Answered step by step

Verified Expert Solution

Question

1 Approved Answer

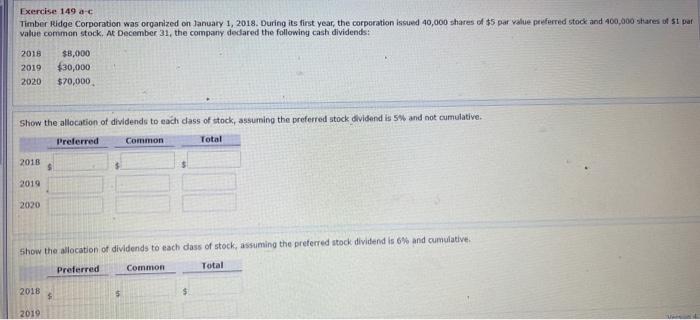

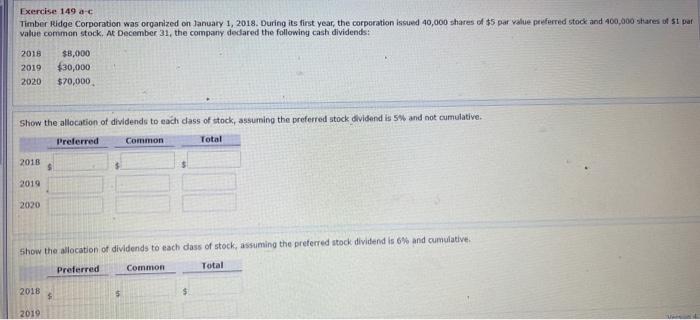

Exercise 149 a-c Timber Ridge Corporation was organized on January 1, 2018. During its first year, the corporation issued 40,000 shares of $5 par value

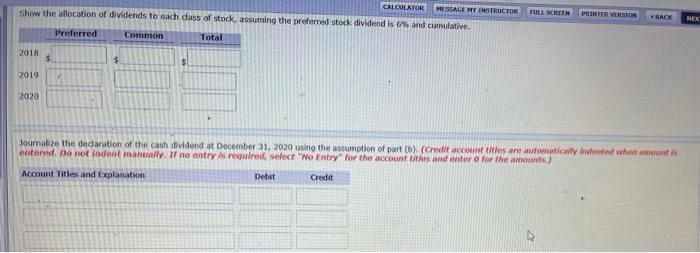

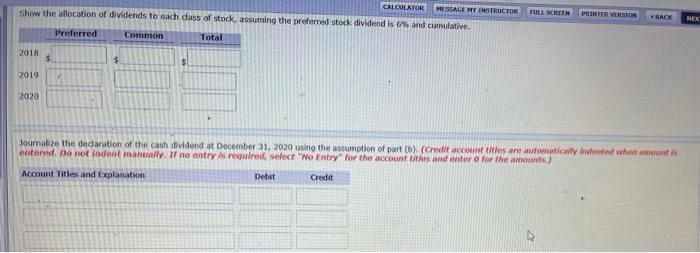

Exercise 149 a-c Timber Ridge Corporation was organized on January 1, 2018. During its first year, the corporation issued 40,000 shares of $5 par value preferred stock and 400,000 shares of St par value common stock. At December 31, the company dedared the following cash dividends: 2018 2019 2020 $8,000 $30,000 $70,000 Show the allocation of dividends to each class of stock, assuming the preferred stock dividend is 5% and not cumulative. Preferred Common Total 2016 $ 2019 2020 Show the allocation of dividends to each dass of stock, assuming the preferred stock dividend is 6% and cumulative, Preferred Common Total 2018 $ 2019 CALCULATOR HESALE HY INSTRUCTOR Show the allocation of dividends to each dass of stock, assuming the preferred stock dividend is % and cumulative Preferred Common Total TULL SCREEN PRINTER VERSION BACK NEK 2018 $ $ $ 2019 2020 Joumalize the dedaration of the cash dividend at December 31, 2020 using the assumption of part() (red account titles are automation indented when amount enterol. Do not indent manually. Il no entry required, select "No Entry for the accounts and enter for the amount Account Titles and Explanation Debit Credit

Exercise 149 a-c Timber Ridge Corporation was organized on January 1, 2018. During its first year, the corporation issued 40,000 shares of $5 par value preferred stock and 400,000 shares of St par value common stock. At December 31, the company dedared the following cash dividends: 2018 2019 2020 $8,000 $30,000 $70,000 Show the allocation of dividends to each class of stock, assuming the preferred stock dividend is 5% and not cumulative. Preferred Common Total 2016 $ 2019 2020 Show the allocation of dividends to each dass of stock, assuming the preferred stock dividend is 6% and cumulative, Preferred Common Total 2018 $ 2019 CALCULATOR HESALE HY INSTRUCTOR Show the allocation of dividends to each dass of stock, assuming the preferred stock dividend is % and cumulative Preferred Common Total TULL SCREEN PRINTER VERSION BACK NEK 2018 $ $ $ 2019 2020 Joumalize the dedaration of the cash dividend at December 31, 2020 using the assumption of part() (red account titles are automation indented when amount enterol. Do not indent manually. Il no entry required, select "No Entry for the accounts and enter for the amount Account Titles and Explanation Debit Credit

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started