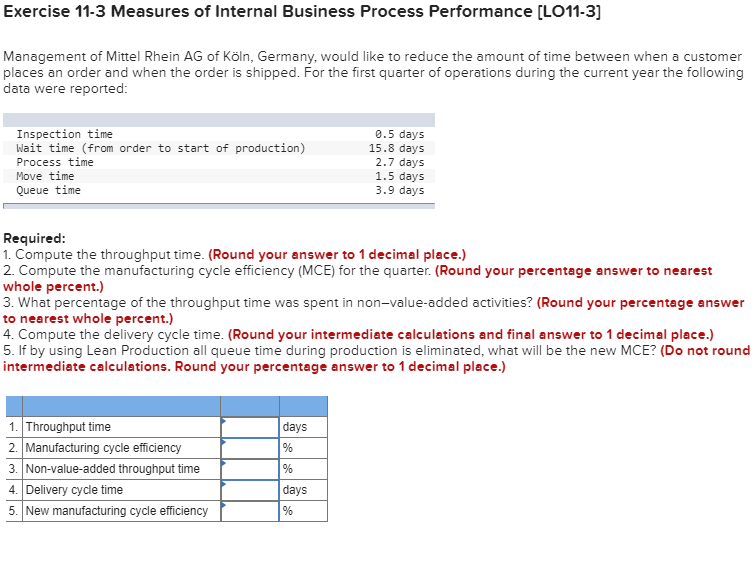

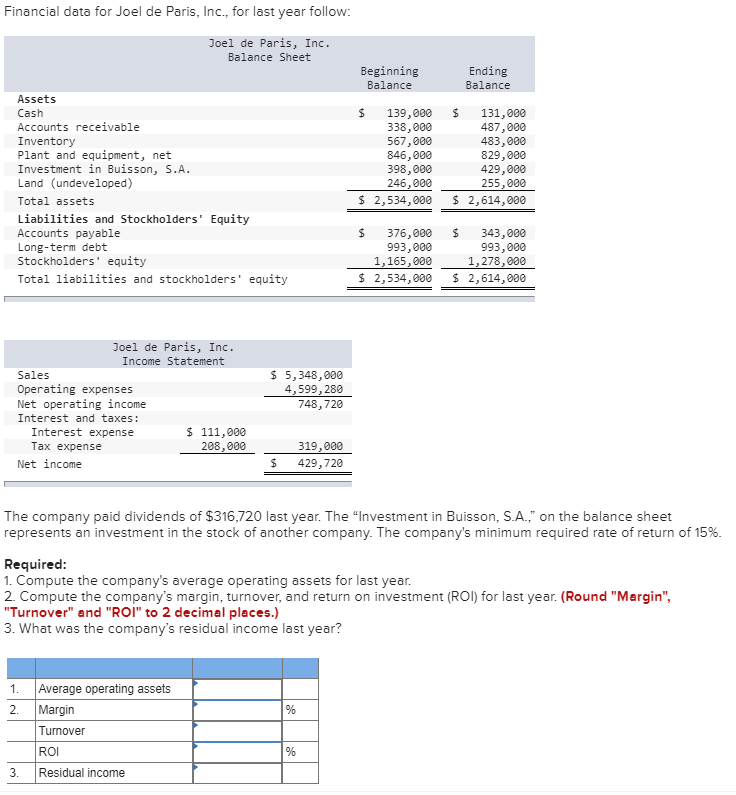

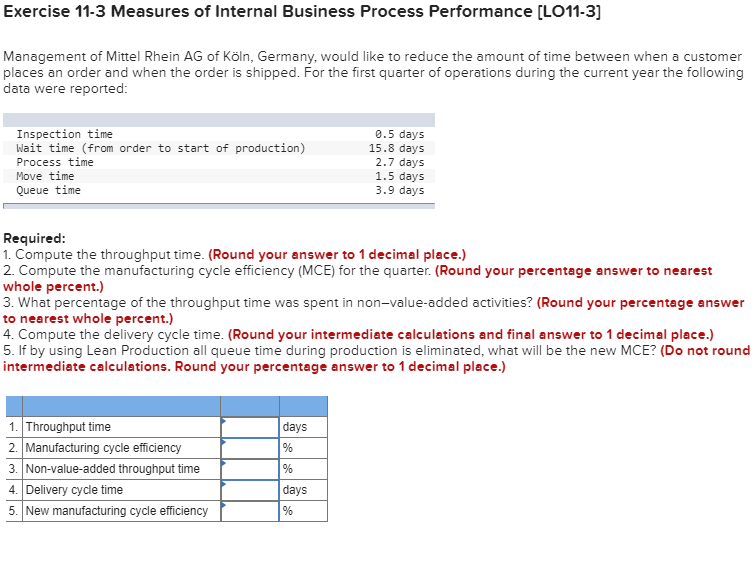

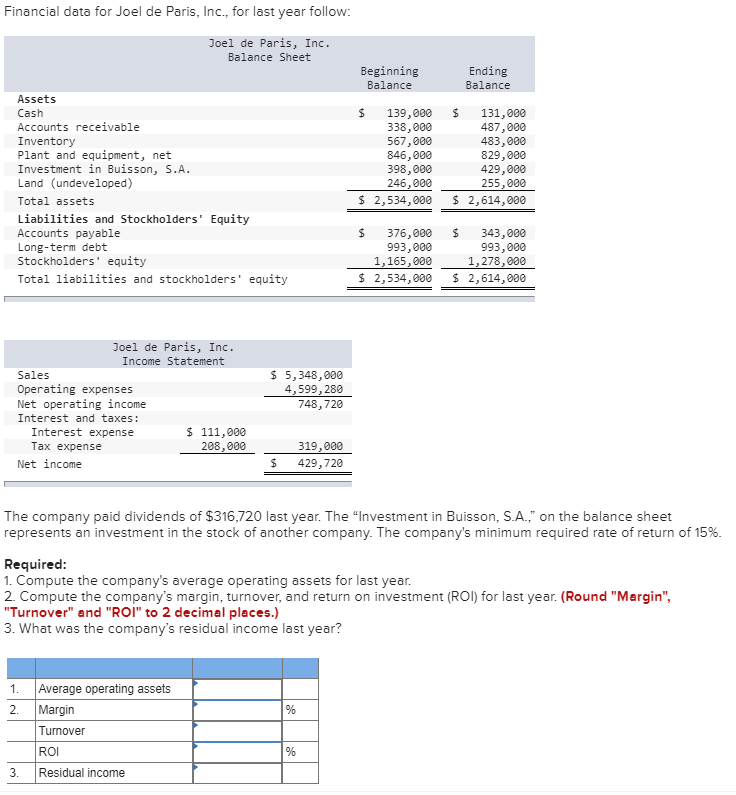

Exercise 11-3 Measures of Internal Business Process Performance (LO11-3] Management of Mittel Rhein AG of Kln, Germany, would like to reduce the amount of time between when a customer places an order and when the order is shipped. For the first quarter of operations during the current year the following data were reported: Inspection time Wait time (from order to start of production) Process time Move time Queue time 0.5 days 15.8 days 2.7 days 1.5 days 3.9 days Required: 1. Compute the throughput time. (Round your answer to 1 decimal place.) 2. Compute the manufacturing cycle efficiency (MCE) for the quarter. (Round your percentage answer to nearest whole percent.) 3. What percentage of the throughput time was spent in non-value-added activities? (Round your percentage answer to nearest whole percent.) 4. Compute the delivery cycle time. (Round your intermediate calculations and final answer to 1 decimal place.) 5. If by using Lean Production all queue time during production is eliminated, what will be the new MCE? (Do not round intermediate calculations. Round your percentage answer to 1 decimal place.) days 1. Throughput time 2. Manufacturing cycle efficiency 3. Non-value-added throughput time 4. Delivery cycle time 5. New manufacturing cycle efficiency days Financial data for Joel de Paris, Inc., for last year follow: Joel de Paris, Inc. Balance Sheet Beginning Balance Ending Balance Assets Cash Accounts receivable Inventory Plant and equipment, net Investment in Buisson, S.A. Land (undeveloped) Total assets Liabilities and Stockholders' Equity Accounts payable Long-term debt Stockholders' equity Total liabilities and stockholders' equity $ 139,000 338,000 567,000 846,000 398,000 246,000 $ 2,534,000 $ 131,000 487,000 483,000 829,000 429,000 255,000 $2,614,000 $ 376,000 993, 000 1,165,000 $ 2,534,000 $ 343,000 993,000 1,278,000 $2,614,000 Joel de Paris, Inc. Income Statement Sales Operating expenses Net operating income Interest and taxes: Interest expense $ 111,000 Tax expense 208,000 Net income $ 5,348,000 4,599, 280 748,720 319,000 429,720 $ The company paid dividends of $316,720 last year. The "Investment in Buisson, S.A.," on the balance sheet represents an investment in the stock of another company. The company's minimum required rate of return of 15%. Required: 1. Compute the company's average operating assets for last year. 2. Compute the company's margin, turnover, and return on investment (ROI) for last year. (Round "Margin", "Turnover" and "ROI" to 2 decimal places.) 3. What was the company's residual income last year? 1. 2. Average operating assets Margin Turnover ROI Residual income