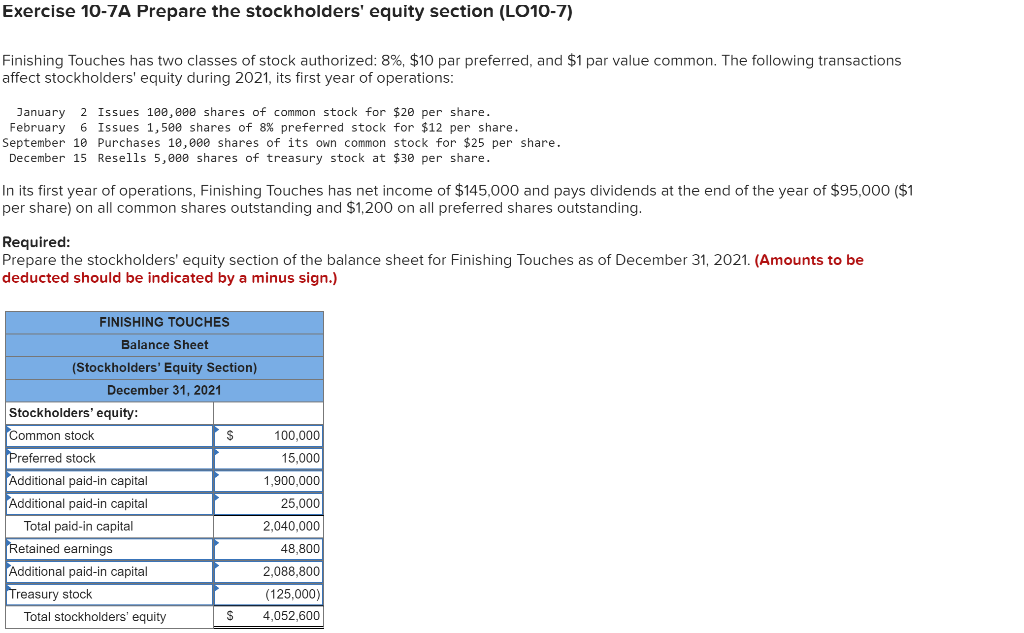

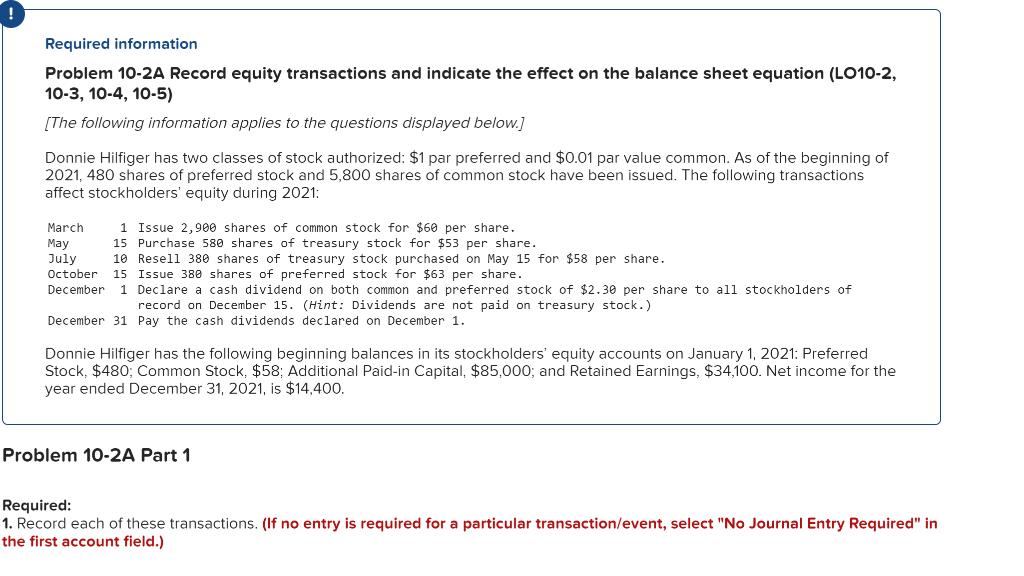

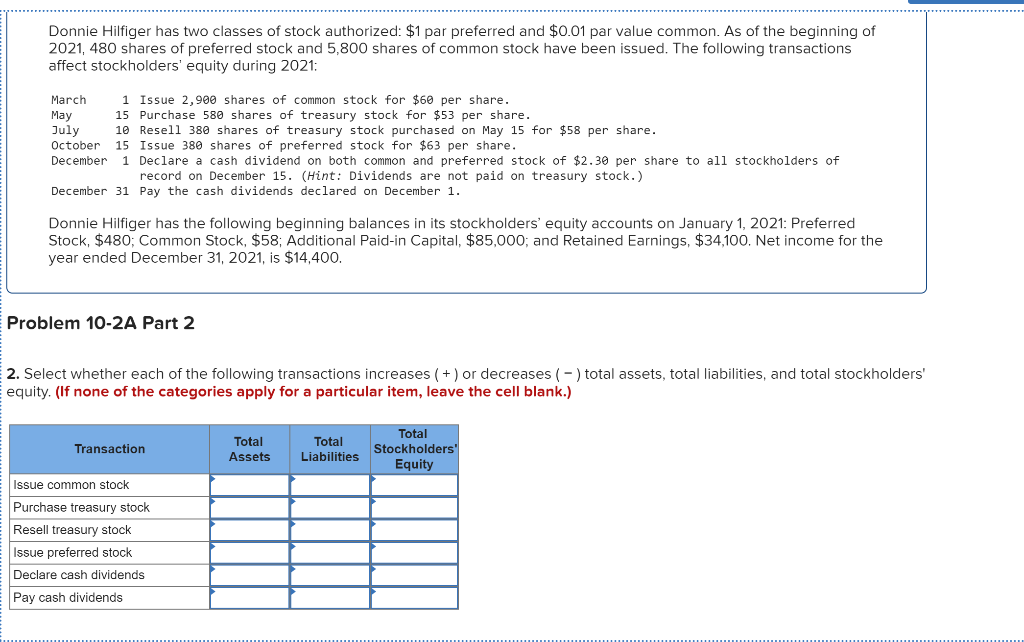

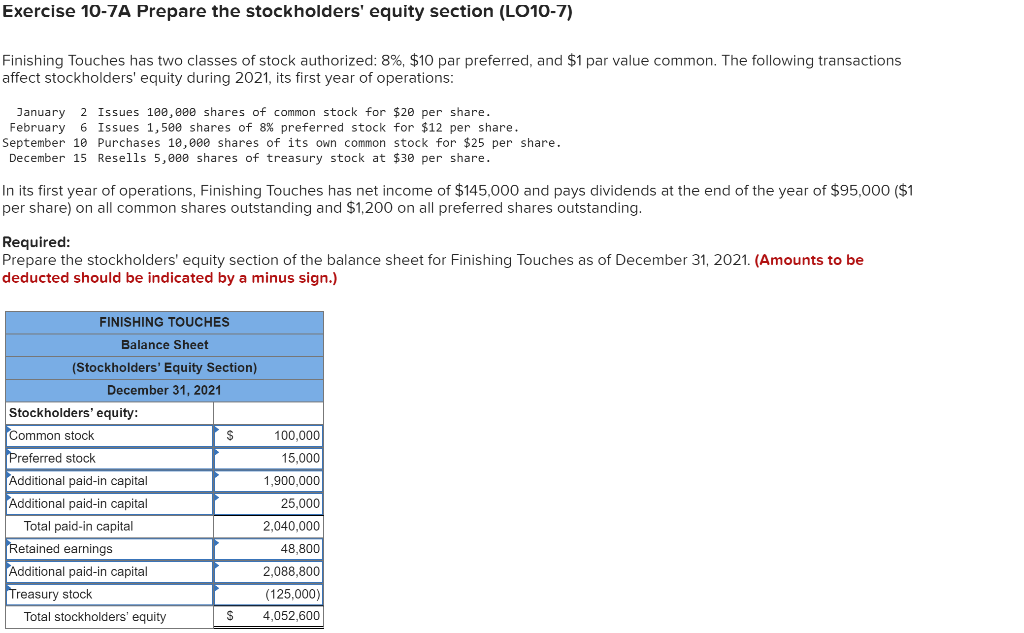

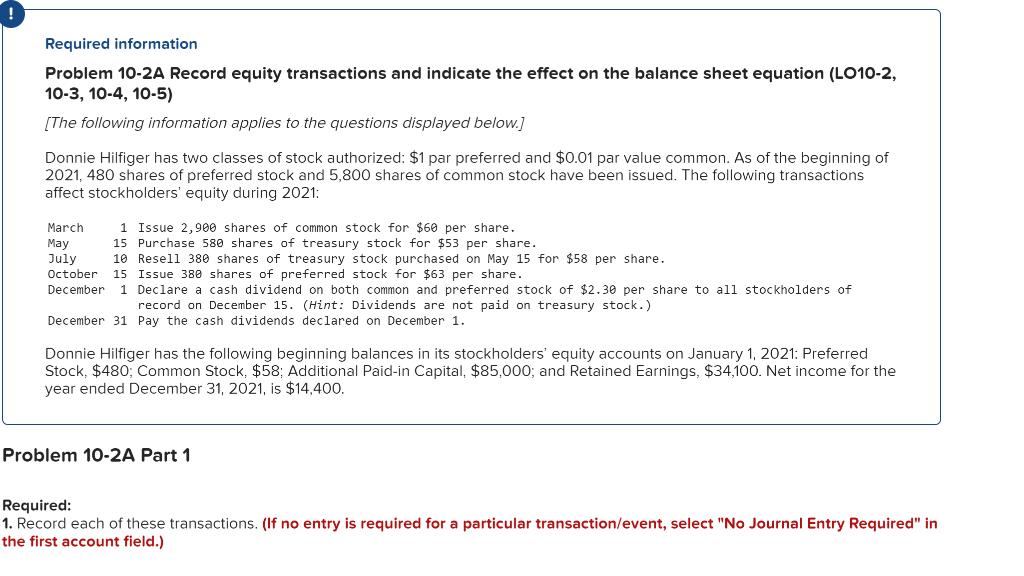

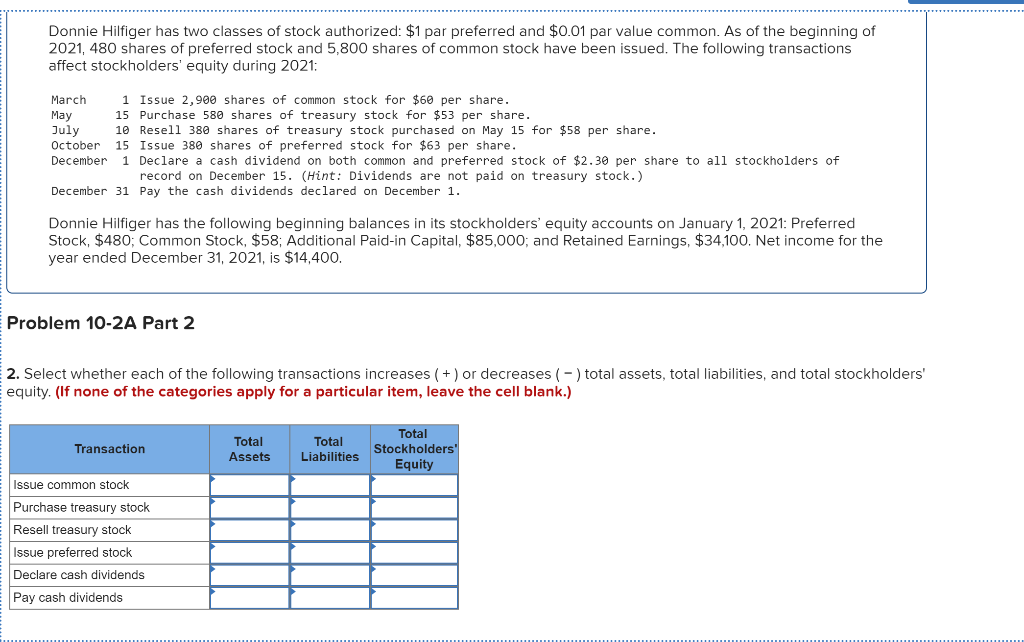

Exercise 10-7A Prepare the stockholders' equity section (LO10-7) Finishing Touches has two classes of stock authorized: 8%, $10 par preferred, and $1 par value common. The following transactions affect stockholders' equity during 2021, its first year of operations: January 2 Issues 100,000 shares of common stock for $20 per share. February 6 Issues 1,500 shares of 8% preferred stock for $12 per share. September 10 Purchases 10,000 shares of its own common stock for $25 per share. December 15 Resells 5,000 shares of treasury stock at $30 per share. In its first year of operations, Finishing Touches has net income of $145,000 and pays dividends at the end of the year of $95,000 ($1 per share) on all common shares outstanding and $1,200 on all preferred shares outstanding. Required: Prepare the stockholders' equity section of the balance sheet for Finishing Touches as of December 31, 2021. (Amounts to be deducted should be indicated by a minus sign.) FINISHING TOUCHES Balance Sheet (Stockholders' Equity Section) December 31, 2021 Stockholders' equity: Common stock $ 100,000 Preferred stock 15,000 Additional paid-in capital 1,900,000 Additional paid-in capital 25,000 Total paid-in capital 2,040,000 Retained earnings 48,800 Additional paid-in capital 2,088,800 Treasury stock (125,000) Total stockholders' equity $ 4,052,600 Required information Problem 10-2A Record equity transactions and indicate the effect on the balance sheet equation (LO10-2, 10-3, 10-4, 10-5) [The following information applies to the questions displayed below.] Donnie Hilfiger has two classes of stock authorized: $1 par preferred and $0.01 par value common. As of the beginning of 2021, 480 shares of preferred stock and 5,800 shares of common stock have been issued. The following transactions affect stockholders' equity during 2021: March 1 Issue 2,900 shares of common stock for $60 per share. May 15 Purchase 580 shares of treasury stock for $53 per share. July 10 Resell 380 shares of treasury stock purchased on May 15 for $58 per share. October 15 Issue 380 shares of preferred stock for $63 per share. December 1 Declare a cash dividend on both common and preferred stock of $2.30 per share to all stockholders of record on December 15. (Hint: Dividends are not paid on treasury stock.) December 31 Pay the cash dividends declared on December 1. Donnie Hilfiger has the following beginning balances in its stockholders' equity accounts on January 1, 2021: Preferred Stock, $480; Common Stock. $58; Additional Paid-in Capital, $85,000, and Retained Earnings, $34,100. Net income for the year ended December 31, 2021, is $14,400. Problem 10-2A Part 1 Required: 1. Record each of these transactions. (If no entry is required for a particular transaction/event, select "No Journal Entry Required" in the first account field.) Donnie Hilfiger has two classes of stock authorized: $1 par preferred and $0.01 par value common. As of the beginning of 2021, 480 shares of preferred stock and 5,800 shares of common stock have been issued. The following transactions affect stockholders' equity during 2021; March 1 Issue 2,900 shares of common stock for $60 per share. May 15 Purchase 580 shares of treasury stock for $53 per share. July 10 Resell 380 shares of treasury stock purchased on May 15 for $58 per share. October 15 Issue 380 shares of preferred stock for $63 per share. December 1 Declare a cash dividend on both common and preferred stock of $2.30 per share to all stockholders of record on December 15. (Hint: Dividends are not paid on treasury stock.) December 31 Pay the cash dividends declared on December 1. Donnie Hilfiger has the following beginning balances in its stockholders' equity accounts on January 1, 2021: Preferred Stock, $480; Common Stock, $58; Additional Paid-in Capital, $85,000; and Retained Earnings, $34,100. Net income for the year ended December 31, 2021, is $14,400. Problem 10-2A Part 2 2. Select whether each of the following transactions increases ( + ) or decreases ( - ) total assets, total liabilities, and total stockholders' equity. (If none of the categories apply for a particular item, leave the cell blank.) Transaction Total Assets Total Liabilities Total Stockholders Equity Issue common stock Purchase treasury stock Resell treasury stock Issue preferred stock Declare cash dividends Pay cash dividends