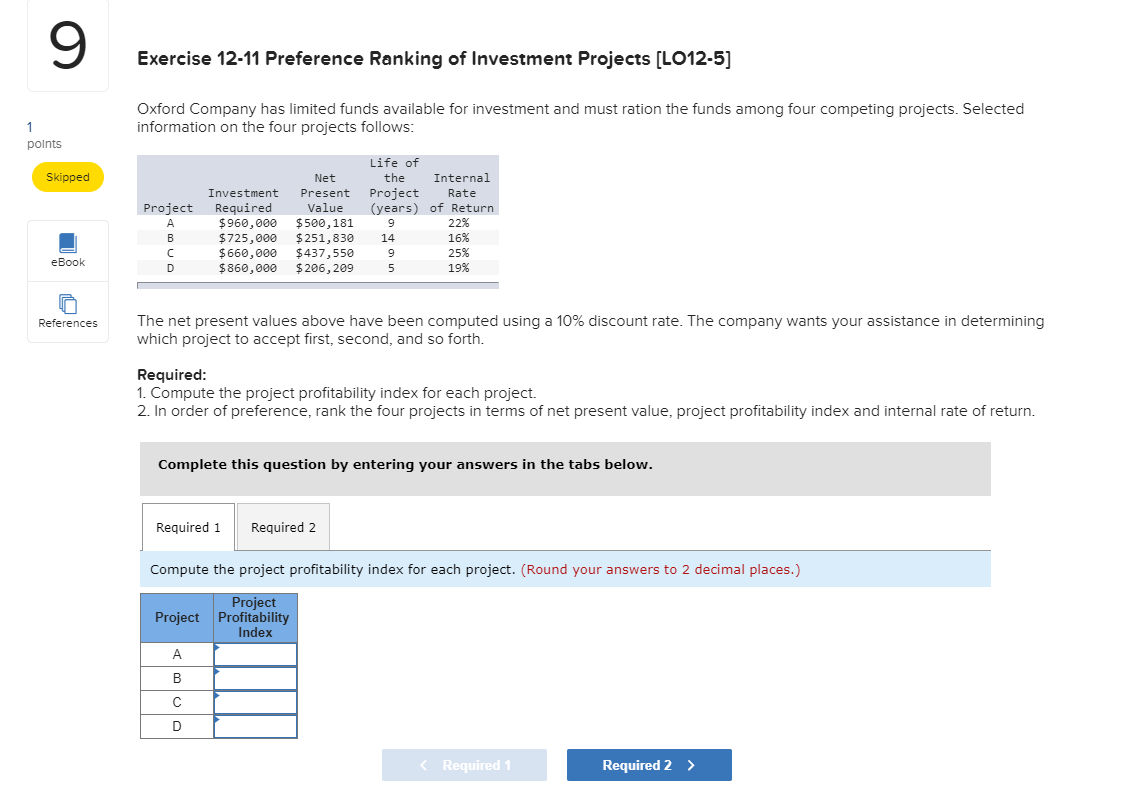

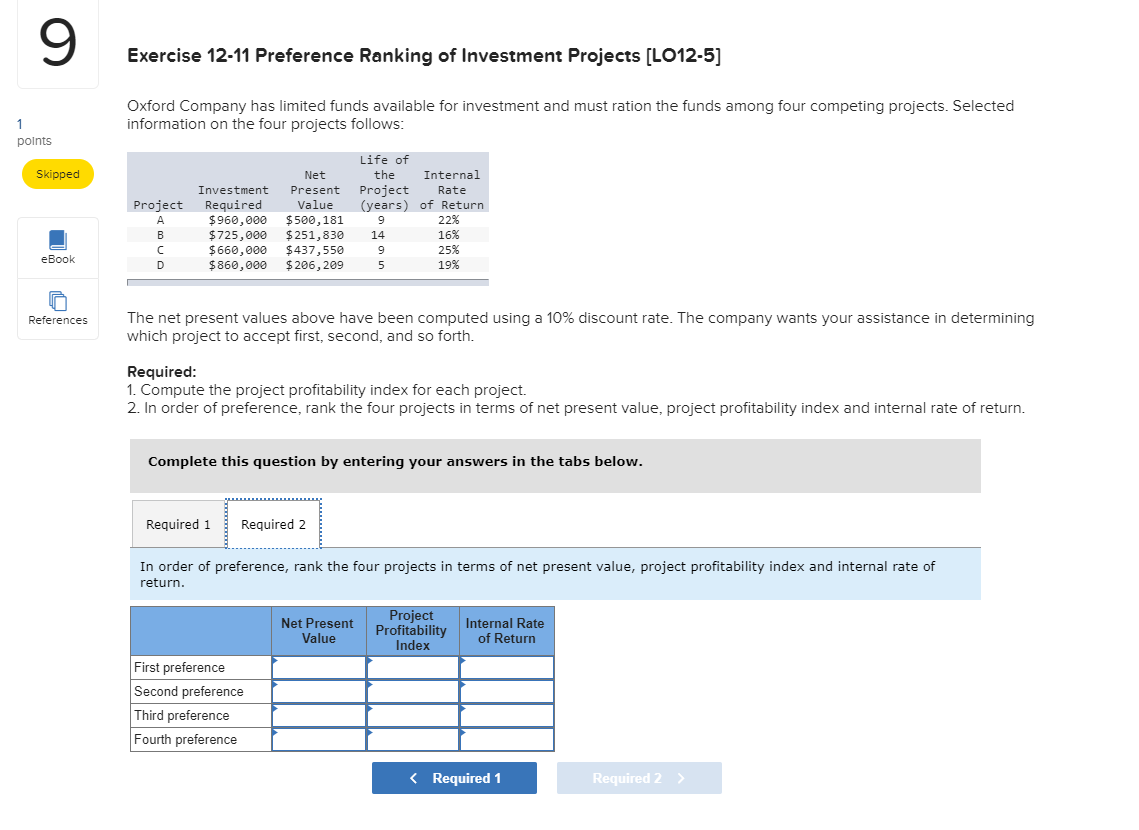

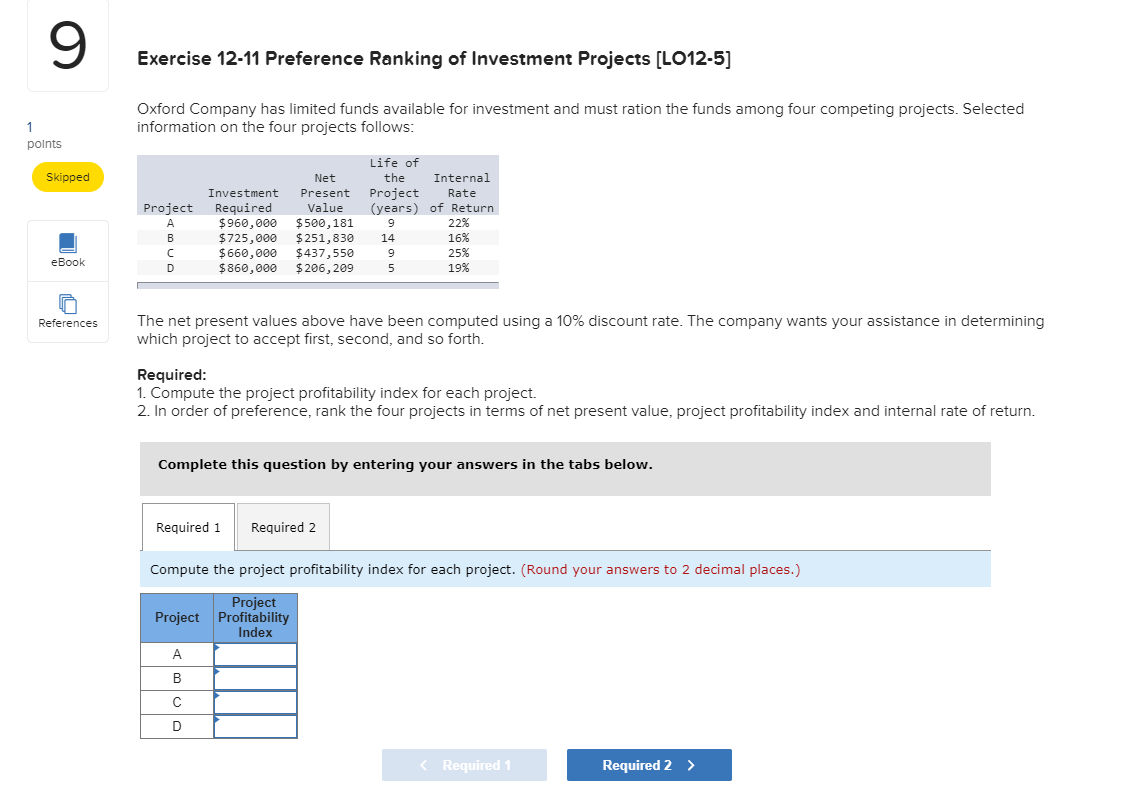

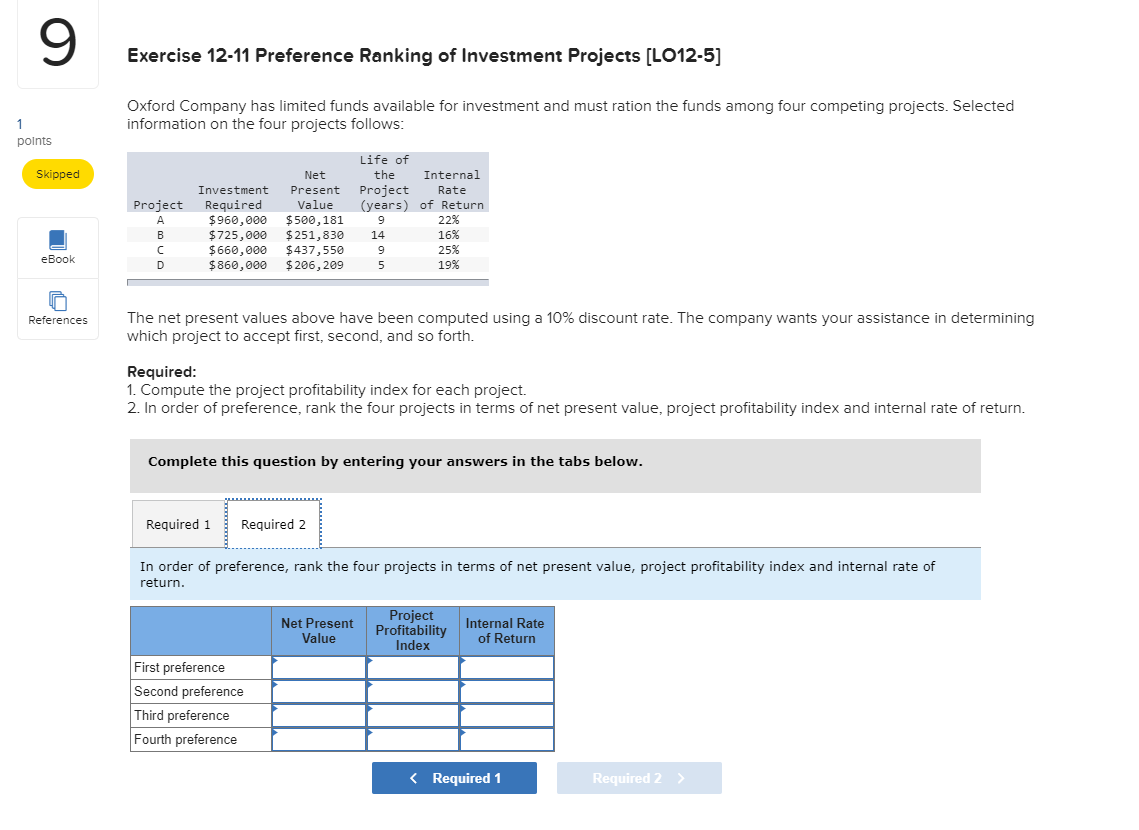

Exercise 12-11 Preference Ranking of Investment Projects [LO12-5] Oxford Company has limited funds available for investment and must ration the funds among four competing projects. Selected information on the four projects follows: points Skipped Project Investment Required $960,000 $725,000 $660,000 $860,000 Life of Net the Internal Present Project Value (years) of Return $500,181 22% $251,830 14 16% $437,5509 25% $206,209 19% eBook References The net present values above have been computed using a 10% discount rate. The company wants your assistance in determining which project to accept first, second, and so forth. Required: 1. Compute the project profitability index for each project. 2. In order of preference, rank the four projects in terms of net present value, project profitability index and internal rate of return. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Compute the project profitability index for each project. (Round your answers to 2 decimal places.) Project Project Profitability Index Required 1 Required 2 > Exercise 12-11 Preference Ranking of Investment Projects [LO12-5] Oxford Company has limited funds available for investment and must ration the funds among four competing projects. Selected information on the four projects follows: points Skipped Project Investment Required $960,000 $725,000 $660,000 $860,000 Life of Net the Internal Present Project Rate Value (years) of Return $500,1819 22% $251,830 14 16% $437,550 9 25% $206,209 5 19% eBook a References The net present values above have been computed using a 10% discount rate. The company wants your assistance in determining which project to accept first, second, and so forth. Required: 1. Compute the project profitability index for each project. 2. In order of preference, rank the four projects in terms of net present value, project profitability index and internal rate of return. Complete this question by entering your answers in the tabs below. Required 1 Required 2 In order of preference, rank the four projects in terms of net present value, project profitability index and internal rate of return. Net Present Project Profitability Index Internal Rate of Return Value First preference Second preference Third preference Fourth preference Required 1 Required 2 >