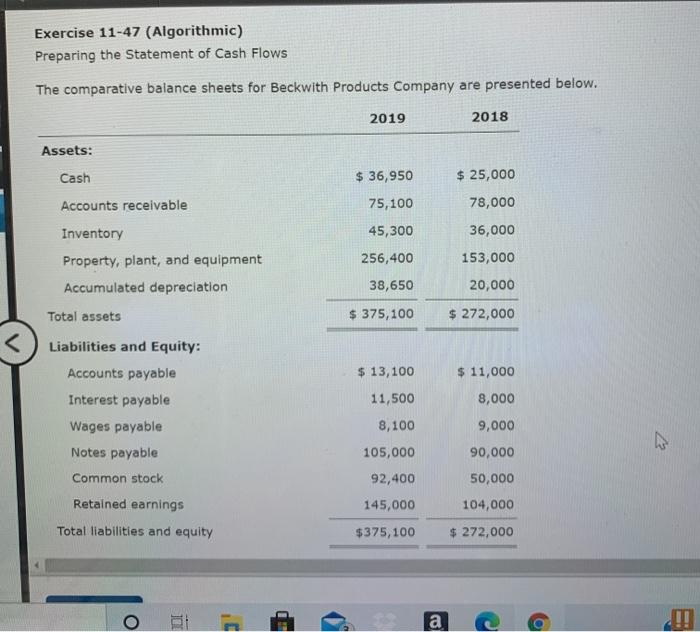

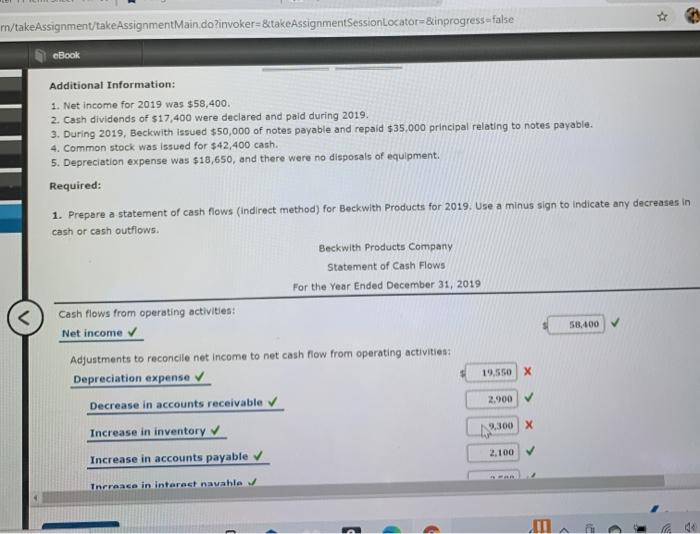

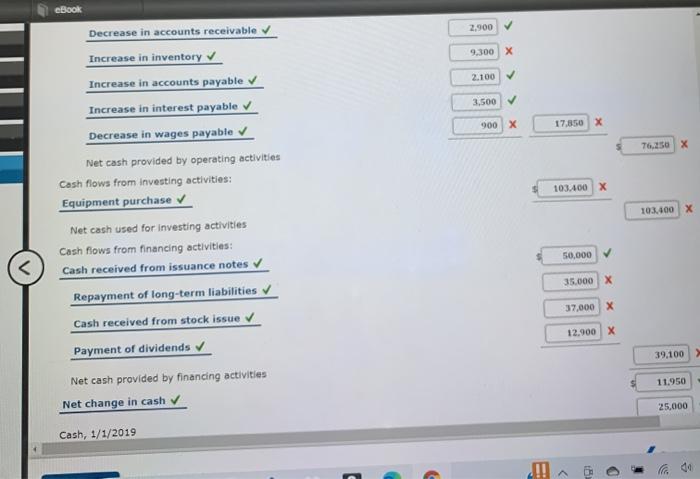

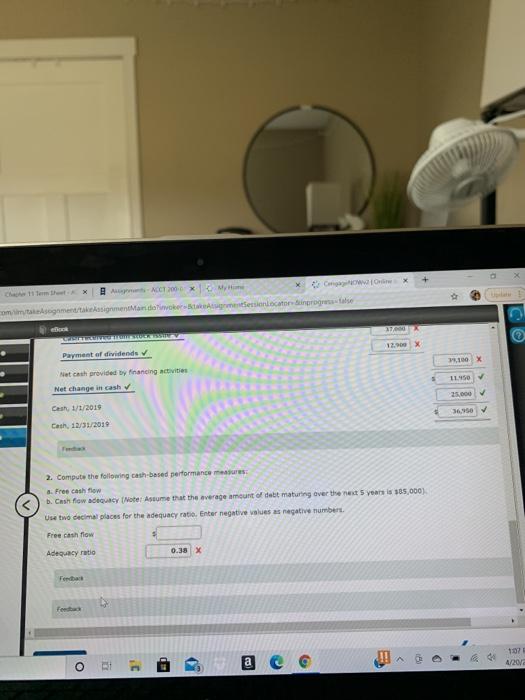

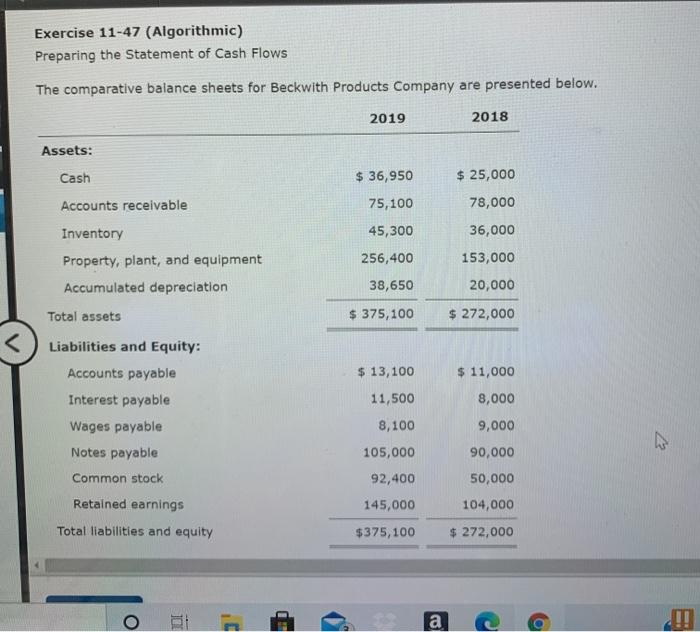

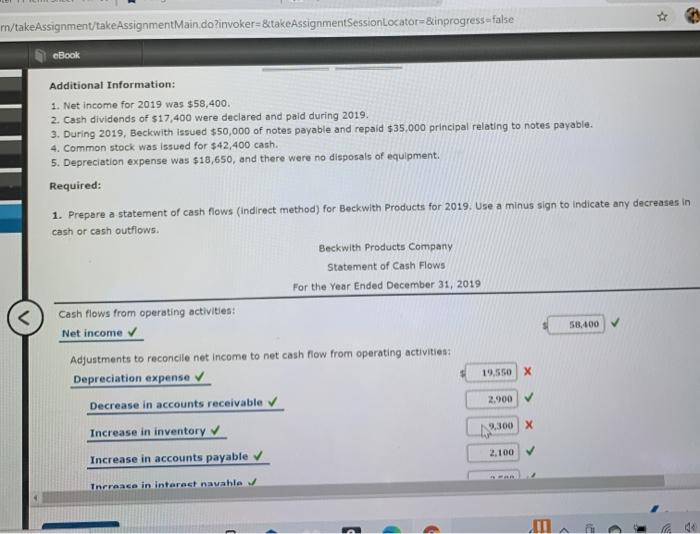

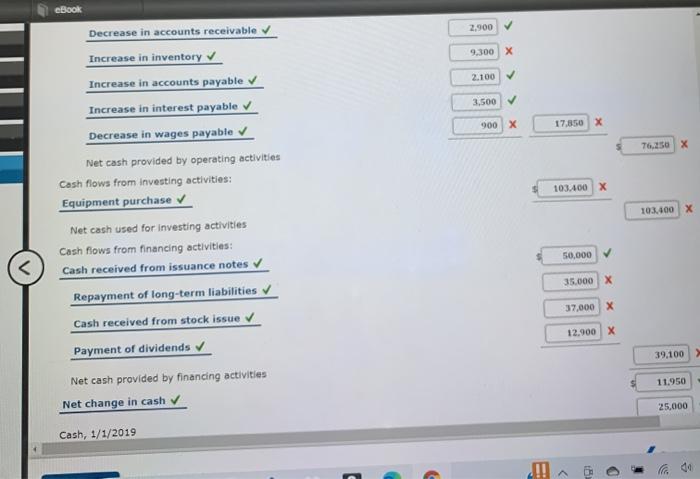

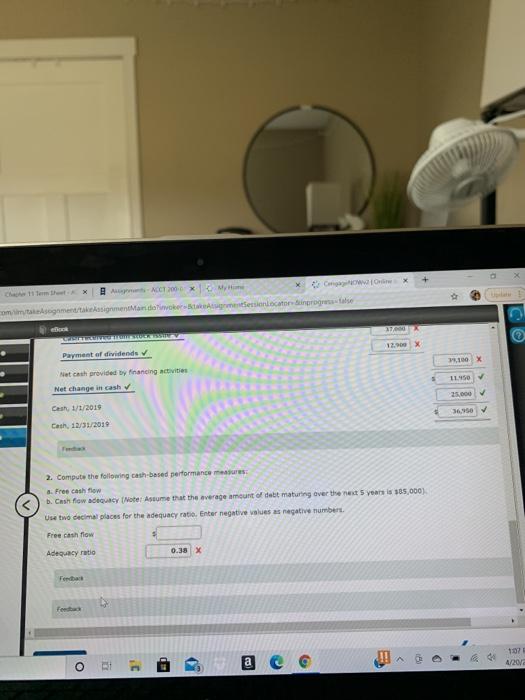

Exercise 11-47 (Algorithmic) Preparing the Statement of Cash Flows The comparative balance sheets for Beckwith Products Company are presented below. 2019 2018 Assets: Cash $ 36,950 $ 25,000 Accounts receivable 75,100 78,000 45,300 36,000 Inventory Property, plant, and equipment Accumulated depreciation 256,400 153,000 38,650 20,000 Total assets $ 375, 100 $ 272,000 2 eBook 2.900 9.300 X 2.100 3.500 900 x 17,850 X 76.250 X 103.400 X 103.400 X Decrease in accounts receivable Increase in inventory Increase in accounts payable Increase in interest payable Decrease in wages payable Net cash provided by operating activities Cash flows from investing activities: Equipment purchase Net cash used for investing activities Cash flows from financing activities: Cash received from issuance notes Repayment of long-term liabilities Cash received from stock issue Payment of dividends Net cash provided by financing activities Net change in cash 50,000 35.000 X 37,000 X 12.900 X 39.100 11.950 25,000 Cash, 1/1/2019 > D dan C - AOCT 2000 x M om megmentssignment and wokertretensionate ingroase 12.X Payment of dividends BOX 1150 Netch provided by financing activities Net change in cash Cash, 1/1/2018 36,950 Cath, 12/31/2010 2. Compute the following cash-based performance measures Free cash flow b. Cash flow adequacy Noter Assume that the average amount of debit maturing over the net 5 years is 385,000) Use two decimal places for the adequacy ratio. Enter negative values as negative number Free cash flow Adequacy ratio 0.38 x Feed 187 D O EP 09 a 420 C Exercise 11-47 (Algorithmic) Preparing the Statement of Cash Flows The comparative balance sheets for Beckwith Products Company are presented below. 2019 2018 Assets: Cash $ 36,950 $ 25,000 Accounts receivable 75,100 78,000 45,300 36,000 Inventory Property, plant, and equipment Accumulated depreciation 256,400 153,000 38,650 20,000 Total assets $ 375, 100 $ 272,000 2 eBook 2.900 9.300 X 2.100 3.500 900 x 17,850 X 76.250 X 103.400 X 103.400 X Decrease in accounts receivable Increase in inventory Increase in accounts payable Increase in interest payable Decrease in wages payable Net cash provided by operating activities Cash flows from investing activities: Equipment purchase Net cash used for investing activities Cash flows from financing activities: Cash received from issuance notes Repayment of long-term liabilities Cash received from stock issue Payment of dividends Net cash provided by financing activities Net change in cash 50,000 35.000 X 37,000 X 12.900 X 39.100 11.950 25,000 Cash, 1/1/2019 > D dan C - AOCT 2000 x M om megmentssignment and wokertretensionate ingroase 12.X Payment of dividends BOX 1150 Netch provided by financing activities Net change in cash Cash, 1/1/2018 36,950 Cath, 12/31/2010 2. Compute the following cash-based performance measures Free cash flow b. Cash flow adequacy Noter Assume that the average amount of debit maturing over the net 5 years is 385,000) Use two decimal places for the adequacy ratio. Enter negative values as negative number Free cash flow Adequacy ratio 0.38 x Feed 187 D O EP 09 a 420 C