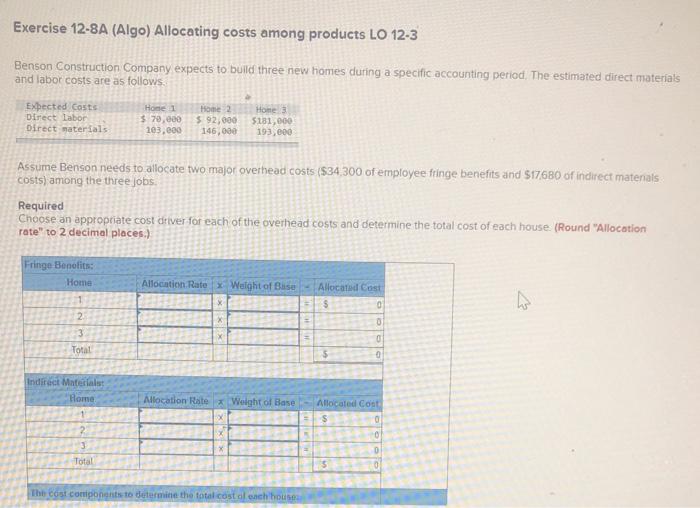

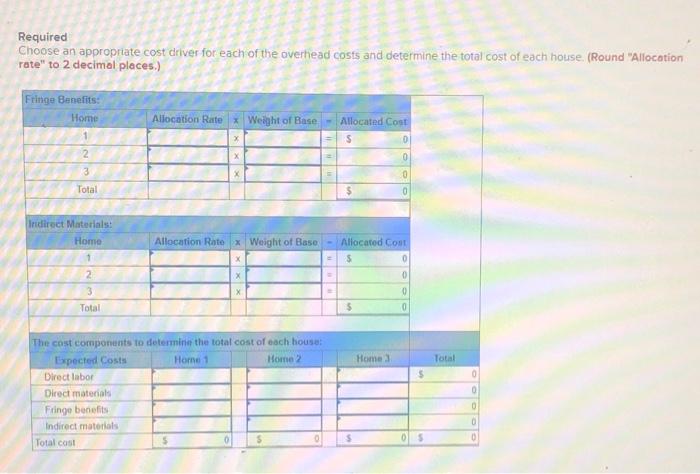

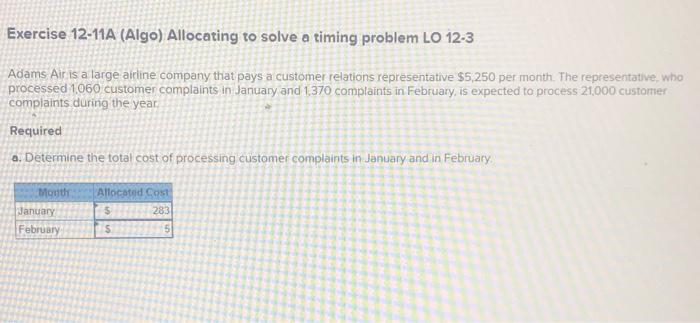

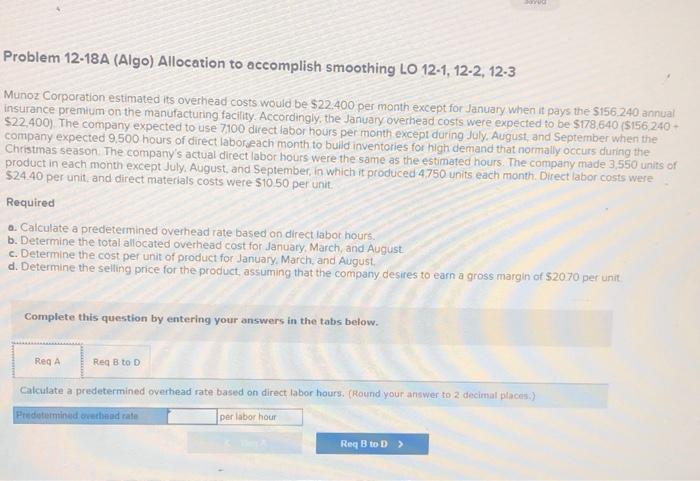

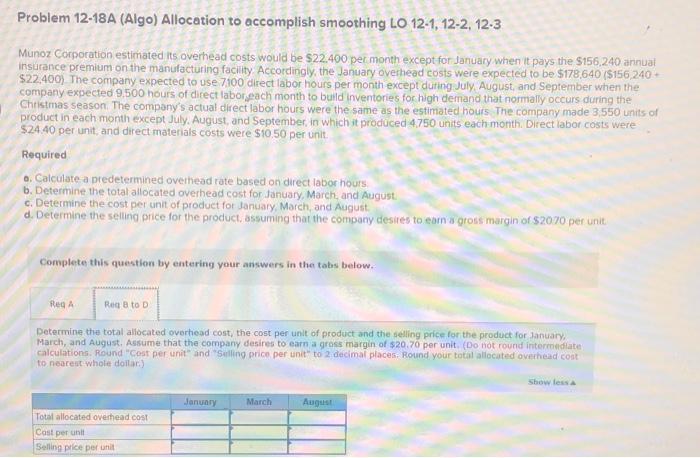

Exercise 12-8A (Algo) Allocating costs among products LO 12-3 Benson Construction Company expects to build three new homes during a specific accounting period. The estimated direct materials and labor costs are as follows. Expected casts Direct Labor Direct materials Home 1 $ 70,000 103,000 Home 2 5 92,000 146,000 Home 3 5181,000 193,000 Assume Benson needs to allocate two major overhead costs ($34.300 of employee fringe benefits and 517680 of indirect matenals costs) among the three jobs. Required Choose an appropriate cost driver for each of the overhead costs and determine the total cost of each house. (Round "Allocation rate" to 2 decimal places.) Fringe Benefits: Home Allocation Rate * Weight of Buse Allocata Cost 1 $ 0 2 0 3 0 Total Indirect Materials Home Allocation Rate * Weight of Base Allocated out $ 0 0 Total $ The cost continents to determine the total cost olonch house Required Choose an appropriate cost driver for each of the overhead costs and determine the total cost of each house. (Round "Allocation rate" to 2 decimal places.) Fringe Benefits: Home Allocation Rate * Weight of Base Allocated Cost 1 > S 0 2 0 3 0 Total 0 Indirect Materials: Home Allocation Rate * Weight of Base Allocated Cou X $ 0 2 X 0 3 0 Total 5 0 The cost components to determine the total cost of each house Expected Costs Home 1 Home 2 Home Total Direct labor $ 0 0 0 Direct materials Fringe benefits Indirect materials 0 $ 5 0 Total cost Exercise 12-11A (Algo) Allocating to solve a timing problem LO 12-3 Adams Air is a large airline company that pays a customer relations representative $5,250 per month. The representative, who processed 1060 customer complaints in January and 1370 complaints in February, is expected to process 21000 customer complaints during the year. Required a. Determine the total cost of processing customer complaints in January and in February Month Allocated Cost 5 283 January February s Problem 12-18A (Algo) Allocation to accomplish smoothing LO 12-1, 12-2, 12-3 Munoz Corporation estimated its overhead costs would be $22.400 per month except for January when it pays the 5156.240 annual insurance premium on the manufacturing facility. Accordingly, the January overhead costs were expected to be $178,640 ($156,240 + $22.400). The company expected to use 7100 direct labor hours per month except during July, August, and September when the company expected 9.500 hours of direct laboreach month to build inventories for high demand that normally occurs during the Christmas season. The company's actual direct labor hours were the same as the estimated hours. The company made 3 550 units of product in each month except July August, and September, in which it produced 4750 units each month. Direct labor costs were $24.40 per unit and direct materials costs were $10.50 per unit Required a. Calculate a predetermined overhead rate based on direct labor hours. b. Determine the total allocated overhead cost for January, March and August c. Determine the cost per unit of product for January, March, and August, d. Determine the selling price for the product, assuming that the company desires to earn a gross margin of $20.70 per unit Complete this question by entering your answers in the tabs below. Reg A Reg B to D Calculate a predetermined overhead rate based on direct labor hours. (Round your answer to 2 decimal places.) Pridtermined behindrata per labor hour Reg B to D > Problem 12-18A (Algo) Allocation to accomplish smoothing LO 12-1, 12-2, 12.3 Munoz Corporation estimated Its overhead costs would be $22.400 per month except for January when it pays the $156,240 annual insurance premium on the manufacturing facility Accordingly, the January overhead costs were expected to be $178,640 ($156 240 + company expected 9,500 hours of direct labor each month to build Inventories for high demand that normally occurs during the Christmas season. The company's actual direct labor hours were the same as the estimated hours The company made 3,550 units of product in each month except July August, and September , in which it produced 4.750 units each month. Direct labor costs were $24.40 per unit, and direct materials costs were $10,50 per unit. Required o. Calculate a predetermined overhead rate based on direct labor hours b. Determine the total allocated overhead cost for January, March, and August c. Determine the cost per unit of product for January, March, and August d. Determine the selling price for the product, assuming that the company desires to earn a grous margin of $2070 per unit Complete this question by entering your answers in the tabs below. Reg Regato D Determine the total allocated overhead cost, the cost per unit of product and the selling price for the product for January, March, and August. Assume that the company desires to earn a gross margin of $20.70 per unit. (Do not round intermediate calculations, Round "Cost per unit and selling price per unit to 2 decimal places. Round your total allocated overhead cont to nearest whole doilar) Show less January March August Total allocated overhead cost Cost per unit Selling price per unit