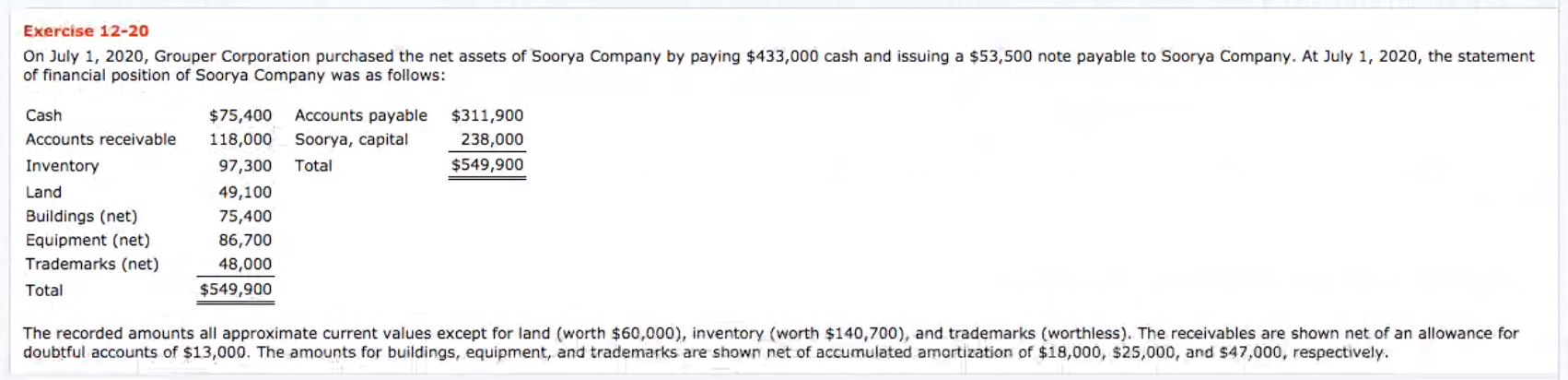

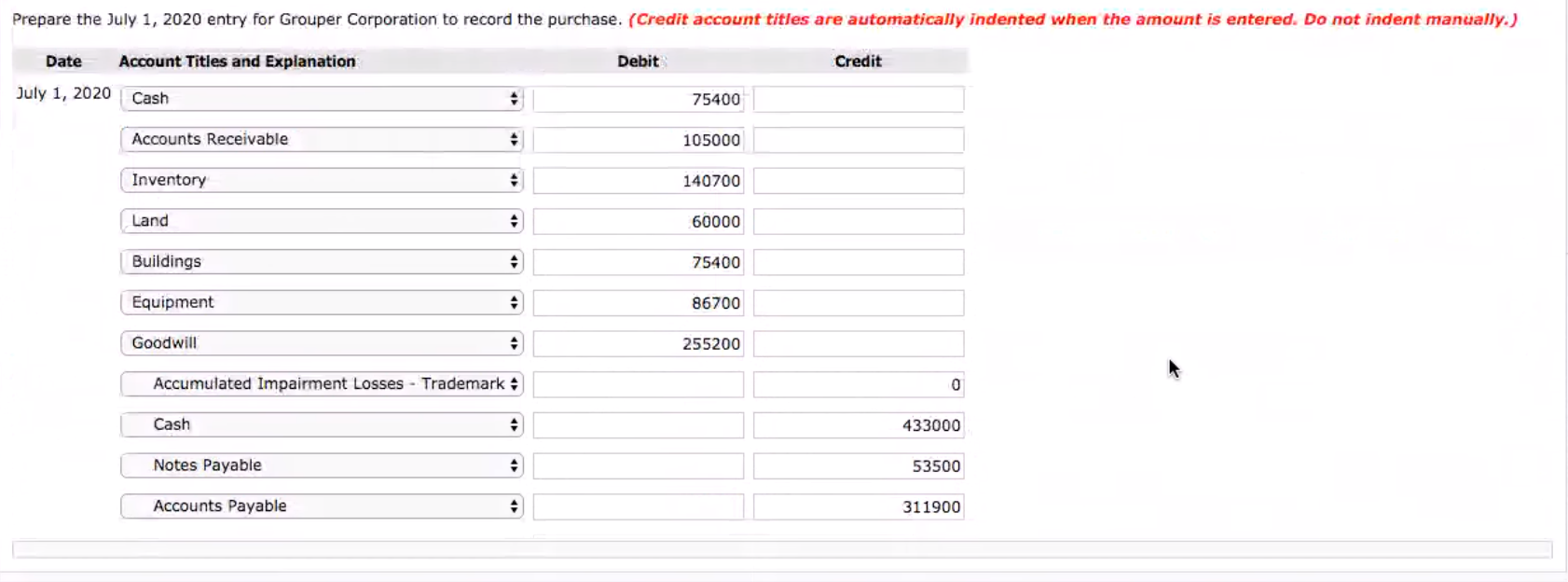

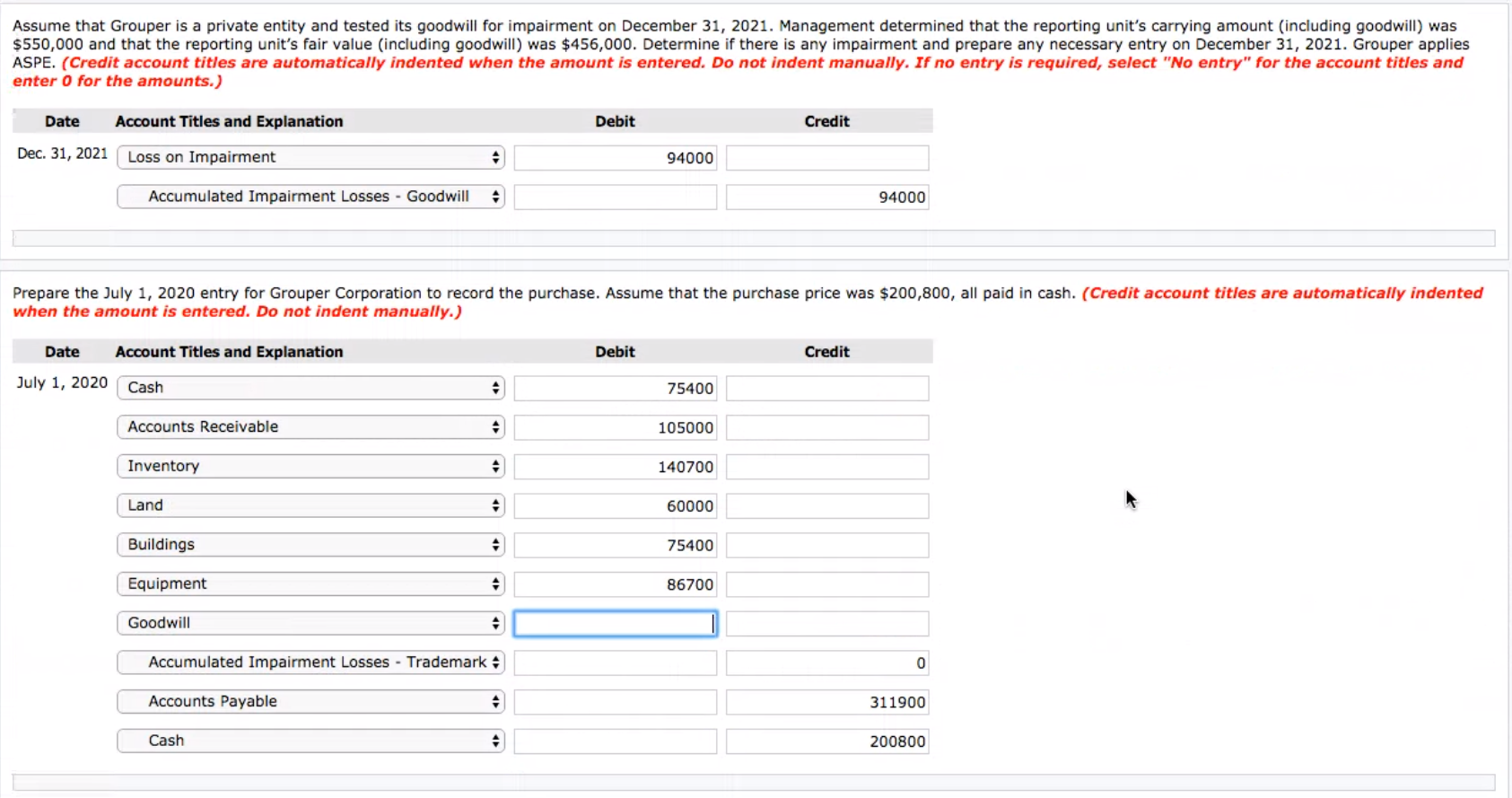

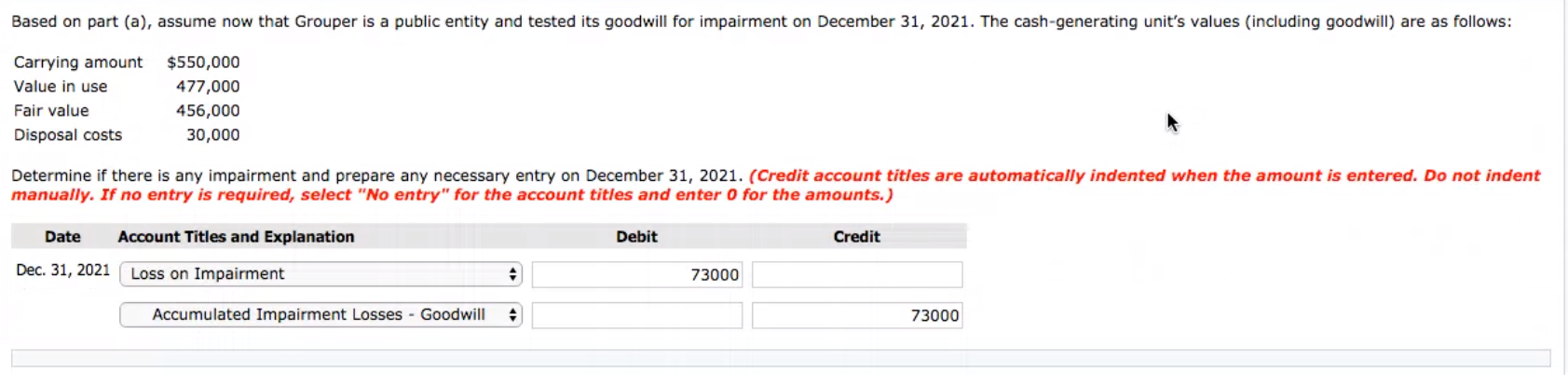

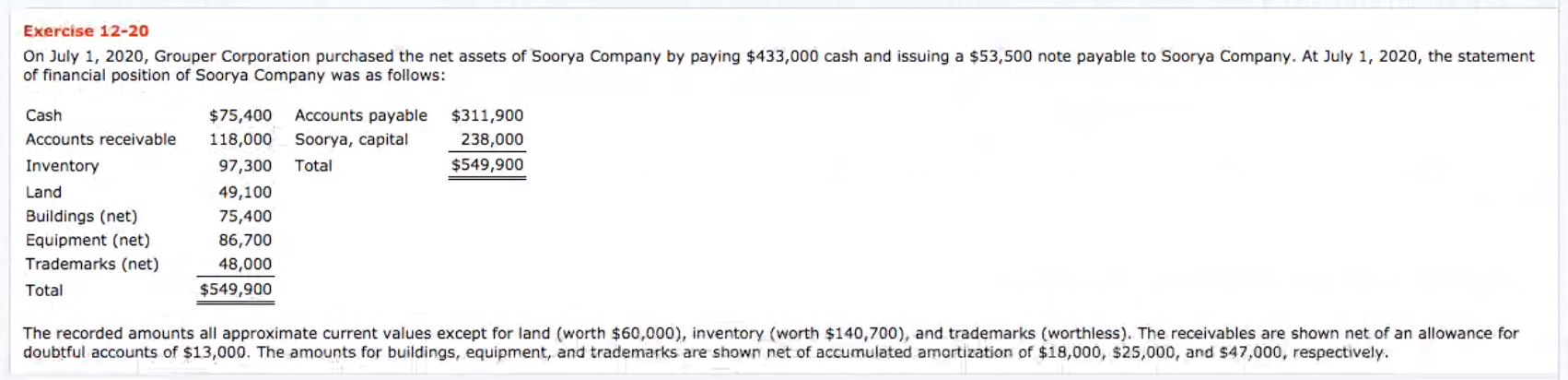

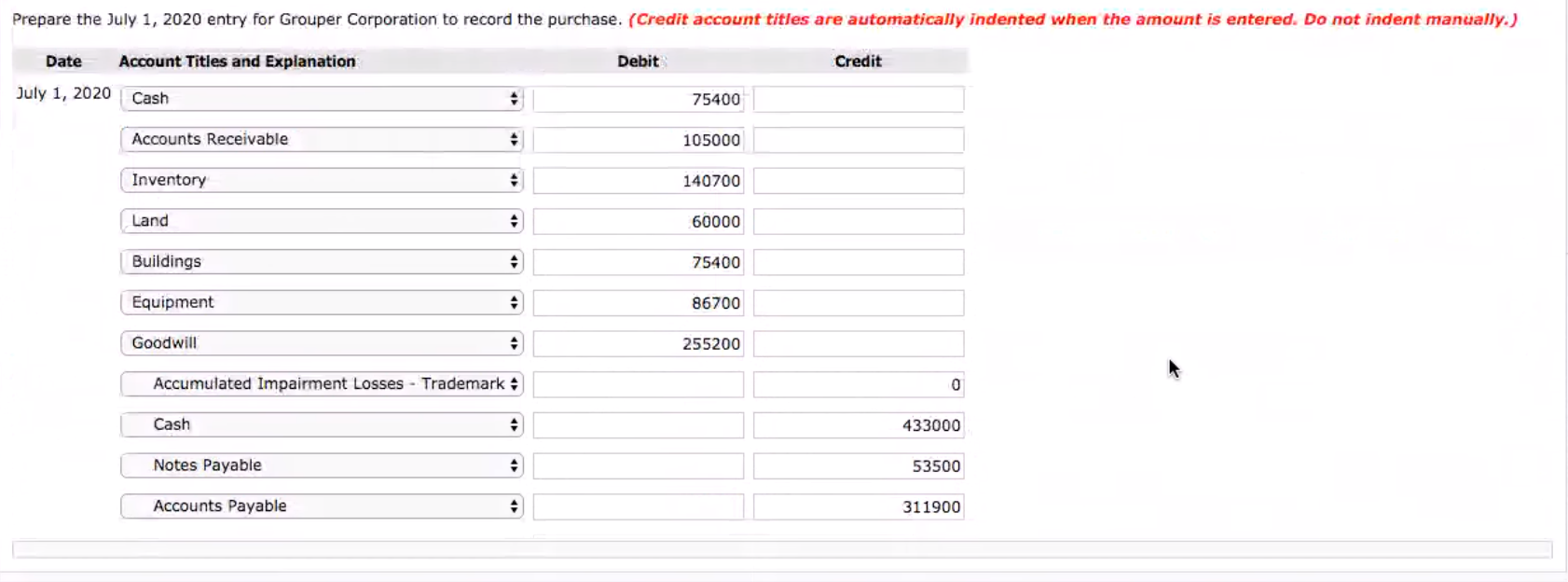

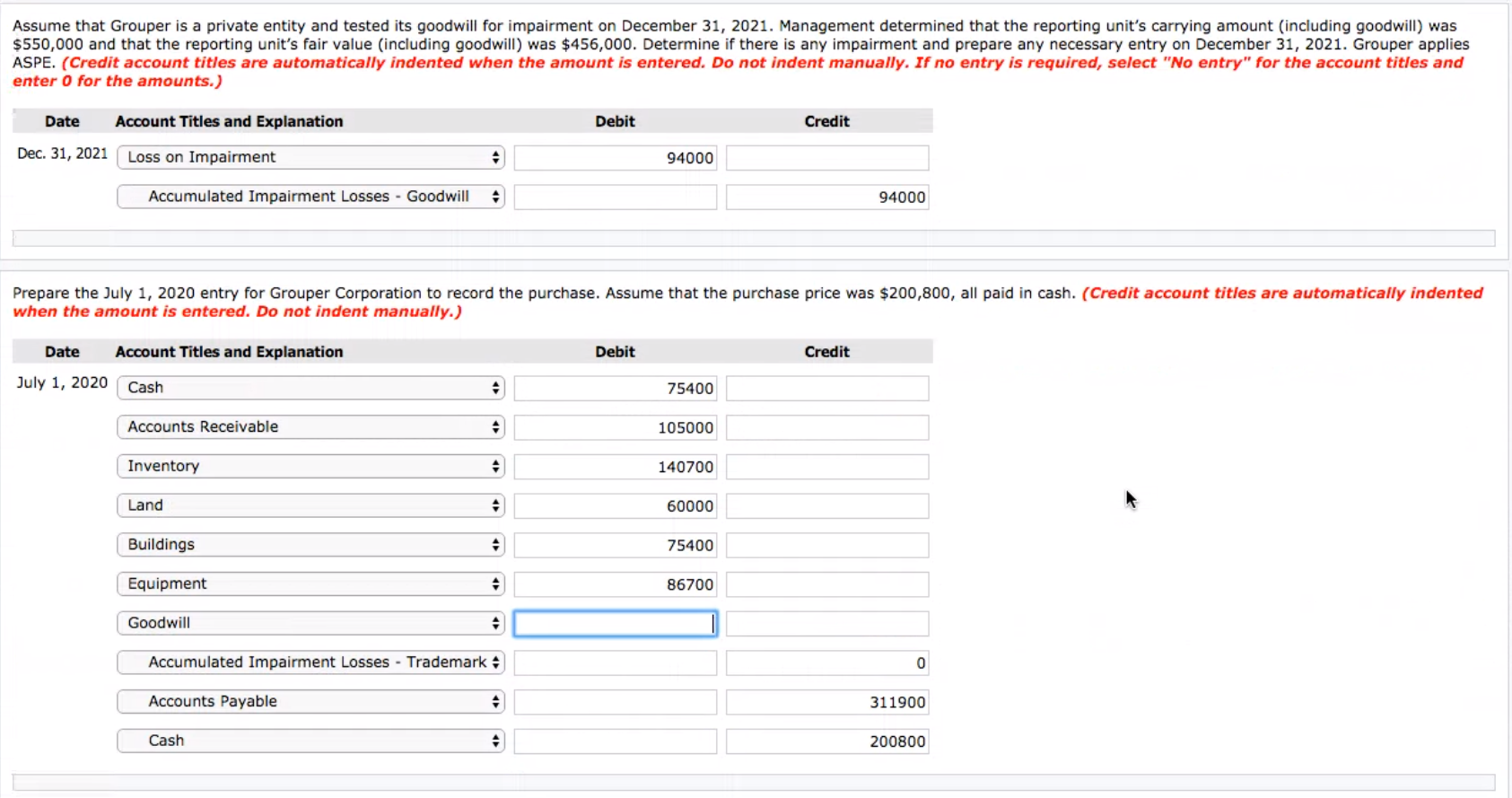

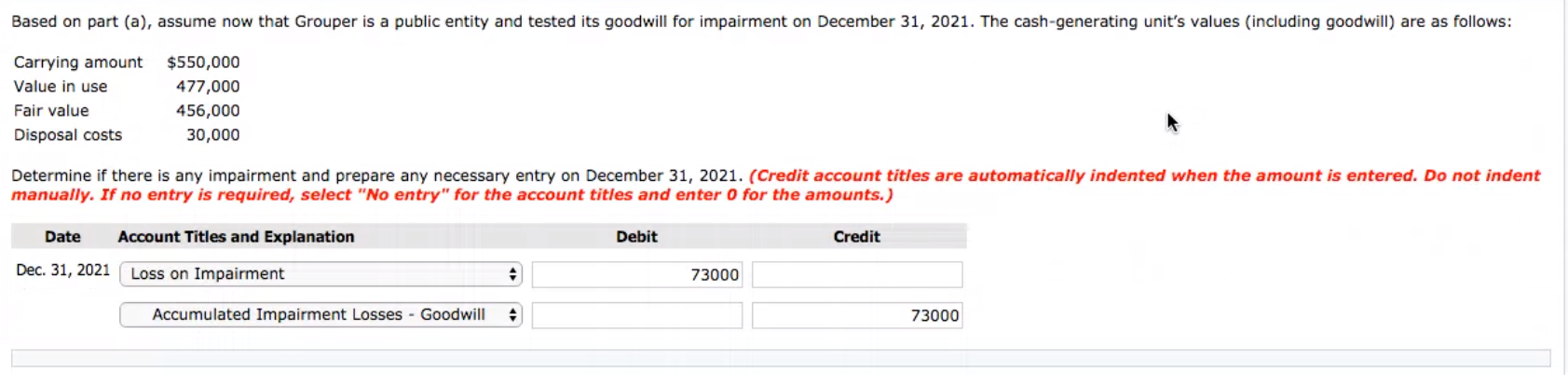

Exercise 12-20 On July 1, 2020, Grouper Corporation purchased the net assets of Soorya Company by paying $433,000 cash and issuing a $53,500 note payable to Soorya Company. At July 1, 2020, the statement of financial position of Soorya Company was as follows: Accounts payable Soorya, capital Total $311,900 238,000 $549,900 Cash Accounts receivable Inventory Land Buildings (net) Equipment (net) Trademarks (net) Total $75,400 118,000 97,300 49,100 75,400 86,700 48,000 $549,900 The recorded amounts all approximate current values except for land (worth $60,000), inventory (worth $140,700), and trademarks (worthless). The receivables are shown net of an allowance for doubtful accounts of $13,000. The amounts for buildings, equipment, and trademarks are shown net of accumulated amortization of $18,000, $25,000, and $47,000, respectively. Prepare the July 1, 2020 entry for Grouper Corporation to record the purchase. (Credit account titles are automatically indented when the amount is entered. Do not indent manually.) Debit Credit Date Account Titles and Explanation July 1, 2020 Cash 75400 Accounts Receivable 105000 Inventory 140700 Land 60000 Buildings 75400 Equipment 86700 Goodwill 255200 Accumulated Impairment Losses - Trademark Cash 433000 Notes Payable 53500 Accounts Payable 311900 Assume that Grouper is a private entity and tested its goodwill for impairment on December 31, 2021. Management determined that the reporting unit's carrying amount (including goodwill) was $550,000 and that the reporting unit's fair value (including goodwill) was $456,000. Determine if there is any impairment and prepare any necessary entry on December 31, 2021. Grouper applies ASPE. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No entry" for the account titles and enter o for the amounts.) Date Account Titles and Explanation Debit Credit Dec. 31, 2021 Loss on Impairment 94000 Accumulated Impairment Losses - Goodwill 94000 Prepare the July 1, 2020 entry for Grouper Corporation to record the purchase. Assume that the purchase price was $200,800, all paid in cash. (Credit account titles are automatically indented when the amount is entered. Do not indent manually.) Debit Credit Date Account Titles and Explanation July 1, 2020 Cash 75400 Accounts Receivable 105000 Inventory 140700 Land 60000 Buildings 75400 Equipment 86700 Goodwill Accumulated Impairment Losses - Trademark Accounts Payable 311900 Cash 200800 Based on part (a), assume now that Grouper is a public entity and tested its goodwill for impairment on December 31, 2021. The cash-generating unit's values (including goodwill) are as follows: Carrying amount Value in use Fair value Disposal costs $550,000 477,000 456,000 30,000 Determine if there is any impairment and prepare any necessary entry on December 31, 2021. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No entry" for the account tities and enter o for the amounts.) Date Account Titles and Explanation Debit Credit Dec. 31, 2021 Loss on Impairment 73000 Accumulated Impairment Losses - Goodwill 73000