Question

Exercise 10-15A Straight-line amortization of a bond premium LO 10-5 {The following information applies to the questions displayed below.] The Square Foot Grill, Inc. issued

Exercise 10-15A Straight-line amortization of a bond premium LO 10-5

{The following information applies to the questions displayed below.] The Square Foot Grill, Inc. issued $230,000 of 10-year, 6 percent bonds on July 1, Year 1, at 104. Interest is payable in cash semiannually on June 30 and December 31. The straight-line method is used for amortization.

Exercise 10-15A Part a

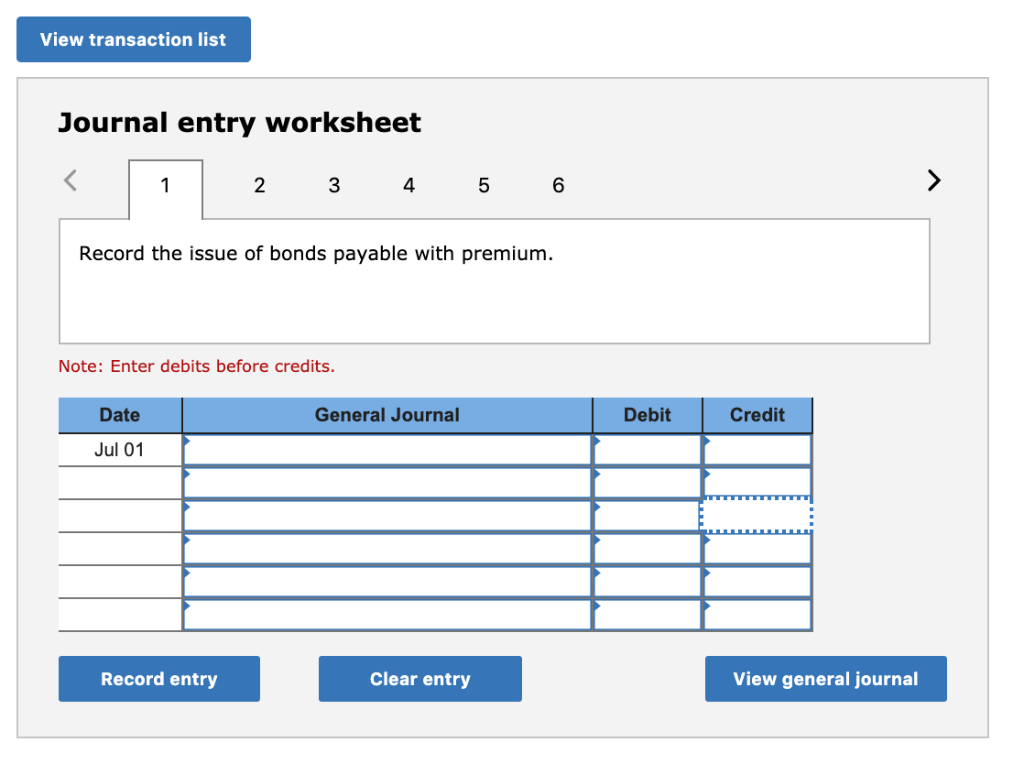

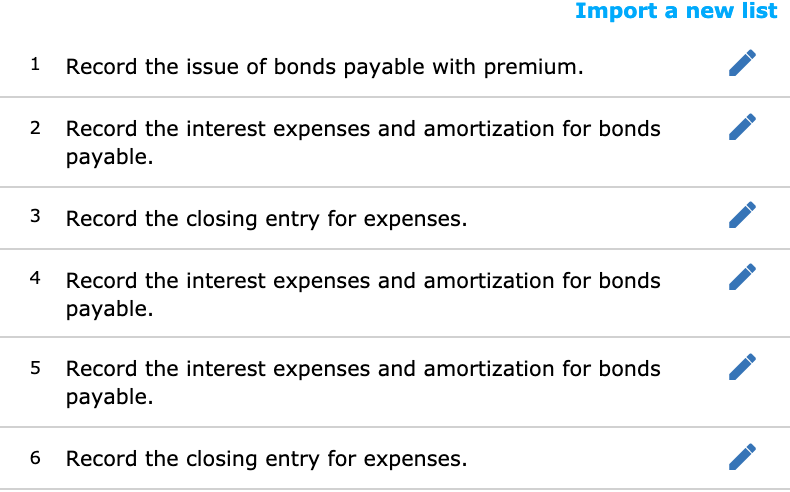

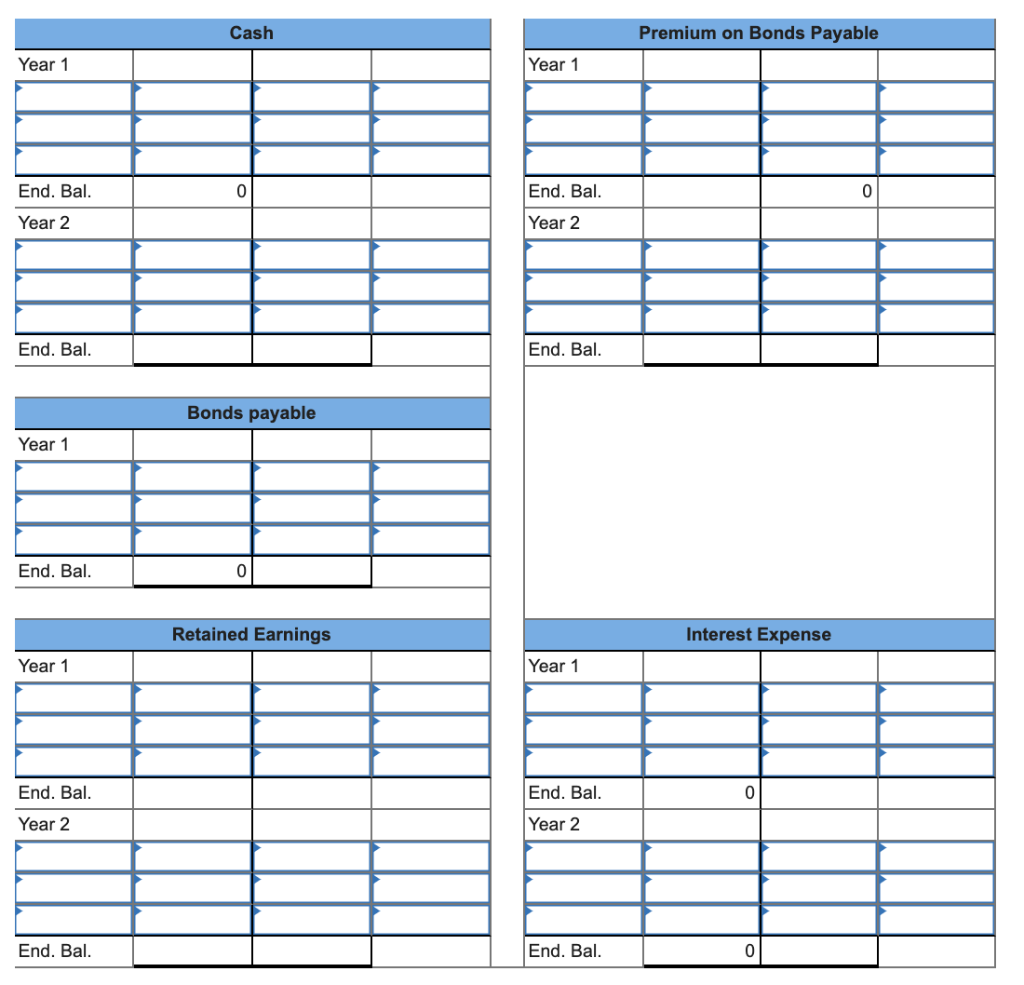

Required a. Prepare the journal entries to record issuing the bonds and any necessary journal entries for Year 1 and Year 2. Post the journal entries to T-accounts. Prepare any necessary closing entries for Year 1. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.)

PLEASE SHOW ALL WORK

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started