Question

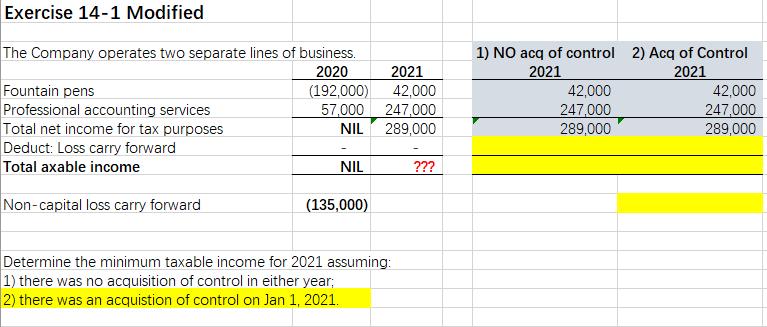

Exercise 14-1 Modified The Company operates two separate lines of business. 2020 2021 Fountain pens (192,000) 42,000 57,000 247,000 Professional accounting services Total net

Exercise 14-1 Modified The Company operates two separate lines of business. 2020 2021 Fountain pens (192,000) 42,000 57,000 247,000 Professional accounting services Total net income for tax purposes Deduct: Loss carry forward NIL 289,000 Total axable income NIL ??? Non-capital loss carry forward (135,000) Determine the minimum taxable income for 2021 assuming: 1) there was no acquisition of control in either year; 2) there was an acquistion of control on Jan 1, 2021. 1) NO acq of control 2) Acq of Control 2021 2021 42,000 42,000 247,000 247,000 289,000 289,000

Step by Step Solution

3.47 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

1 No Acquisition of control The year 2021 Net Income for Tax Purpose 289000 42000 247000 less No...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Income Tax Fundamentals 2013

Authors: Gerald E. Whittenburg, Martha Altus Buller, Steven L Gill

31st Edition

1111972516, 978-1285586618, 1285586611, 978-1285613109, 978-1111972516

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App