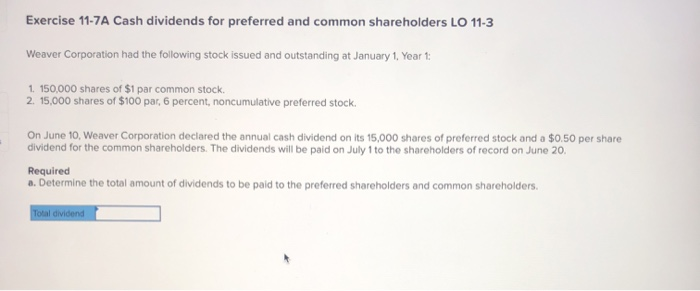

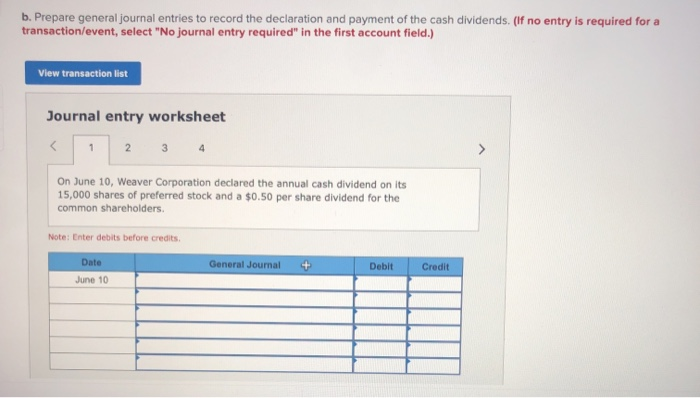

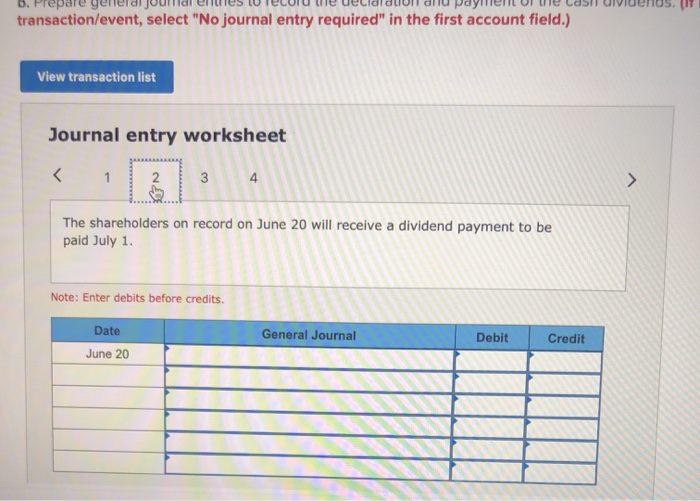

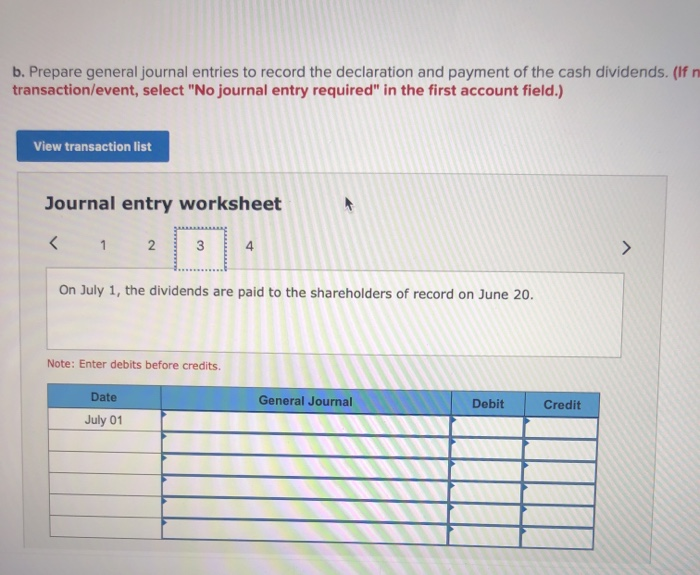

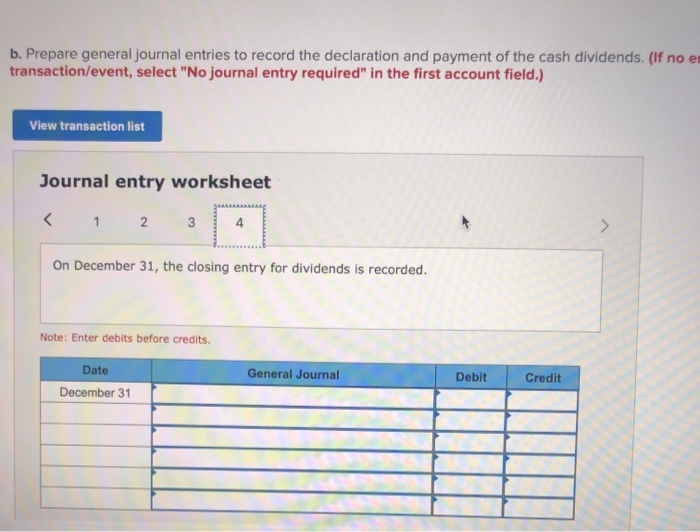

Exercise 11-7A Cash dividends for preferred and common shareholders LO 11-3 Weaver Corporation had the following stock issued and outstanding at January 1, Yeart 1. 150,000 shares of $1 par common stock, 2. 15,000 shares of $100 par, 6 percent, noncumulative preferred stock. On June 10, Weaver Corporation declared the annual cash dividend on its 15,000 shares of preferred stock and a $0.50 per share dividend for the common shareholders. The dividends will be paid on July 1 to the shareholders of record on June 20. Required a. Determine the total amount of dividends to be paid to the preferred shareholders and common shareholders. Total dividend b. Prepare general journal entries to record the declaration and payment of the cash dividends. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) View transaction list Journal entry worksheet 1 2 3 4 On June 10, Weaver Corporation declared the annual cash dividend on its 15,000 shares of preferred stock and a $0.50 per share dividend for the common shareholders. Note: Enter debits before credits Date General Journal + Debit Credit June 10 0. Prepare yered Juura tres Telur euecidi UU UNU PUH UL transaction/event, select "No journal entry required" in the first account field.) View transaction list Journal entry worksheet The shareholders on record on June 20 will receive a dividend payment to be paid July 1. Note: Enter debits before credits. General Debit Credit Date June 20 / II. b. Prepare general journal entries to record the declaration and payment of the cash dividends. (If n transaction/event, select "No journal entry required" in the first account field.) View transaction list Journal entry worksheet On July 1, the dividends are paid to the shareholders of record on June 20. Note: Enter debits before credits. General Journal Debit Credit Date July 01 TI b. Prepare general journal entries to record the declaration and payment of the cash dividends. (If no e transaction/event, select "No journal entry required" in the first account field.) View transaction list Journal entry worksheet On December 31, the closing entry for dividends is recorded. Note: Enter debits before credits. General Journal Debit Credit Date December 31