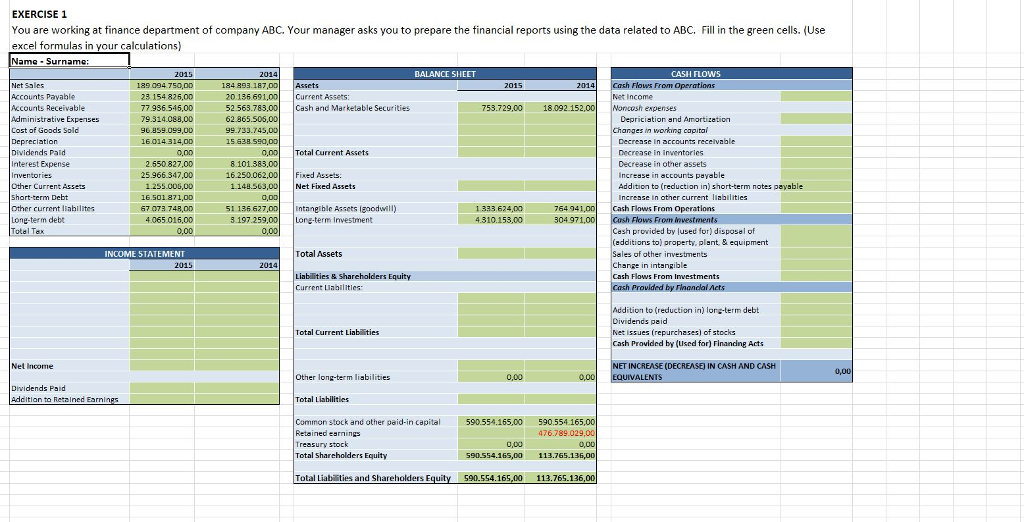

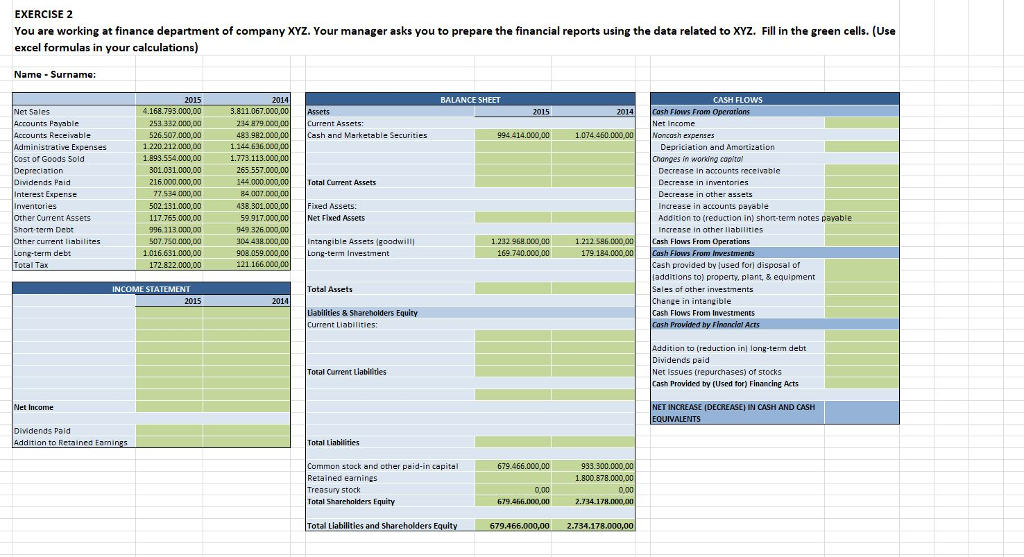

EXERCISE 1 You are working at tinance department of company ABC. Your manager asks you to prepare the tinancial reports using the data related to ABC. Fill in the green cells. (Use excel formulas in your calculations) Name Surname: DALANCE SHEET CASH FLOws Flows From Operations Income 189 084 750,00 23 154 826,00 77.936.545,00 79.314.088,00 96.859.099,00 16.014.314,00 184 893.187 Accounts Payable Accounts Receivable Current Assets: Cash and Marketable Securities 20.136691 52 563.783 62 865.505 99.733.745 15.638.5 729,00 180Noncosh expenses De?r?c?tion and Amortization in woking capital Cost of Goods Sold Depreciation Dividends Paid Interest Expense 0,00 Total Current Assets Decrease in inventories Decrease in other assets Incresse in accounts payable Addition to (reduction in) short-term notes payable Increase in other current liabilities 8101.383 2.550.827,00 25.966.347,00 1.255.00,00 16.501.871,00 67 073 748,0D 4065.016,00 Fixed Assets Net Fixed Assets Other Current Assets Short-term Debt Other current liabilites Long-term debt Total T 51 136 627 3.197.259 Intangible Assets lgoodwill) Lone-term Investment 1.333,624,00764 941 4.310.153,00 804971.00 h rlows From Operatlons Cash Flows From investments provided by lused for) disposel of ditions to) property, plant, & equipment les of other investments INCOME STATEMENT Total Assets in intangible Flows From Investments s & shareholders Equity t Liabilities: Addition to (reduction in) lonc-term debt peid Total Current Liabiities ssues (repurchases) of stocks Provided by (Used for) Financing Acts Net Income INCREASE (DECREASE) IN CASH AND CASH Other long-term liabilities Dividends Paid Adcition to Retained Earnl Common stock and other paid-in capital Retained earnings 590.554.165,00 590.554 165 476.789.029 0,00 shareholders Equity Total Liabiities and Shareholders E 590.554.165 113.765.136 EXERCISE 1 You are working at tinance department of company ABC. Your manager asks you to prepare the tinancial reports using the data related to ABC. Fill in the green cells. (Use excel formulas in your calculations) Name Surname: DALANCE SHEET CASH FLOws Flows From Operations Income 189 084 750,00 23 154 826,00 77.936.545,00 79.314.088,00 96.859.099,00 16.014.314,00 184 893.187 Accounts Payable Accounts Receivable Current Assets: Cash and Marketable Securities 20.136691 52 563.783 62 865.505 99.733.745 15.638.5 729,00 180Noncosh expenses De?r?c?tion and Amortization in woking capital Cost of Goods Sold Depreciation Dividends Paid Interest Expense 0,00 Total Current Assets Decrease in inventories Decrease in other assets Incresse in accounts payable Addition to (reduction in) short-term notes payable Increase in other current liabilities 8101.383 2.550.827,00 25.966.347,00 1.255.00,00 16.501.871,00 67 073 748,0D 4065.016,00 Fixed Assets Net Fixed Assets Other Current Assets Short-term Debt Other current liabilites Long-term debt Total T 51 136 627 3.197.259 Intangible Assets lgoodwill) Lone-term Investment 1.333,624,00764 941 4.310.153,00 804971.00 h rlows From Operatlons Cash Flows From investments provided by lused for) disposel of ditions to) property, plant, & equipment les of other investments INCOME STATEMENT Total Assets in intangible Flows From Investments s & shareholders Equity t Liabilities: Addition to (reduction in) lonc-term debt peid Total Current Liabiities ssues (repurchases) of stocks Provided by (Used for) Financing Acts Net Income INCREASE (DECREASE) IN CASH AND CASH Other long-term liabilities Dividends Paid Adcition to Retained Earnl Common stock and other paid-in capital Retained earnings 590.554.165,00 590.554 165 476.789.029 0,00 shareholders Equity Total Liabiities and Shareholders E 590.554.165 113.765.136