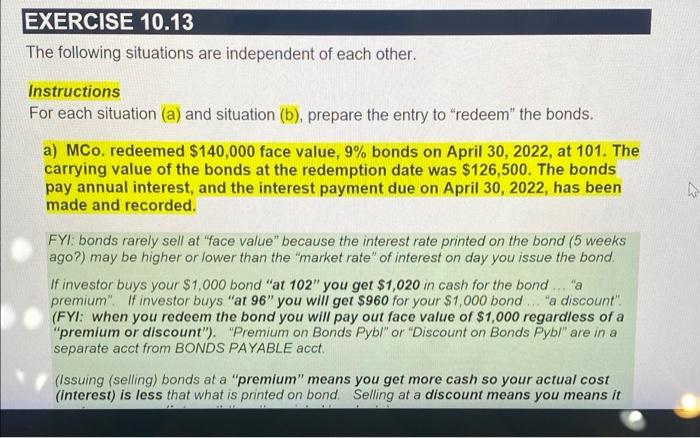

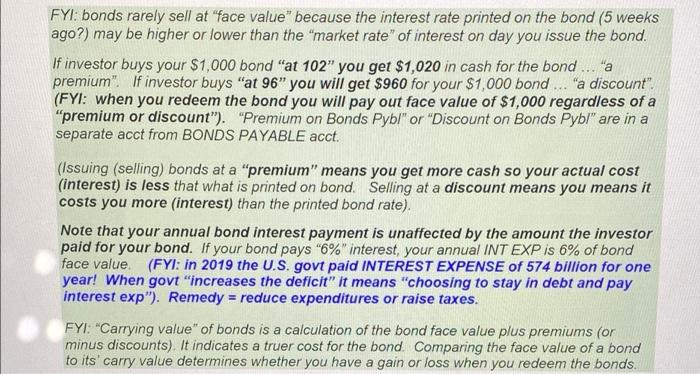

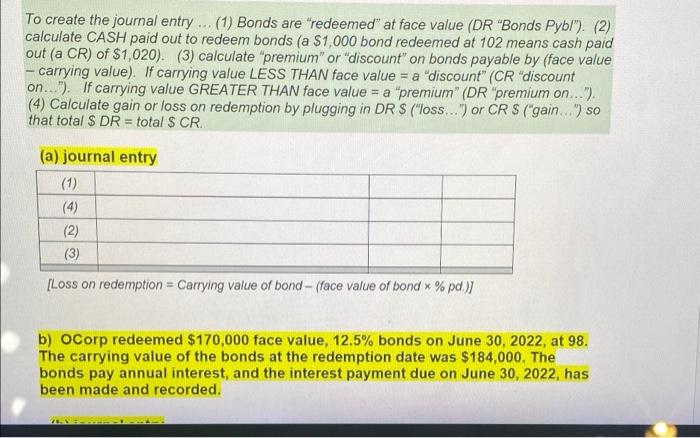

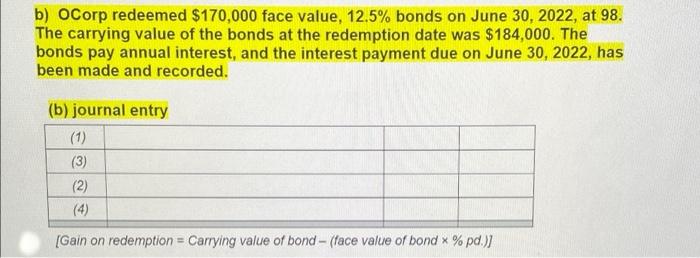

EXERCISE 10.13 The following situations are independent of each other. Instructions For each situation (a) and situation (b), prepare the entry to "redeem" the bonds. a) MCo. redeemed $140,000 face value, 9% bonds on April 30, 2022, at 101. The carrying value of the bonds at the redemption date was $126,500. The bonds pay annual interest, and the interest payment due on April 30, 2022, has been made and recorded. w FYI: bonds rarely sell at "face value" because the interest rate printed on the bond (5 weeks ago?) may be higher or lower than the market rate" of interest on day you issue the bond. If investor buys your $1,000 bond "at 102" you get $1,020 in cash for the bond ... " premium". If investor buys "at 96" you will get $960 for your $1,000 bond ... "a discount". (FYI: when you redeem the bond you will pay out face value of $1,000 regardless of a "premium or discount"). "Premium on Bonds Pybl" or "Discount on Bonds Pybl" are in a separate acct from BONDS PAYABLE acct. (Issuing (selling) bonds at a "premium" means you get more cash so your actual cost (interest) is less that what is printed on bond Selling at a discount means you means it FYI: bonds rarely sell at "face value" because the interest rate printed on the bond (5 weeks ago?) may be higher or lower than the market rate" of interest on day you issue the bond. If investor buys your $1,000 bond "at 102" you get $1,020 in cash for the bond .. " premium". If investor buys "at 96" you will get $960 for your $1,000 bond ... "a discount". (FYI: when you redeem the bond you will pay out face value of $1,000 regardless of a "premium or discount"). "Premium on Bonds Pybl" or "Discount on Bonds Pybl" are in a separate acct from BONDS PAYABLE acct. (Issuing (selling) bonds at a "premium" means you get more cash so your actual cost (interest) is less that what is printed on bond. Selling at a discount means you means it costs you more interest) than the printed bond rate). Note that your annual bond interest payment is unaffected by the amount the investor paid for your bond. If your bond pays "6%" interest, your annual INT EXP is 6% of bond face value. (FYI: in 2019 the U.S. govt paid INTEREST EXPENSE of 574 billion for one year! When govt "increases the deficit" it means "choosing to stay in debt and pay interest exp'). Remedy = reduce expenditures or raise taxes. FYI: "Carrying value" of bonds is a calculation of the bond face value plus premiums (or minus discounts). It indicates a truer cost for the bond. Comparing the face value of a bond to its' carry value determines whether you have a gain or loss when you redeem the bonds. To create the journal entry ... (1) Bonds are "redeemed" at face value (DR "Bonds Pyb/"). (2) calculate CASH paid out to redeem bonds (a $1,000 bond redeemed at 102 means cash paid out (a CR) of $1,020). (3) calculate "premium" or "discount" on bonds payable by (face value carrying value). If carrying value LESS THAN face value = a "discount" (CR "discount on..."). If carrying value GREATER THAN face value = a "premium" (DR "premium on..."). (4) Calculate gain or loss on redemption by plugging in DR $("loss...") or CR $ ("gain...") so that total $ DR = total $ CR. = (a) journal entry (1) (4) (3) [Loss on redemption = Carrying value of bond - (face value of bond * % pd)) b) OCorp redeemed $170,000 face value, 12.5% bonds on June 30, 2022, at 98. The carrying value of the bonds at the redemption date was $184,000. The bonds pay annual interest, and the interest payment due on June 30, 2022, has been made and recorded. b) OCorp redeemed $170,000 face value, 12.5% bonds on June 30, 2022, at 98. The carrying value of the bonds at the redemption date was $184,000. The bonds pay annual interest, and the interest payment due on June 30, 2022, has been made and recorded. (b) journal entry (1) (3) (2) (4) [Gain on redemption = Carrying value of bond - (face value of bond * % pd.)]