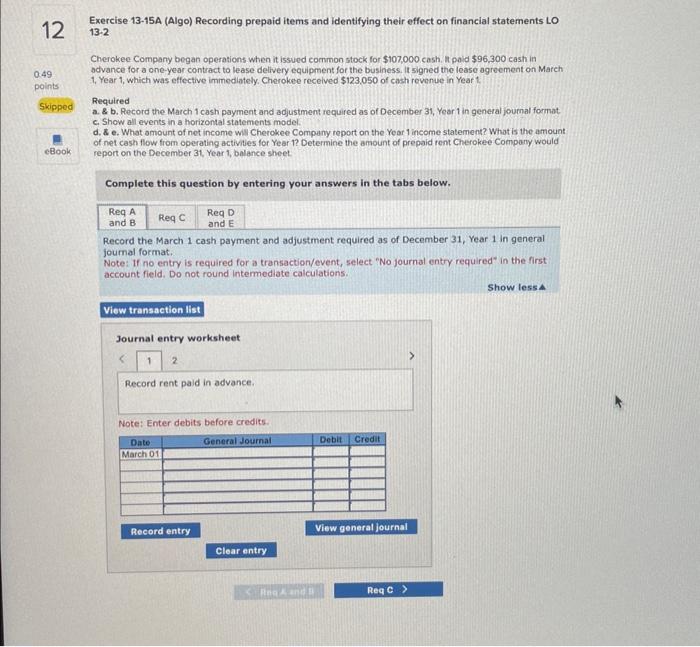

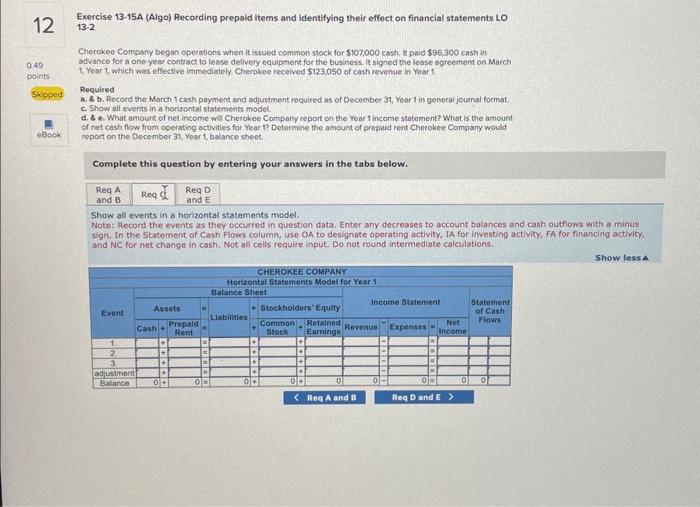

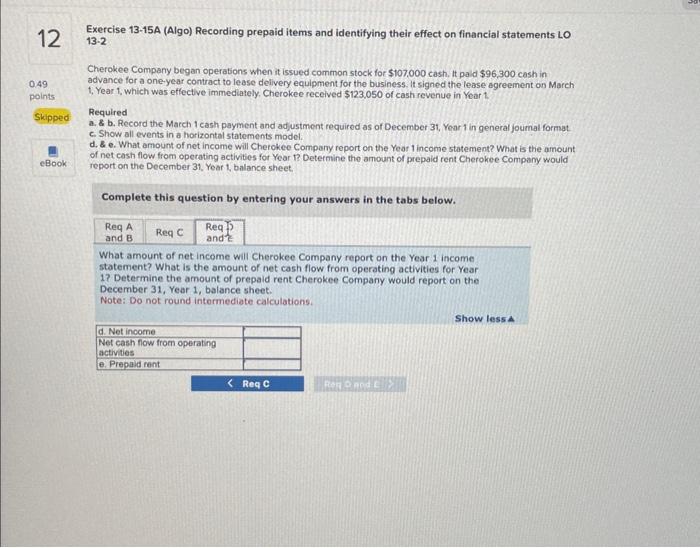

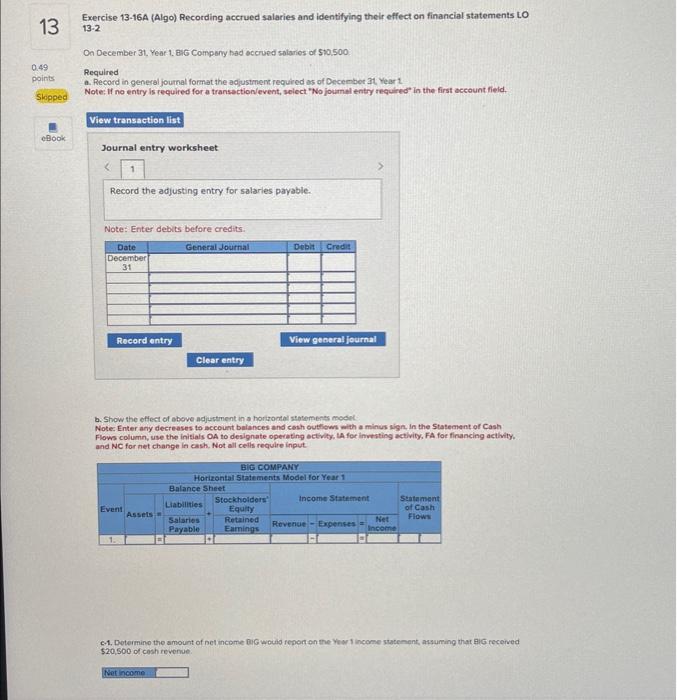

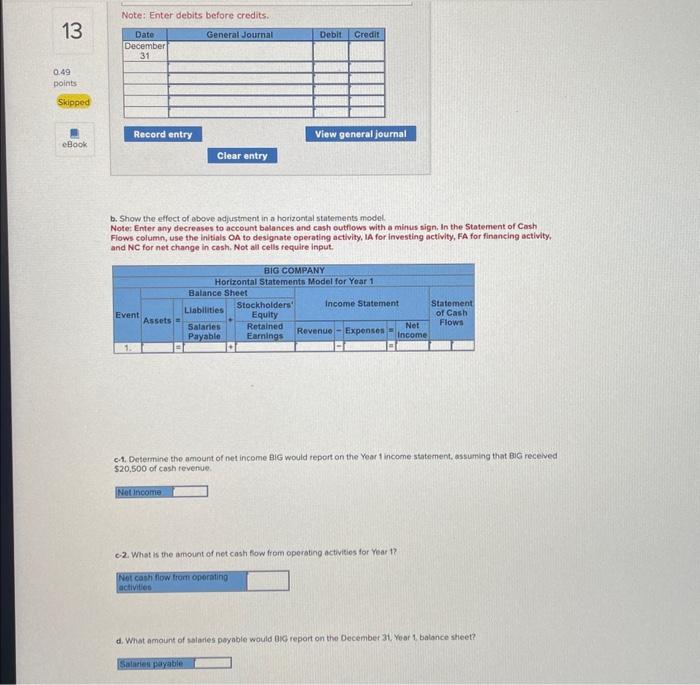

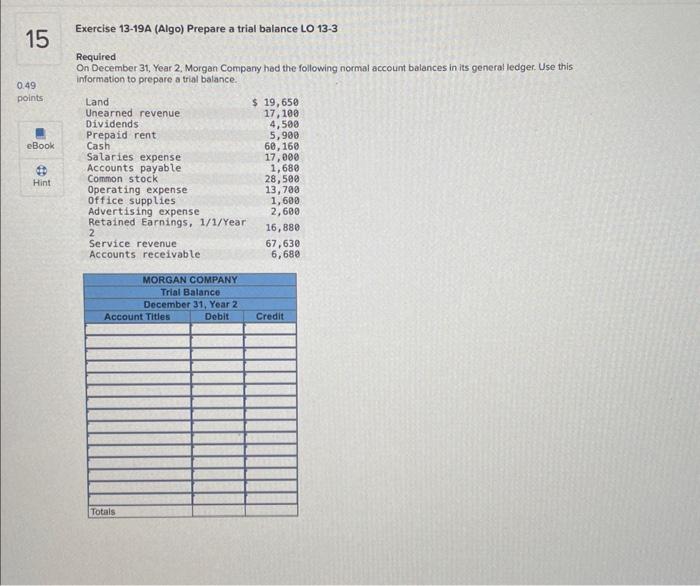

Exercise 13-15A (Algo) Recording prepaid items and identifying their effect on financial statements LO 132 Cherokee Company began operations when it issued common stock for $107,000cash. ll paid $96,300cash in advance for a one-year contract to lease delivery equipment for the business. It signed the lease agreement on March 1, Year 1, which was effective iminedlately. Charokee recelved $123,050 of cash revonue in Year 1 . Required a. \& b. Record the March 1 cash payment and adjustment required as of December 31 , Year 1 in general journal format c. Show all events in a horizontal statements model. d. 8 e. What amount of net income will Cherokee Company report on the Year 1 income statement? What is the amount of net cash flow from operating activities for Year 1? Determine the amount of prepaid rent Cherokee Compony would report on the December 31, Year 1, balance sheet. Complete this question by entering your answers in the tabs below. Record the March 1 cash payment and adjustment required as of December 31 , Year 1 in general journal format. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Do not round intermediate calculations. Show less A Journal entry worksheet Record rent pald in advance. Note: Enter debits before credits. Exercise 13-15A (Algo) Recording prepaid items and identifying their effect on financial statements LO 132 Cherokee Company began operations when it issued common stock for $107,000 cash. k paid $96,300 cash in advance for a one yeur contract to lease delivery equipment for the business. it signed the leose agreement on March 1. Year 1. which was effective immediately Cherokee recelved $123.050 of cash revenue in Year 1 Required a. \& b. Record the March 1 cash poyment and adjustment required as of December 34 , Yoar 1 in genoral joumbl format. c. Show all events in a horizontal statements model d. e. What amourt of net income will Chetokee Company report on the Year 1 income statement? What is the amount of net cash flow from operating octivites for Year T? Determine the amount of prepaid rent Cherokec Company would report on the December 31, Year 1 , balance sheot. Complete this question by entering your answers in the tabs below. Show all events in a horizontal statements model. Note: Record the events as they occurred in question dato. Enter any decreases to account balances and casb outfiows with a minus sign. In the Statement of Cash Flows column, use OA to designote operating activity, IA for investing activity, FA for financing activity; and NC for net change in cash. Not all celts require input. Do not round intermediate calculations. Exercise 13-15A (Algo) Recording prepaid items and identifying their effect on financial statements LO 132 Cherokee Company began operations when it issued common stock for $107,000 cash, It paid $96,300 cash in advance for a one.year contract to leese delivery equipment for the business. it signed the lease agreement on March 1, Year 1 , which was effective immediately, Cherokee received $123.050 of cash revenue in Year 1. Required a. \& b. Record the March 1 cash payment and adjustment required as of December 31, Year 1 in general joumal format c. Show all events in a horizontal statements model. d. \& e. What amount of net income will Cherokee Company report on the Year income statement? What is the amount of net cash flow from opetating activities for Year 1? Deternine the amount of prepaid rent Cherohee Company would report on the December 31, Year 1 , balance sheet. Complete this question by entering your answers in the tabs below. What amount of net income will Cherokee Company report on the Year 1 income statement? What is the amount of net cash flow from operating activities for Year 1? Determine the amount of prepaid rent Cherokee Company would report on the December 31 , Year 1 , balance sheet. Note: Do not round intermediate calculations. Exercise 13-16A (Algo) Recording accrued salaries and identifying their effect on financial statements LO 132 On December 31. Yeat 1. BuG Company had accrued salaries of $10,500 Required a. Record in general joumal format the adjustment required as of December at. Vear 1 Note: If no entry is required for a transaction/event, select "No joumel entry required" in the first acceunt field. Journal entry worksheet Record the adjusting entry for salarles payable. Note: Enter debits before credits. b. Show the effect of above adjustment in a horizoglal statemens modet- Note: Enter any decreases to account bulances and cash outhews with a minus wign, in the Statement of Cash Flows column, use the inisials OA to designate operating octivity, IA for investing activity, FA foe financing acthity. and NC for net change in cash. Not all cells require input. c-1, Dotermino the amount of net income BiG wouls report en the Ywor 1 income statement, atsuming that gig recerved 520,500 of cash revenue Note: Enter debits before credits. b. Show the efflect of obove adjustment in a horizontal statements model Note: Enter any decreases to account balances and cash outfows with a minus sign, In the Statement of Cash Flows column, use the initials OA to designate operating activity, IA for investing activity, FA for financing activity, and NC for net change in cash. Not all cells require input. a. Determine the amount of net income BiG would report on the Year 1 income statement, assuming that BiG recelved \$20,500 of cash revenue. 0.2. What is the amount of net cash fow from operating activitios for Year 1? d. What amount of salaries payable would Big report on the December 3i. Yoar 1 balance sheet? Exercise 13-19A (Algo) Prepare a trial balance LO 13-3 Required On December 31, Year 2, Morgan Company had the following normal account balances in its general ledger. Use this information to prepare a trial balance