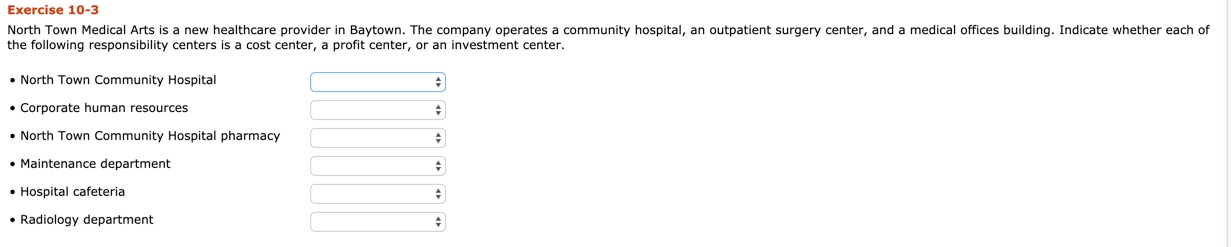

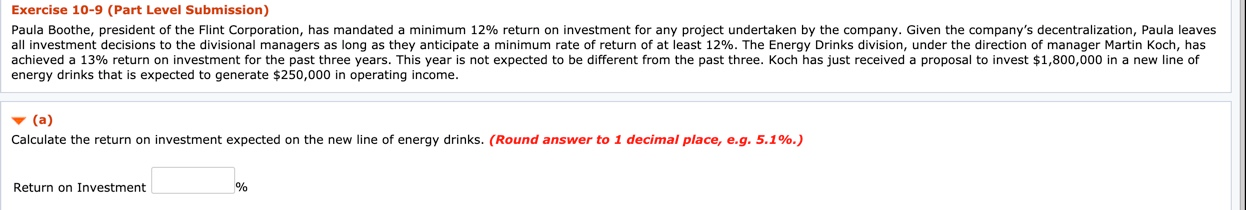

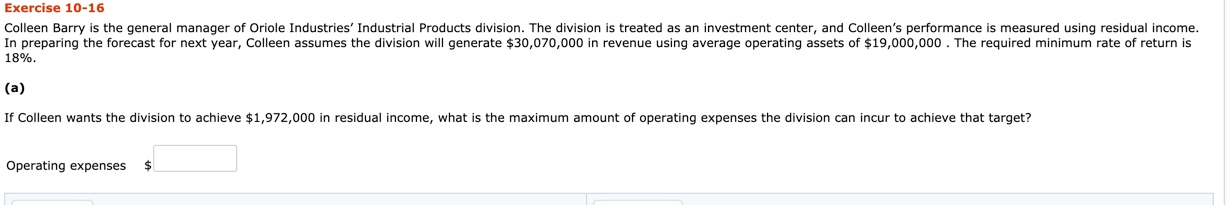

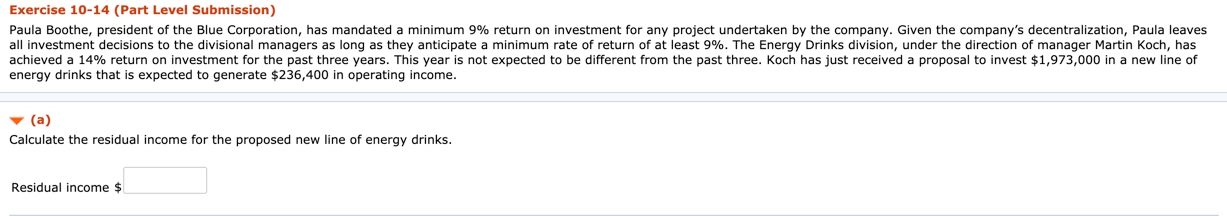

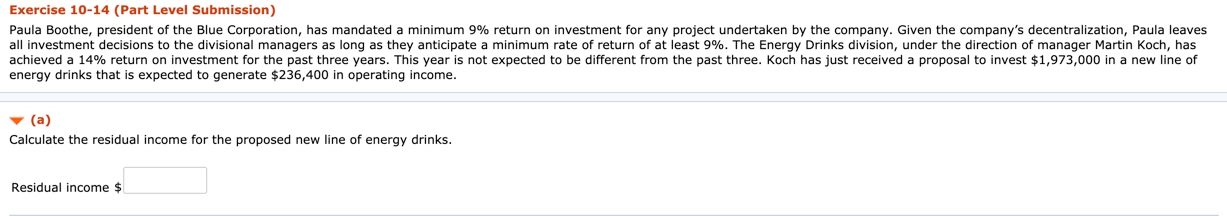

Exercise 10-3 North Town Medical Arts is a new healthcare provider in Baytown. The company operates a community hospital, an outpatient surgery center, and a medical offices building. Indicate whether each of the following responsibility centers is a cost center, a profit center, or an investment center. North Town Community Hospital Corporate human resources North Town Community Hospital pharmacy Maintenance department Hospital cafeteria Radiology department Exercise 10-9 (Part Level Submission) Paula Boothe, president of the Flint Corporation, has mandated a minimum 12% return on investment for any project undertaken by the company. Given the company's decentralization, Paula leaves all investment decisions to the divisional managers as long as they anticipate a minimum rate of return of at least 12%. The Energy Drinks division, under the direction of manager Martin Koch, has achieved a 13% return on investment for the past three years. This year is not expected to be different from the past three. Koch has just received a proposal to invest $1,800,000 in a new line of energy drinks that is expected to generate $250,000 in operating income. (a) Calculate the return on investment expected on the new line of energy drinks. (Round answer to 1 decimal place, e.g. 5.1%.) Return on Investment Exercise 10-16 Colleen Barry is the general manager of Oriole Industries' Industrial Products division. The division is treated as an investment center, and Colleen's performance is measured using residual income. In preparing the forecast for next year, Colleen assumes the division will generate $30,070,000 in revenue using average operating assets of $19,000,000. The required minimum rate of return is 18%. (a) If Colleen wants the division to achieve $1,972,000 in residual income, what is the maximum amount of operating expenses the division can incur to achieve that target? Operating expenses $ Exercise 10-14 (Part Level Submission) Paula Boothe, president of the Blue Corporation, has mandated a minimum 9% return on investment for any project undertaken by the company. Given the company's decentralization, Paula leaves all investment decisions to the divisional managers as long as they anticipate a minimum rate of return of at least 9%. The Energy Drinks division, under the direction of manager Martin Koch, has achieved a 14% return on investment for the past three years. This year is not expected to be different from the past three. Koch has just received a proposal to invest $1,973,000 in a new line of energy drinks that is expected to generate $236,400 in operating income. (a) Calculate the residual income for the proposed new line of energy drinks. Residual income $