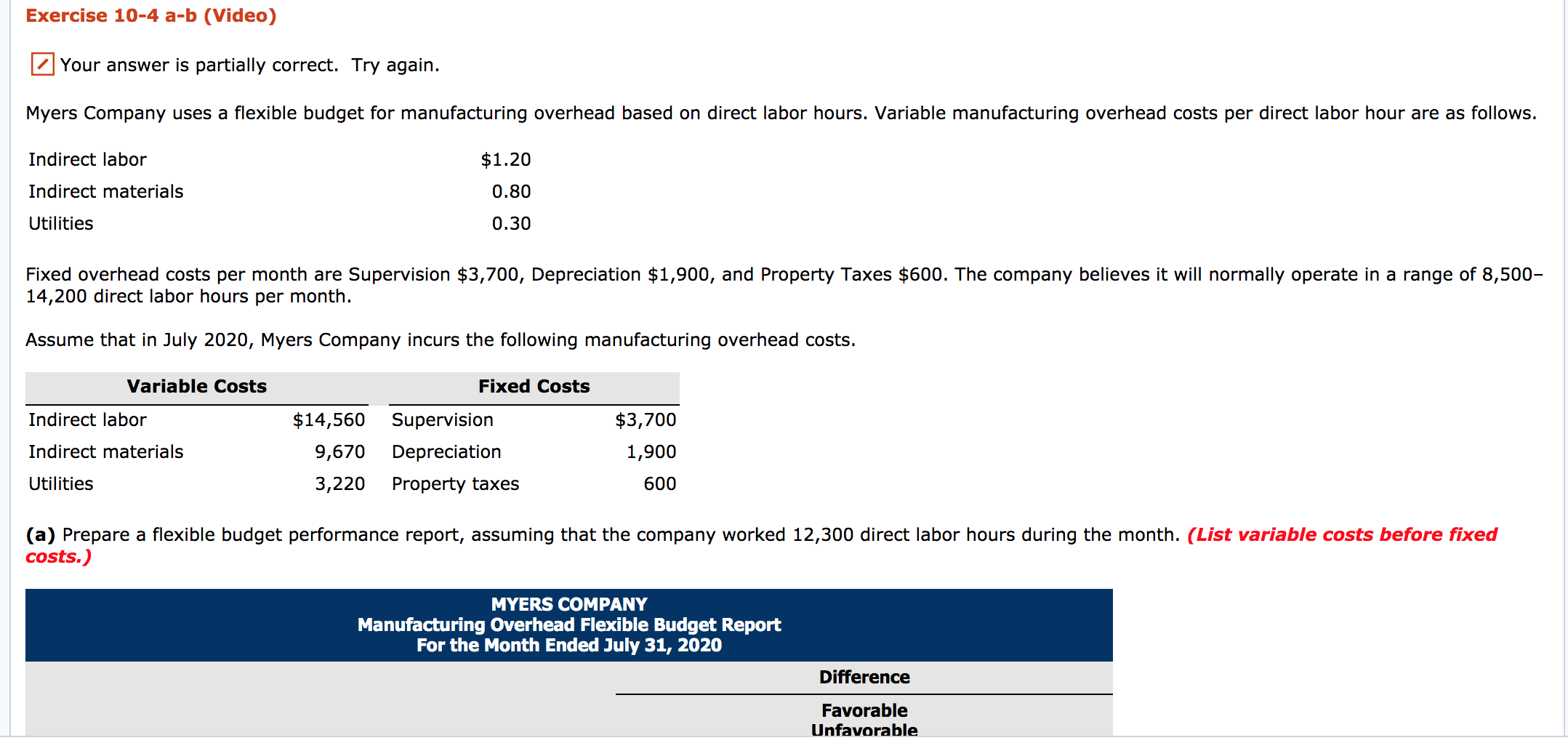

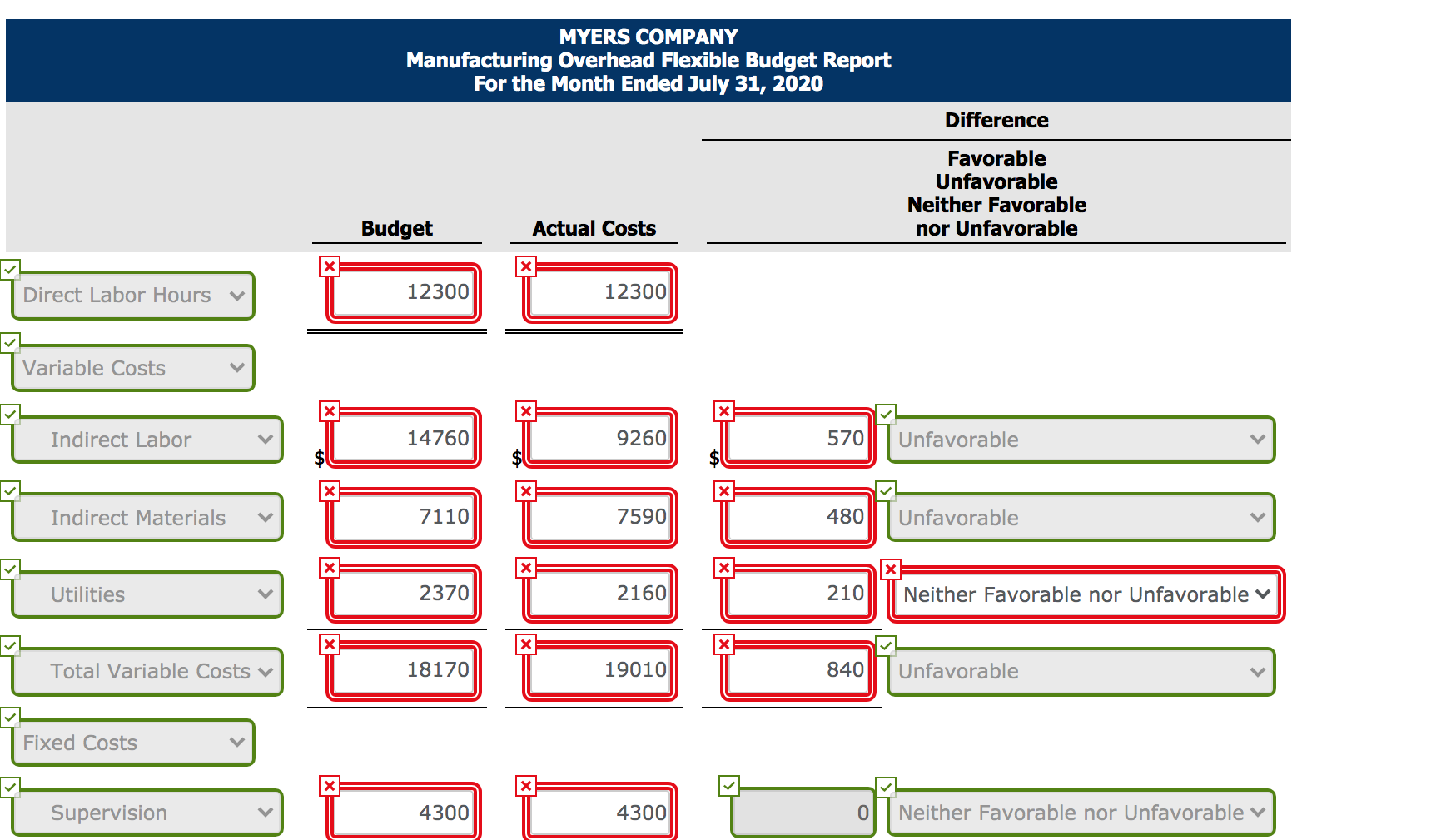

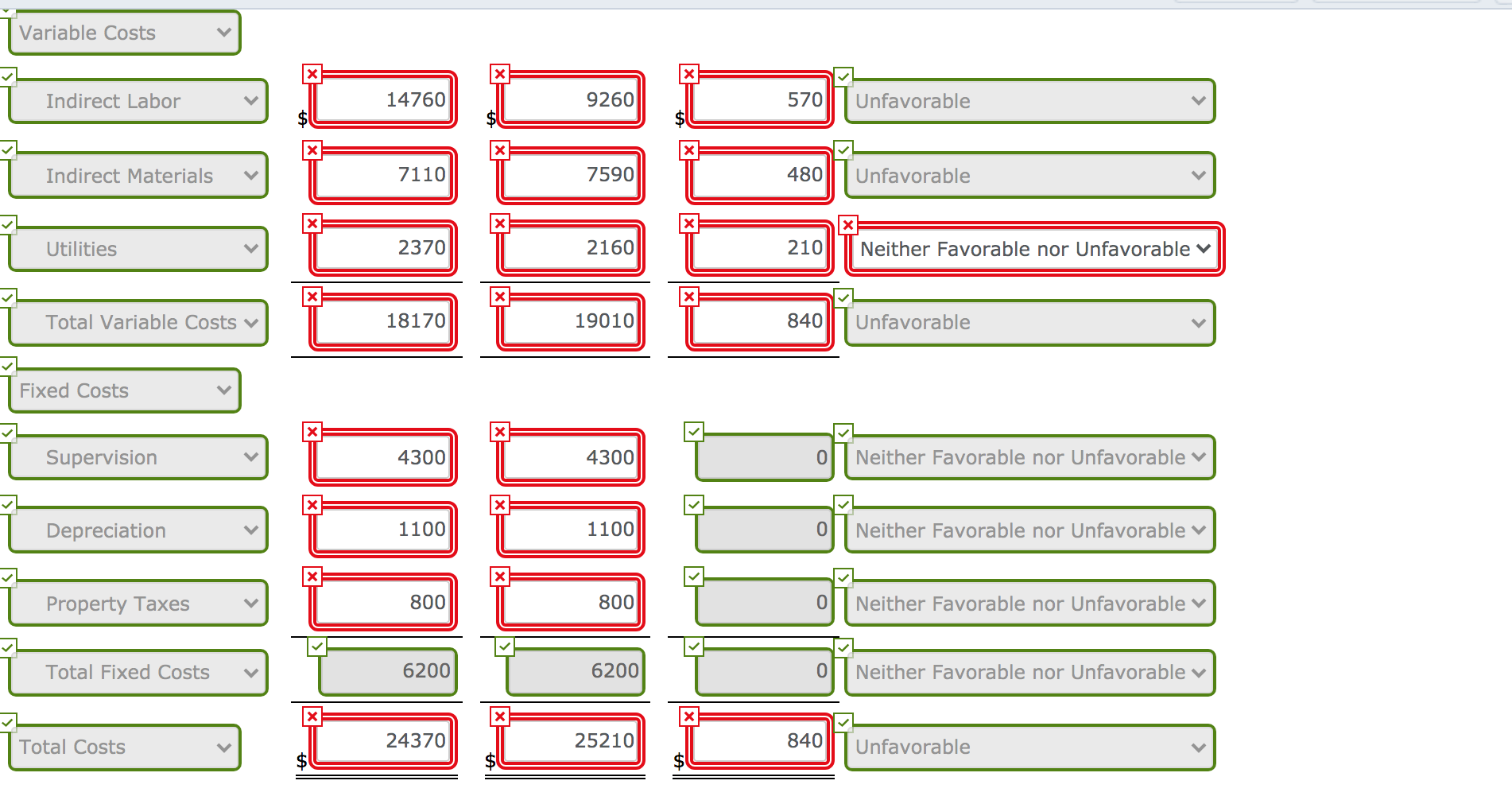

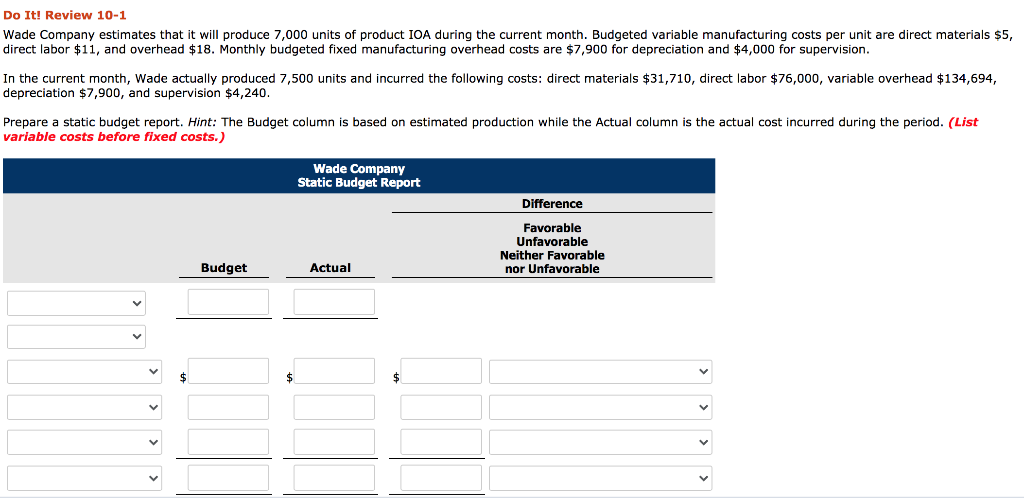

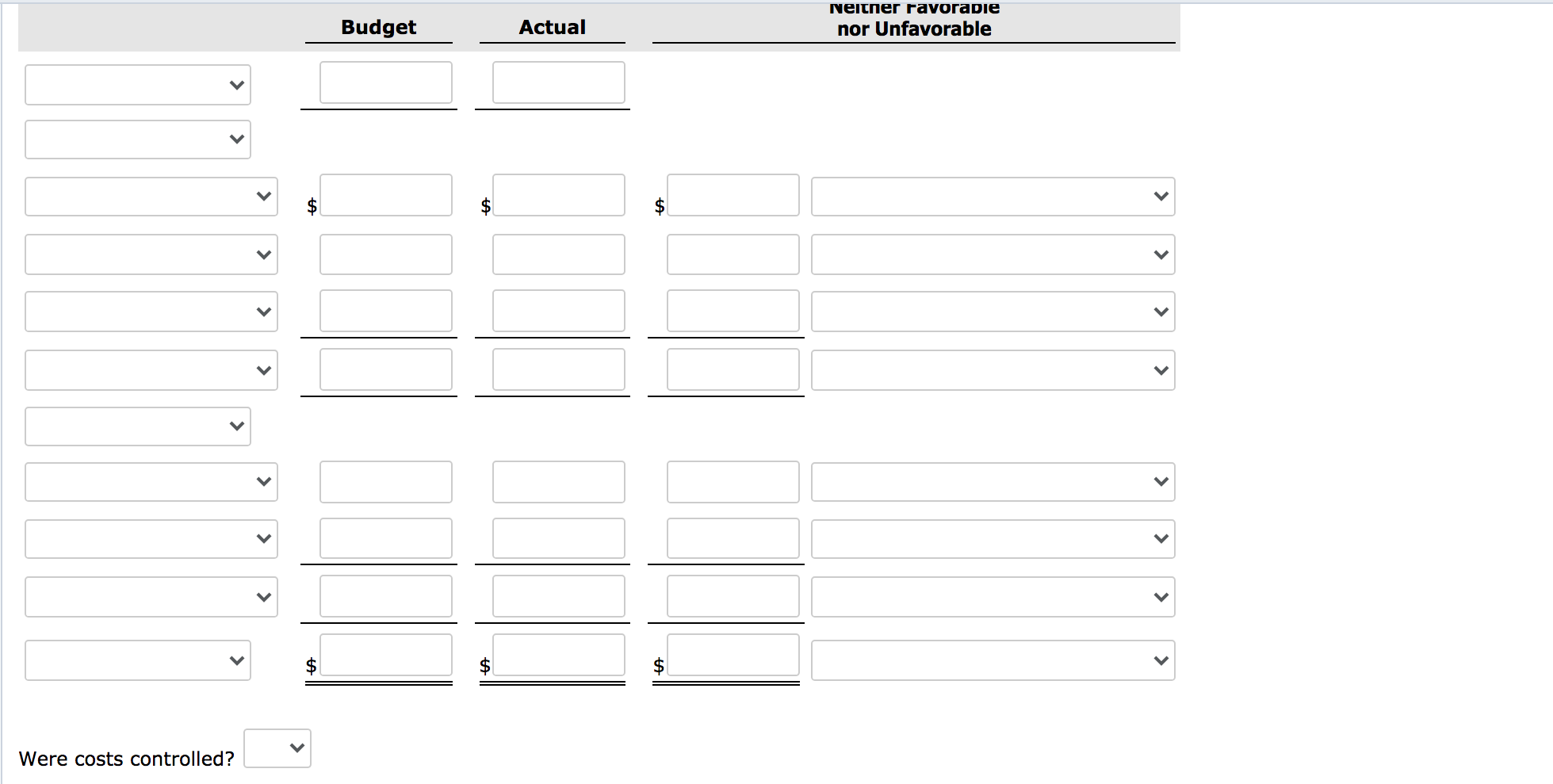

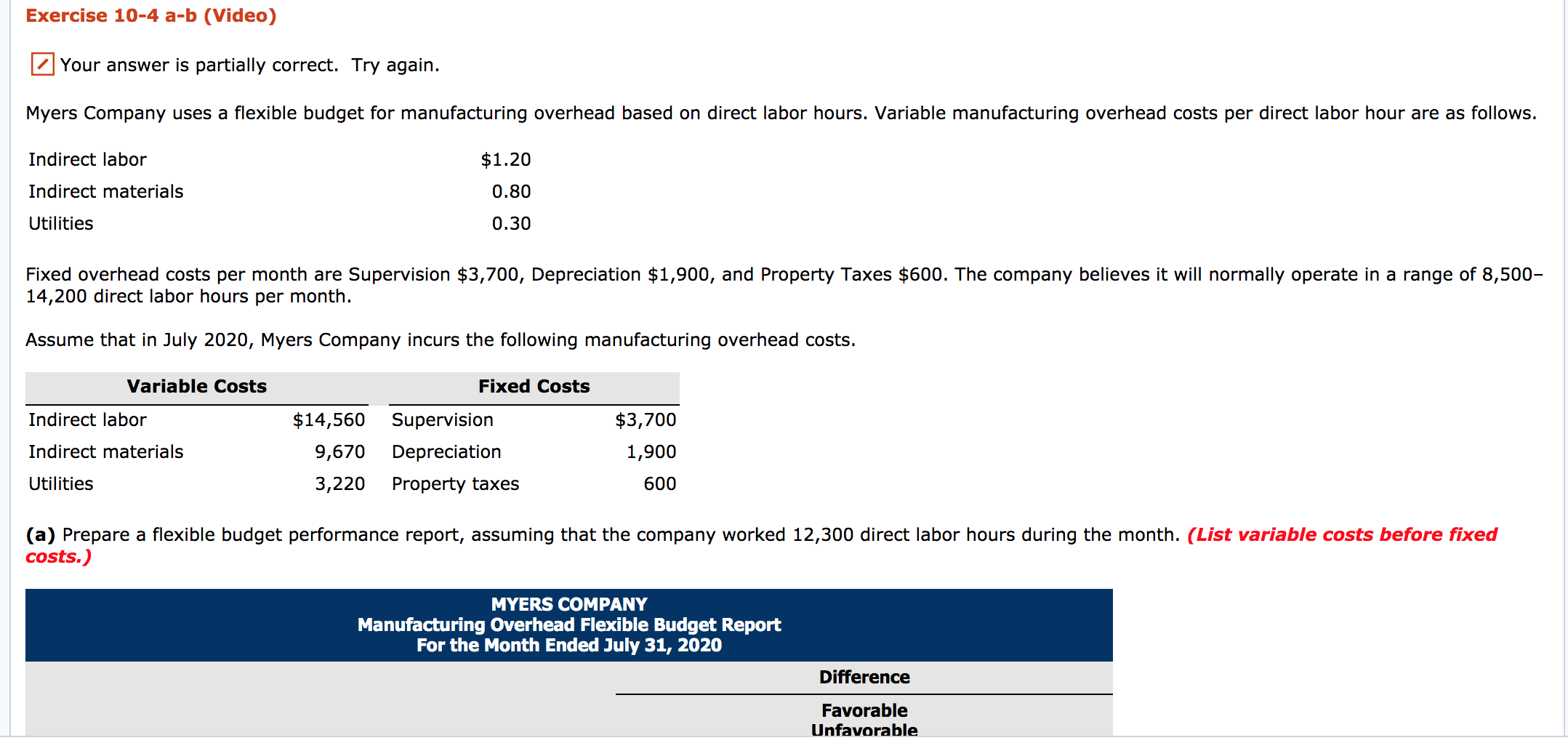

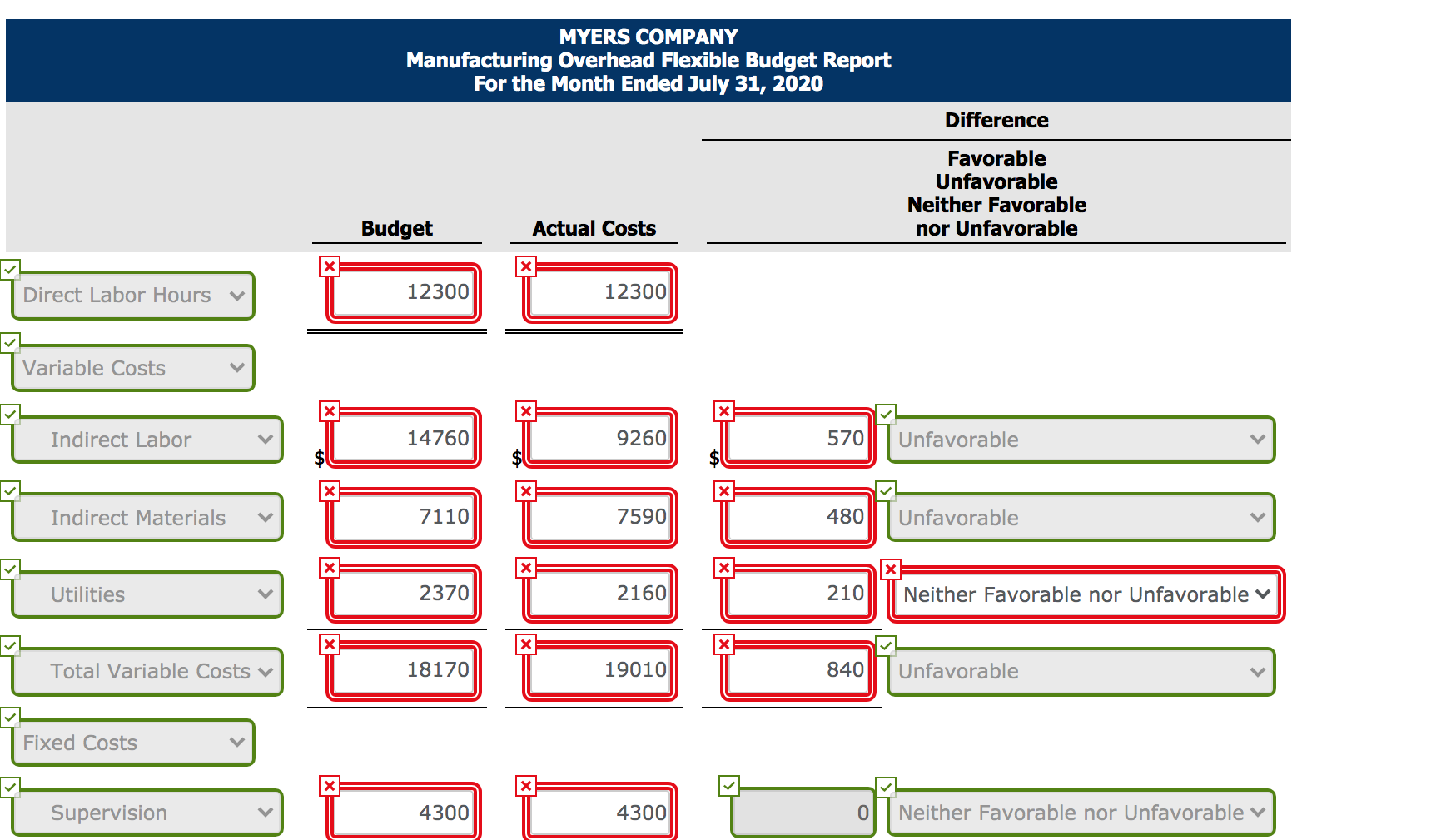

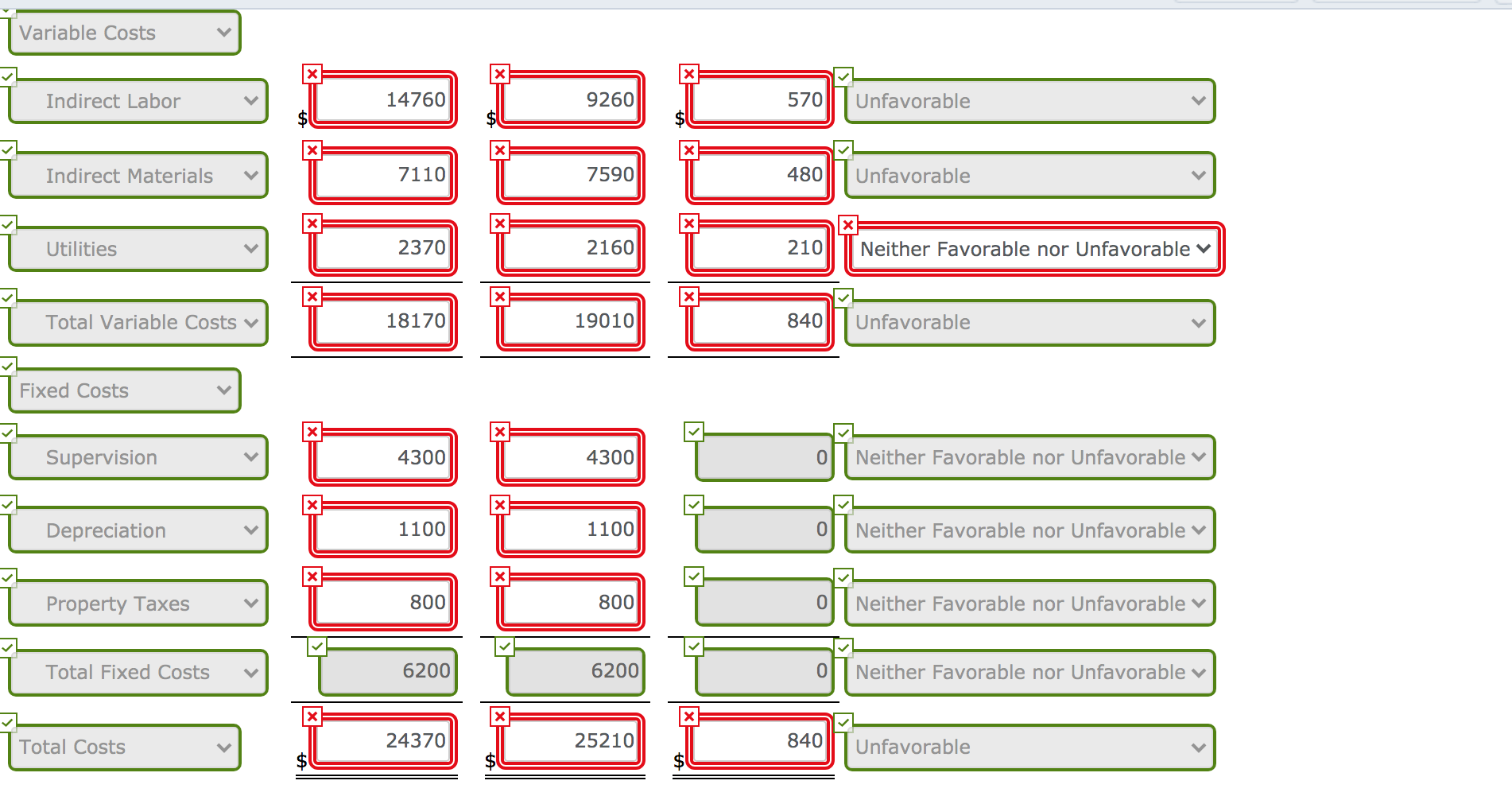

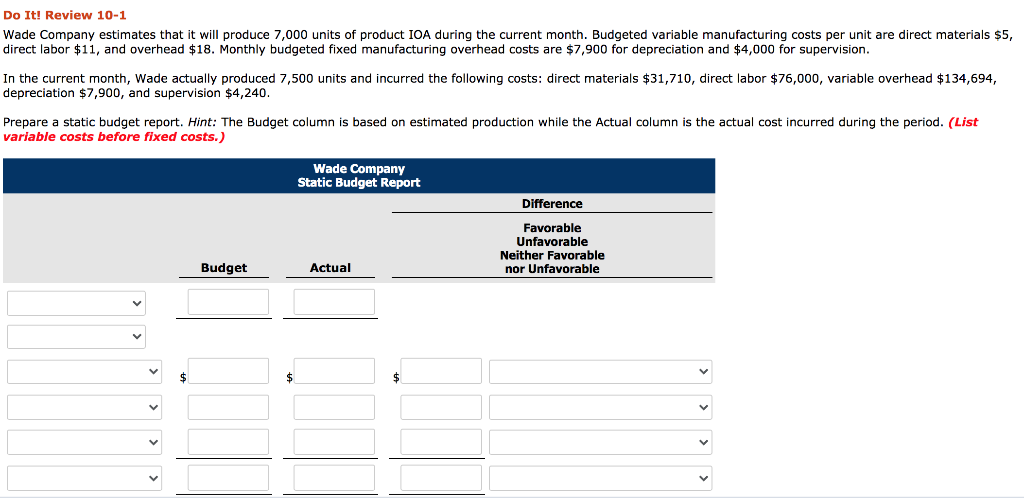

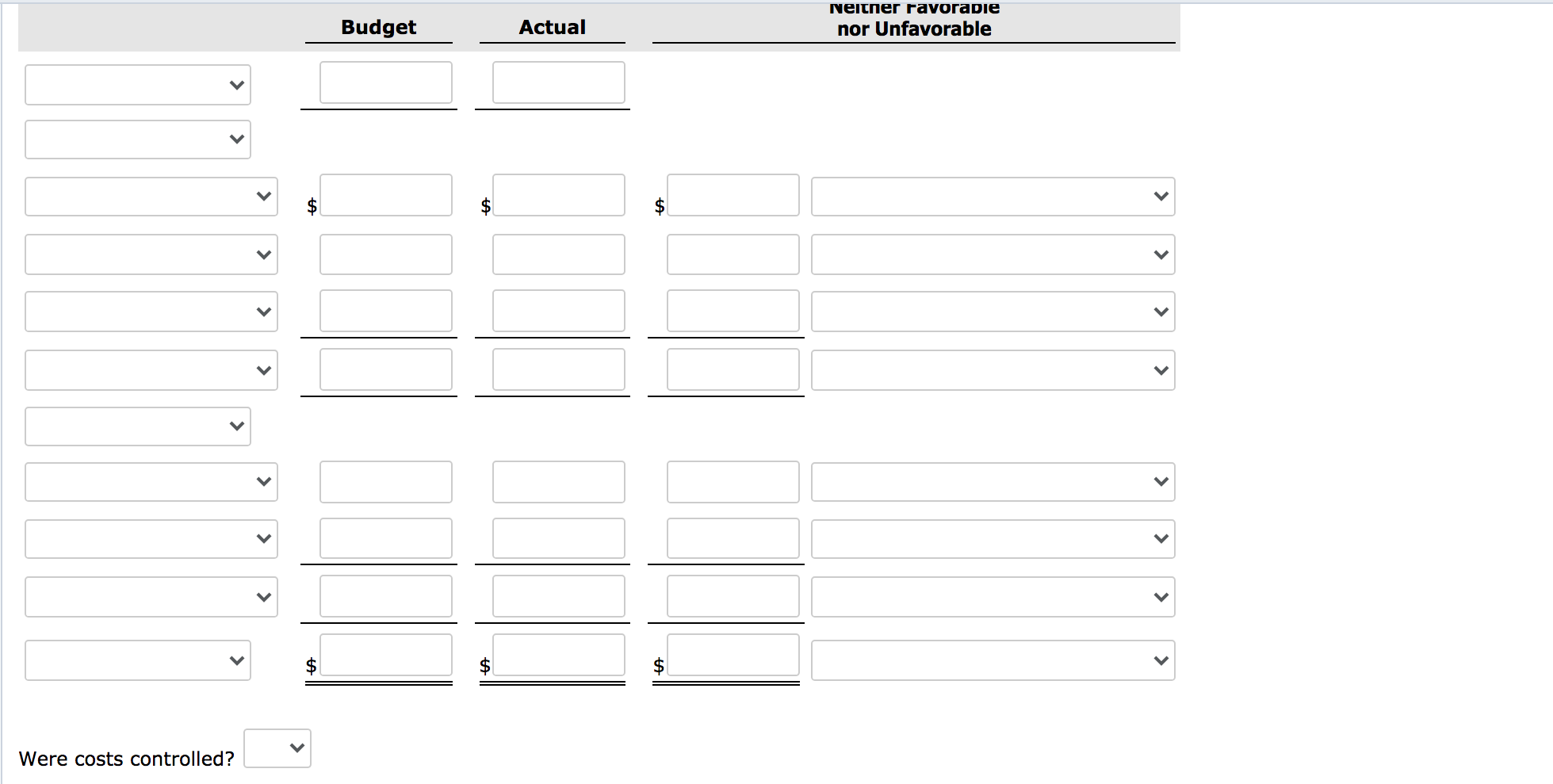

Exercise 10-4 a-b (Video) Your answer is partially correct. Try again. Myers Company uses a flexible budget for manufacturing overhead based on direct labor hours. Variable manufacturing overhead costs per direct labor hour are as follows. Indirect labor $1.20 Indirect materials 0.80 Utilities 0.30 Fixed overhead costs per month are Supervision $3,700, Depreciation $1,900, and Property Taxes $600. The company believes it will normally operate in a range of 8,500- 14,200 direct labor hours per month. Assume that in July 2020, Myers Company incurs the following manufacturing overhead costs. Variable Costs Fixed Costs Indirect labor $14,560 Supervision 9,670 Depreciation 3,220 Property taxes $3,700 1,900 Indirect materials Utilities 600 (a) Prepare a flexible budget performance report, assuming that the company worked 12,300 direct labor hours during the month. (List variable costs before fixed costs.) MYERS COMPANY Manufacturing Overhead Flexible Budget Report For the Month Ended July 31, 2020 Difference Favorable Unfavorable MYERS COMPANY Manufacturing Overhead Flexible Budget Report For the Month Ended July 31, 2020 Difference Favorable Unfavorable Neither Favorable nor Unfavorable Budget Actual Costs Direct Labor Hours 12300 12300 Variable Costs X X X Indirect Labor 14760 9260 570 Unfavorable x x x Indirect Materials 7110 7590 480 Unfavorable X x x Neither Favorable nor Unfavorable v Utilities 2370 2160 210 x X Total Variable Costs V 18170 19010 840 Unfavorable Fixed Costs X Supervision 4300 4300 0 Neither Favorable nor Unfavorable v Variable Costs x X Indirect Labor 14760 9260 570 Unfavorable $ x X Indirect Materials 7110 7590 480 Unfavorable X x Utilities 2370 2160 Neither Favorable nor Unfavorable 210 XII x Total Variable Costs V 18170 19010 840 Unfavorable Fixed Costs Supervision 4300 4300 0 Neither Favorable nor Unfavorable v x Depreciation 1100 1100 O Neither Favorable nor Unfavorable x X Property Taxes 800 800 o Neither Favorable nor Unfavorable Total Fixed Costs 6200 6200 0 Neither Favorable nor Unfavorable v X X Total Costs 24370 25210 840 Unfavorable Do It! Review 10-1 Wade Company estimates that it will produce 7,000 units of product IOA during the current month. Budgeted variable manufacturing costs per unit are direct materials $5, direct labor $11, and overhead $18. Monthly budgeted fixed manufacturing overhead costs are $7,900 for depreciation and $4,000 for supervision. In the current month, Wade actually produced 7,500 units and incurred the following costs: direct materials $31,710, direct labor $76,000, variable overhead $134,694, depreciation $7,900, and supervision $4,240. Prepare a static budget report. Hint: The Budget column is based on estimated production while the Actual column is the actual cost incurred during the period. (List variable costs before fixed costs.) Wade Company Static Budget Report Difference Favorable Unfavorable Neither Favorable nor Unfavorable Budget Actual $ Budget Actual Neither favorable nor Unfavorable >