Question

Exercise 14-24 (Algo) Compute Divisional Income (LO 14-1) Lauderdale Corporation is organized in three geographical divisions (regions) with managers responsible for revenues, costs, and assets

Exercise 14-24 (Algo) Compute Divisional Income (LO 14-1)

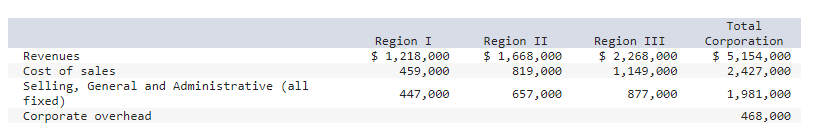

Lauderdale Corporation is organized in three geographical divisions (regions) with managers responsible for revenues, costs, and assets in their respective regions. The firm is highly decentralized and managers are evaluated solely on divisional performance. Corporate overhead (all fixed) is allocated to the regions based on regional gross margin (regional revenue minus regional cost of sales).

The following information is from Lauderdale's first year of operations:

Required:

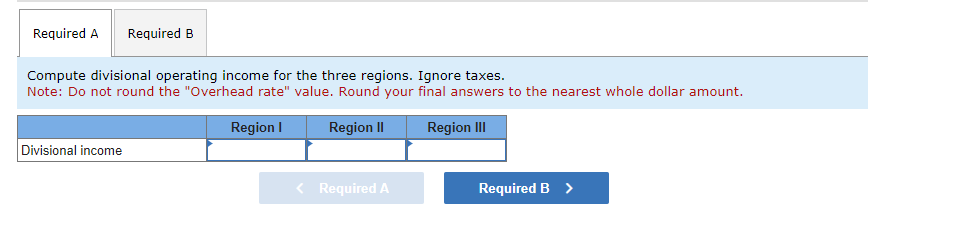

A. Compute divisional operating income for the three regions. Ignore taxes.

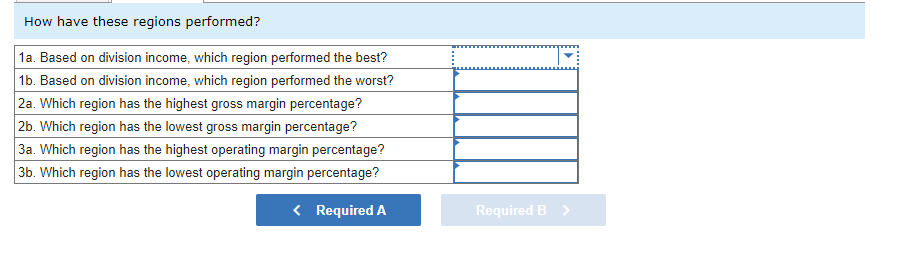

B. How have these regions performed?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started