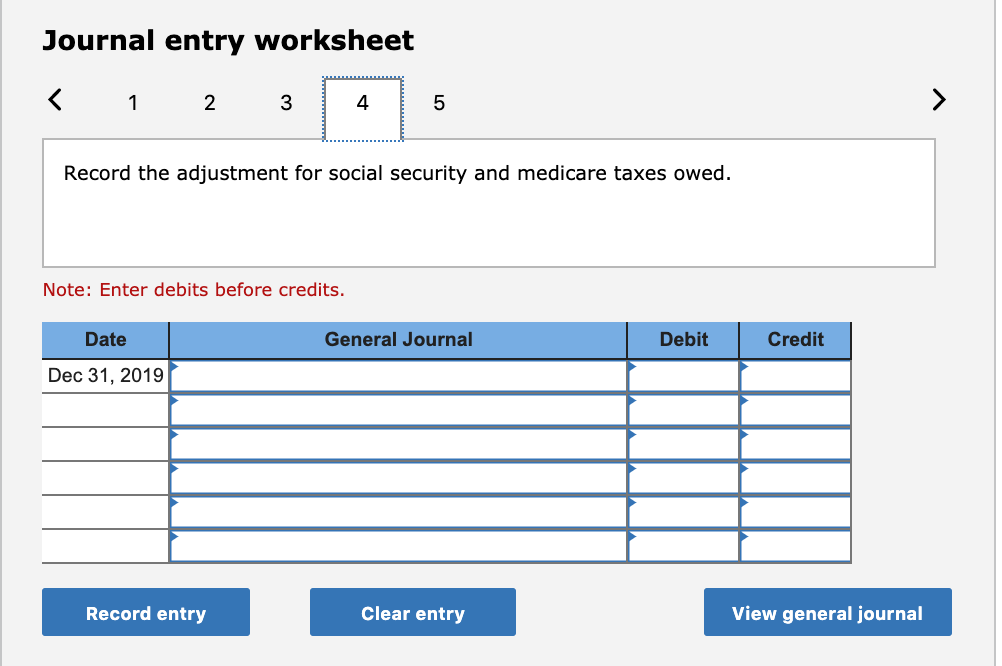

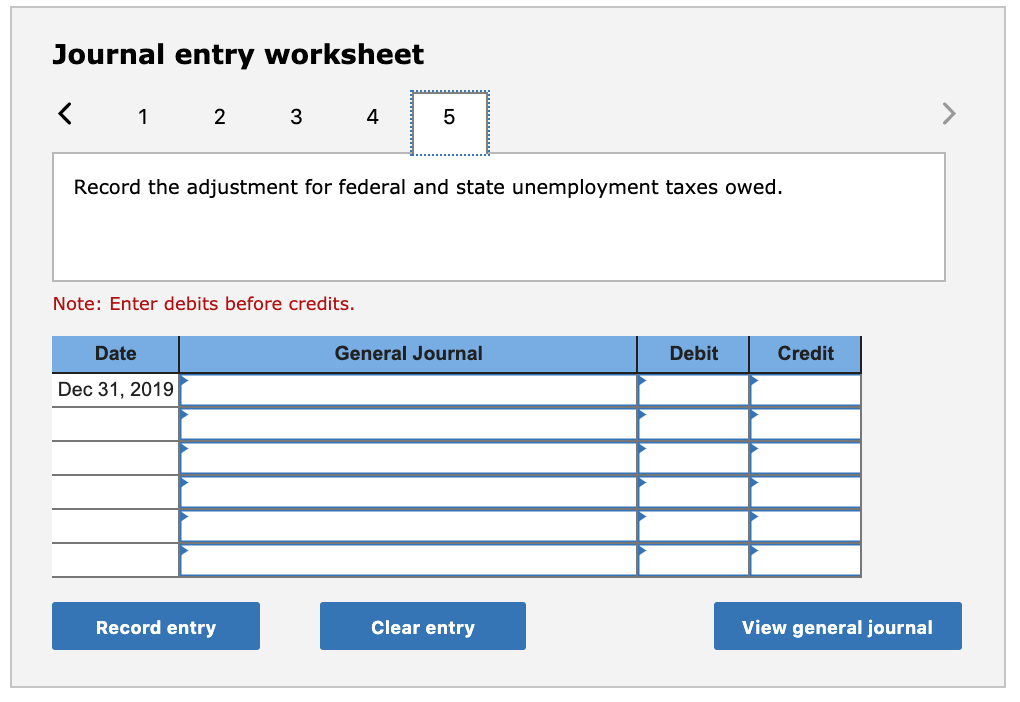

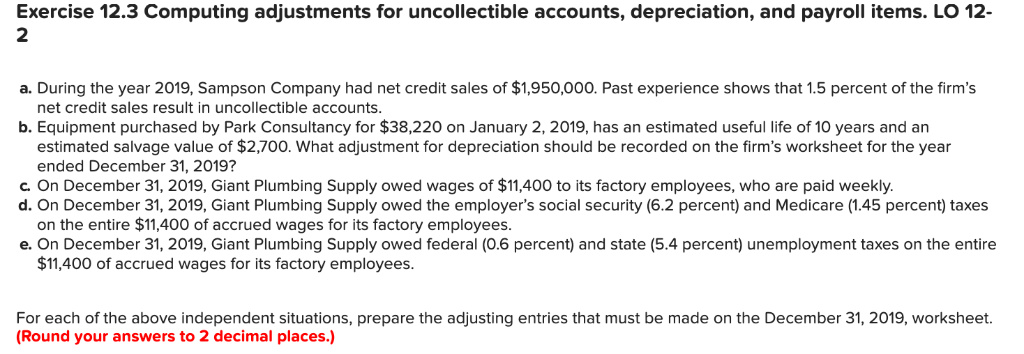

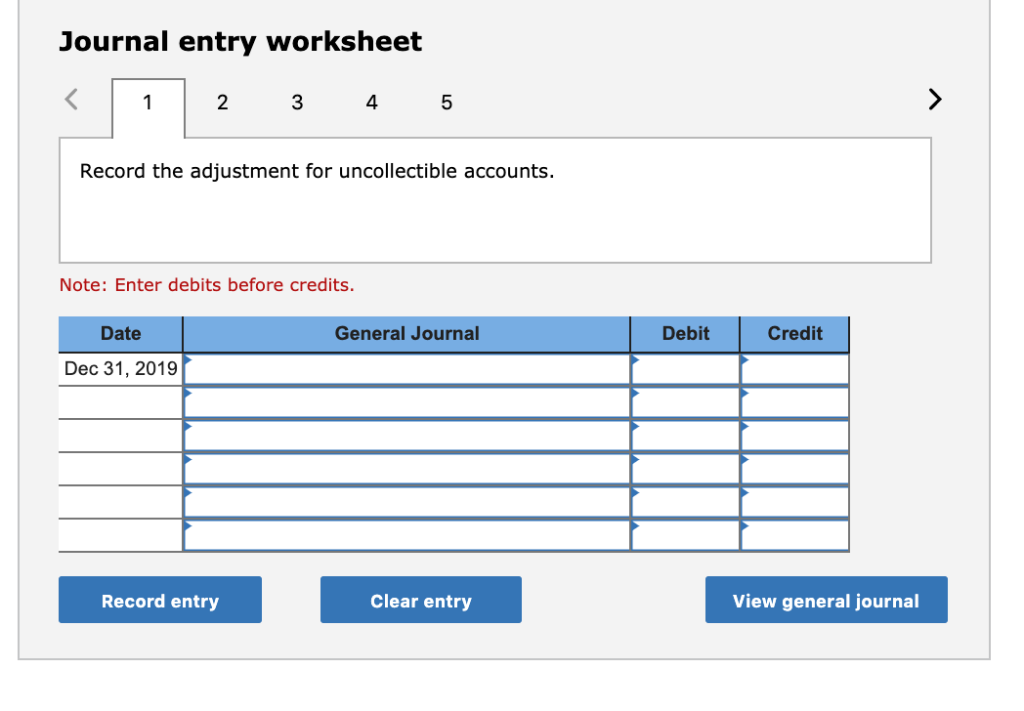

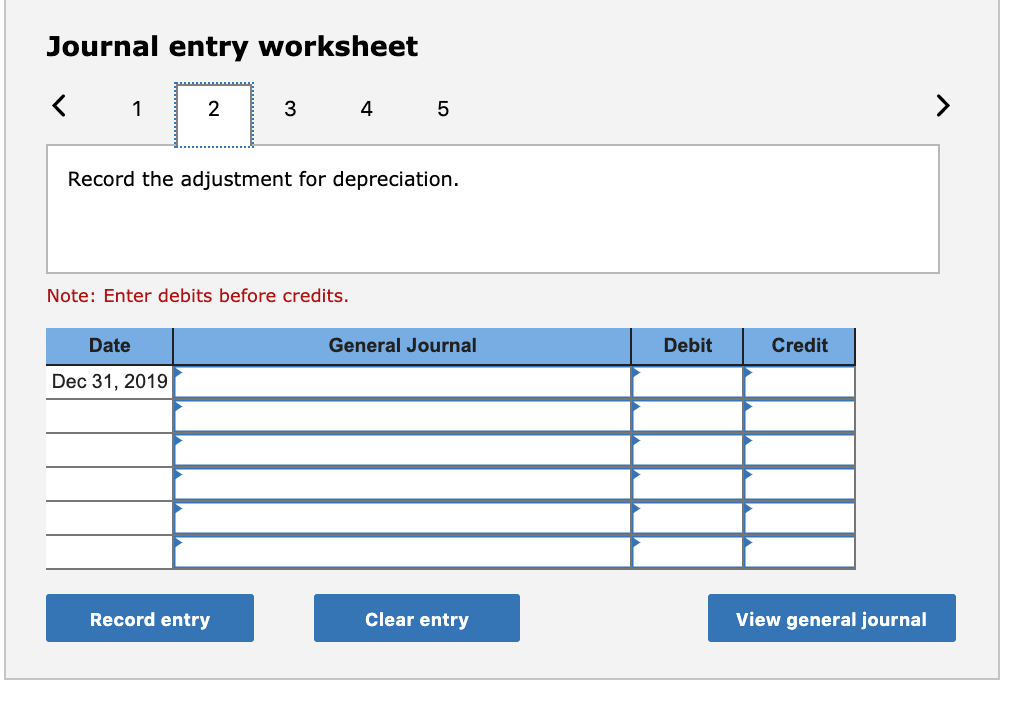

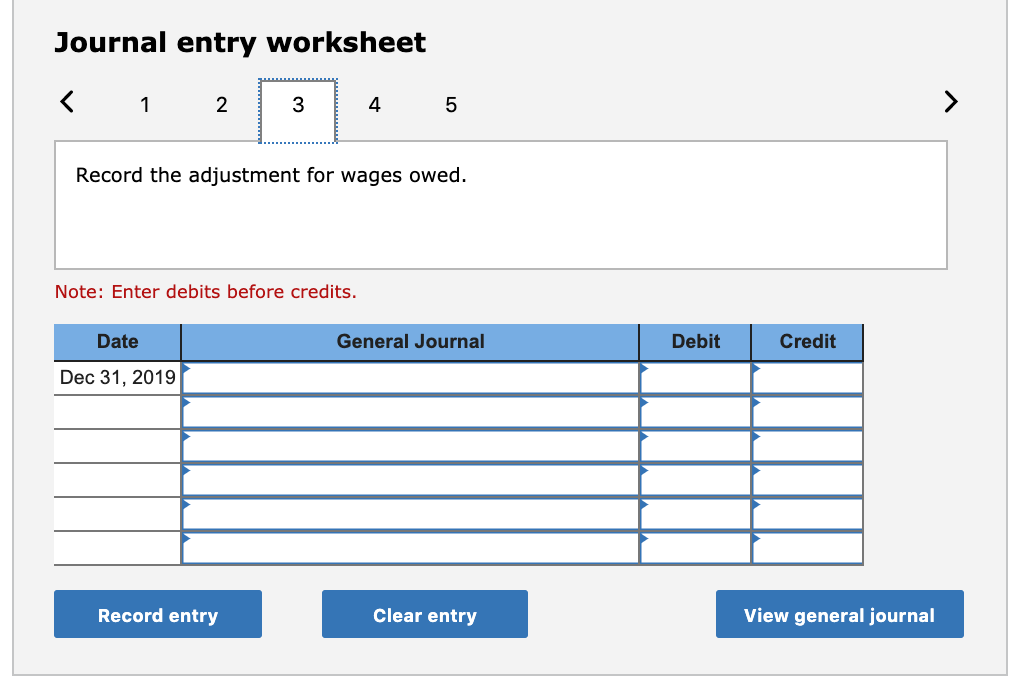

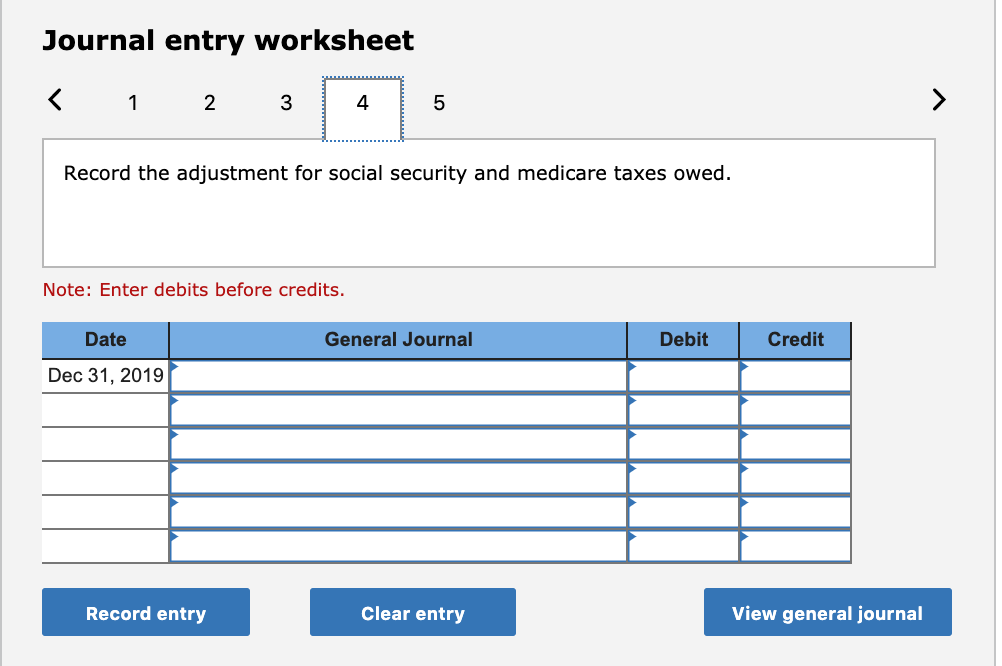

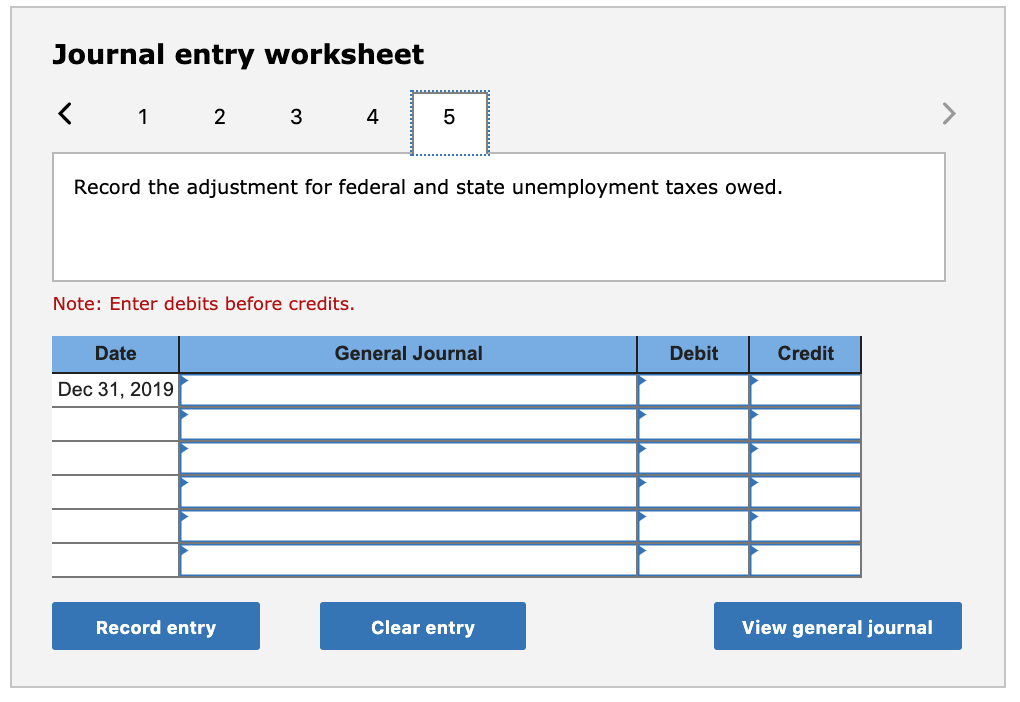

Exercise 12.3 Computing adjustments for uncollectible accounts, depreciation, and payroll items. LO 12- 2 a. During the year 2019, Sampson Company had net credit sales of $1,950,000. Past experience shows that 1.5 percent of the firm's net credit sales result in uncollectible accounts b. Equipment purchased by Park Consultancy for $38,220 on January 2, 2019, has an estimated useful life of 10 years and an estimated salvage value of $2,700. What adjustment for depreciation should be recorded on the firm's worksheet for the year ended December 31, 2019? On December 31, 2019, Giant Plumbing Supply owed wages of $11,400 to its factory employees, who are paid weekly. d. On December 31, 2019, Giant Plumbing Supply owed the employer's social security (6.2 percent) and Medicare (1.45 percent) taxes on the entire $11,400 of accrued wages for its factory employees. e. On December 31, 2019, Giant Plumbing Supply owed federal (0.6 percent) and state (5.4 percent) unemployment taxes on the entire $11,400 of accrued wages for its factory employees. For each of the above independent situations, prepare the adjusting entries that must be made on the December 31, 2019, worksheet. Round your answers to 2 decimal places.) Journal entry worksheet 2 1 4 5 Record the adjustment for uncollectible accounts Note: Enter debits before credits. Date General Journal Debit Credit Dec 31, 2019 Record entry Clear entry View general journal Journal entry worksheet 2 3 4 5 Record the adjustment for depreciation. Note: Enter debits before credits. Date General Journal Debit Credit Dec 31, 2019 Record entry Clear entry View general journal Journal entry worksheet 2 4 5 Record the adjustment for wages owed Note: Enter debits before credits. Date General Journal Debit Credit Dec 31, 2019 Record entry Clear entry View general journal Journal entry worksheet 2 3 4 5 Record the adjustment for social security and medicare taxes owed Note: Enter debits before credits. Date General Journal Debit Credit Dec 31, 2019 Record entry Clear entry View general journal Journal entry worksheet 2 4 5 Record the adjustment for federal and state unemployment taxes owed. Note: Enter debits before credits Date General Journal Debit Credit Dec 31, 2019 Record entry Clear entry View general journal