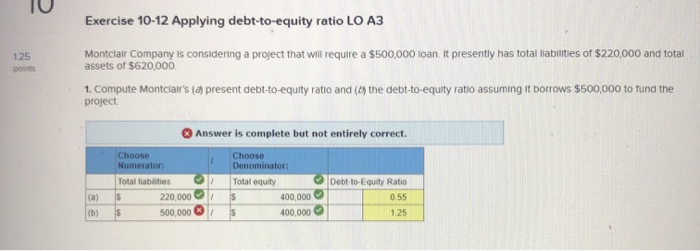

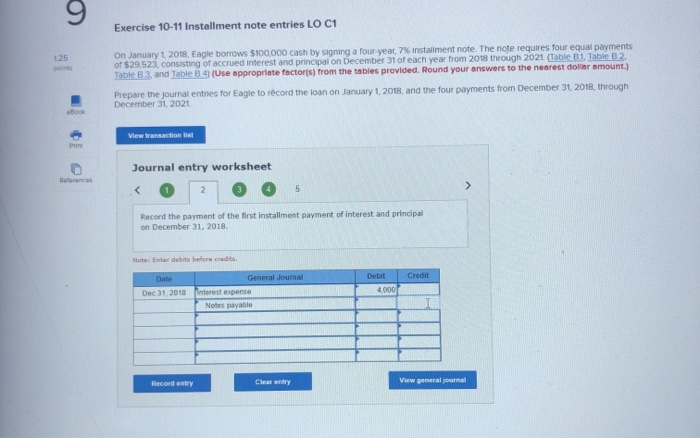

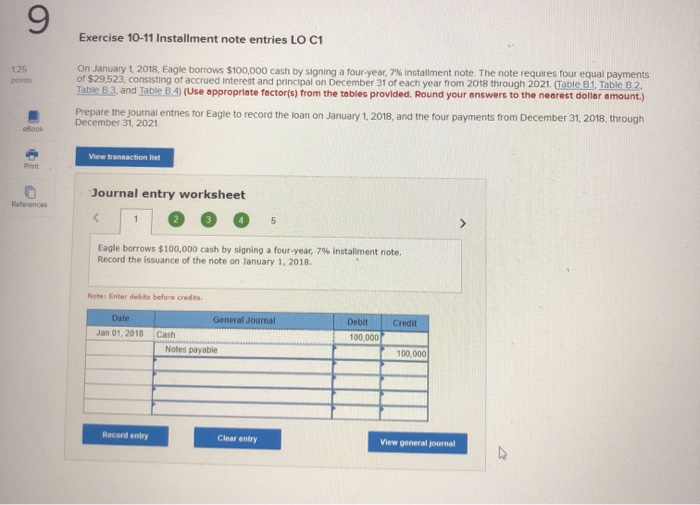

Exercise 10-12 Applying debt-to-equity ratio LO A3 125 points Montclair Company is considering a project that will require a $500,000 loan. It presently has total liabilities of $220,000 and total assets of $620.000 1. Compute Montclair's la present debt-to-equity ratio and (b) the debt-to-equity ratio assuming it borrows $500,000 to fund the project Answer is complete but not entirely correct. Choose Numerator Choose Denominator: Total liables Total equity Debt-to-Equity Ratio 0.55 220,000 500,000 400,000 400,000 (b) 1.25 Exercise 10-11 Installment note entries LO C1 On January 1 2018 Eagle borrows $100 000 cash by signing a four year installment note. The note requires four equal payments of 529 523 consisting of accrued interest and principal on December 31 of each year from 2018 through 2021 Tablet Table B 2 Table 3. and Table34 (Use appropriate factors from the tables provided. Round your answers to the nearest dollar amount.) Prepare the journal entries for Eagle to record the loan on January 1, 2018, and the four payments from December 31, 2018, through December 31, 2021 View transaction lit Journal entry worksheet Record the payment of the first installment payment of interest and principal on December 31, 2018 General Journal Antarest expense Dec 31, 2018 Notes payable Record entry Clear entry Viw al journal o Exercise 10-11 Installment note entries LO C1 1.25 On January 1, 2018, Eagle borrows $100,000 cash by signing a four year, 7% installment note. The note requires four equal payments of $29,523, consisting of accrued interest and principal on December 31 of each year from 2018 through 2021. Table B1, Table B2 Table 8. 3. and Table B. 4) (Use appropriate factor(s) from the tables provided. Round your answers to the nearest dollar amount.) Prepare the journal entries for Eagle to record the loan on January 1, 2018, and the four payments from December 31, 2018, through December 31, 2021 lon. View transaction list Journal entry worksheet References Eagle borrows $100,000 cash by signing a four-year, 7% installment note. Record the issuance of the note on January 1, 2018 Note: Enter debits before credits General Journal Debit Credit Jan 01. 2018 Cash 100.000 Notes payable 100.000 Record entry Clear entry View general journal