Answered step by step

Verified Expert Solution

Question

1 Approved Answer

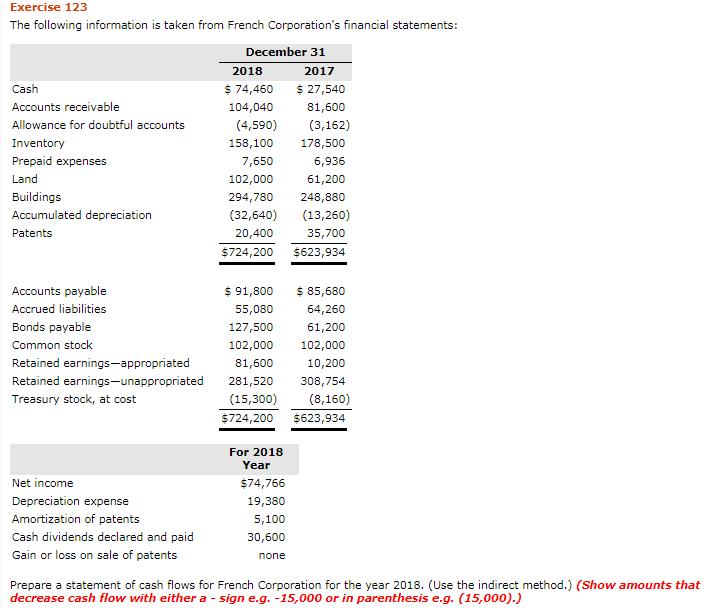

Exercise 123 The following information is taken from French Corporation s financial statements: Cash Accounts receivable Allowance for doubtful accounts Inventory Prepaid expenses Land

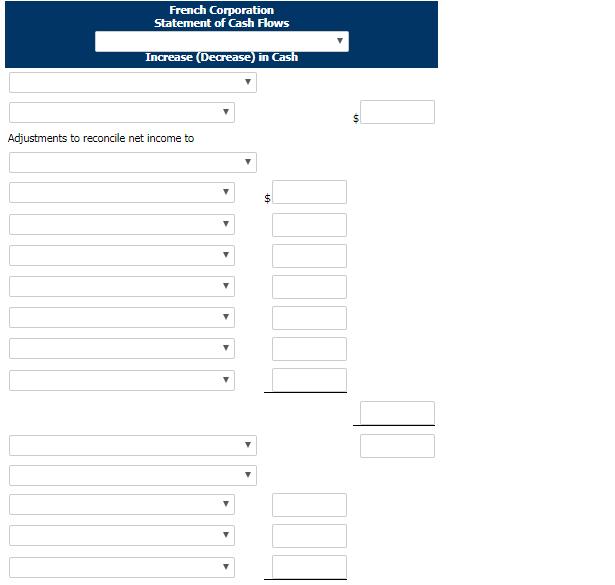

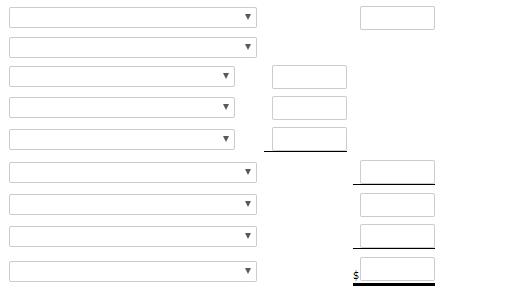

Exercise 123 The following information is taken from French Corporation s financial statements: Cash Accounts receivable Allowance for doubtful accounts Inventory Prepaid expenses Land Buildings Accumulated depreciation Patents Accounts payable Accrued liabilities Bonds payable Common stock Retained earnings-appropriated Retained earnings-unappropriated Treasury stock, at cost Net income Depreciation expense Amortization of patents Cash dividends declared and paid Gain or loss on sale of patents December 31 2017 2018 $ 74,460 104,040 (4,590) 158,100 7,650 102,000 294,780 (32,640) 20,400 $724,200 $ 91,800 55,080 127,500 For 2018 Year $ 27,540 81,600 (3,162) 178,500 6,936 61,200 248,880 (13,260) 35,700 $623,934 102,000 81,600 281,520 (15,300) $724,200 $623,934 $74,766 19,380 5,100 30,600 none $ 85,680 64,260 61,200 102,000 10,200 308,754 (8,160) Prepare a statement of cash flows for French Corporation for the year 2018. (Use the indirect method.) (Show amounts that decrease cash flow with either a - sign e.g. -15,000 or in parenthesis e.g. (15,000).) French Corporation Statement of Cash Flows Increase (Decrease) in Cash Adjustments to reconcile net income to $ $

Step by Step Solution

★★★★★

3.43 Rating (166 Votes )

There are 3 Steps involved in it

Step: 1

Cash Flow Statement Indirect Method For the Year December 31 2018 Cash flow from Operating Activitie...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started