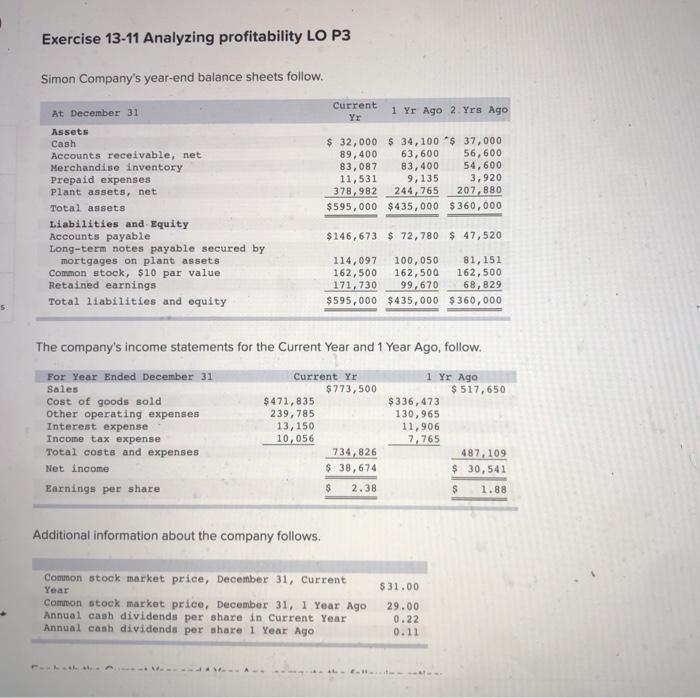

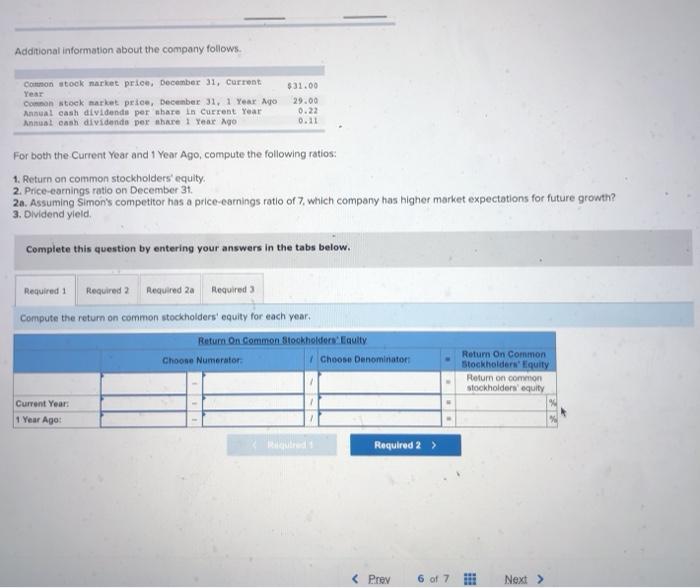

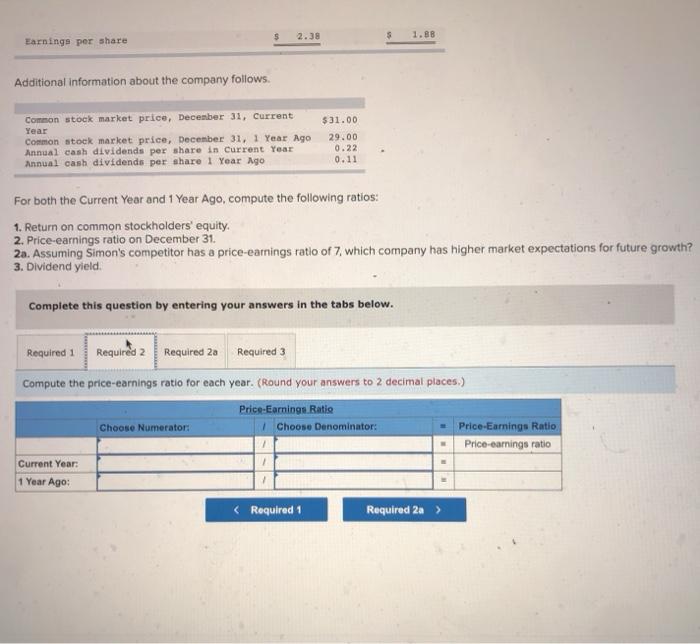

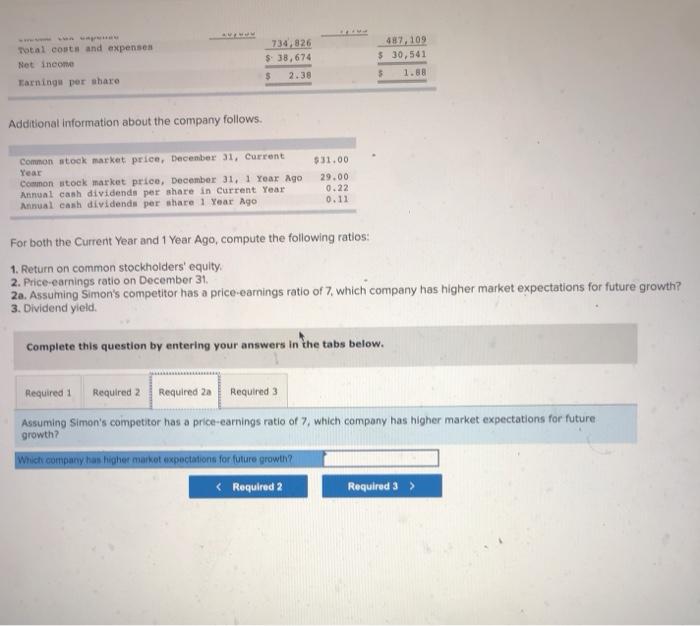

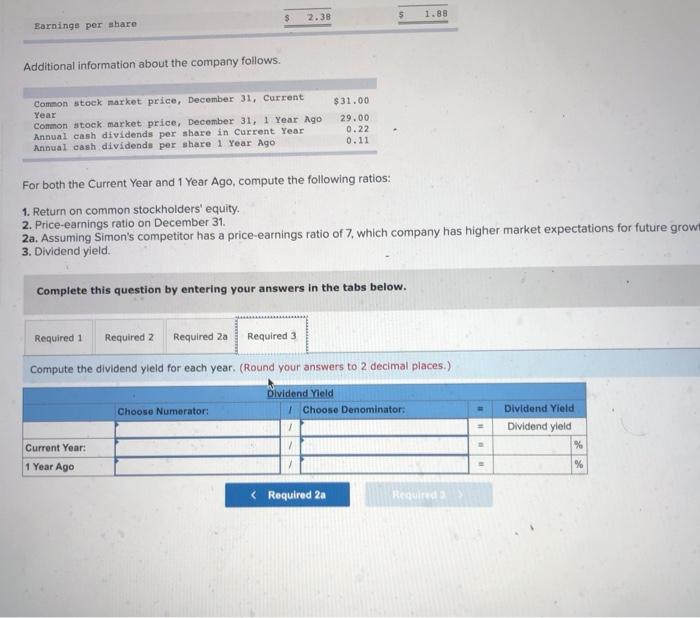

Exercise 13-11 Analyzing profitability LO P3 Simon Company's year-end balance sheets follow. Current Yr 1 Yr Ago 2 Yrs Ago At December 31 Assets Cash Accounts receivable, net Merchandise inventory Prepaid expenses Plant assets, net Total assets Liabilities and Equity Accounts payable Long-term notes payable secured by mortgages on plant assets Common stock, $10 par value Retained earnings Total liabilities and equity $ 32,000 $ 34,100 $ 37,000 89,400 63,600 56,600 83,087 83,400 54,600 11,531 9,135 3,920 378,982 244,765 207,880 $595,000 $435,000 $360,000 $146,673 $ 72, 780 $ 47,520 114,097 100,050 81, 152 162,500 162,500 162,500 171,730 99,670 68,829 $595,000 $435,000 $360,000 5 The company's income statements for the Current Year and 1 Year Ago, follow. For Year Ended December 31 Sales Cost of goods sold Other operating expenses Interest expense Income tax expense Total costs and expenses Net income Earnings per share Current Yr $773,500 $ 471, 835 239,785 13,150 10,056 734,826 $ 38,674 1 Yr Ago $ 517,650 $336,473 130,965 11,906 7,765 487, 109 $ 30,541 $ 1.88 $ 2.38 Additional information about the company follows. Year $31.00 Common stock market price, December 31, current common stock market price, December 31, 1 Year Ago Annual cash dividends per share in Current Year Annual cash dividends per share 1 Year Ago 29.00 0.22 0.11 E. Additional information about the company follows $31.00 Common stock market price, December 31, Current Year Common stock market price, December 31, 1 Year ago Annual cash dividende per share in current Year Annual cash dividendo per bare 1 year ago 29.00 0.22 0.11 For both the Current Year and 1 Year Ago, compute the following ratios: 1. Return on common stockholders' equity. 2. Price-earnings ratio on December 31 21. Assuming Simon's competitor has a price-carnings ratio of 7, which company has higher market expectations for future growth? 3. Dividend yield Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 2a Required 3 Compute the return on common stockholders' equity for each year, Return On Common Stockholdersgutty Choose Numerator Choose Denominator Return On Common Stockholders' Equity Return on common stockholders' equity Current Year: 1 Year Ago: Required 2 > 2.38 1.BB Earnings per share Additional information about the company follows. Common stock market price, December 31, Current Year Common stock market price, December 31, 1 Year Ago Annual cash dividends per share in Current Year Annual cash dividends per share 1 Year ago $31.00 29.00 0.22 0.11 For both the Current Year and 1 Year Ago, compute the following ratios: 1. Return on common stockholders' equity. 2. Price earnings ratio on December 31 2a. Assuming Simon's competitor has a price-earnings ratio of 7, which company has higher market expectations for future growth? 3. Dividend yield Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 2a Required 3 Compute the price-earnings ratio for each year. (Round your answers to 2 decimal places) Price-Earnings Ratio Choose Numerator: 1 Choose Denominator: Price-Earnings Ratio Price earnings ratio Current Year: 1 Year Ago: 1 1 1 Total costs and expenses Net income Tarningu per share 734,826 $ 38,674 $ 2.38 487, 109 $ 30,541 5 1.88 Additional information about the company follows Common stock market price, December 31, Current Year Common stock market price, December 31, 1 Year ago Annual canh dividends per share in Current Year Annual cash dividends per share 1 Year ago $31.00 29.00 0.22 0.11 For both the Current Year and 1 Year Ago, compute the following ratios: 1. Return on common stockholders' equity 2. Price-earnings ratio on December 31, 2a. Assuming Simon's competitor has a price earnings ratio of 7, which company has higher market expectations for future growth? 3. Dividend yield Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 2 Required 3 Assuming Simon's competitor has a price-earnings ratio of 7, which company has higher market expectations for future growth? Which company has higher market expoctations for future growth? $ 2.38 5 1.88 Earnings per share Additional information about the company follows. $31.00 Common stock market price, December 31, Current Year Common stock market price, December 31, 1 Year Ago Annual cash dividends per share in Current Year Annual cash dividends per share 1 Year Ago 29.00 0.22 0.11 For both the Current Year and 1 Year Ago, compute the following ratios: 1. Return on common stockholders' equity. 2. Price-earnings ratio on December 31. 2a. Assuming Simon's competitor has a price-earnings ratio of 7, which company has higher market expectations for future growt 3. Dividend yield. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required za Required 3 Compute the dividend yield for each year. (Round your answers to 2 decimal places.) Dividend Yield | Choose Denominator: Choose Numerator: Dividend Yield Dividend yield % % Current Year: 1 Year Ago