Answered step by step

Verified Expert Solution

Question

1 Approved Answer

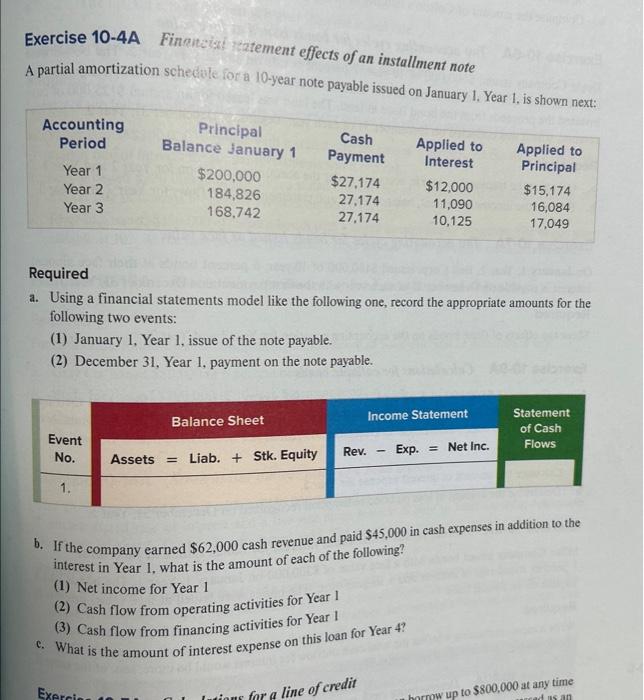

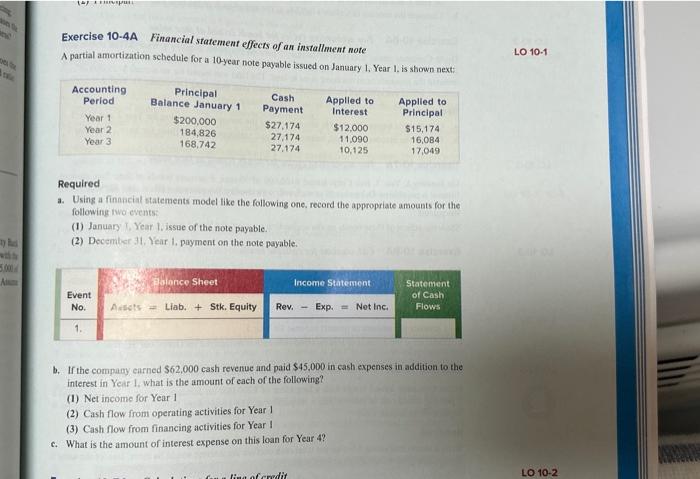

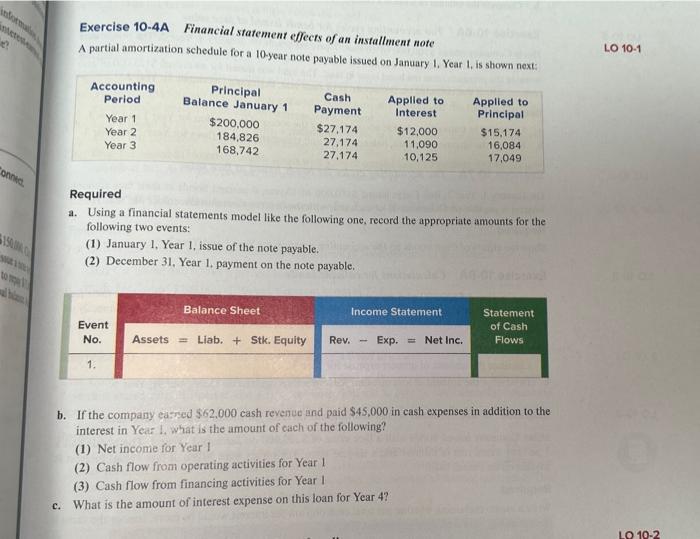

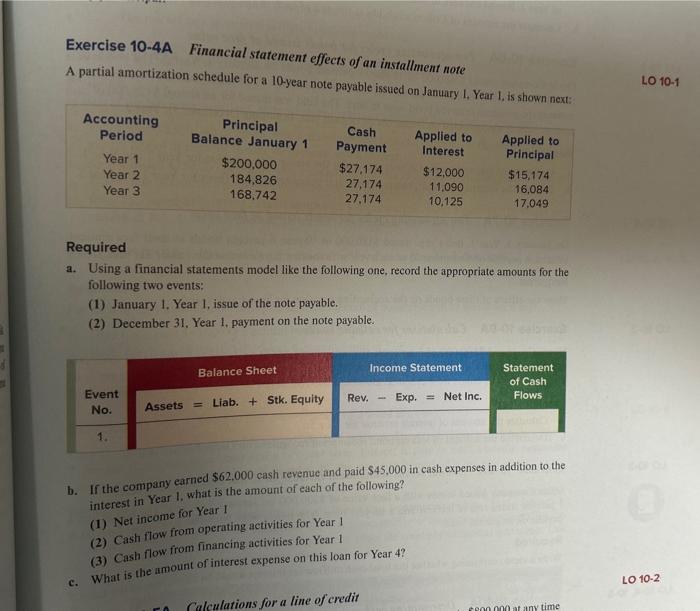

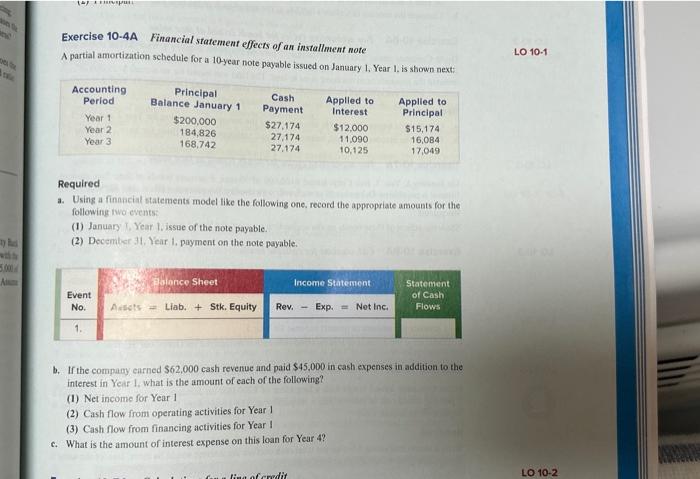

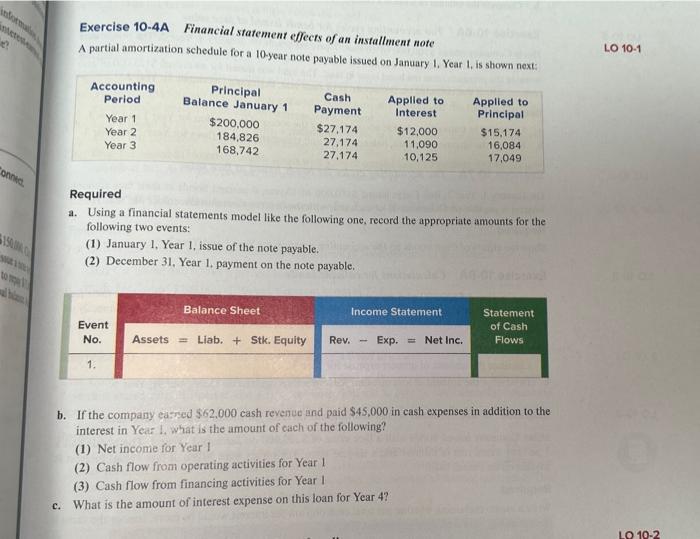

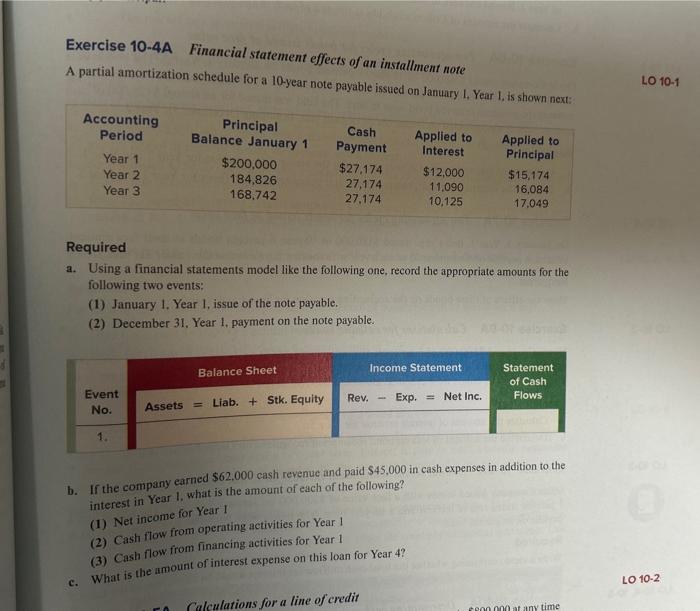

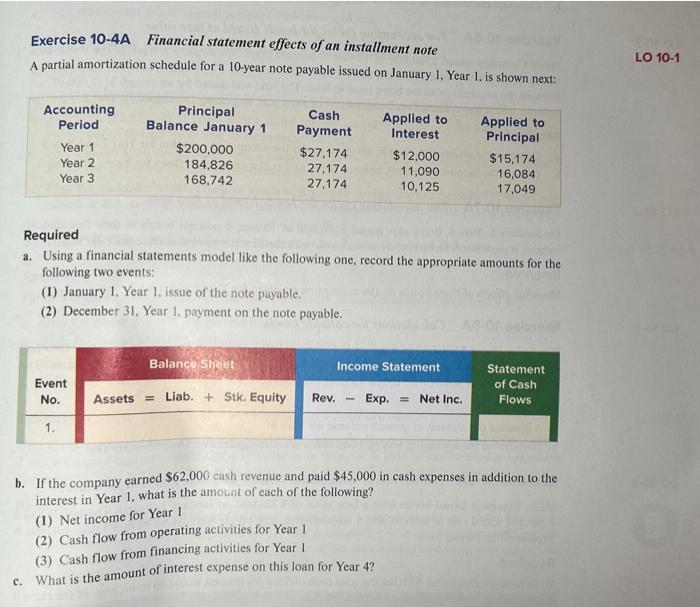

EXERCISE 10-4A Exercise 10-4A Finaitctit katement effects of an installment note A partial amortization schedele for a 10-year note payable issued on January 1. Year

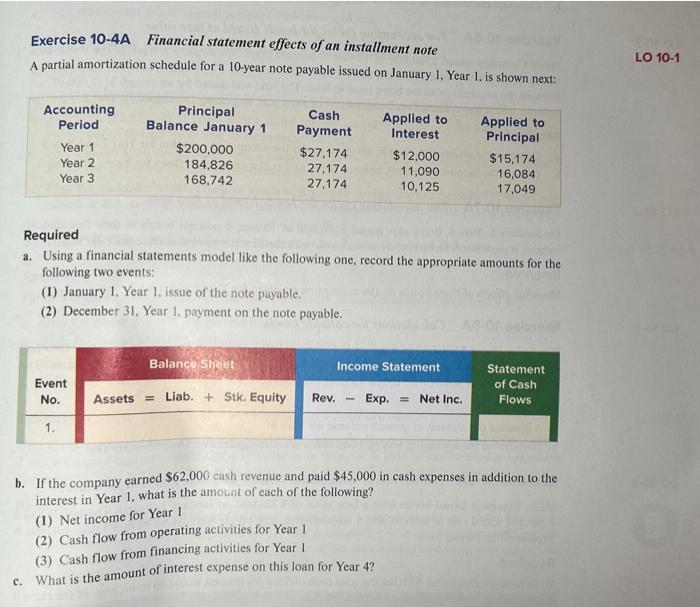

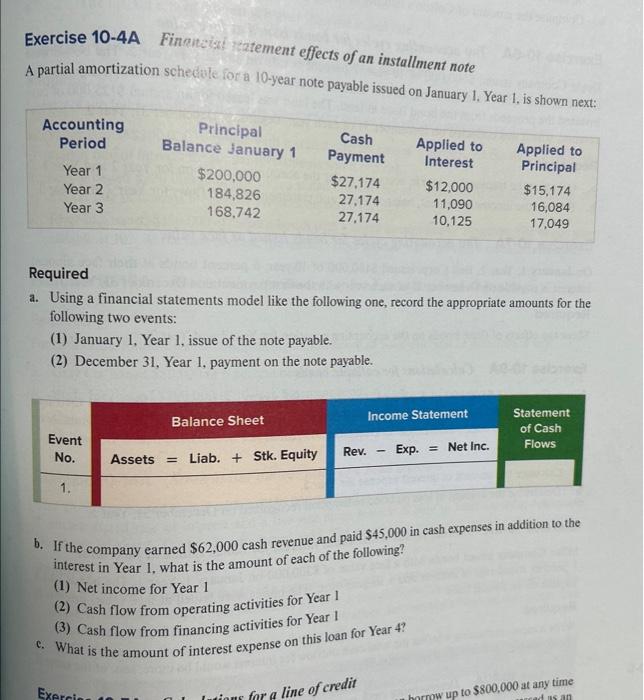

EXERCISE 10-4A

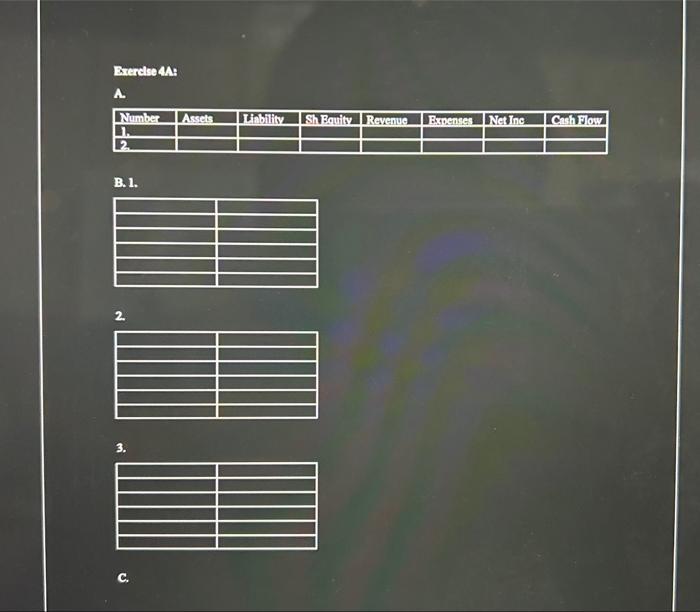

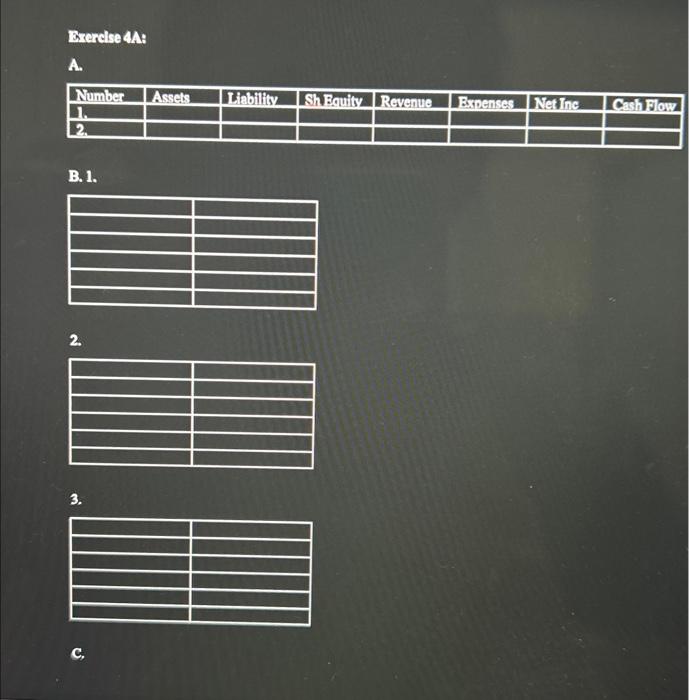

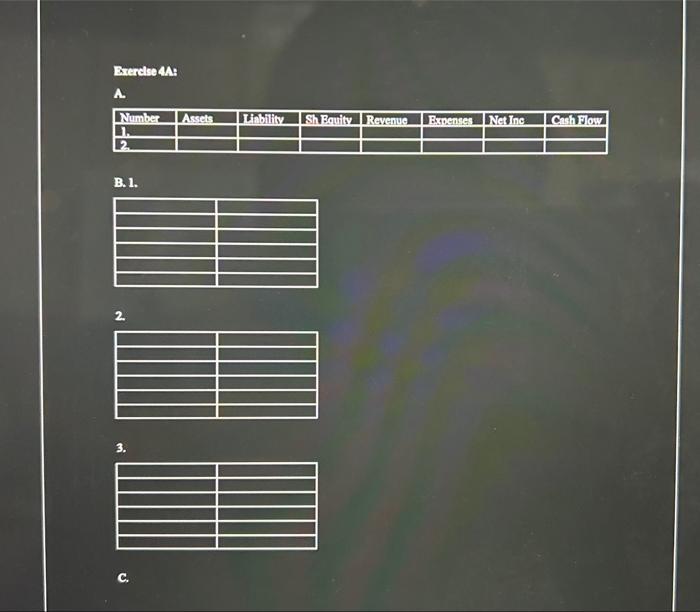

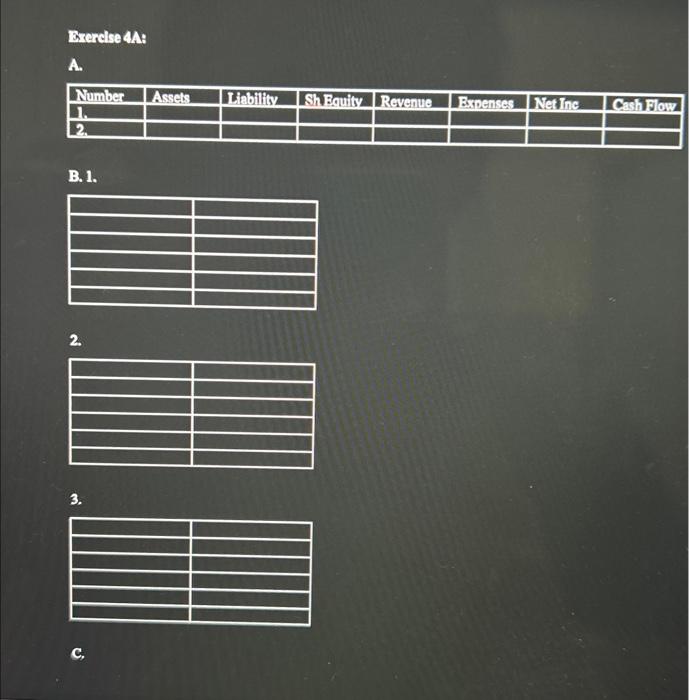

Exercise 10-4A Finaitctit katement effects of an installment note A partial amortization schedele for a 10-year note payable issued on January 1. Year 1 . is shoum naw. Required a. Using a financial statements model like the following one, record the appropriate amounts for the following two events: (1) January 1, Year 1, issue of the note payable. (2) December 31, Year 1, payment on the note payable. b. If the company earned $62,000 cash revenue and paid $45,000 in cash expenses in addition to the interest in Year 1, what is the amount of each of the following? (1) Net income for Year 1 (2) Cash flow from operating activities for Year 1 (3) Cash flow from financing activities for Year 1 c. What is the amount of interest expense on this loan for Year 4 ? Exercise 10-4A Financial statement effects of an installment note A partial amortization schedule for a 10-year note payable issued on January 1. Year I. is shown next: Required a. Using a financial statements model like the following one, record the appropriate amousts for the following iwo events: (1) January T, Year I. issue of the note payable. (2) December 31, Year 1, payment on the note payable. b. If the company earned $62,000 cash revenue and paid $45,000 in cash expenses in addition to the interest in Yeir 1, what is the amount of each of the following? (1) Net income for Year 1 (2) Cash flow from operating activities for Year I (3) Cash flow from financing activities for Year I c. What is the amount of interest expense on this loan for Year 4 ? Exercise 10-4A Financial statement effects of an installment note A partial amortization schedule for a 10-year note payable issued on January 1 . Year 1 , is shown next: Required a. Using a financial statements model like the following one, record the appropriate amounts for the following two events: (1) January 1, Year 1, issue of the note payable. (2) December 31 , Year 1, payment on the note payable. b. If the company earyed $62,000 cash revenue and paid $45,000 in cash expenses in addition to the interest in Year 1. what is the amount of cach of the following? (1) Net income for Year 1 (2) Cash flow from operating activities for Year 1 (3) Cash flow from financing activities for Year I c. What is the amount of interest expense on this loan for Year 4 ? Exercise 10-4A Financial statement effects of an installment note A partial amortization schedule for a 10-year note payable issued on January 1 . Year 1 is shown asa. Required a. Using a financial statements model like the following one, record the appropriate amounts for the following two events: (1) January 1. Year 1, issue of the note payable. (2) December 31. Year 1, payment on the note payable. b. If the company earned $62,000 cash revenue and paid $45,000 in cash expenses in addition to the interest in Year 1 . what is the amount of each of the following? (1) Net income for Year 1 (2) Cash flow from operating activities for Year 1 (3) Cash flow from financing activities for Year 1 c. What is the umount of interest expense on this loan for Year 4 ? Brerelse 4A: A. \begin{tabular}{|l|l|l|l|l|l|l|l|} \hline Number & Assets & Kiability & Sh Equity & Revenue & Expenses & Net inc & Cash Flow \\ \hline 1. & & & & & & & \\ \hline 2. & & & & & & & \\ \hline \end{tabular} B.1. \begin{tabular}{|l|l|} \hline & \\ \hline & \\ \hline & \\ \hline & \\ \hline & \\ \hline & \\ \hline \end{tabular} 2. \begin{tabular}{|l|l|} \hline & \\ \hline & \\ \hline & \\ \hline & \\ \hline & \\ \hline & \\ \hline \end{tabular} 3. \begin{tabular}{|l|l|} \hline & \\ \hline & \\ \hline & \\ \hline & \\ \hline & \\ \hline & \\ \hline \end{tabular} c. Exercise 10-4A Financial statement effects of an installment note A partial amortization schedule for a 10-year note payable issued on January 1, Year 1, is shown next: Required a. Using a financial statements model like the following one, record the appropriate amounts for the following two events: (1) January 1, Year 1, issue of the note payable. (2) December 31, Year 1, payment on the note payable. b. If the company earned $62,000 cash revenue and paid $45,000 in cash expenses in addition to the interest in Year 1 , what is the amount of each of the following? (1) Net income for Year 1 (2) Cash flow from operating activities for Year 1 (3) Cash flow from financing activities for Year 1 c. What is the amount of interest expense on this loan for Year 4

Exercise 10-4A Finaitctit katement effects of an installment note A partial amortization schedele for a 10-year note payable issued on January 1. Year 1 . is shoum naw. Required a. Using a financial statements model like the following one, record the appropriate amounts for the following two events: (1) January 1, Year 1, issue of the note payable. (2) December 31, Year 1, payment on the note payable. b. If the company earned $62,000 cash revenue and paid $45,000 in cash expenses in addition to the interest in Year 1, what is the amount of each of the following? (1) Net income for Year 1 (2) Cash flow from operating activities for Year 1 (3) Cash flow from financing activities for Year 1 c. What is the amount of interest expense on this loan for Year 4 ? Exercise 10-4A Financial statement effects of an installment note A partial amortization schedule for a 10-year note payable issued on January 1. Year I. is shown next: Required a. Using a financial statements model like the following one, record the appropriate amousts for the following iwo events: (1) January T, Year I. issue of the note payable. (2) December 31, Year 1, payment on the note payable. b. If the company earned $62,000 cash revenue and paid $45,000 in cash expenses in addition to the interest in Yeir 1, what is the amount of each of the following? (1) Net income for Year 1 (2) Cash flow from operating activities for Year I (3) Cash flow from financing activities for Year I c. What is the amount of interest expense on this loan for Year 4 ? Exercise 10-4A Financial statement effects of an installment note A partial amortization schedule for a 10-year note payable issued on January 1 . Year 1 , is shown next: Required a. Using a financial statements model like the following one, record the appropriate amounts for the following two events: (1) January 1, Year 1, issue of the note payable. (2) December 31 , Year 1, payment on the note payable. b. If the company earyed $62,000 cash revenue and paid $45,000 in cash expenses in addition to the interest in Year 1. what is the amount of cach of the following? (1) Net income for Year 1 (2) Cash flow from operating activities for Year 1 (3) Cash flow from financing activities for Year I c. What is the amount of interest expense on this loan for Year 4 ? Exercise 10-4A Financial statement effects of an installment note A partial amortization schedule for a 10-year note payable issued on January 1 . Year 1 is shown asa. Required a. Using a financial statements model like the following one, record the appropriate amounts for the following two events: (1) January 1. Year 1, issue of the note payable. (2) December 31. Year 1, payment on the note payable. b. If the company earned $62,000 cash revenue and paid $45,000 in cash expenses in addition to the interest in Year 1 . what is the amount of each of the following? (1) Net income for Year 1 (2) Cash flow from operating activities for Year 1 (3) Cash flow from financing activities for Year 1 c. What is the umount of interest expense on this loan for Year 4 ? Brerelse 4A: A. \begin{tabular}{|l|l|l|l|l|l|l|l|} \hline Number & Assets & Kiability & Sh Equity & Revenue & Expenses & Net inc & Cash Flow \\ \hline 1. & & & & & & & \\ \hline 2. & & & & & & & \\ \hline \end{tabular} B.1. \begin{tabular}{|l|l|} \hline & \\ \hline & \\ \hline & \\ \hline & \\ \hline & \\ \hline & \\ \hline \end{tabular} 2. \begin{tabular}{|l|l|} \hline & \\ \hline & \\ \hline & \\ \hline & \\ \hline & \\ \hline & \\ \hline \end{tabular} 3. \begin{tabular}{|l|l|} \hline & \\ \hline & \\ \hline & \\ \hline & \\ \hline & \\ \hline & \\ \hline \end{tabular} c. Exercise 10-4A Financial statement effects of an installment note A partial amortization schedule for a 10-year note payable issued on January 1, Year 1, is shown next: Required a. Using a financial statements model like the following one, record the appropriate amounts for the following two events: (1) January 1, Year 1, issue of the note payable. (2) December 31, Year 1, payment on the note payable. b. If the company earned $62,000 cash revenue and paid $45,000 in cash expenses in addition to the interest in Year 1 , what is the amount of each of the following? (1) Net income for Year 1 (2) Cash flow from operating activities for Year 1 (3) Cash flow from financing activities for Year 1 c. What is the amount of interest expense on this loan for Year 4

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access with AI-Powered Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started