Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Exercise 15 Consider a one-period financial market model that consists of the risk-free asset and a risky asset, defined on the probability space (,F,P), where

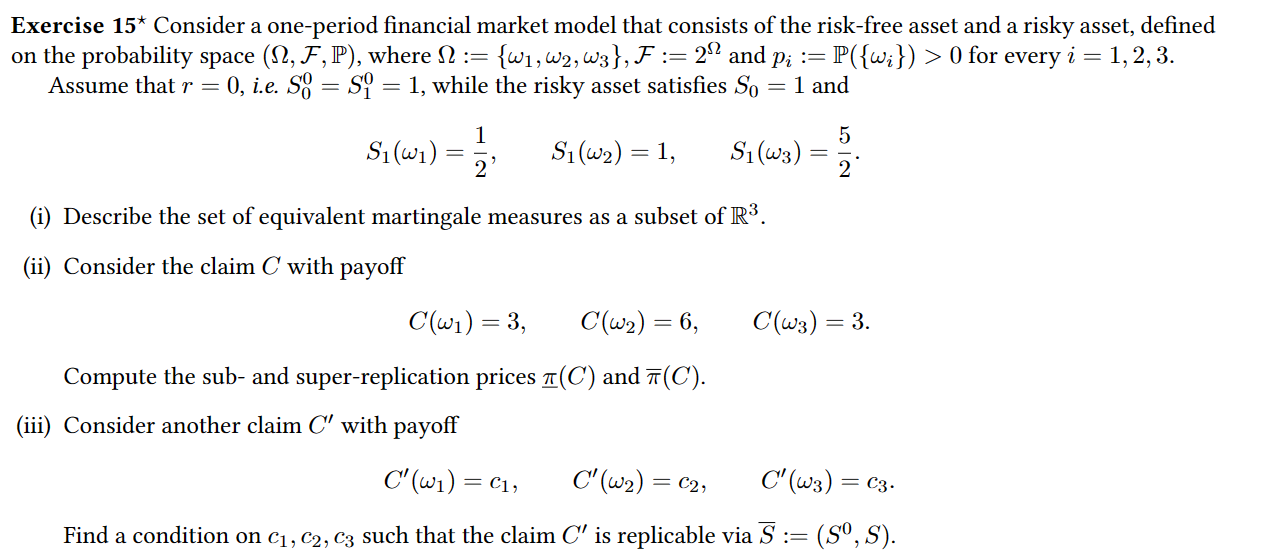

Exercise 15 Consider a one-period financial market model that consists of the risk-free asset and a risky asset, defined on the probability space (,F,P), where :={1,2,3},F:=2 and pi:=P({i})>0 for every i=1,2,3. Assume that r=0, i.e. S00=S10=1, while the risky asset satisfies S0=1 and S1(1)=21,S1(2)=1,S1(3)=25. (i) Describe the set of equivalent martingale measures as a subset of R3. (ii) Consider the claim C with payoff C(1)=3,C(2)=6,C(3)=3. Compute the sub- and super-replication prices (C) and (C). (iii) Consider another claim C with payoff C(1)=c1,C(2)=c2,C(3)=c3. Find a condition on c1,c2,c3 such that the claim C is replicable via S:=(S0,S)

Exercise 15 Consider a one-period financial market model that consists of the risk-free asset and a risky asset, defined on the probability space (,F,P), where :={1,2,3},F:=2 and pi:=P({i})>0 for every i=1,2,3. Assume that r=0, i.e. S00=S10=1, while the risky asset satisfies S0=1 and S1(1)=21,S1(2)=1,S1(3)=25. (i) Describe the set of equivalent martingale measures as a subset of R3. (ii) Consider the claim C with payoff C(1)=3,C(2)=6,C(3)=3. Compute the sub- and super-replication prices (C) and (C). (iii) Consider another claim C with payoff C(1)=c1,C(2)=c2,C(3)=c3. Find a condition on c1,c2,c3 such that the claim C is replicable via S:=(S0,S) Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started