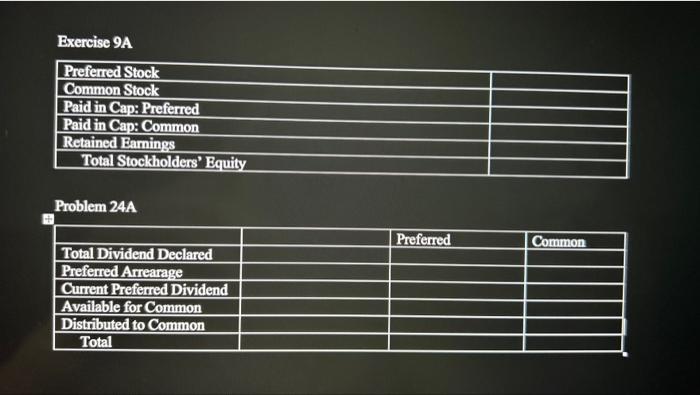

EXERCISE 11-9A & PROBLEM 11-24A

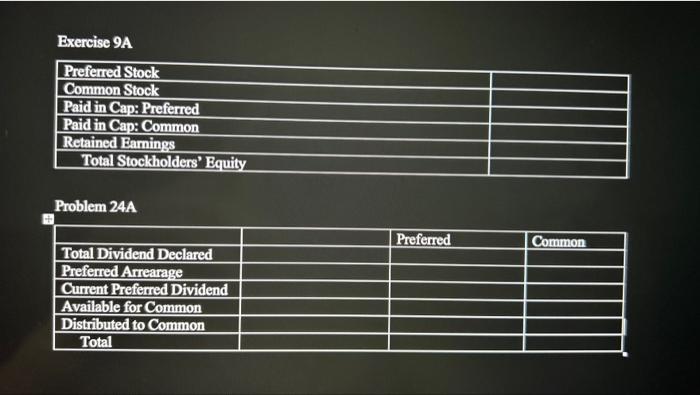

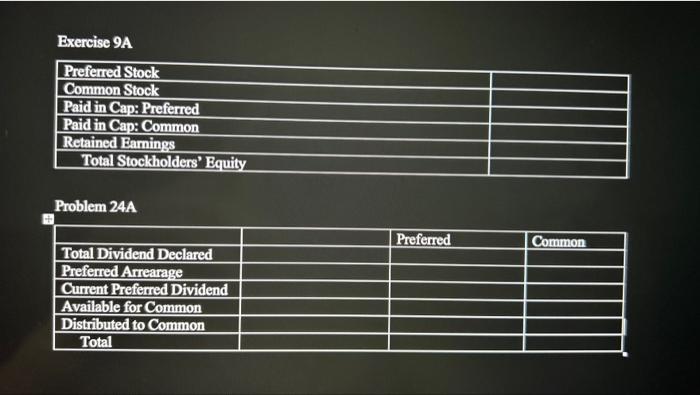

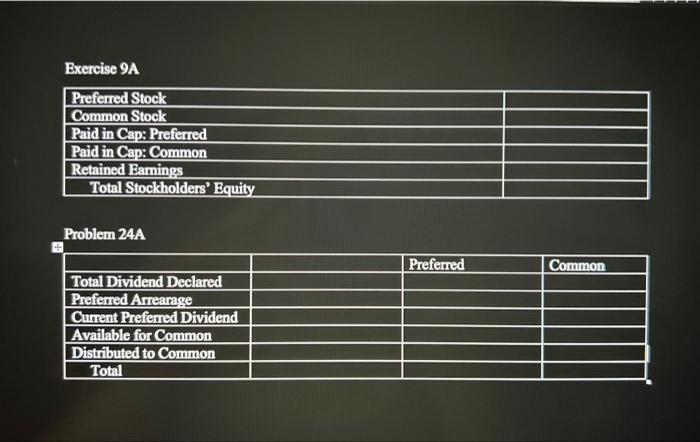

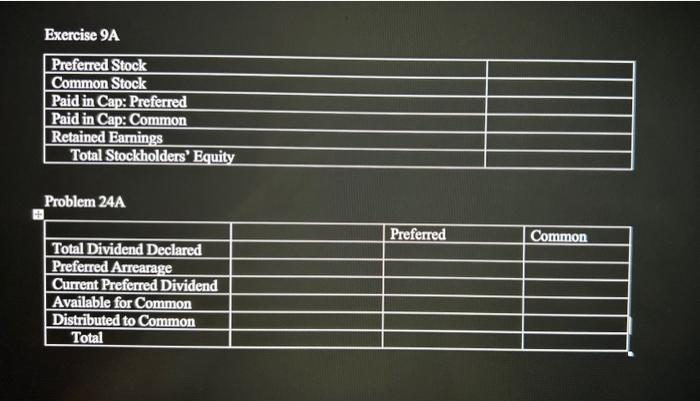

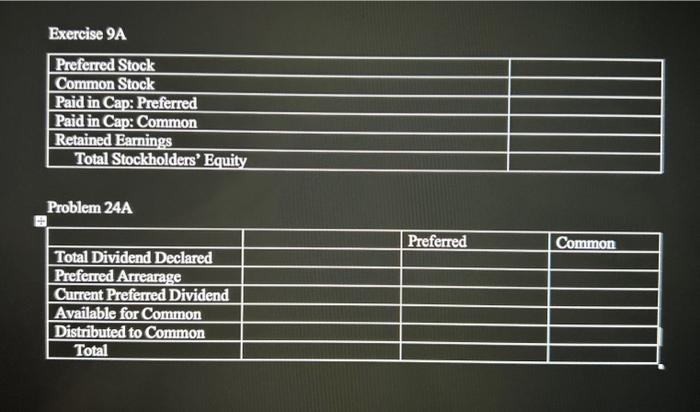

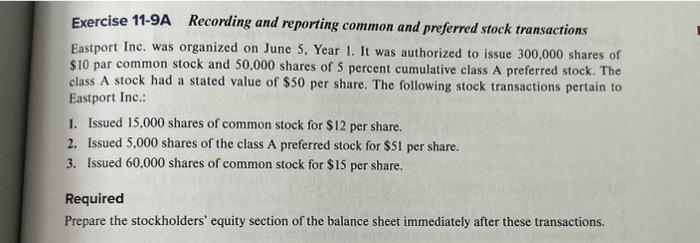

Exercise 9A Exercise 9A \begin{tabular}{|l|l|} \hline Preferred Stock & \\ \hline Common Stock & \\ \hline Paid in Cap: Preferred & \\ \hline Paid in Cap: Common & \\ \hline Retained Eamings & \\ \hline Total Stockholders' Equity & \\ \hline \end{tabular} Problem 24A \begin{tabular}{|l|l|l|l|} \hline & & Preferred & Common \\ \hline Total Dividend Declared & & & \\ \hline Preferred Arrearage & & & \\ \hline Current Preferred Dividend & & & \\ \hline Available for Common & & & \\ \hline Distributed to Common & & & \\ \hline Total & & & \\ \hline \end{tabular} Exercise 9A \begin{tabular}{|l|l|} \hline Preferred Stock & \\ \hline Common Stock & \\ \hline Paid in Cap: Preferred & \\ \hline Paid in Cap: Common & \\ \hline Retained Earnings & \\ \hline Total Stockholders' Equity & \\ \hline \end{tabular} Problem 24A \begin{tabular}{|l|l|l|l|} \hline & & Preferred & Common \\ \hline Total Dividend Declared & & & \\ \hline Preferred Arrearage & & & \\ \hline Current Preferred Dividend & & & \\ \hline Available for Common & & & \\ \hline Distributed to Common & & & \\ \hline Total & & & \\ \hline \end{tabular} = Exercise 11-9A Recording and reporting common and preferred stock transactions Eastport Inc. was organized on June 5, Year 1. It was authorized to issue 300,000 shares of $10 par common stock and 50,000 shares of 5 percent cumulative class A preferred stock. The class A stock had a stated value of $50 per share. The following stock transactions pertain to Eastport Inc.: 1. Issued 15,000 shares of common stock for $12 per share. 2. Issued 5,000 shares of the class A preferred stock for $51 per share. 3. Issued 60,000 shares of common stock for $15 per share. Required Prepare the stockholders' equity section of the balance sheet immediately after these transactions. Exercise 11-9A Recording and reporting common and preferred stock transactions Eastport Inc. was organized on June 5, Year 1. It was authorized to issue 300.000 shares of $10 par common stock and 50,000 shares of 5 percent cumulative class A preferred stock. The class A stock had a stated value of $50 per share. The following stock transactions pertain to Eastport Inc.: 1. Issued 15,000 shares of common stock for $12 per share. 2. Issued 5,000 shares of the class A preferred stock for $51 per share. 3. Issued 60,000 shares of common stock for $15 per share. Exercise 11-9A Recording and reporting common and preferred stock transactions Eastport Inc. was organized on June 5, Year 1. It was authorized to issue 300,000 shares of $10 par common stock and 50,000 shares of 5 percent cumulative class A preferred stock. The class A stock had a stated value of $50 per share. The following stock transactions pertain to Eastport Inc.: 1. Issued 15,000 shares of common stock for $12 per share. 2. Issued 5,000 shares of the class A preferred stock for $51 per share. 3. Issued 60,000 shares of common stock for $15 per share. Problem 11-24A Cash dividends: common and preferred stock Nowell Inc. had the following stock issued and outstanding at January 1, Year 1: 1. 150,000 shares of no-par common stock. 2. 30,000 shares of $50 par, 4 percent, cumulative preferred stock. (Dividends are in arrears for one year.) On March 8, Year 1. Nowell declared a \$175,000 cash dividend to be paid March 31 to shareholders of record on March 20. Required What amount of dividends will be paid to the preferred shareholders versus the common shareholders? Problem 11-24A Cash dividends: common and preferred stock Nowell Inc. had the following stock issued and outstanding at January 1, Year 1: 1. 150,000 shares of no-par common stock. 2. 30,000 shares of $50 par, 4 percent, cumulative preferred stock. (Dividends are in arrears for one year.) On March 8, Year 1, Nowell declared a $175,000 cash dividend to be paid March 31 to shareholders of record on March 20. Required What amount of dividends will be paid to the preferred shareholders versus the common shareholders? Proprietorships, Partnerships, and C Problem 11-24A Cash dividends: common and preferred stock Nowell Inc. had the following stock issued and outstanding at January 1, Year 1: 1. 150,000 shares of no-par common stock. 2. 30,000 shares of $50 par, 4 percent, cumulative preferred stock. (Dividends are in arrears for one year.) On March 8, Year 1, Nowell declared a $175,000 cash dividend to be paid March 31 to shareholders of record on March 20. Required What amount of dividends will be paid to the preferred shareholders versus the common shareholders? Problem 11-24A Cash dividends: common and preferred stock Nowell Inc. had the following stock issued and outstanding at January 1, Year 1: 1. 150,000 shares of no-par common stock. 2. 30,000 shares of $50 par, 4 percent, cumulative preferred stock. (Dividends are in arrears for one year.) On March 8. Year 1, Nowell declared a $175,000 cash dividend to be paid March 31 to shareholders of record on March 20. Required What amount of dividends will be paid to the preferred shareholders versus the common shareholders