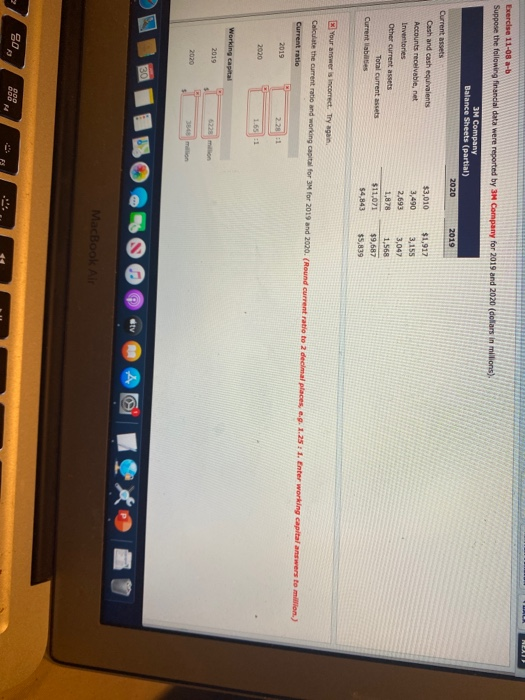

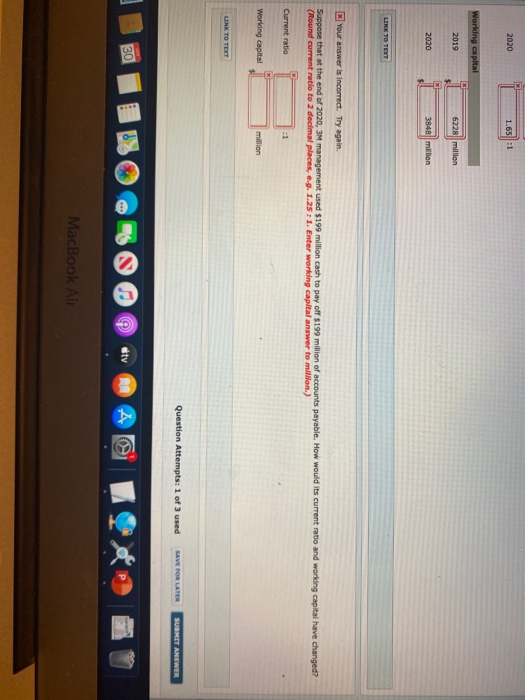

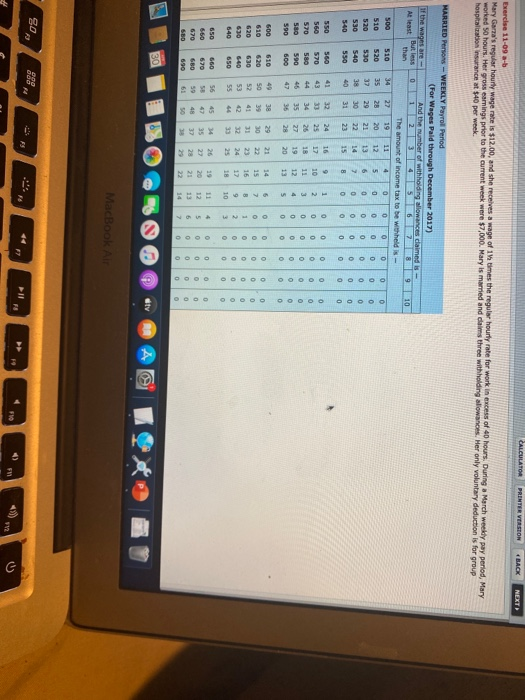

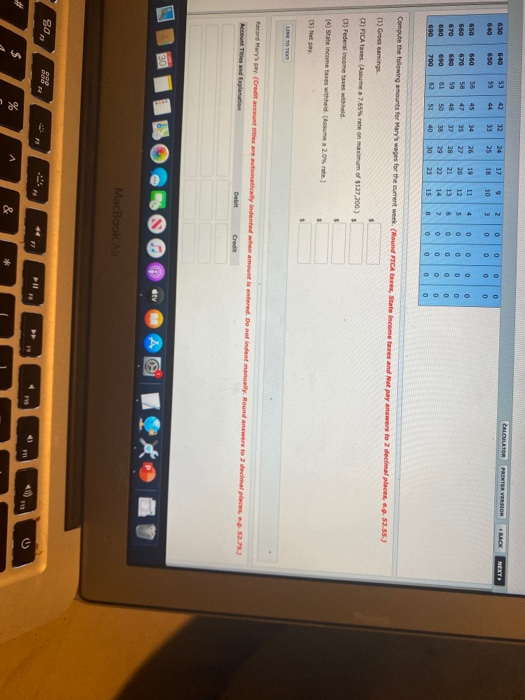

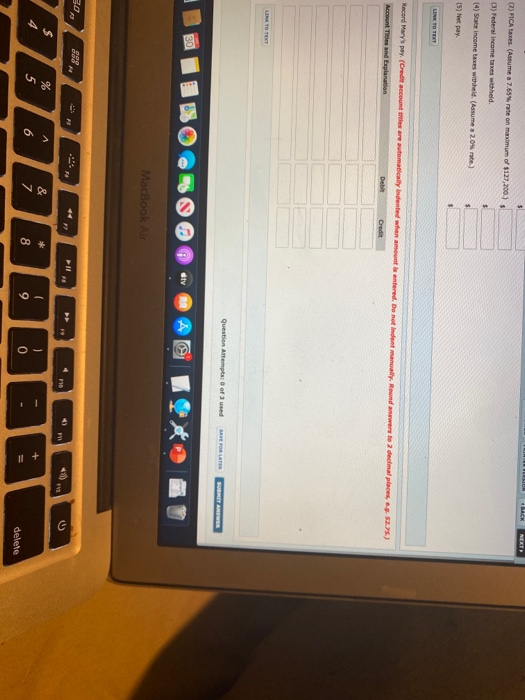

Exercise 11-05a-b Suppose the following financial data were reported by 3M Company for 2019 and 2020 (dollars in millions). 2019 3M Company Balance Sheets (partial) 2020 Current assets Cash and cash equivalents $3,010 Accounts receivable, net 3,490 Inventories 2,693 Other current assets Total current assets $11,071 Current liabilities 54.843 $1,917 3,155 3,047 1,568 $9,687 $5,839 your answers incorrect. Try again. Calculate the current ratio and working capital for 3M for 2019 and 2020. (Round cu Current ratio places. e.g. 1.25 : 1. Enter working capital answers to milion 2019 228 2020 Working capital 2020 MacBook Air 2020 I 1.651 Working capital 2019 6228 million 2020 million Your answer is incorrect. Try again, Suppose that at the end of 2020, 3M management used $199 million cash to pay off $199 million of accounts payable. How would its current ratio and working capital have changed? (Round current ratio to 2 decimal places, .g. 1.25 1 1. Enter working capital answer to million.) Current ratio Working capital million Question Attempts: 1 of 3 used SAVE FOR LATER SUBMIT ANSWER MacBook Air PRINTER VERSION BACK NEXT Exercise 11-09 ab Mary Garra's regular hourly wage rate is $12.00, and she receives a wage of 13 times the regular hourly rate for work in excess of 40 hours. During a March weekly pay period, Mary worked 50 hours. Her gross earnings prior to the current week were $7,000. Mary is mamed and claims three withholding allowances. Her only voluntary deduction is for group hospitalization Insurance at $40 per week. MARRIED Perso -WEEKLY Payrol Period (For Wages Pald through December 2017) And the number of withholding allowances claimed is- 012345678910 The amount of income tax to be withheld- 12 500 000 16 0 0 0 0 17 000 OOOOOOOOOOOOOO OOOOOOOOOOOO OOOOOOOooooo OOOOOOOOOOOOOO 0 13 14 5 6 7 0 0 0 0 0 MacBook Air BACK NEXT 40 0 50 000 60 000 70 0 0 0 88 ON Compute the following amounts for Mary's wages for the current week. (Round FTCA , State income taxes and Netay answer to 2 decimal places . 52.55. (1) Gross carings (2) PICA taxes. Asume a 7.65 rate on mamum of $127,200.) (3) Federal income taxes withheld (9) State income taxes witheid. Asume a 2.0% ) (5) Netpay Record Mary's ey Credit accounts Account Tides and nation are automatically indent dent manu Roundw o deca % & * (2) PICA taxes. (Assume a 7.65% rate on maximum of $127,200) (3) Federal income taxes withheld. (4) State income taxes withheld. (Assume a 20% rate) (5) Net pay Record Mary's pay. (Credit accountries are automatically Indented when amount ante. Do not indent l y. Round answers to Account Titles and Explanation decal s S275) Question Attempts of used SAVE FOR LATER MET ANSWER V O EBEP dolore delete