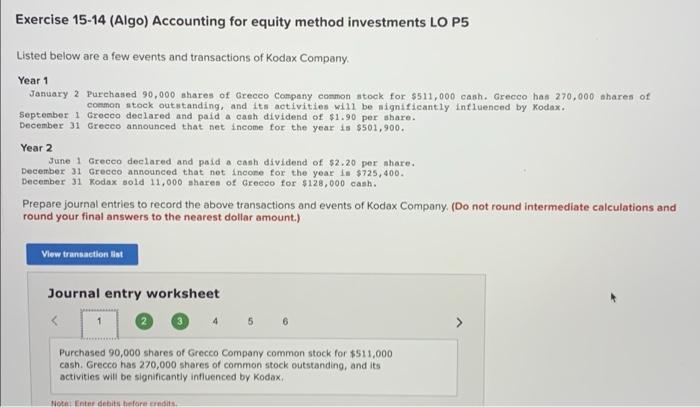

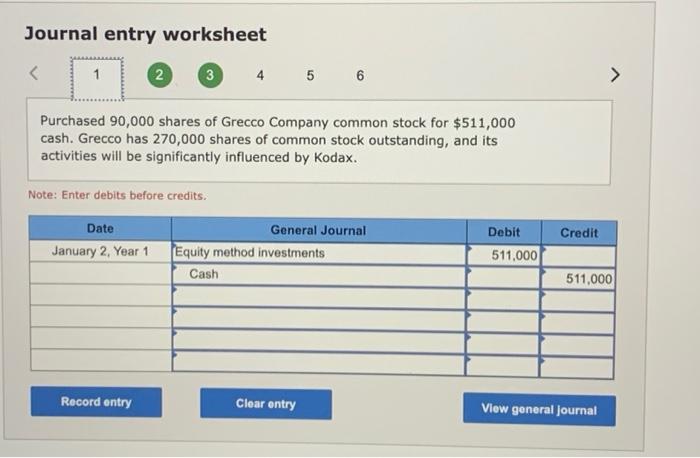

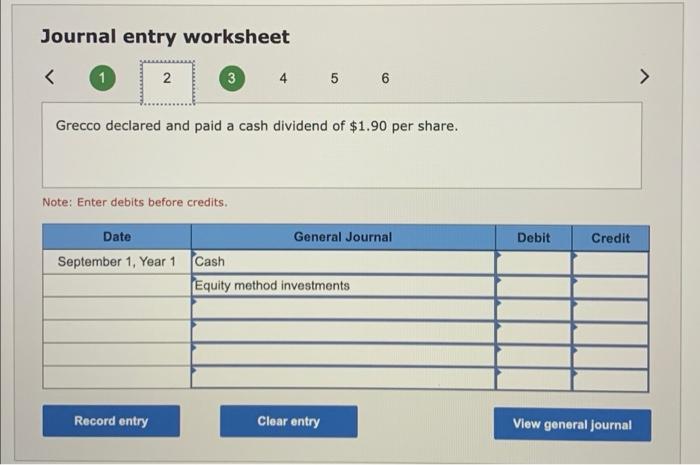

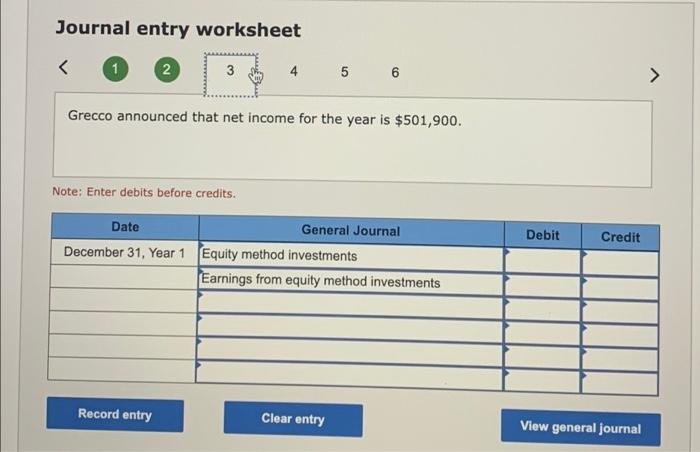

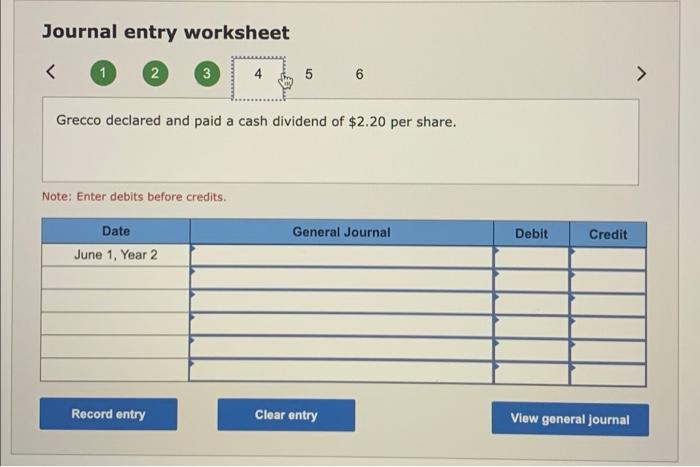

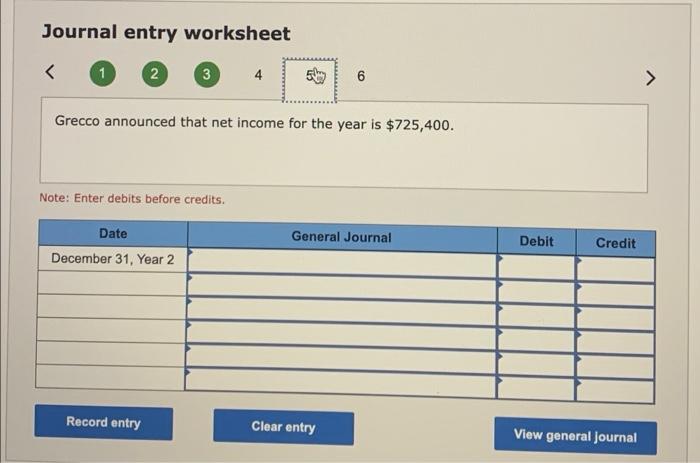

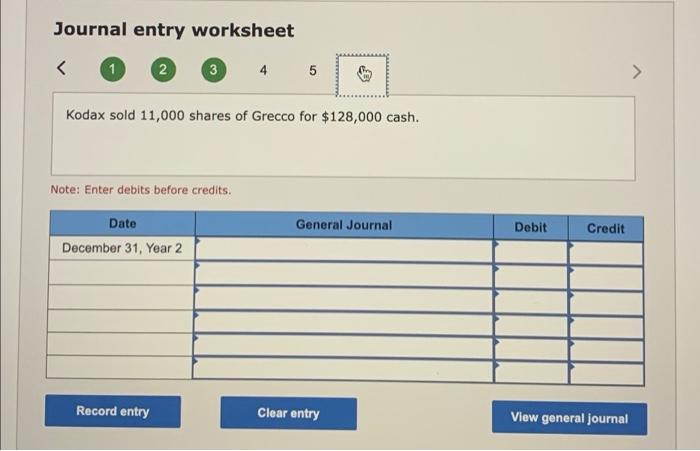

Exercise 15-14 (Algo) Accounting for equity method investments LO P5 Listed below are a few events and transactions of Kodax Company Year 1 January 2 Purchased 90,000 shares of Grecco Company common stock for $511,000 cash. Grecco has 270,000 shares of common stock outstanding, and its activities will be significantly influenced by Kodex. September 1 Crecco declared and paid a cash dividend of $1.90 per share. December 31 Grecco announced that net income for the year is $501,900. Year 2 June 1 Grecco declared and paid a cash dividend of $2.20 per share. December 31 Grecco announced that net income for the year is $725,400. December 31 Kodax sold 11,000 shares of Grocco for $128,000 cash. Prepare journal entries to record the above transactions and events of Kodax Company. (Do not round intermediate calculations and round your final answers to the nearest dollar amount.) View transaction et Journal entry worksheet 5 > Purchased 90,000 shares of Grecco Company common stock for $511,000 cash. Grecco has 270,000 shares of common stock outstanding, and its activities will be significantly influenced by Kodax Not Enter debit before trdi Journal entry worksheet Purchased 90,000 shares of Grecco Company common stock for $511,000 cash. Grecco has 270,000 shares of common stock outstanding, and its activities will be significantly influenced by Kodax. Note: Enter debits before credits. Credit Date January 2, Year 1 General Journal Equity method investments Cash Debit 511,000 511,000 Record entry Clear entry View general journal Journal entry worksheet Grecco declared and paid a cash dividend of $1.90 per share. Note: Enter debits before credits. Date General Journal Debit Credit September 1, Year 1 Cash Equity method investments Record entry Clear entry View general journal Journal entry worksheet Grecco announced that net income for the year is $501,900. Note: Enter debits before credits. Debit Credit Date General Journal December 31, Year 1 Equity method investments Earnings from equity method investments Record entry Clear entry View general journal Journal entry worksheet Grecco declared and paid a cash dividend of $2.20 per share. Note: Enter debits before credits. General Journal Debit Credit Date June 1, Year 2 Record entry Clear entry View general journal Journal entry worksheet 2 3 4 569 6 CO > Grecco announced that net income for the year is $725,400. Note: Enter debits before credits. Date General Journal Debit Credit December 31, Year 2 Record entry Clear entry View general Journal Journal entry worksheet 1 2 3 4 5 LO Kodax sold 11,000 shares of Grecco for $128,000 cash. Note: Enter debits before credits. General Journal Date December 31, Year 2 Debit Credit Record entry Clear entry View general journal