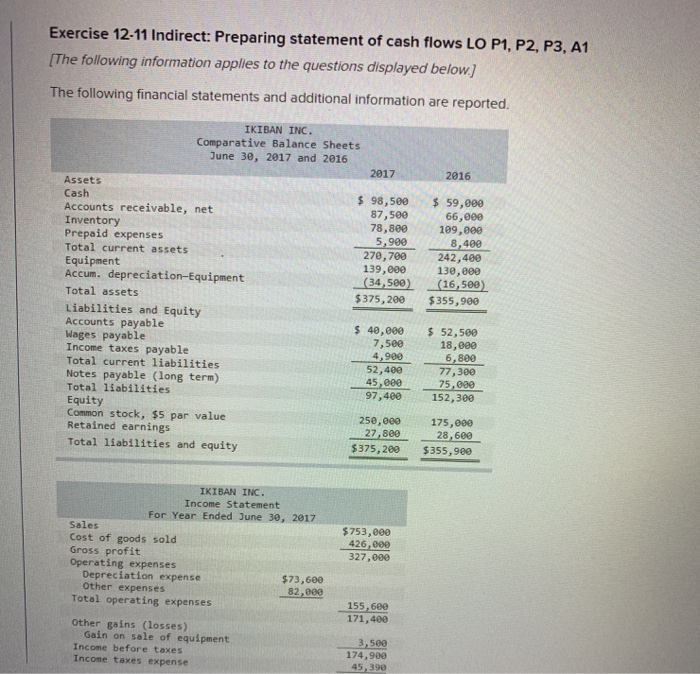

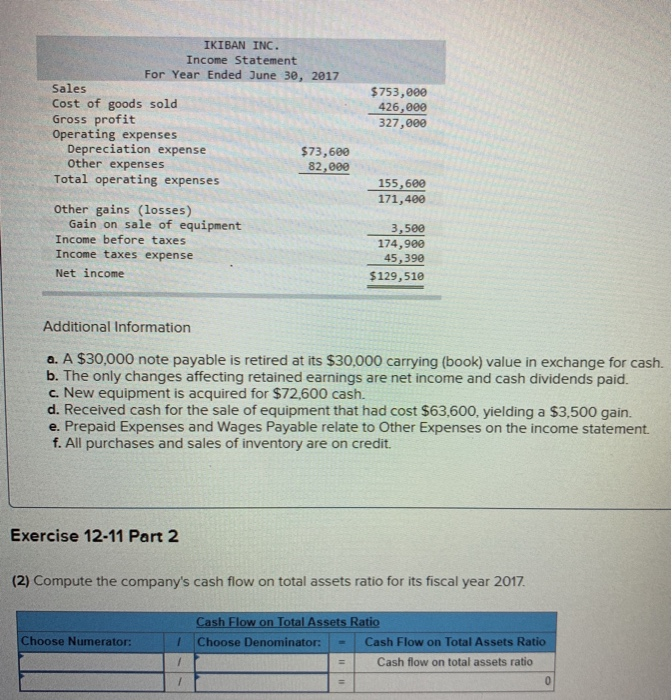

Exercise 12-11 Indirect: Preparing statement of cash flows LO P1, P2, P3, A1 The following information applies to the questions displayed below.) The following financial statements and additional information are reported, IKIBAN INC. Comparative Balance Sheets June 30, 2017 and 2016 2017 2016 $ 98,500 87,500 78.800 5,900 270,700 139,000 (34,589) $375,200 $ 59,000 66,000 109,000 8,490 242,400 130, (16,500) $355,900 Assets Cash Accounts receivable, net Inventory Prepaid expenses Total current assets Equipment Accum. depreciation-Equipment Total assets Liabilities and Equity Accounts payable Wages payable Income taxes payable Total current liabilities Notes payable (long term) Total liabilities Equity Common stock, $5 par value Retained earnings Total liabilities and equity $ 40,000 7,500 4,900 52,400 45,000 97,400 $ 52,500 18, eee 6,800 77,380 75,689 152,300 250,000 27,800 $375,200 175,089 28,600 $355,900 IKIBAN INC. Income Statement For Year Ended June 30, 2017 Sales Cost of goods sold Gross profit Operating expenses Depreciation expense $73,600 other expenses 82,899 Total operating expenses $753,000 426,000 327,000 155,600 171,400 Other gains (losses) Gain on sale of equipment Income before taxes Income taxes expense 3,500 174,900 45, 390 IKIBAN INC. Income Statement For Year Ended June 30, 2017 Sales Cost of goods sold Gross profit Operating expenses Depreciation expense $73,680 Other expenses 82,880 Total operating expenses $753,000 426,000 327,000 155,600 171,400 Other gains (losses) Gain on sale of equipment Income before taxes Income taxes expense Net income 3,500 174,900 45, 390 $129,510 Additional Information a. A $30,000 note payable is retired at its $30,000 carrying (book) value in exchange for cash. b. The only changes affecting retained earnings are net income and cash dividends paid. c. New equipment is acquired for $72,600 cash. d. Received cash for the sale of equipment that had cost $63,600, yielding a $3,500 gain. e. Prepaid Expenses and Wages Payable relate to Other Expenses on the income statement. f. All purchases and sales of inventory are on credit. Exercise 12-11 Part 2 (2) Compute the company's cash flow on total assets ratio for its fiscal year 2017. Choose Numerator: Cash Flow on Total Assets Ratio Choose Denominator = Cash Flow on Total Assets Ratio = Cash flow on total assets ratio =