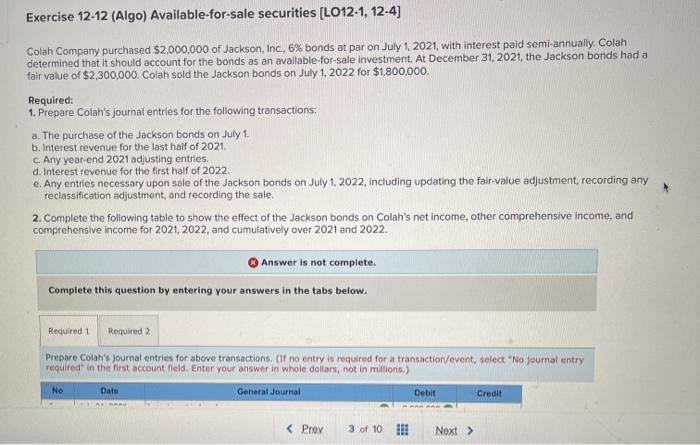

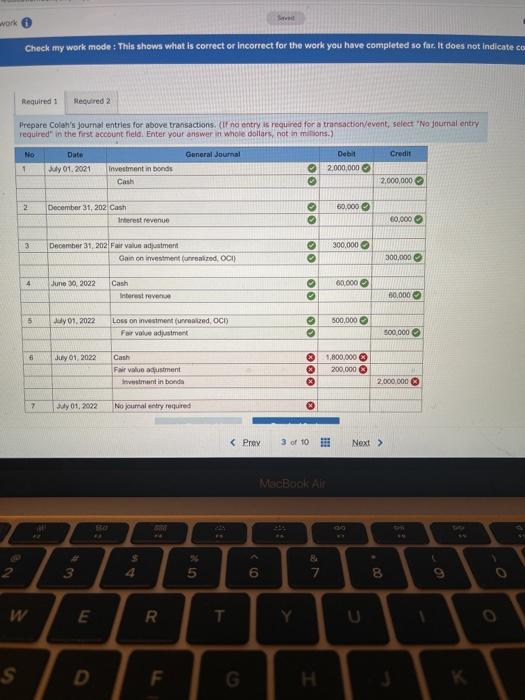

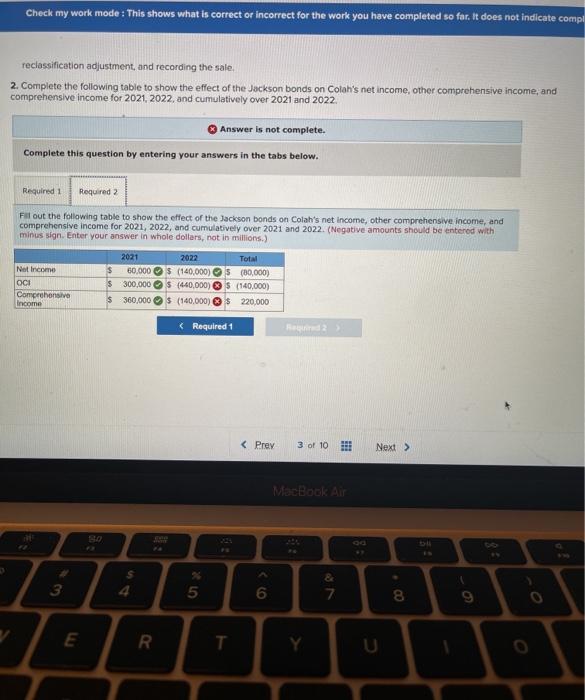

Exercise 12-12 (Algo) Available-for-sale securities (LO12-1, 12-4) Colah Company purchased $2,000,000 of Jackson, Inc., 6% bonds at par on July 1, 2021, with interest paid semi-annually. Colah determined that it should account for the bonds as an available for sale investment. At December 31, 2021 , the Jackson bonds had a fair value of $2,300,000. Colah sold the Jackson bonds on July 1, 2022 for $1,800,000 Required: 1. Prepare Colah's journal entries for the following transactions: a. The purchase of the Jackson bonds on July 1. b. Interest revenue for the last half of 2021. c. Any year-end 2021 adjusting entries. d. Interest revenue for the first half of 2022 e. Any entries necessary upon sole of the Jackson bonds on July 1, 2022, including updating the fair value adjustment, recording any reclassification adjustment, and recording the sale. 2. Complete the following table to show the effect of the Jackson bonds on Colah's net income, other comprehensive income, and comprehensive income for 2021 , 2022, and cumulatively over 2021 and 2022. Answer is not complete. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Prepare colon's Journal entries for above transactions. (If no entry is required for a transaction event, select "No journal entry required in the first account field. Enter your answer in whole dollars, not in millions) No General Journal Debit Credit Date vork Check my work mode: This shows what is correct or Incorrect for the work you have completed so far. It does not indicate co Required 1 Required 2 Prepare Colah's journal entries for above transactions. Cur na entry is required for a transaction/event, select "No journal entry required in the first account field. Enter your answer in whole dollars, not in millions.) General Journal Debit Credit No 1 Date July 01, 2021 2,000,000 Investment in bonds Cash oo 2,000,000 2 60.000 December 31, 202 Cash Interest revenue olo 80,000 3 300,000 December 31, 202 Fair value adjustment Gain on investment funrealized OCI) 300,000 O 4 June 30, 2022 60.000 Cash Interest reves os 60,000 5 July 01, 2022 500,000 Loss on investment furnized. OCH Farvou adjustment 500.000 8 July 01, 2022 Cash Fairvoko apustment Investment in bonda : 1,800.000 200.000 2.000.000 7 dy 01, 2022 No jaural estry required MacBook All 3 5 6 7 8 W E R. T Y U S D F G Check my work mode : This shows what is correct or incorrect for the work you have completed so far. It does not indicate compl reclassification adjustment, and recording the sale. 2. Complete the following table to show the effect of the Jackson bonds on Colah's net income, other comprehensive income, and comprehensive income for 2021 2022, and cumulatively over 2021 and 2022. Answer is not complete. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Fill out the following table to show the effect of the Jackson bonds on Colah's net income, other comprehensive income, and comprehensive income for 2021, 2022, and cumulatively over 2021 and 2022. (Negative amounts should be entered with minus sign. Enter your answer in whole dollars, not in millions.) Not Income $ $ 2021 2022 Total 60,000 5 (140,000) $ (80,000) 300,000$ (440,000) $ (140,000) 360,000$ (140.000) 220,000 OCI Comprehensive Income $ MacBook Air S 3 4 5 6 E 7 8 9. E R T