Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Exercise 10-40 Budgeting for a Service Firm (LO 10-6] Refer to the AccuTax Inc, exhibit One of the partners is planning to retire at the

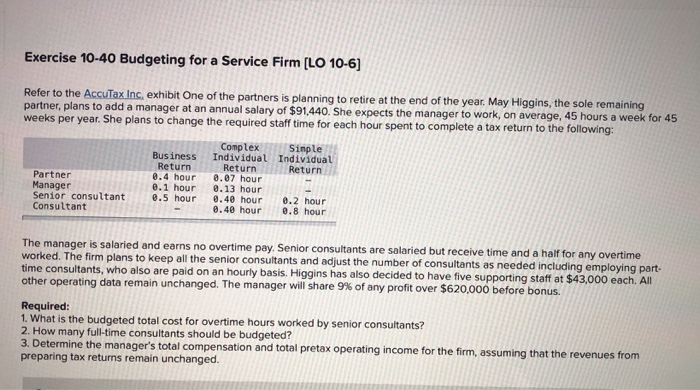

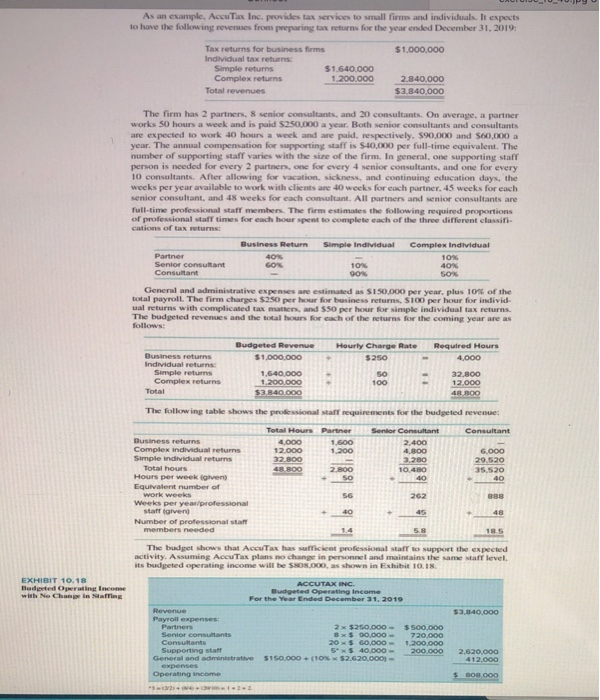

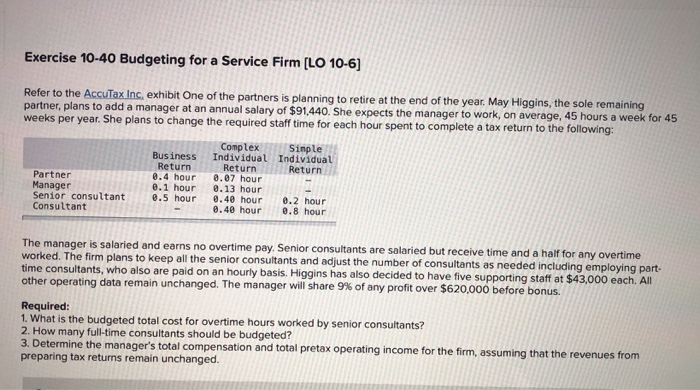

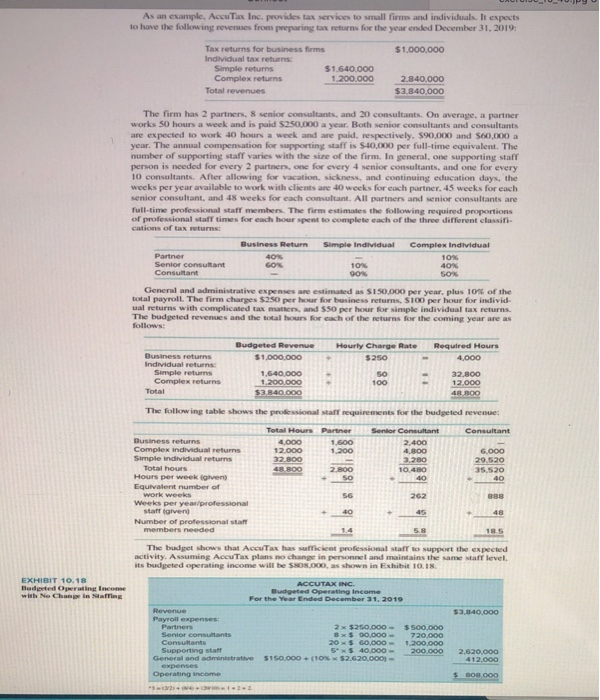

Exercise 10-40 Budgeting for a Service Firm (LO 10-6] Refer to the AccuTax Inc, exhibit One of the partners is planning to retire at the end of the year. May Higgins, the sole remaining partner, plans to add a manager at an annual salary of $91,440. She expects the manager to work, on average, 45 hours a week for 45 weeks per year. She plans to change the required staff time for each hour spent to complete a tax return to the following: Complex Simple Business Individual Individual Return Return Return Partner 0.4 hour 0.07 hour Manager @.1 hour 0.13 hour Senior consultant 0.5 hour 0.40 hour 0.2 hour Consultant 0.40 hour 8.8 hour The manager is salaried and earns no overtime pay. Senior consultants are salaried but receive time and a half for any overtime worked. The firm plans to keep all the senior consultants and adjust the number of consultants as needed including employing part- time consultants, who also are paid on an hourly basis. Higgins has also decided to have five supporting staff at $43,000 each. All other operating data remain unchanged. The manager will share 9% of any profit over $620,000 before bonus. Required: 1. What is the budgeted total cost for overtime hours worked by senior consultants? 2. How many full-time consultants should be budgeted? 3. Determine the manager's total compensation and total pretax operating income for the firm, assuming that the revenues from preparing tax returns remain unchanged. As an example. Accu Tax Inc. provides tax services to small firms and individuals. It expects to have the following revenues from preparing tax returns for the year ended December 31, 2019: $1.000.000 Tax returns for business firms Individual tax returns Simple returns $1.640.000 Complex returns 1.200.000 Total revenues 2.840.000 $3.840.000 The firm has 2 partners, 8 senior consultants, and 20 consultants. On average, a partner works 50 hours a week and is paid $250.000 a year. Both senior consultants and consultants are expected to work 40 hours a week and are paid respectively. $90,000 and $60,000 a year. The annual compensation for supporting staff is $40,000 per full-time equivalent. The number of supporting staff varies with the size of the firm. In general. one supporting star person is needed for every 2 partners, one for every 4 senior consultants, and one for every 10 consultants. After allowing for vacation, sickness, and continuing education days, the weeks per year available to work with clients are 40 weeks for each partner. 45 weeks for each senior consultant, and 48 weeks for each consultant. All partners and senior consultants are full-time professional staff members. The firm estimates the following required proportions of professional staff times for each hour spent to complete each of the three different classi- cations of tax returns Business Return Simple Individual Complex Individual Partner 40% 10% Senior consultant GON 10% 40% Consultant 90% SOM General and administrative expenses are estimated as $150,000 per year, plus 10% of the total payroll. The firm charges $250 per hour for business returns, S100 per hour for individ ual returns with complicated tax matters, and $50 per hour for simple individual tax returns The budgeted revenues and the total hours for each of the returns for the coming year areas follows: Business returns Individual returns Simple returns Complex returns Total Budgeted Revenue $1.000.000 1.640.000 1.200.000 $3840 000 Hourly Charge Rate $250 50 100 Required Hours 4,000 32,800 12.000 48 BOO The following table shows the professional Maff requirements for the budgeted revenue Total Hours Partner Senior Consultant Consultant Business returns 4.000 1.600 2.400 Complex individual returns 12.000 1.200 4.800 6.000 Simple individual returns 32.800 2.280 29.520 Total hours 48 BOO 2.800 10.480 35.520 Hours per week given) 50 40 Equivalent number of work weeks 56 262 Weeks per year professional staff igiven 45 48 Number of professional staff members needed 5.8 EXHIBIT 10.18 Budgeted rating Income with No Change in Nafting The budget shows that Accu Tax has sufficient professional staff to support the expected activity. Assuming Accu Tax plans no change in personnel and maintains the same staff level. its budgeted operating income will be SOK.OOO, as shown in Exhibit 10.18. ACCUTAX INC. Budgeted Operating Income For the Year Ended December 31, 2010 Revenue 53.1140,000 Payroll expenses Partners 2x $250,000 - $500,000 Senior Consultants 8x$ 90,000 - 720.000 Consultants 20$ 60.000 200.000 Supporting start 5'* $ 40.000 200.000 2.620.000 General and administrative $150.000 + (0 x 52.620.000) - 412.000 expenses Operating income SBOB OOO 3 wete- Exercise 10-40 Budgeting for a Service Firm (LO 10-6] Refer to the AccuTax Inc, exhibit One of the partners is planning to retire at the end of the year. May Higgins, the sole remaining partner, plans to add a manager at an annual salary of $91,440. She expects the manager to work, on average, 45 hours a week for 45 weeks per year. She plans to change the required staff time for each hour spent to complete a tax return to the following: Complex Simple Business Individual Individual Return Return Return Partner 0.4 hour 0.07 hour Manager @.1 hour 0.13 hour Senior consultant 0.5 hour 0.40 hour 0.2 hour Consultant 0.40 hour 8.8 hour The manager is salaried and earns no overtime pay. Senior consultants are salaried but receive time and a half for any overtime worked. The firm plans to keep all the senior consultants and adjust the number of consultants as needed including employing part- time consultants, who also are paid on an hourly basis. Higgins has also decided to have five supporting staff at $43,000 each. All other operating data remain unchanged. The manager will share 9% of any profit over $620,000 before bonus. Required: 1. What is the budgeted total cost for overtime hours worked by senior consultants? 2. How many full-time consultants should be budgeted? 3. Determine the manager's total compensation and total pretax operating income for the firm, assuming that the revenues from preparing tax returns remain unchanged. As an example. Accu Tax Inc. provides tax services to small firms and individuals. It expects to have the following revenues from preparing tax returns for the year ended December 31, 2019: $1.000.000 Tax returns for business firms Individual tax returns Simple returns $1.640.000 Complex returns 1.200.000 Total revenues 2.840.000 $3.840.000 The firm has 2 partners, 8 senior consultants, and 20 consultants. On average, a partner works 50 hours a week and is paid $250.000 a year. Both senior consultants and consultants are expected to work 40 hours a week and are paid respectively. $90,000 and $60,000 a year. The annual compensation for supporting staff is $40,000 per full-time equivalent. The number of supporting staff varies with the size of the firm. In general. one supporting star person is needed for every 2 partners, one for every 4 senior consultants, and one for every 10 consultants. After allowing for vacation, sickness, and continuing education days, the weeks per year available to work with clients are 40 weeks for each partner. 45 weeks for each senior consultant, and 48 weeks for each consultant. All partners and senior consultants are full-time professional staff members. The firm estimates the following required proportions of professional staff times for each hour spent to complete each of the three different classi- cations of tax returns Business Return Simple Individual Complex Individual Partner 40% 10% Senior consultant GON 10% 40% Consultant 90% SOM General and administrative expenses are estimated as $150,000 per year, plus 10% of the total payroll. The firm charges $250 per hour for business returns, S100 per hour for individ ual returns with complicated tax matters, and $50 per hour for simple individual tax returns The budgeted revenues and the total hours for each of the returns for the coming year areas follows: Business returns Individual returns Simple returns Complex returns Total Budgeted Revenue $1.000.000 1.640.000 1.200.000 $3840 000 Hourly Charge Rate $250 50 100 Required Hours 4,000 32,800 12.000 48 BOO The following table shows the professional Maff requirements for the budgeted revenue Total Hours Partner Senior Consultant Consultant Business returns 4.000 1.600 2.400 Complex individual returns 12.000 1.200 4.800 6.000 Simple individual returns 32.800 2.280 29.520 Total hours 48 BOO 2.800 10.480 35.520 Hours per week given) 50 40 Equivalent number of work weeks 56 262 Weeks per year professional staff igiven 45 48 Number of professional staff members needed 5.8 EXHIBIT 10.18 Budgeted rating Income with No Change in Nafting The budget shows that Accu Tax has sufficient professional staff to support the expected activity. Assuming Accu Tax plans no change in personnel and maintains the same staff level. its budgeted operating income will be SOK.OOO, as shown in Exhibit 10.18. ACCUTAX INC. Budgeted Operating Income For the Year Ended December 31, 2010 Revenue 53.1140,000 Payroll expenses Partners 2x $250,000 - $500,000 Senior Consultants 8x$ 90,000 - 720.000 Consultants 20$ 60.000 200.000 Supporting start 5'* $ 40.000 200.000 2.620.000 General and administrative $150.000 + (0 x 52.620.000) - 412.000 expenses Operating income SBOB OOO 3 wete

Exercise 10-40 Budgeting for a Service Firm (LO 10-6] Refer to the AccuTax Inc, exhibit One of the partners is planning to retire at the end of the year. May Higgins, the sole remaining partner, plans to add a manager at an annual salary of $91,440. She expects the manager to work, on average, 45 hours a week for 45 weeks per year. She plans to change the required staff time for each hour spent to complete a tax return to the following: Complex Simple Business Individual Individual Return Return Return Partner 0.4 hour 0.07 hour Manager @.1 hour 0.13 hour Senior consultant 0.5 hour 0.40 hour 0.2 hour Consultant 0.40 hour 8.8 hour The manager is salaried and earns no overtime pay. Senior consultants are salaried but receive time and a half for any overtime worked. The firm plans to keep all the senior consultants and adjust the number of consultants as needed including employing part- time consultants, who also are paid on an hourly basis. Higgins has also decided to have five supporting staff at $43,000 each. All other operating data remain unchanged. The manager will share 9% of any profit over $620,000 before bonus. Required: 1. What is the budgeted total cost for overtime hours worked by senior consultants? 2. How many full-time consultants should be budgeted? 3. Determine the manager's total compensation and total pretax operating income for the firm, assuming that the revenues from preparing tax returns remain unchanged. As an example. Accu Tax Inc. provides tax services to small firms and individuals. It expects to have the following revenues from preparing tax returns for the year ended December 31, 2019: $1.000.000 Tax returns for business firms Individual tax returns Simple returns $1.640.000 Complex returns 1.200.000 Total revenues 2.840.000 $3.840.000 The firm has 2 partners, 8 senior consultants, and 20 consultants. On average, a partner works 50 hours a week and is paid $250.000 a year. Both senior consultants and consultants are expected to work 40 hours a week and are paid respectively. $90,000 and $60,000 a year. The annual compensation for supporting staff is $40,000 per full-time equivalent. The number of supporting staff varies with the size of the firm. In general. one supporting star person is needed for every 2 partners, one for every 4 senior consultants, and one for every 10 consultants. After allowing for vacation, sickness, and continuing education days, the weeks per year available to work with clients are 40 weeks for each partner. 45 weeks for each senior consultant, and 48 weeks for each consultant. All partners and senior consultants are full-time professional staff members. The firm estimates the following required proportions of professional staff times for each hour spent to complete each of the three different classi- cations of tax returns Business Return Simple Individual Complex Individual Partner 40% 10% Senior consultant GON 10% 40% Consultant 90% SOM General and administrative expenses are estimated as $150,000 per year, plus 10% of the total payroll. The firm charges $250 per hour for business returns, S100 per hour for individ ual returns with complicated tax matters, and $50 per hour for simple individual tax returns The budgeted revenues and the total hours for each of the returns for the coming year areas follows: Business returns Individual returns Simple returns Complex returns Total Budgeted Revenue $1.000.000 1.640.000 1.200.000 $3840 000 Hourly Charge Rate $250 50 100 Required Hours 4,000 32,800 12.000 48 BOO The following table shows the professional Maff requirements for the budgeted revenue Total Hours Partner Senior Consultant Consultant Business returns 4.000 1.600 2.400 Complex individual returns 12.000 1.200 4.800 6.000 Simple individual returns 32.800 2.280 29.520 Total hours 48 BOO 2.800 10.480 35.520 Hours per week given) 50 40 Equivalent number of work weeks 56 262 Weeks per year professional staff igiven 45 48 Number of professional staff members needed 5.8 EXHIBIT 10.18 Budgeted rating Income with No Change in Nafting The budget shows that Accu Tax has sufficient professional staff to support the expected activity. Assuming Accu Tax plans no change in personnel and maintains the same staff level. its budgeted operating income will be SOK.OOO, as shown in Exhibit 10.18. ACCUTAX INC. Budgeted Operating Income For the Year Ended December 31, 2010 Revenue 53.1140,000 Payroll expenses Partners 2x $250,000 - $500,000 Senior Consultants 8x$ 90,000 - 720.000 Consultants 20$ 60.000 200.000 Supporting start 5'* $ 40.000 200.000 2.620.000 General and administrative $150.000 + (0 x 52.620.000) - 412.000 expenses Operating income SBOB OOO 3 wete- Exercise 10-40 Budgeting for a Service Firm (LO 10-6] Refer to the AccuTax Inc, exhibit One of the partners is planning to retire at the end of the year. May Higgins, the sole remaining partner, plans to add a manager at an annual salary of $91,440. She expects the manager to work, on average, 45 hours a week for 45 weeks per year. She plans to change the required staff time for each hour spent to complete a tax return to the following: Complex Simple Business Individual Individual Return Return Return Partner 0.4 hour 0.07 hour Manager @.1 hour 0.13 hour Senior consultant 0.5 hour 0.40 hour 0.2 hour Consultant 0.40 hour 8.8 hour The manager is salaried and earns no overtime pay. Senior consultants are salaried but receive time and a half for any overtime worked. The firm plans to keep all the senior consultants and adjust the number of consultants as needed including employing part- time consultants, who also are paid on an hourly basis. Higgins has also decided to have five supporting staff at $43,000 each. All other operating data remain unchanged. The manager will share 9% of any profit over $620,000 before bonus. Required: 1. What is the budgeted total cost for overtime hours worked by senior consultants? 2. How many full-time consultants should be budgeted? 3. Determine the manager's total compensation and total pretax operating income for the firm, assuming that the revenues from preparing tax returns remain unchanged. As an example. Accu Tax Inc. provides tax services to small firms and individuals. It expects to have the following revenues from preparing tax returns for the year ended December 31, 2019: $1.000.000 Tax returns for business firms Individual tax returns Simple returns $1.640.000 Complex returns 1.200.000 Total revenues 2.840.000 $3.840.000 The firm has 2 partners, 8 senior consultants, and 20 consultants. On average, a partner works 50 hours a week and is paid $250.000 a year. Both senior consultants and consultants are expected to work 40 hours a week and are paid respectively. $90,000 and $60,000 a year. The annual compensation for supporting staff is $40,000 per full-time equivalent. The number of supporting staff varies with the size of the firm. In general. one supporting star person is needed for every 2 partners, one for every 4 senior consultants, and one for every 10 consultants. After allowing for vacation, sickness, and continuing education days, the weeks per year available to work with clients are 40 weeks for each partner. 45 weeks for each senior consultant, and 48 weeks for each consultant. All partners and senior consultants are full-time professional staff members. The firm estimates the following required proportions of professional staff times for each hour spent to complete each of the three different classi- cations of tax returns Business Return Simple Individual Complex Individual Partner 40% 10% Senior consultant GON 10% 40% Consultant 90% SOM General and administrative expenses are estimated as $150,000 per year, plus 10% of the total payroll. The firm charges $250 per hour for business returns, S100 per hour for individ ual returns with complicated tax matters, and $50 per hour for simple individual tax returns The budgeted revenues and the total hours for each of the returns for the coming year areas follows: Business returns Individual returns Simple returns Complex returns Total Budgeted Revenue $1.000.000 1.640.000 1.200.000 $3840 000 Hourly Charge Rate $250 50 100 Required Hours 4,000 32,800 12.000 48 BOO The following table shows the professional Maff requirements for the budgeted revenue Total Hours Partner Senior Consultant Consultant Business returns 4.000 1.600 2.400 Complex individual returns 12.000 1.200 4.800 6.000 Simple individual returns 32.800 2.280 29.520 Total hours 48 BOO 2.800 10.480 35.520 Hours per week given) 50 40 Equivalent number of work weeks 56 262 Weeks per year professional staff igiven 45 48 Number of professional staff members needed 5.8 EXHIBIT 10.18 Budgeted rating Income with No Change in Nafting The budget shows that Accu Tax has sufficient professional staff to support the expected activity. Assuming Accu Tax plans no change in personnel and maintains the same staff level. its budgeted operating income will be SOK.OOO, as shown in Exhibit 10.18. ACCUTAX INC. Budgeted Operating Income For the Year Ended December 31, 2010 Revenue 53.1140,000 Payroll expenses Partners 2x $250,000 - $500,000 Senior Consultants 8x$ 90,000 - 720.000 Consultants 20$ 60.000 200.000 Supporting start 5'* $ 40.000 200.000 2.620.000 General and administrative $150.000 + (0 x 52.620.000) - 412.000 expenses Operating income SBOB OOO 3 wete

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started