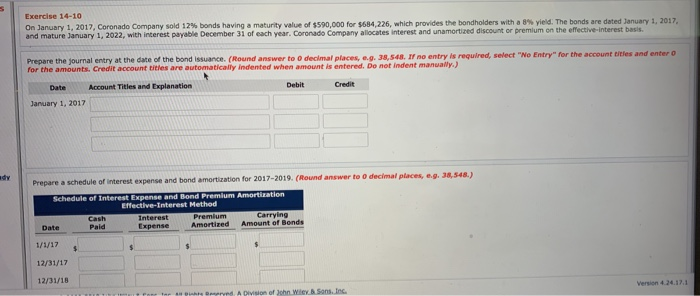

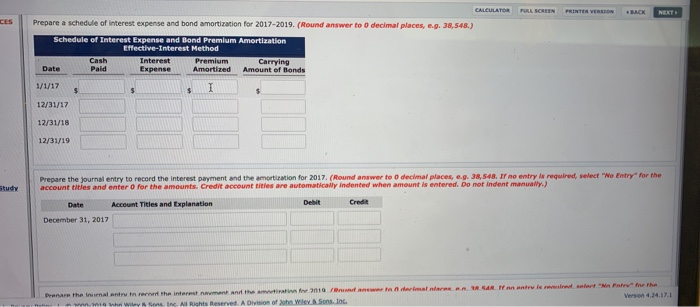

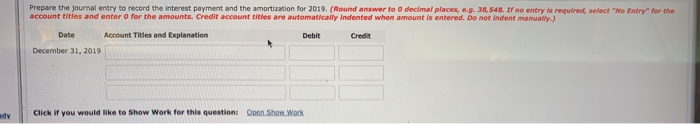

Exercise 14-10 On January 1, 2017, Coronado Company sold 12% bonds having a maturity value of $590,000 for $684,226, which provides the bondholders with a 8% yield. The bonds are dated January 1, 2017, and mature January 1, 2022, with interest payable December 31 of each year. Coronado Company allocates interest and unamortized discount or premium on the effective-interest basis. Prepare the journal entry at the date of the bond issuance. (Round answer to 0 declmal places, e.g. 38.548. If no entry is required, select "No Entry" for the account titles and enter o for the amounts. Credit account titles are automatically indented when amount is entered. Do not indent manually.) Credit Debit Account Titles and Explanation Date January 1, 2017 ady Prepare a schedule of interest expense and bond amortization for 2017-2019. (Round answer to 0 decimal places, e.g. 38.548.) Schedule of Interest Expense and Bond Premium Amortization Effective-Interest Method Carrying Amount of Bonds Cash Paid Interest Premium Amortized Expense Date 1/1/17 12/31/17 12/31/18 Version 4.24.17.1 phte Daerved.A Division of John Wiey &Sons. Inc ter CALCULATOR FULL SCREEN NEXT PRINTER VERSION BACK CES Prepare a schedule of interest expense and bond amortization for 2017-2019. (Round answer to 0 decimal places, e.g. 38,548.) Schedule of Interest Expense and Bond Premium Amortization Effective-Interest Method Premium Interest Expense Carrying Amount of Bonds Cash Paid Date Amortized 1/1/17 12/31/17 12/31/18 12/31/19 Prepare the journal entry to record the interest payment and the amortization for 2017. (Round answer te o decimal places, e.g. 38,548. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts. Credit account titles are automatically indented when amount is entered. Do not indent manually.) Study Debit Credit Account Titles and Explanation Date December 31, 2017 nn entru le remlred elect "Nn Fntry" ne the Version 4.24.17.1 Prenare the Inurnal entru tn rernet the interest nnyment and the amntiratinn f 2010 /8nnd anwr tn n deimat ntareean 1R SAR A Division of John Wley ASons. Inc. m14whn WiyA Sens Inc. All Richts Reserved . Aelin. Prepare the journal entry to record the interest payment and the amortization for 2019. (Round answer to 0 decimal places, e.g. 38,548. If no entry is required, select "No Entry" for the account titles and enter o for the amounts. Credit account titles are automatically Indented when amount is entered. Do not indent manually.) Date Account Titles and Explanation Debit Credit December 31, 2019 Open Show. Work Click if you would like to Show Work for this question: dy