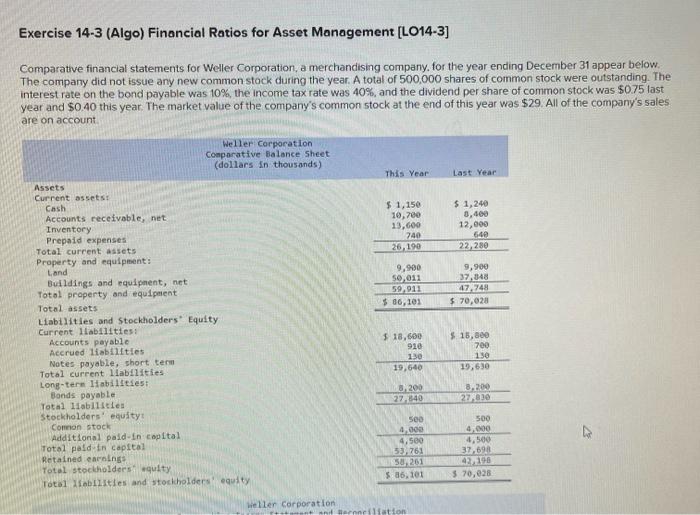

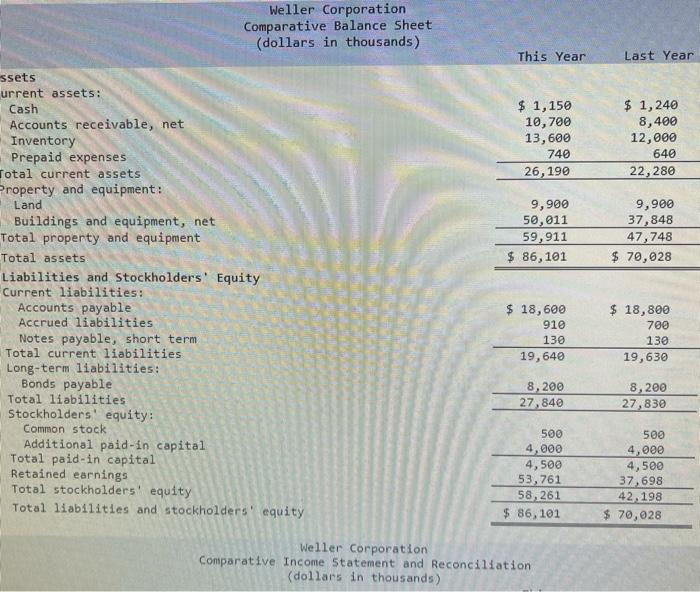

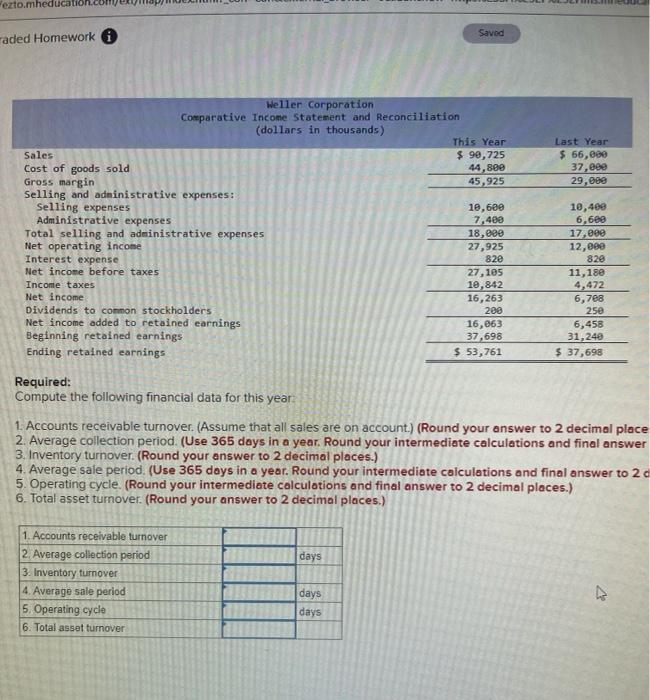

Exercise 14-3 (Algo) Financial Ratios for Asset Management [LO14-3] Comparative financial statements for Weller Corporation, a merchandising company, for the year ending December 31 appear below. The company did not issue any new common stock during the year. A total of 500,000 shares of common stock were outstanding. The interest rate on the bond payable was 10%, the income tax rate was 40%, and the dividend per share of common stock was $0.75 last year and $0.40 this year. The market value of the company's common stock at the end of this year was $29. All of the company's sales are on account. Weller Corporation Comparative Balance Sheet (dollars in thousands) This Year Last Year ssets urrent assets: Cash Accounts receivable, net Inventory Prepaid expenses Total current assets Property and equipment: Land Buildings and equipment, net Total property and equipment Total assets \begin{tabular}{rr} $1,150 & $1,240 \\ 10,700 & 8,400 \\ 13,600 & 12,000 \\ 740 & 640 \\ \hline 26,190 & 22,280 \\ 99,900 & 9,900 \\ 50,011 & 37,848 \\ \hline 59,911 & 47,748 \\ \hline$86,101 & $70,028 \\ \hline \hline \end{tabular} Liabilities and Stockholders' Equity Current liabilities: Accounts payable Accrued liabilities Notes payable, short term Total current liabilities \begin{tabular}{rr} $18,600 & $18,800 \\ 910 & 700 \\ 130 & 130 \\ \hline 19,640 & 19,630 \end{tabular} Long-term 1iabilities: Bonds payable Total liabilities \begin{tabular}{rr} 8,200 & 8,200 \\ \hline 27,840 & 27,830 \\ \hline \end{tabular} Stockholders' equity: Common stock Additional paid-in capital Total paid-in capital Retained earnings Total stockholders' equity Total liabilities and stockholders' equity Weller Corporation Comparative Income statement and Reconciliation (dollars in thousands) Required: Compute the following financial data for this year: 1. Accounts receivable turnover. (Assume that all sales are on account.) (Round your answer to 2 decimal place 2. Average collection period. (Use 365 days in a year. Round your intermediate calculations and final answer 3. Inventory turnover. (Round your answer to 2 decimal places.) 4. Average sale period. (Use 365 days in a year. Round your intermediate calculations and final answer to 2 5. Operating cycle. (Round your intermediate calculations and final answer to 2 decimal places.) 6. Total asset tumover. (Round your answer to 2 decimal places.)