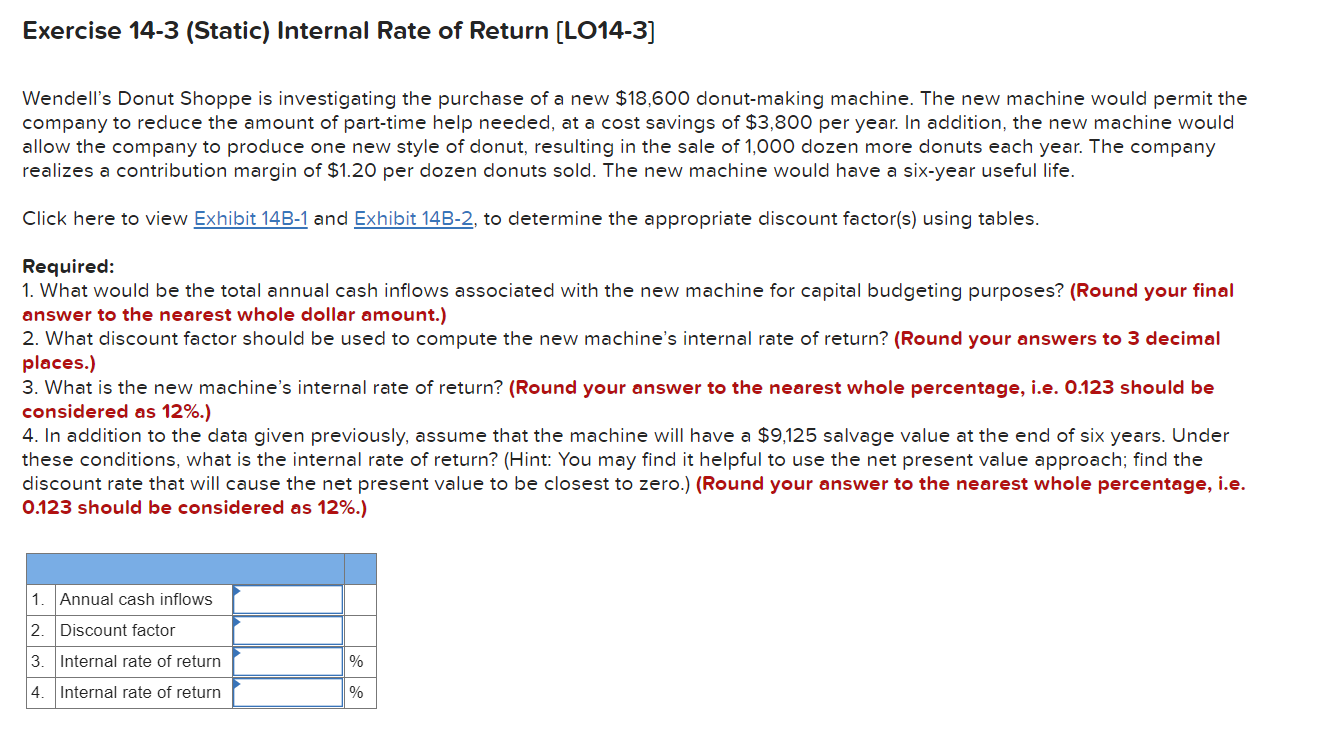

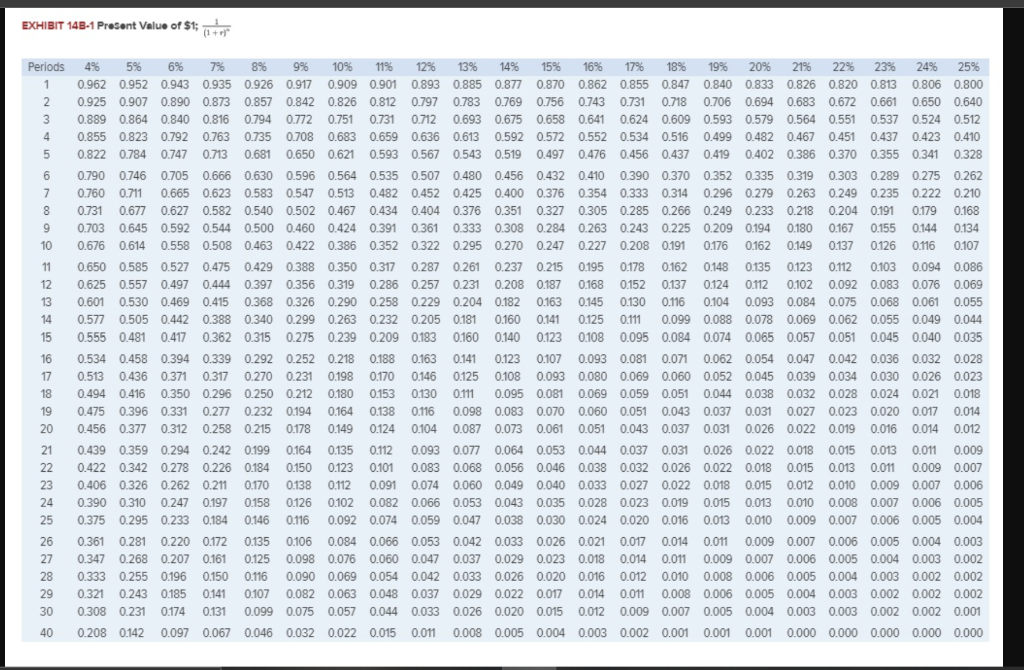

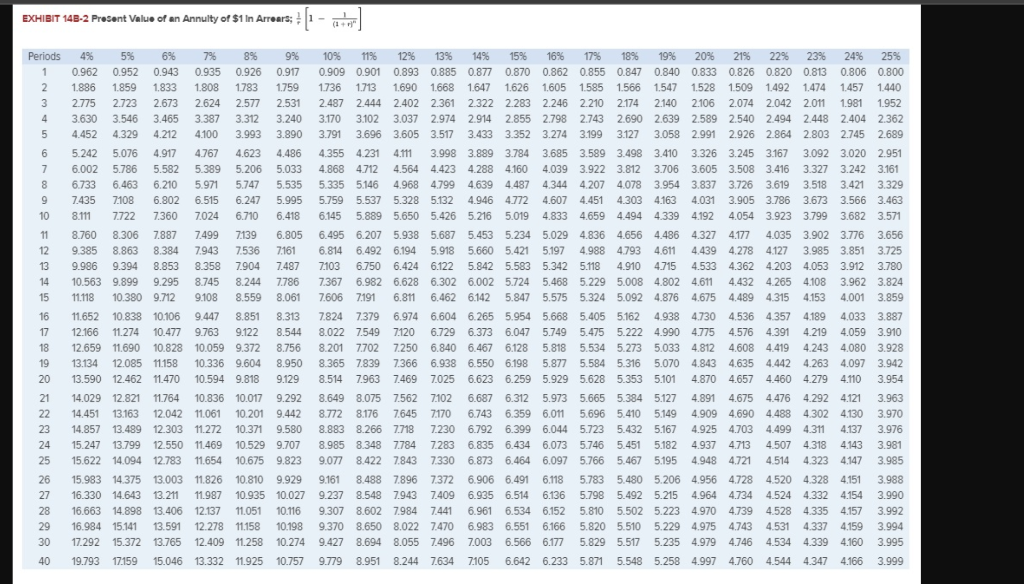

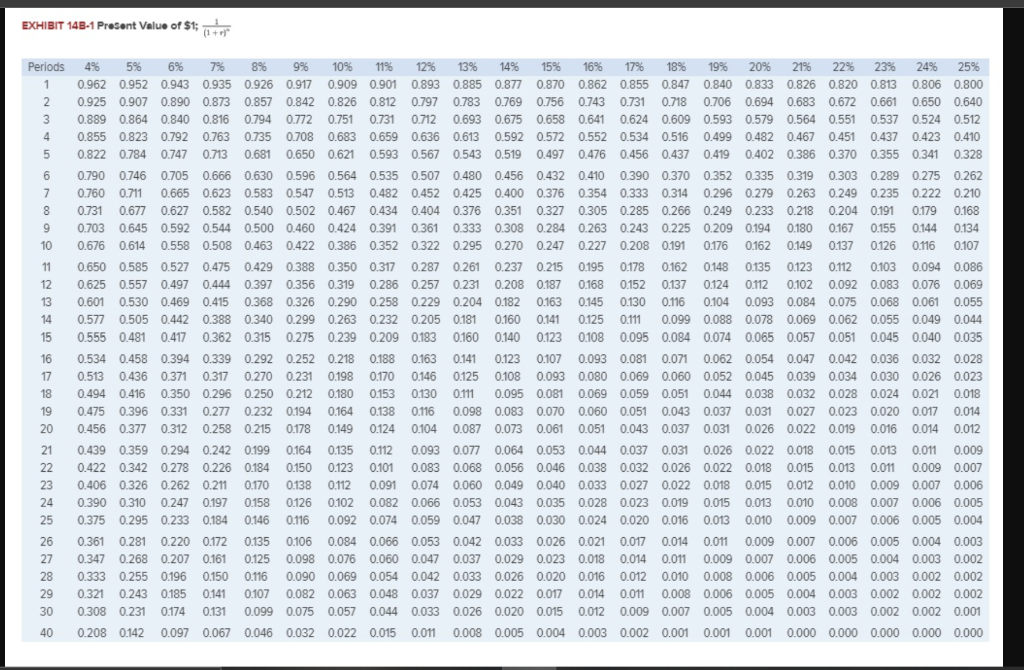

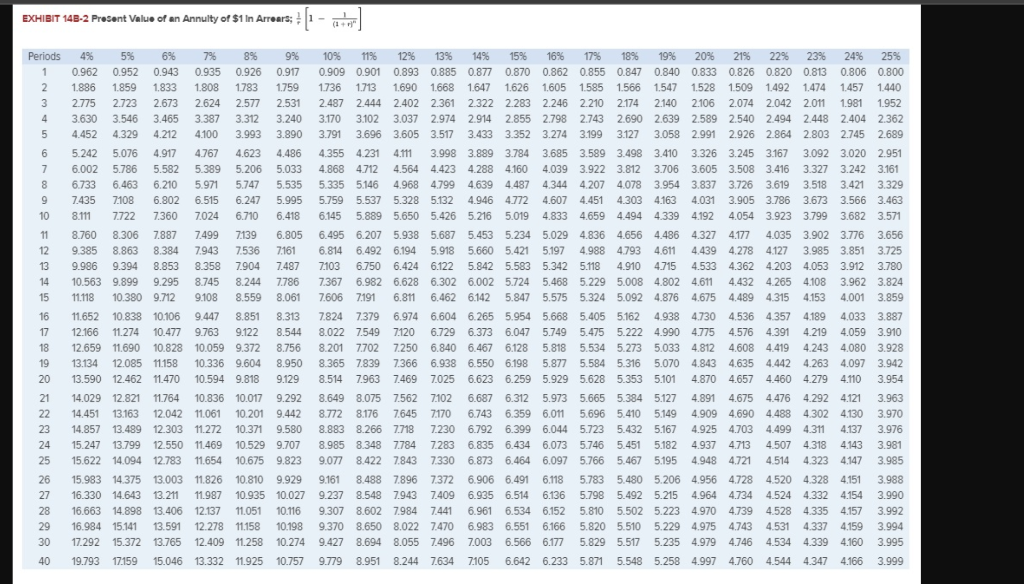

Exercise 14-3 (Static) Internal Rate of Return (LO14-3] Wendell's Donut Shoppe is investigating the purchase of a new $18,600 donut-making machine. The new machine would permit the company to reduce the amount of part-time help needed, at a cost savings of $3,800 per year. In addition, the new machine would allow the company to produce one new style of donut, resulting in the sale of 1,000 dozen more donuts each year. The company realizes a contribution margin of $1.20 per dozen donuts sold. The new machine would have a six-year useful life. Click here to view Exhibit 14B-1 and Exhibit 14B-2, to determine the appropriate discount factor(s) using tables. Required: 1. What would be the total annual cash inflows associated with the new machine for capital budgeting purposes? (Round your final answer to the nearest whole dollar amount.) 2. What discount factor should be used to compute the new machine's internal rate of return? (Round your answers to 3 decimal places.) 3. What is the new machine's internal rate of return? (Round your answer to the nearest whole percentage, i.e. 0.123 should be considered as 12%.) 4. In addition to the data given previously, assume that the machine will have a $9,125 salvage value at the end of six years. Under these conditions, what is the internal rate of return? (Hint: You may find it helpful to use the net present value approach; find the discount rate that will cause the net present value to be closest to zero.) (Round your answer to the nearest whole percentage, i.e. 0.123 should be considered as 12%.) 1 Annual cash inflows 2. Discount factor 3. Internal rate of return % 4. Internal rate of return % EXHIBIT 148-1 Present Value of $1: (1 to Periods 1 2 4 5 7 8 9 10 11 12 6 14 5% 6% % 8 9% 10% 2% 13% 14% | 15% 16% 17% % 19% 20% 218 22% 23% 24% 25% 0.962 0952 0943 0.935 0.926 0.97 0.909 0.901 0893 0.885 0.87 0.870 0862 0.855 0.847 0.840 0833 0.826 0.820 0.86 0806 0800 0.925 0907 0.890 0.873 0.857 0.842 0.826 0.82 0797 0.783 0.769 0756 0756 0743 0.73] 07 0.706 0.694 0.683 0.672 0.661 0.650 0.640 0.889 0.864 0.840 0.816 0.794 0.72 0.751 0.731 0.712 0.63 0.675 0658 0.64] 0624 0.609 0.593 0.579 0564 0.551 0.537 0524 0.512 0855 0823 0.792 0.763 0735 0708 0.683 0.659 0636 0613 0.592 0572 0552 0534 0516 0.499 0.482 0.467 0.451 0.437 0.423 0.423 0.410 0822 0.784 0.747 0.73 0.681 0650 0.621 0.650 0.62 0.593 0.567 0543 0.519 0.497 0.476 0.456 0.437 0479 0.402 0.386 0.370 0.355 0341 0.328 0790 0746 0705 0.666 0.666 0630 0.596 0564 0535 0.507 0.480 0.456 0432 0.10 0390 0.370 0352 0335 0319 0303 0289 0275 0262 0.760 0.7M 0.665 0.623 0.583 0.547 0.53 0.482 0.452 0.425 0.400 0.376 0.354 0.333 0.314 0.296 0.279 0.263 0.249 0.235 0.222 0.210 031 0.6 0.627 0.582 0540 0502 0.467 0.434 0.404 0.404 0376 0351 0327 0305 0285 0.266 0.249 0233 0.218 0.204 011 0179 0.168 0703 0.645 0.592 0.544 0.500 0.460 0.424 0.390 0361 0333 0.308 0.284 0.263 0.243 0.225 0.209 0194 0.180 0.167 0.155 0.144 0.134 0.676 0614 0.558 0.508 0.463 0422 0.386 0352 0322 0295 0270 0247 0227 0.208 09 076 0162 0.149 037 026 016 0107 0650 0.585 0527 0475 0429 0388 0350 037 0287 0261 0237 02 0195 0.178 0.162 0.148 035 0123 012 0103 0.094 0.026 0.625 0557 0497 0.444 03970356 0319 0.286 0.257 0231 0.208 0187 0.168 0.152 037 0.124 othe 0102 0.092 0.083 0.076 0.069 0.600 0.530 0.469 0.415 0.368 0326 0.290 0.258 0.229 0.204 0.182 0.163 0.145 0.130 0.16 0.104 0.093 0.084 0.075 0.068 0.061 0.055 0570505 0.442 0388 0340 0299 0.28 0.232 0205 0.181 0.160 0 025 0 0.099 0.088 0.078 0.069 0.062 0.055 0.049 0.044 0555 0481 047 0.362 0315 0275 0.239 0.209 0183 0160 0.140 01/23 0108 0.005 0.084 0.074 0.065 0.057 0.051 0.045 0040 0.035 0.534 0.458 0.394 0.339 0.292 0252 0.218 0.188 0.163 0.141 0.123 0.107 0.093 0.081 0.071 0.062 0.054 0.047 0.042 0.036 0032 0.028 058 0.436 0.37] 03 0.270 0.231 0.198 0.170 0146 0125 0.108 0.093 0.080 0.069 0.060 0.052 0.045 0.039 0.034 0.030 0.026 0.023 0.494 0416 0350 0.296 0.250 0212 0.180 0.153 0.130 011 0.095 008 0.069 0.059 0.051 0.069 0.059 0.051 0.04 0.038 0.032 0.028 0.024 0.021 0.018 0.475 0396 0.331 0.27 0232 0.194 0.164 0.138 016 0.098 0.083 0.070 0.060 0.051 0.043 0.037 0.031 0.027 0.023 0.020 0.07 0.014 0.456 0.37 0.312 0.31 0.258 0.25 0.178 0.149 0.124 0104 0.087 0.073 0061 0.051 0.043 0.037 0.031 0.026 0022 0.019 0.016 0.04 0.02 0.439 0359 0.294 0.242 0.199 0.164 0.135 0.12 0000 007 0.064 0.053 0.044 0.037 0.031 0.026 0.022 0.018 0.015 0.0% 0.01 0.009 0422 0342 0.278 0.226 0.184 0.150 0.123 0101 0.083 0.068 0.056 0.046 0.038 0.032 0.026 0.022 0.01% 0.015 0.00% 0.00 0.009 0.007 0.406 0326 0.262 0.2H 0170 0.138 012 0.091 0.074 0.060 0.049 0.040 0.033 0.027 0.022 0.01% 0.015 0.012 0.010 0.009 0.007 0.006 03900 0310 02470197 0158 0126 0102 0.082 0.066 0.053 0.043 0035 0028 0023 0.09 0.05 00% 0.00 0.00 0.007 0.006 0.005 0.375 0.295 0.233 0.184 0.146 0.16 0.092 0.074 0.059 0.047 0.03% 0.030 0.024 0.020 0.016 0.0% 0.010 0.00 0.007 0.006 0.005 0.004 0361 0281 0220 0.172 035 0.106 0.084 0.066 0.053 0.042 0.033 0.026 0.021 0.00 0.004 0.0m 0.009 0.007 0.006 0.005 0.004 0.003 0.347 0.268 0.207 0.161 025 0.098 0.076 0.060 0.047 0.037 0.029 0.023 0.018 0.014 0.0 0.009 0.007 0.006 0.005 0.004 0.003 0.002 0333 0.255 0196 0150 0.16 0.090 0.069 0.054 0.042 0033 0.026 0.020 0.016 0.00 0.010 0.008 0.006 0.005 0.004 0.003 0.002 0.002 0321 0.243 0.185 0.141 0107 0.082 0.063 0.048 0.048 0.037 0.029 0.022 0.07 0.014 0.01 0.00 0.006 0.005 0.004 0.003 0.002 0.002 0.002 0308 0231 0174 031 0.099 0.075 0.05 0.04 0.033 0.026 0.020 0.05 0.00.009 0.00 0.05 0.004 0.00 0.003 0.002 0.002 0.001 0208 0142 0.097 0.067 0.046 0.032 0.022 0.015 0.01 0.008 0.005 0.004 0.003 0.002 0.00 0.00 0.00 0.000 0.000 0.000 0.000 0.000 7 9 20 21 22 2. 24 25 25 27 28 29 30 40 0.943 8.7728.176 7645 EXHIBIT 14B-2 Present Value of an Annulty of $1 in Arrears; Periods 4% 5% 6% 7% 8% 9% 10% 11% 12% 13% 14% 15% 16% 17% 18% 19% 20% 21% 22% 23% 24% 25% 1 0.962 0.952 0.935 0.926 0.917 0.909 0.901 0.893 0.885 0.877 0.870 0.862 0.855 0.847 0.840 0.833 0.826 0.820 0.813 0.806 0.800 2 1.886 1.859 1.833 1.808 1.783 1759 1736 1.713 1.690 1.668 1.647 1.626 1.605 1.585 1.566 1.547 1528 1.509 1.492 1.474 1.457 1.440 3 2.775 2.723 2.673 2.624 2577 2.531 2.487 2.444 2.402 2.361 2.322 2.283 2.246 2.210 2.174 2.140 2106 2.074 2.042 2.011 1981 1952 4 3.630 3.546 3.465 3.387 3.312 3.240 3.170 3102 3.037 2.974 2.914 2.855 2.798 2.743 2.690 2.639 2.589 2.540 2.494 2.448 2.404 2.362 5 4.452 4.329 4.212 4.100 3.993 3.890 3.791 3.696 3.605 3.517 3.433 3.352 3.274 3.199 3.127 3.058 2.991 2.926 2.864 2.803 2.745 2.745 2689 6 6 5.242 5.076 4.917 4767 4.623 4.486 4.355 4.231 4.111 3.998 3.889 3.784 3.784 3.685 3.589 3.498 3.410 3.326 3.245 3.167 3.092 3.020 2.951 7 6.002 5.786 5.582 5.389 5.206 5.033 4.868 4.712 4.564 4.423 4.288 4.160 4.039 3.922 3.812 3.706 3.605 3.508 3.416 3.327 3.242 3.161 8 6.733 6.463 6.210 5.971 5.747 5.535 5.335 5.146 4.968 4.799 4.639 4.487 4.344 4.207 4.078 3.954 3.837 3.726 3.726 3.619 3.518 3.421 3.329 9 7.435 7108 6.802 6.515 6.247 5.995 5.759 5.537 5.328 5132 4.946 4.772 4.607 4.451 4.303 4.163 4.031 3.905 3.786 3.673 3.566 3.463 10 8.111 7.722 7.360 7024 6.710 6.418 6.145 5.889 5.650 5.426 5.216 5.019 4.833 4.659 4.494 4.339 4.192 4.054 3.923 3.799 3.682 3.571 11 8.760 8.306 7.887 7499 7.139 6.805 6.495 6.207 5.938 5.687 5.453 5.234 5.029 4.836 4.656 4.486 4.327 4.177 4.035 3.902 3.776 3.656 12 9.385 8.863 8.384 7.943 7.536 7.161 6.814 6.492 6.194 5.918 5.660 5.421 5.197 4.988 4793 4.611 4.439 4.278 4.127 3.985 3.851 3.725 13 9.986 9.394 8.853 8.358 7.904 7.487 7.103 6.750 6.424 6.122 5.842 5.583 5.342 5.118 4.910 4.715 4.533 4.362 4.203 4.053 3.912 3.780 14 10.563 9.899 9.295 8.745 8.244 7.786 7.367 6.982 6.628 6.302 6.002 5.724 5.468 5.229 5.008 4.802 4.611 4.432 4.265 4.108 3.962 3.824 15 11.118 10.380 9.712 9.108 8.559 8.061 7.606 7.191 6.811 6.462 6.142 5.847 5.575 5.324 5.092 4.876 4.675 4,489 4.315 4.153 4.001 3.859 16 11.652 10.838 10.106 9.447 8.851 8.313 7.824 7.379 6.974 6.604 6.265 5.954 5.668 5.405 5.162 4.938 4.730 4.536 4.357 4.189 4.033 3.887 17 12.166 11.274 10.477 9.763 9.122 8.544 8.022 7.549 7.120 6.729 6.373 6.047 e 6.047 5.749 5.475 5.222 4.990 4.775 4.576 4.219 4.391 4.059 3.910 18 12.659 11.690 10.828 10.059 9.372 8.756 8.201 7.702 7.250 6.840 6.467 6.128 5.818 5.534 5.273 5.033 4.812 1942 4.608 4.419 4.243 4.080 3.928 19 13.134 0 12.085 11.158 E 2008 --- FEO 6400 10.336 9.604 20 8.950 8.365 7.839 EM 5070 2012 7.366 6.938 6.550 6.198 5.877 5.584 5.316 5.070 4.843 4.635 4.442 4.263 4.097 3.942 20 20 1000 13.590 12.462 11.470 10.594 9.818 9.129 8.514 7963 20 7.025 7.469 400 6.623 6.259 5.929 5.628 5.353 5.101 4.870 4.657 4.460 4.279 4.460 4.110 3.954 21 14.029 12.821 11.764 10.836 10.017 9.292 8.6498.075 7.562 7102 6.687 6.3125.9735.665 5.384 5.127 4.891 4.675 4.476 4.292 4.121 3.963 22 14.451 13.163 12.042 11.061 10.2019.442 6.743 6.359 6.011 5.696 5.410 5.149 3.030 3.410 4.909 4.690 4.488 4.302 4.130 4.130 3.970 w 23 14.857 13.489 12.303 11.272 10.371 9.580 8.883 8.266 7.718 7.230 6.792 6.399 6.044 5.723 5.432 5.167 4.925 4.703 4.499 4.311 4.137 3.976 24 15.247 13.799 12.550 11.469 10.529 9.707 8.985 8.348 7.784 7.283 6.835 6.434 6.073 5.746 5.451 5.182 4.937 4.713 4.507 4.318 4.143 3.981 25 15.622 14.094 12.783 11.654 10.675 9.823 9.077 8.422 7.843 8.422 7.843 7330 6.873 6.464 6.097 5.766 5.467 5.195 4.948 4.721 4.514 4.323 4.147 3.985 26 15.983 14.375 13.003 11.826 10.810 9.929 9.161 8.488 7.896 7.372 6.906 6.491 6.118 5.783 5.480 5.206 4.956 4.728 4.520 4.328 4.151 3.988 27 16.330 14.643 13.211 11.987 10.935 10.027 9.237 8.548 7.943 7.409 6.935 6.514 6.136 5.798 5.492 5.215 4.964 4.734 4.524 4.332 4.154 3.990 28 16.663 14.898 13.406 12.137 11.051 10.116 9.307 8.602 7.984 7441 6.961 6.534 6.152 5.810 5.502 5.223 4.970 4.739 4.528 4.335 4.157 3.992 29 16.984 15.141 13.591 12.278 11.158 10.198 9.370 8.650 8.022 7.470 6.983 6.551 6.166 5.820 5.510 5.229 4.975 4.743 4.531 4.337 4.159 3.994 30 17.292 15.372 13.765 12.409 11.258 10.274 9.427 8.694 8.055 8.055 7.496 7.003 6.566 6.177 5.829 5.517 5.235 4.979 4.746 4.534 4.3394.160 3.995 40 19.793 17.159 15.046 13.332 11.925 10.757 9.779 8.951 8.244 7.634 7.105 6.642 6.233 5.871 5.548 5.258 4.997 4.760 4.544 4.347 4.166 3.999 6623