Question

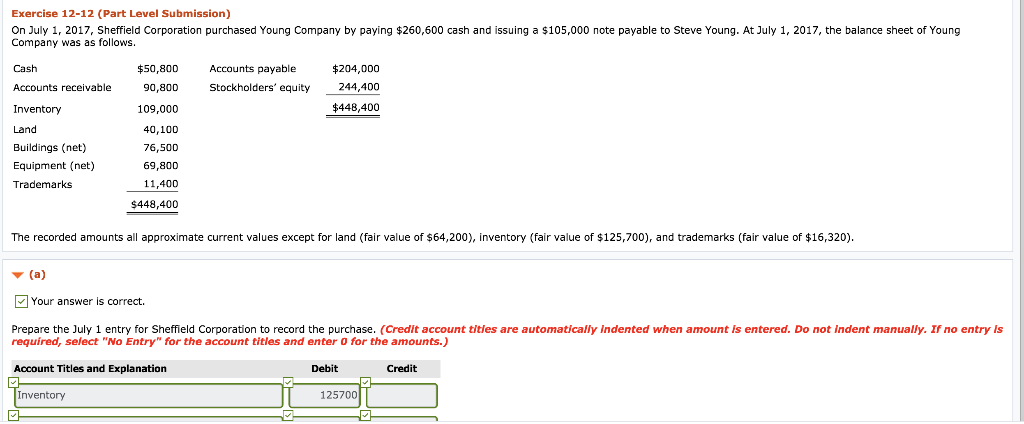

Exercise 12-12 (Part Level Submission) On July 1, 2017, Sheffield Corporation purchased Young Company by paying $260,600 cash and issuing a $105,000 note payable to

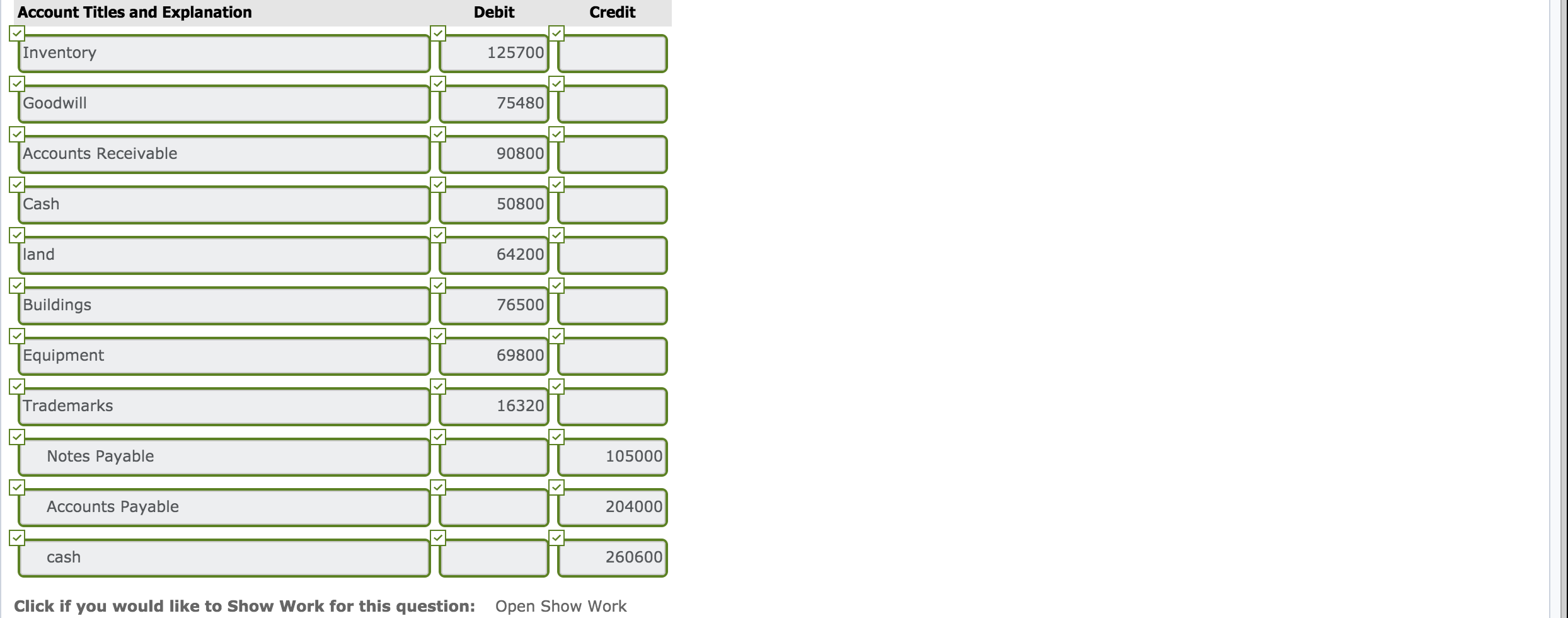

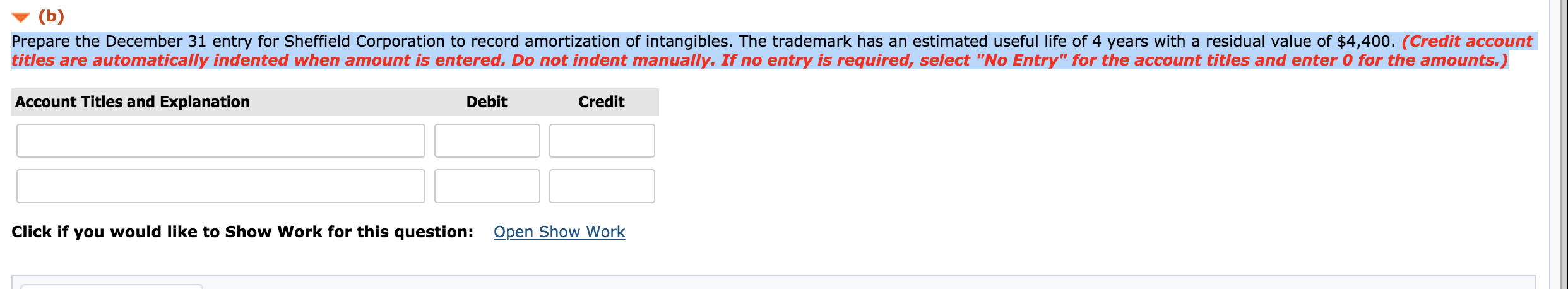

Exercise 12-12 (Part Level Submission) On July 1, 2017, Sheffield Corporation purchased Young Company by paying $260,600 cash and issuing a $105,000 note payable to Steve Young. At July 1, 2017, the balance sheet of Young Company was as follows. Cash $50,800 Accounts payable $204,000 Accounts receivable 90,800 Stockholders equity 244,400 Inventory 109,000 $448,400 Land 40,100 Buildings (net) 76,500 Equipment (net) 69,800 Trademarks 11,400 $448,400 The recorded amounts all approximate current values except for land (fair value of $64,200), inventory (fair value of $125,700), and trademarks (fair value of $16,320). \Prepare the December 31 entry for Sheffield Corporation to record amortization of intangibles. The trademark has an estimated useful life of 4 years with a residual value of $4,400. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts.)

Exercise 12-12 (Part Level Submission) On July 1, 2017, Sheffield Corporation purchased Young Company by paying $260,600 cash and issuing a $105,000 note payable to Steve Young. At July 1, 2017, the balance sheet of Young Company was as follows. Cash $50,800 Accounts payable $204,000 Accounts receivable 90,800 Stockholders equity 244,400 Inventory 109,000 $448,400 Land 40,100 Buildings (net) 76,500 Equipment (net) 69,800 Trademarks 11,400 $448,400 The recorded amounts all approximate current values except for land (fair value of $64,200), inventory (fair value of $125,700), and trademarks (fair value of $16,320). \Prepare the December 31 entry for Sheffield Corporation to record amortization of intangibles. The trademark has an estimated useful life of 4 years with a residual value of $4,400. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started