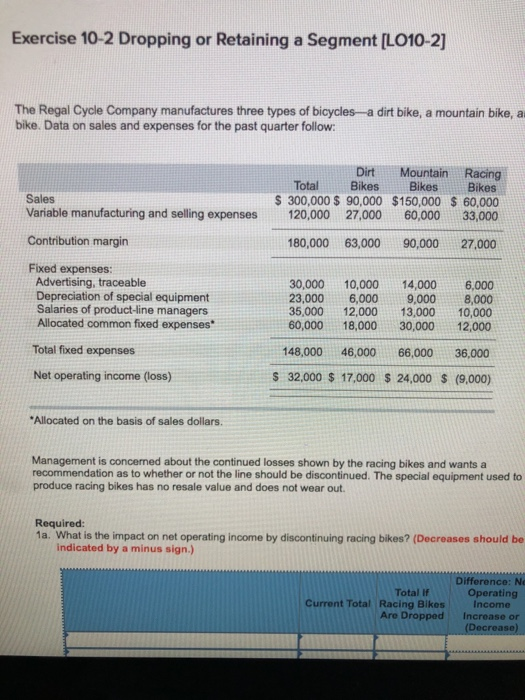

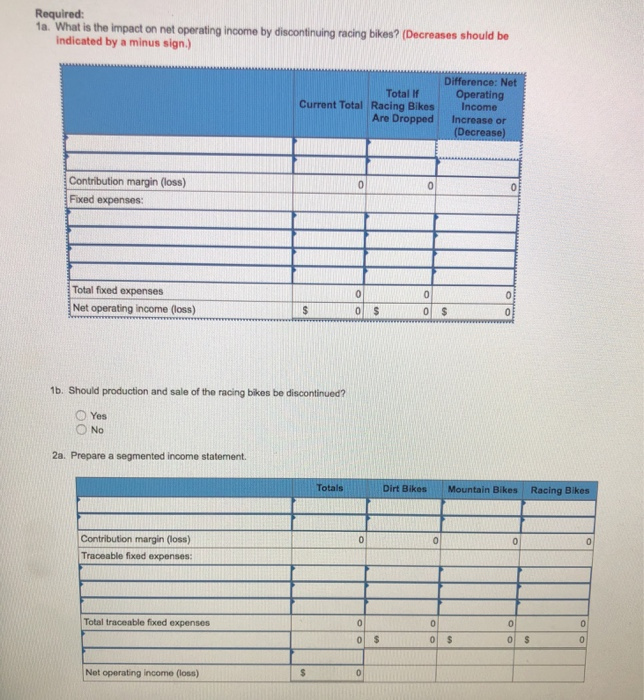

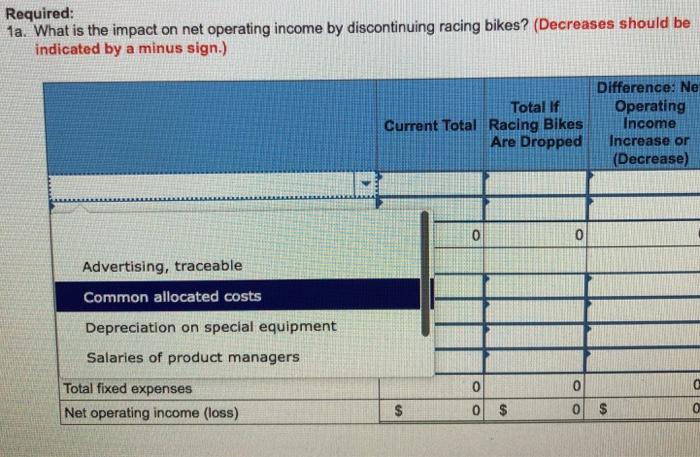

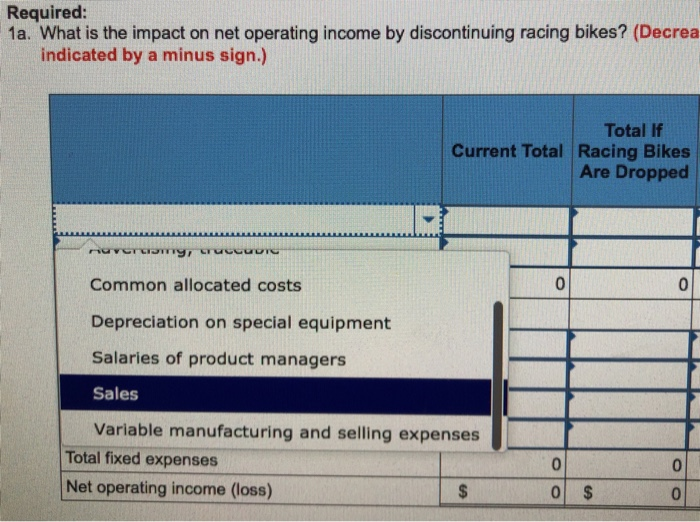

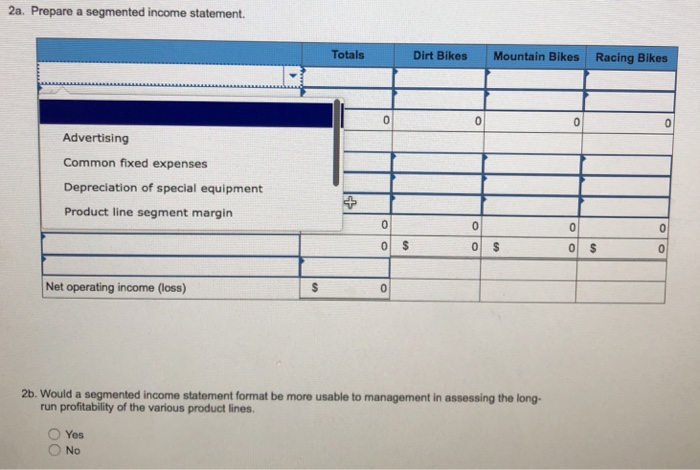

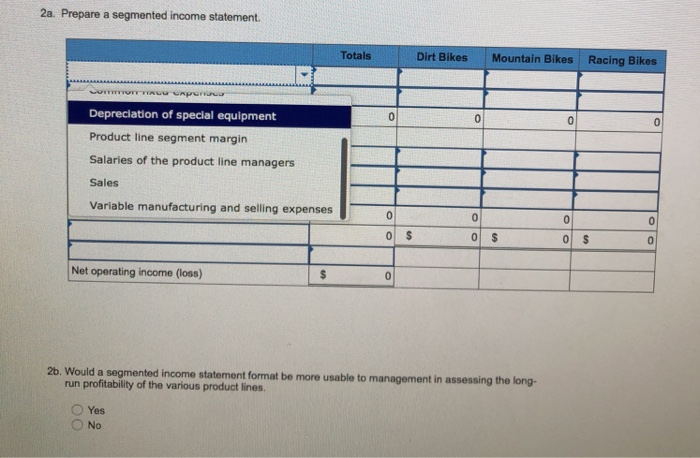

Exercise 10-2 Dropping or Retaining a Segment [LO10-2] The Regal Cycle Company manufactures three types of bicycles-a dirt bike, a mountain bike, a bike. Data on sales and expenses for the past quarter follow: Dirt Mountain Racing Total Bikes Bikes Bikes S 300,000$ 90,000 $150,000 60,000 Variable manufacturing and selling expenses 120,000 27,000 60,000 33,000 Sales Contribution margin 180,000 63,000 90,000 27,000 Fixed expenses: Advertising, traceable Depreciation of special equipment Salaries of product-line managers Allocated common fixed expenses 30,000 10,00014,0006,000 23,000 6,0009,0008,000 35,000 12,00013,00010,000 60,000 18,000 30,000 12,000 Total fixed expenses 148,000 46,000 66,000 36,000 Net operating income (loss) s 32.000 $ 17,000 $ 24,000 (9.000) Allocated on the basis of sales dollars. Management is concemed about the continued losses shown by the racing bikes and wants a recommendation as to whether or not the line should be discontinued. The special equipment used to produce racing bikes has no resale value and does not wear out. Required: 1a. What is the impact on net operating income by discontinuing racing bikes? (Decreases should be indicated by a minus sign.) Difference: Ne Operating Income Increase or Decrease) Total If Current Total Racing Bikes Are Dropped Required 1a What is the impact on net operating f income by discontinuing racing bikes? (Decreases should be indicated by a minus sign.) Difference: Net If Operating Current Total Racing Bikes Income Are Dropped Increase or Contribution margin (loss) Fixed expenses: Total fixed expenses Net operating income (loss) 1b. Should production and sale of the racing bikes be discontinued? Yes O No 2a. Prepare a segmented income statement. Totals Dirt Bikes Mountain Bikes Racing Bikes Contribution margin (loss) Traceable fixed expenses: Total traceable fixed expenses Not operating income (loss) Required: 1a. What is the impact on net operating income by discontinuing racing bikes? (Decreases should be indicated by a minus sign.) Difference: Ne Operating Total If Current Total Racing BikesIncome Are Dropped Increase or (Decrease) 0 0 Advertising, traceable Common allocated costs Depreciation on special equipment Salaries of product managers 0 0 Total fixed expenses Net operating income (loss) Required: 1a. What is the impact on net operating income by discontinuing racing bikes? (Decrea indicated by a minus sign.) Total If Current Total Racing Bikes Are Dropped 0 Common allocated costs Depreciation on special equipment Salaries of product managers Sales Variable manufacturing and selling expenses Total fixed expenses Net operating income (loss) 0 2a. Prepare a segmented income statement Totals Dirt Bikes Mountain Bikes Racing Bikes Advertising Common fixed expenses Depreciation of special equipment Product line segment margin O S 0 Net operating income (loss) 2b. Would a segmented income statement format be more usable to management in assessing the long- run profitability of the various product lines Yes O No 2a. Prepare a segmented income statement. Totals Dirt Bikes Mountain Bikes Racing Bikes Depreciation of special equipment Product line segment margin Salaries of the product line managers Sales Variable manufacturing and selling expenses 0 Net operating income (loss) 2b. Would a segmented income statoment format be more usable to management in assessing the long- run profitability of the various product lines O Yes O No