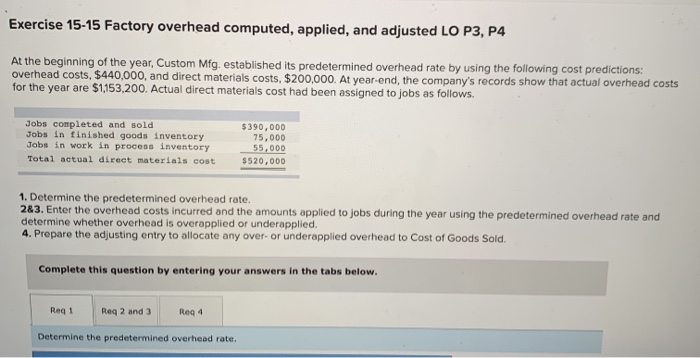

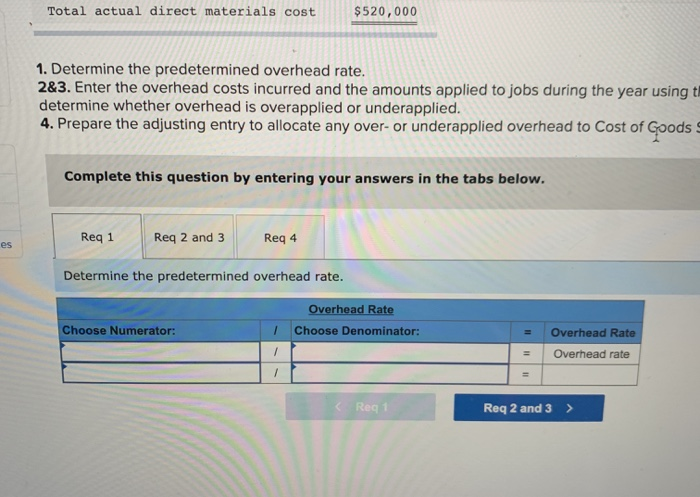

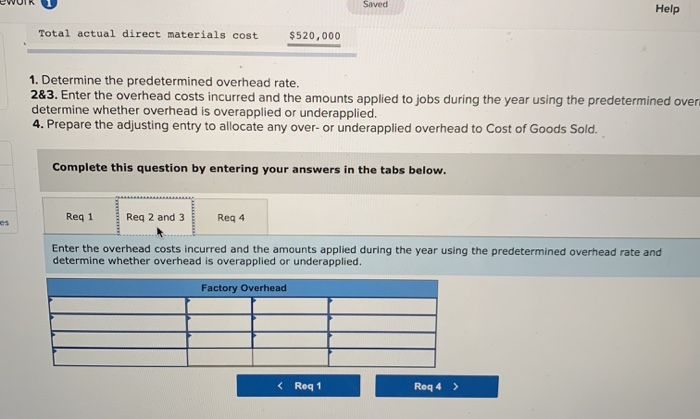

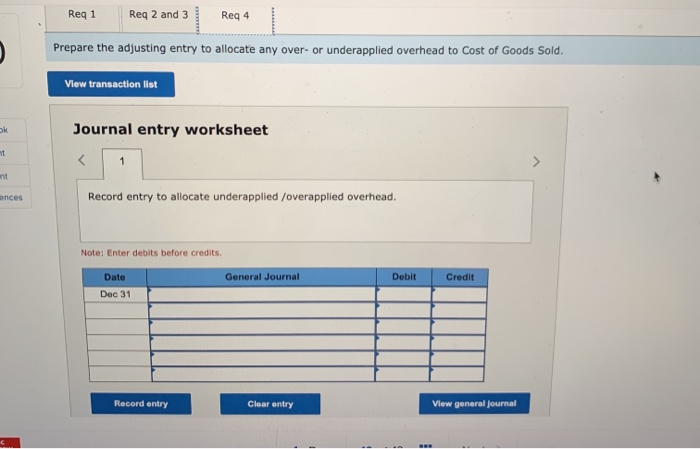

Exercise 15-15 Factory overhead computed, applied, and adjusted LO P3, P4 At the beginning of the year, Custom Mfg. established its predetermined overhead rate by using the following cost predictions: overhead costs, $440,000, and direct materials costs. $200,000. At year-end, the company's records show that actual overhead costs for the year are $1153,200. Actual direct materials cost had been assigned to jobs as follows. Jobs completed and sold Jobs in finished goods inventory Jobs in work in process inventory Total actual direct materials cost $390,000 75,000 55,000 $520,000 1. Determine the predetermined overhead rate. 283. Enter the overhead costs incurred and the amounts applied to jobs during the year using the predetermined overhead rate and determine whether overhead is overapplied or underapplied. 4. Prepare the adjusting entry to allocate any over- or underapplied overhead to Cost of Goods Sold. Complete this question by entering your answers in the tabs below. Reg 1 Reg 2 and 3 Reg 4 Determine the predetermined overhead rate. Total actual direct materials cost $520,000 1. Determine the predetermined overhead rate. 2&3. Enter the overhead costs incurred and the amounts applied to jobs during the year using t determine whether overhead is overapplied or underapplied. 4. Prepare the adjusting entry to allocate any over- or underapplied overhead to Cost of Goods Complete this question by entering your answers in the tabs below. Req 1 Req 2 and 3 Reg 4 es Determine the predetermined overhead rate. Overhead Rate Choose Numerator: Choose Denominator: Overhead Rate Overhead rate / Reg 1 Req 2 and 3 > Saved Help Total actual direct materials cost $520,000 1. Determine the predetermined overhead rate. 2&3. Enter the overhead costs incurred and the amounts applied to jobs during the year using the predetermined over determine whether overhead is overapplied or underapplied. 4. Prepare the adjusting entry to allocate any over- or underapplied overhead to Cost of Goods Sold. Complete this question by entering your answers in the tabs below. Reg 1 Reg 2 and 3 Reg 4 Enter the overhead costs incurred and the amounts applied during the year using the predetermined overhead rate and determine whether overhead is overapplied or underapplied. Factory Overhead Reg 1 Reg 2 and 3 Reg 4 Prepare the adjusting entry to allocate any over- or underapplied overhead to Cost of Goods Sold. View transaction list ok Journal entry worksheet