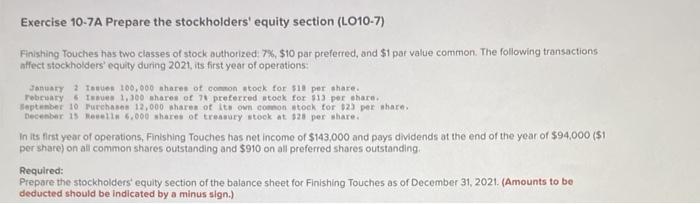

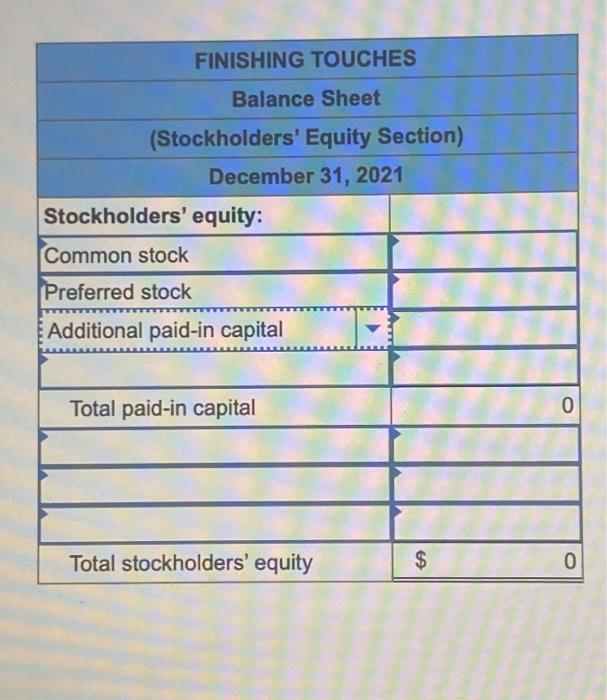

Exercise 10-7A Prepare the stockholders' equity section (1.010-7) Finishing Touches has two classes of stock authorized 7%, $10 par preferred, and $1 par value common. The following transactions affect stockholders' equity during 2021, its first year of operations January 2 Torben 100,000 shares of common stock for $10 per share. robaty T 1,300 shares of 71 preferred stock for 513 per share September 10 Purchases 12,000 shares of its own common stock for $25 per share: December 15 Mell6.000 shares of treasury stock at $28 per share In its first year of operations, Finishing Touches has net income of $143,000 and pays dividends at the end of the year of $94,000 (S1 per share) on all common shares outstanding and $910 on all preferred shares outstanding Required: Prepare the stockholders equity section of the balance sheet for Finishing Touches as of December 31, 2021. (Amounts to be deducted should be indicated by a minus sign.) FINISHING TOUCHES Balance Sheet (Stockholders' Equity Section) December 31, 2021 Stockholders' equity: Common stock Preferred stock Additional paid-in capital Total paid-in capital 0 Total stockholders' equity $ 0 Exercise 10-7A Prepare the stockholders' equity section (1.010-7) Finishing Touches has two classes of stock authorized 7%, $10 par preferred, and $1 par value common. The following transactions affect stockholders' equity during 2021, its first year of operations January 2 Torben 100,000 shares of common stock for $10 per share. robaty T 1,300 shares of 71 preferred stock for 513 per share September 10 Purchases 12,000 shares of its own common stock for $25 per share: December 15 Mell6.000 shares of treasury stock at $28 per share In its first year of operations, Finishing Touches has net income of $143,000 and pays dividends at the end of the year of $94,000 (S1 per share) on all common shares outstanding and $910 on all preferred shares outstanding Required: Prepare the stockholders equity section of the balance sheet for Finishing Touches as of December 31, 2021. (Amounts to be deducted should be indicated by a minus sign.) FINISHING TOUCHES Balance Sheet (Stockholders' Equity Section) December 31, 2021 Stockholders' equity: Common stock Preferred stock Additional paid-in capital Total paid-in capital 0 Total stockholders' equity $ 0