Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Exercise 1-3: True or False- Theory 1. The Conceptual Framework is not a PFRS and hence does not define standards for any particular measurement or

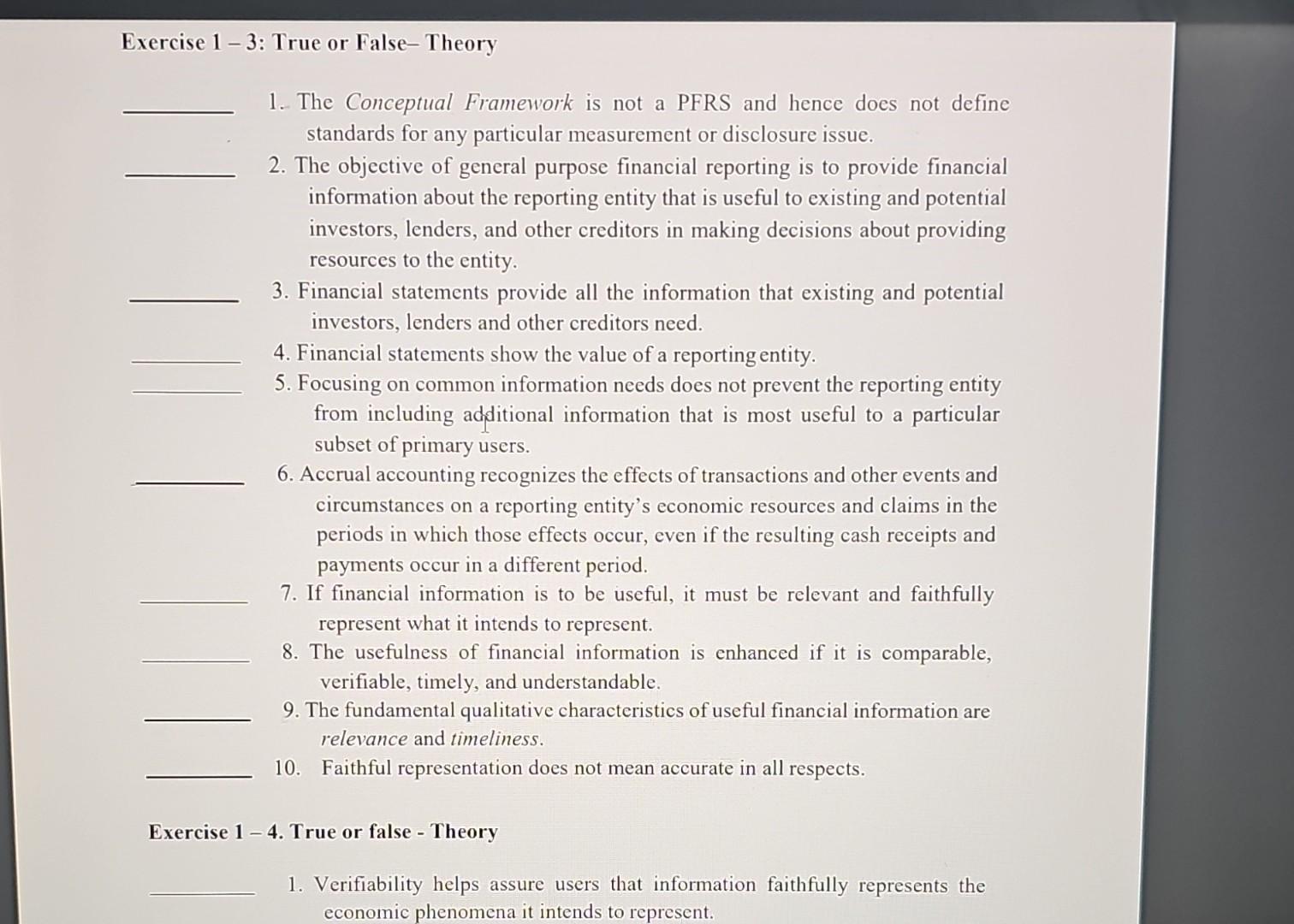

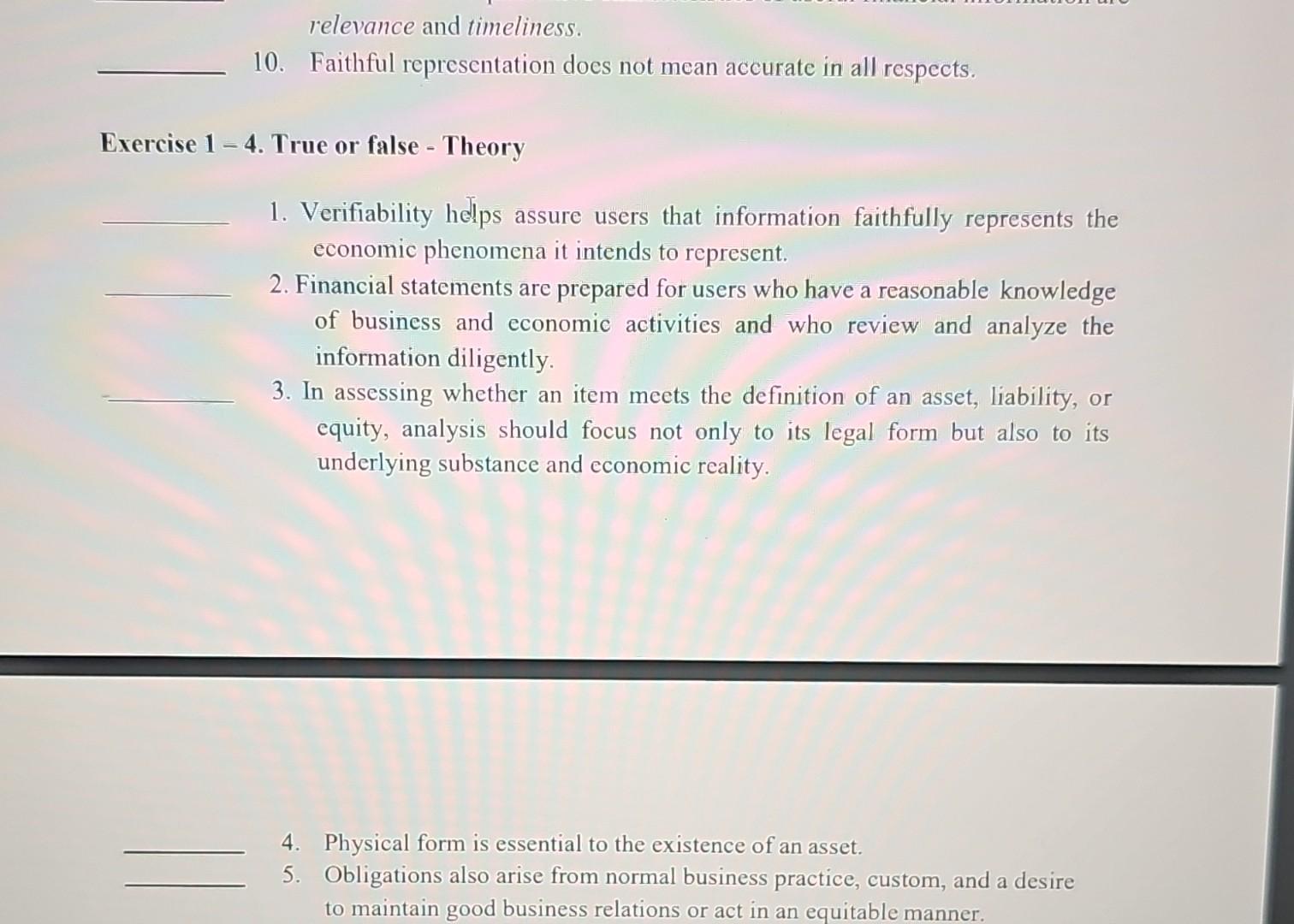

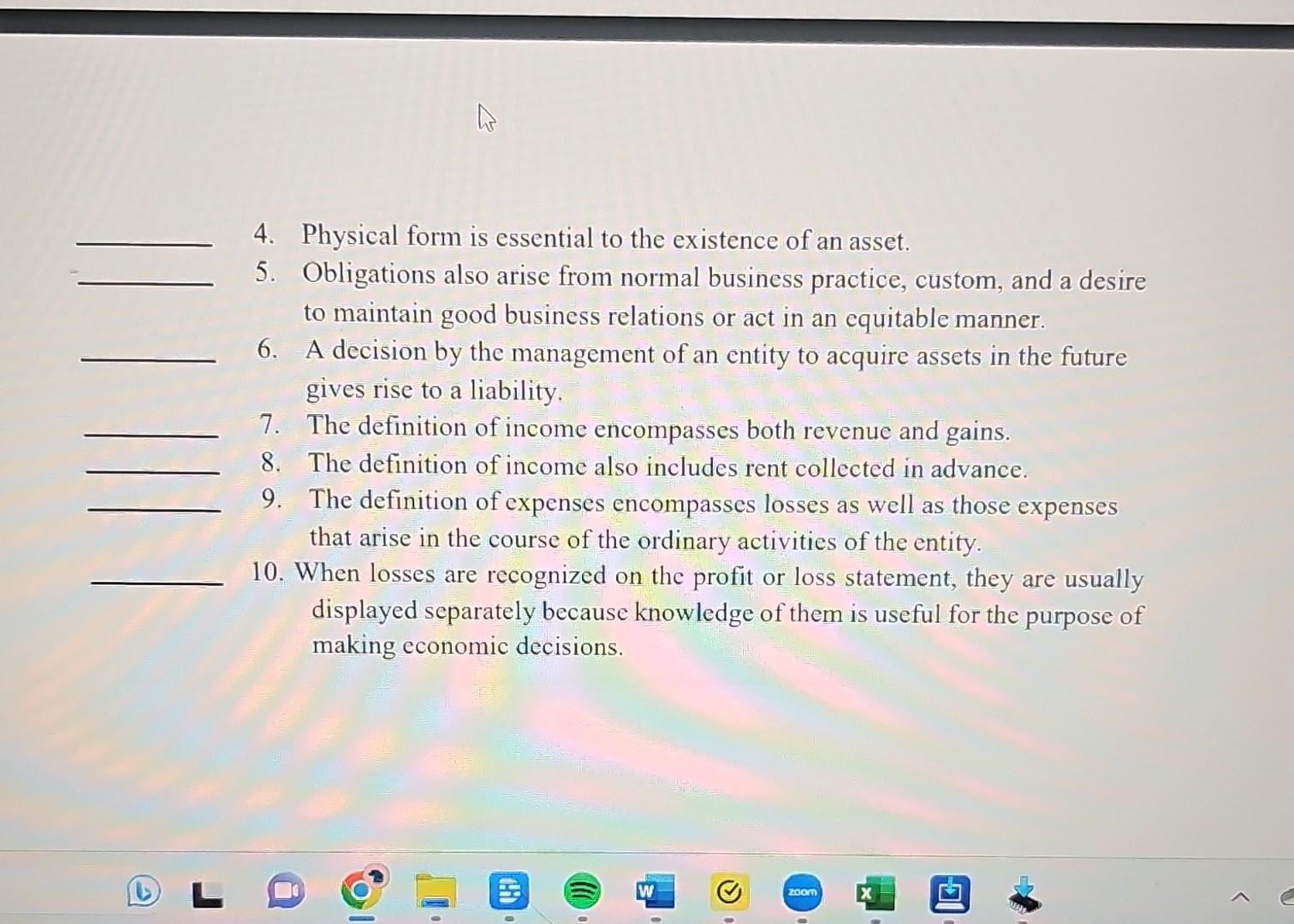

Exercise 1-3: True or False- Theory 1. The Conceptual Framework is not a PFRS and hence does not define standards for any particular measurement or disclosure issue. 2. The objective of general purpose financial reporting is to provide financial information about the reporting entity that is useful to existing and potential investors, lenders, and other creditors in making decisions about providing resources to the entity. 3. Financial statements provide all the information that existing and potential investors, lenders and other creditors need. 4. Financial statements show the value of a reporting entity. 5. Focusing on common information needs does not prevent the reporting entity from including additional information that is most useful to a particular subset of primary users. 6. Accrual accounting recognizes the effects of transactions and other events and circumstances on a reporting entity's economic resources and claims in the periods in which those effects occur, even if the resulting cash receipts and payments occur in a different period. 7. If financial information is to be useful, it must be relevant and faithfully represent what it intends to represent. 8. The usefulness of financial information is enhanced if it is comparable, verifiable, timely, and understandable. 9. The fundamental qualitative characteristics of useful financial information are relevance and timeliness. 10. Faithful representation does not mean accurate in all respects. Exercise 1 - 4. True or false - Theory 1. Verifiability helps assure users that information faithfully represents the economic phenomena it intends to represent. relevance and timeliness. 10. Faithful representation does not mean accurate in all respects. Exercise 1-4. True or false - Theory 1. Verifiability helps assure users that information faithfully represents the economic phenomena it intends to represent. 2. Financial statements are prepared for users who have a reasonable knowledge of business and economic activities and who review and analyze the information diligently. 3. In assessing whether an item meets the definition of an asset, liability, or equity, analysis should focus not only to its legal form but also to its underlying substance and economic reality. 4. Physical form is essential to the existence of an asset. 5. Obligations also arise from normal business practice, custom, and a desire to maintain good business relations or act in an equitable manner. 4. Physical form is essential to the existence of an asset. 5. Obligations also arise from normal business practice, custom, and a desire to maintain good business relations or act in an equitable manner. 6. A decision by the management of an entity to acquire assets in the future gives rise to a liability. 7. The definition of income encompasses both revenue and gains. 8. The definition of income also includes rent collected in advance. 9. The definition of expenses encompasses losses as well as those expenses that arise in the course of the ordinary activities of the entity. 10. When losses are recognized on the profit or loss statement, they are usually displayed separately because knowledge of them is useful for the purpose of making economic decisions

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started