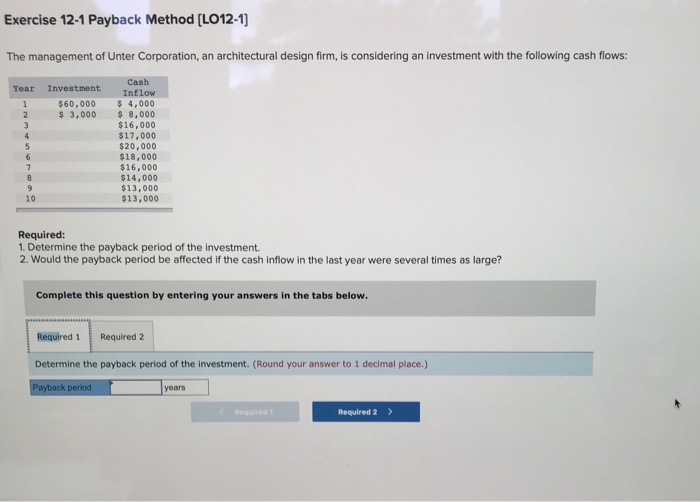

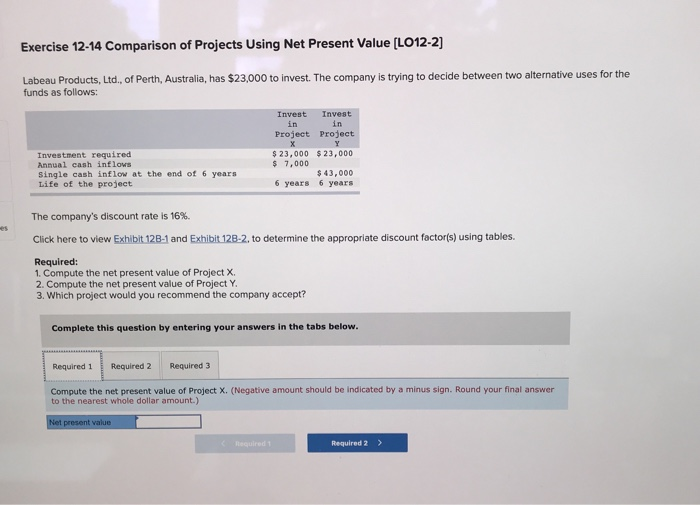

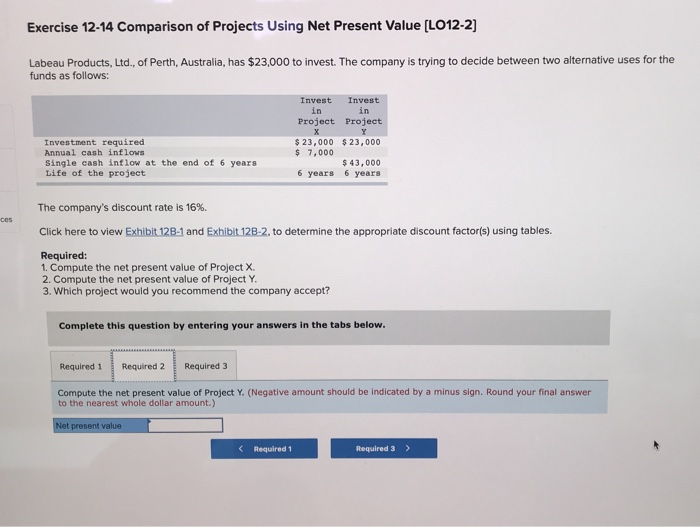

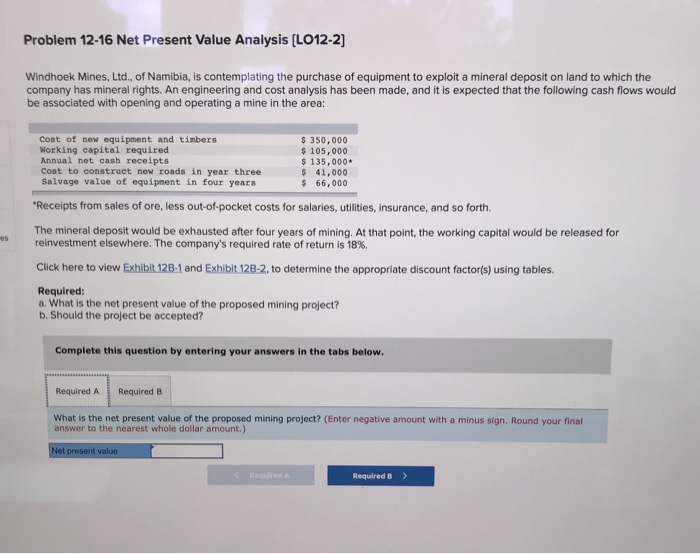

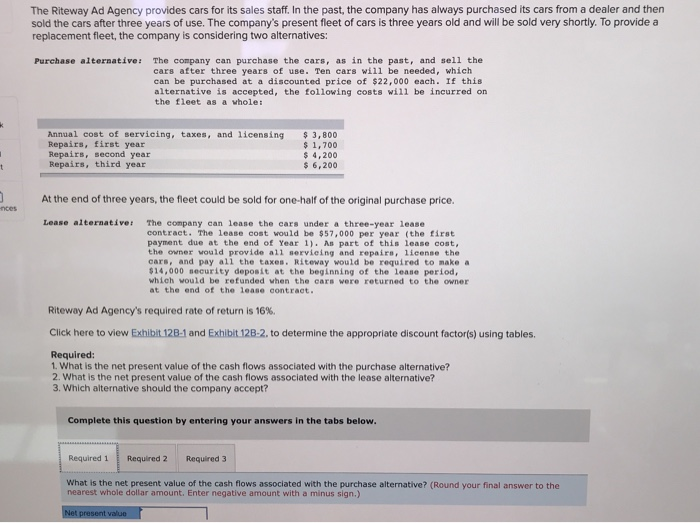

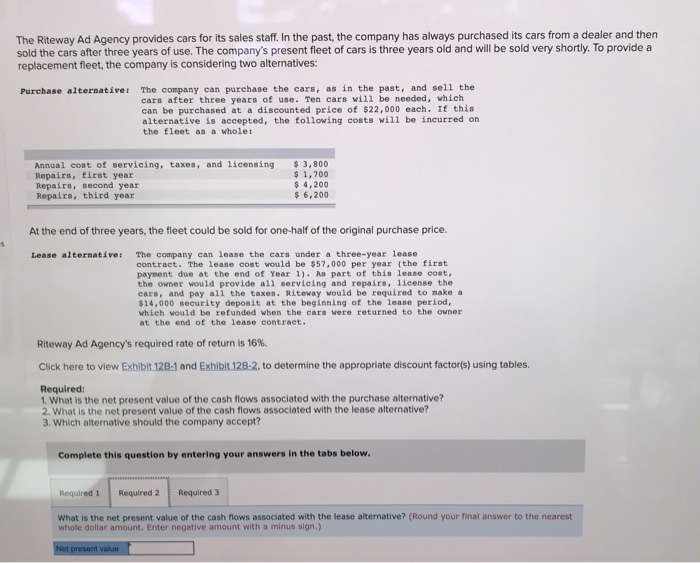

Exercise 12-1 Payback Method [LO12-1) The management of Unter Corporation, an architectural design firm, is considering an investment with the following cash flows: Year Investment $60,000 $ 3,000 1 2 3 4 5 Cash Inflow $ 4,000 $ 8,000 $16,000 $17,000 $20,000 $18,000 $ 16,000 $14,000 $13,000 $13,000 7 8 9 10 Required: 1. Determine the payback period of the investment 2. Would the payback period be affected if the cash inflow in the last year were several times as large? Complete this question by entering your answers in the tabs below. Required 1 Required 2 Determine the payback period of the investment. (Round your answer to 1 decimal place.) Payback period years Reduled Required 2 > Exercise 12-14 Comparison of Projects Using Net Present Value (LO12-2] Labeau Products, Ltd., of Perth, Australia, has $23,000 to invest. The company is trying to decide between two alternative uses for the funds as follows: Investment required Annual cash inflows Single cash inflow at the end of 6 years Life of the project Invest Invest in in Project Project $ 23,000 $23,000 $ 7,000 $ 43,000 6 years 6 years The company's discount rate is 16%. Click here to view Exhibit 128-1 and Exhibit 128-2, to determine the appropriate discount factor(s) using tables. Required: 1. Compute the net present value of Project X 2. Compute the net present value of Project Y. 3. Which project would you recommend the company accept? Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Compute the net present value of Project X. (Negative amount should be indicated by a minus sign. Round your final answer to the nearest whole dollar amount.) Net present value Required Required 2 > Exercise 12-14 Comparison of Projects Using Net Present Value (L012-2] Labeau Products, Ltd., of Perth, Australia, has $23,000 to invest. The company is trying to decide between two alternative uses for the funds as follows: Investment required Annual cash inflows Single cash inflow at the end of 6 years Life of the project Invest Invest in in Project Project x Y $ 23,000 $ 23,000 $ 7,000 $ 43,000 6 years 6 years ces The company's discount rate is 16% Click here to view Exhibit 12B-1 and Exhibit 12B-2. determine the appropriate discount factor(s) using tables. Required: 1. Compute the net present value of Project X. 2. Compute the net present value of Project Y. 3. Which project would you recommend the company accept? Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Compute the net present value of Project Y. (Negative amount should be indicated by a minus sign. Round your final answer to the nearest whole dollar amount.) Net present value Required 1 Required 3 > Problem 12-16 Net Present Value Analysis (L012-2] Windhoek Mines, Ltd., of Namibia, is contemplating the purchase of equipment to exploit a mineral deposit on land to which the company has mineral rights. An engineering and cost analysis has been made, and it is expected that the following cash flows would be associated with opening and operating a mine in the area: Cost of new equipment and timbers Working capital required Annual net cash receipts Cost to construct new roads in year three Salvage value of equipment in four years $ 350,000 $ 105,000 $ 135,000 $ 41,000 $ 66,000 "Receipts from sales of ore, less out-of-pocket costs for salaries, utilities, insurance, and so forth. The mineral deposit would be exhausted after four years of mining. At that point, the working capital would be released for reinvestment elsewhere. The company's required rate of return is 18% Click here to view Exhibit 128-1 and Exhibit 12B-2, to determine the appropriate discount factor(s) using tables. Required: a. What is the net present value of the proposed mining project? b. Should the project be accepted? Complete this question by entering your answers in the tabs below. Required A Required B What is the net present value of the proposed mining project? (Enter negative amount with a minus sign. Round your final answer to the nearest whole dollar amount.) Net present value Regard Required 8 > The Riteway Ad Agency provides cars for its sales staff. In the past, the company has always purchased its cars from a dealer and then sold the cars after three years of use. The company's present fleet of cars is three years old and will be sold very shortly. To provide a replacement fleet, the company is considering two alternatives: Purchase alternative: The company can purchase the cars, as in the past, and sell the cars after three years of use. Ten cars will be needed, which can be purchased at a discounted price of $22,000 each. If this alternative is accepted, the following costs will be incurred on the fleet as a whole: Annual cost of servicing, taxes, and licensing Repairs, first year Repairs, second year Repairs, third year $ 3,800 $ 1,700 $ 4,200 $ 6,200 - -nces At the end of three years, the fleet could be sold for one-half of the original purchase price. Lease alternativer The company can lease the cars under a three-year lease contract. The lease cost would be $57,000 per year (the first payment due at the end of Year 1). As part of this lease cost, the owner would provide all servicing and repairs, license the cars, and pay all the taxes. Riteway would be required to make a $14,000 security deposit at the beginning of the lease period, which would be refunded when the cars were returned to the owner at the end of the lease contract. Riteway Ad Agency's required rate of return is 16%. Click here to view Exhibit 128-1 and Exhibit 12B-2. to determine the appropriate discount factor(s) using tables, Required: 1. What is the net present value of the cash flows associated with the purchase alternative? 2. What is the net present value of the cash flows associated with the lease alternative? 3. Which alternative should the company accept? Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 What is the net present value of the cash flows associated with the purchase alternative? (Round your final answer to the nearest whole dollar amount. Enter negative amount with a minus sign.) Net present value The Riteway Ad Agency provides cars for its sales staff. In the past, the company has always purchased its cars from a dealer and then sold the cars after three years of use. The company's present fleet of cars is three years old and will be sold very shortly. To provide a replacement fleet, the company is considering two alternatives: Purchase alternative: The company can purchase the cars, as in the past, and sell the cars after three years of use. Ten cars will be needed, which can be purchased at a discounted price of $22,000 each. If this alternative is accepted, the following costs will be incurred on the fleet as a whole Annual cost of servicing, taxes, and licensing Repairs, first year Repairs, second year Repairs, third year $ 3,800 $ 1,700 $ 4,200 $ 6,200 At the end of three years, the fleet could be sold for one-half of the original purchase price. Lease alternative: The company can lease the cars under a three-year lease contract. The lease cost would be $57,000 per year (the first payment due at the end of Year 1). As part of this lease cost, the owner would provide all servicing and repairs, license the cars, and pay all the taxes. Riteway would be required to make a $14,000 security deposit at the beginning of the lease period, which would be refunded when the cars were returned to the owner at the end of the lease contract. Riteway Ad Agency's required rate of return is 16%. Click here to view Exhibit 12B-1 and Exhibit 12B-2. to determine the appropriate discount factor(s) using tables. Required: 1. What is the net present value of the cash flows associated with the purchase alternative? 2. What is the net present value of the cash flows associated with the lease alternative? 3. Which alternative should the company accept? Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 What is the net present value of the cash flows associated with the lease alternative? (Round your final answer to the nearest whole dollar amount. Enter negative amount with a minus sign.) Not present value