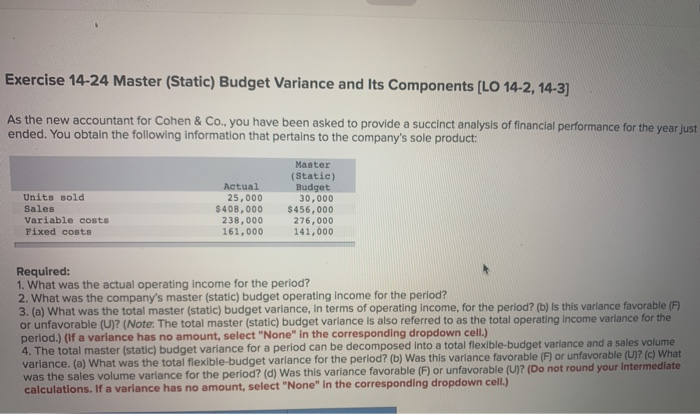

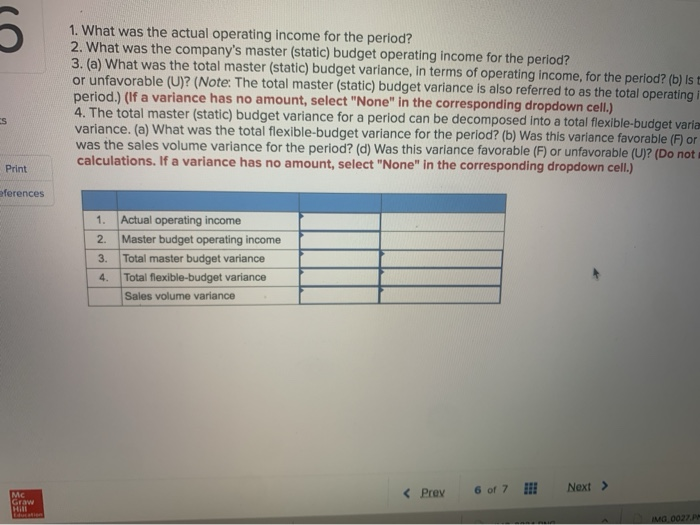

Exercise 14-24 Master (Static) Budget Variance and Its Components [LO 14-2, 14-3) As the new accountant for Cohen & Co., you have been asked to provide a succinct analysis of financial performance for the year just ended. You obtain the following information that pertains to the company's sole product: Units sold Sales Variable costs Fixed costs Actual 25,000 $408,000 238,000 161,000 Master (Static) Budget 30,000 $ 456,000 276,000 141,000 Required: 1. What was the actual operating income for the period? 2. What was the company's master (static) budget operating income for the period? 3. (a) What was the total master (static) budget variance, in terms of operating Income, for the period? (b) Is this variance favorable (F) or unfavorable (U? (Note: The total master (static) budget variance is also referred to as the total operating Income variance for the period.) (if a variance has no amount, select "None" in the corresponding dropdown cell.) 4. The total master (static) budget variance for a period can be decomposed into a total flexible-budget variance and a sales volume variance. (a) What was the total flexible-budget variance for the period? (b) Was this variance favorable (F) or unfavorable (U7 (c) What was the sales volume variance for the period? (d) Was this variance favorable (F) or unfavorable (U)? (Do not round your intermediate calculations. If a variance has no amount, select "None" in the corresponding dropdown cell.) 1. What was the actual operating income for the period? 2. What was the company's master (static) budget operating income for the period? 3. (a) What was the total master (static) budget variance, in terms of operating income, for the period? (b) ist or unfavorable (U)? (Note: The total master (static) budget variance is also referred to as the total operating period.) (If a variance has no amount, select "None" in the corresponding dropdown cell.) 4. The total master (static) budget variance for a period can be decomposed into a total flexible-budget varia variance. (a) What was the total flexible-budget variance for the period? (b) Was this variance favorable (F) or was the sales volume variance for the period? (d) Was this variance favorable (F) or unfavorable (U)? (Do not calculations. If a variance has no amount, select "None" in the corresponding dropdown cell.) Print ferences 1. Actual operating income 2. Master budget operating income 3. Total master budget variance Total flexible-budget variance Sales volume variance 0022