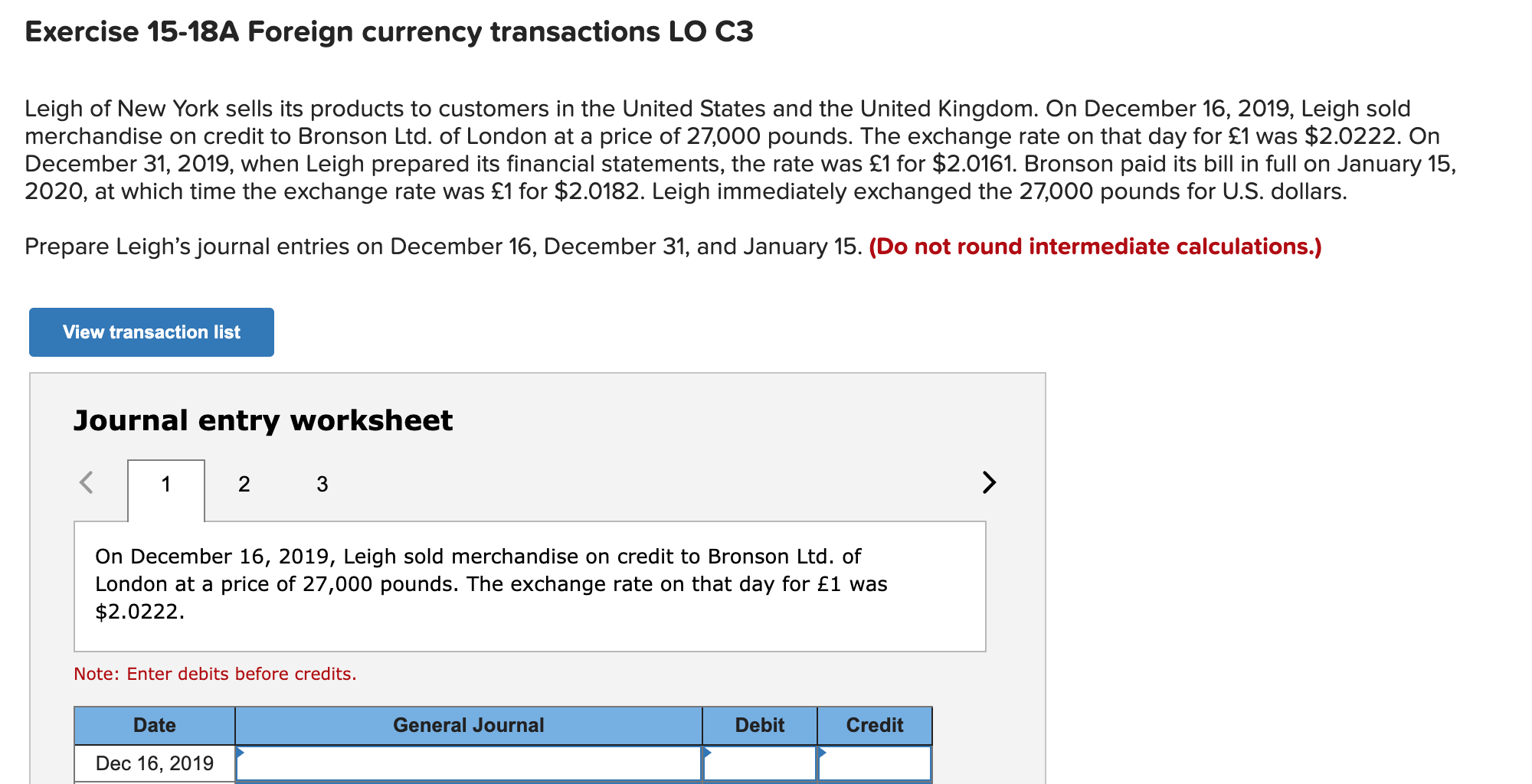

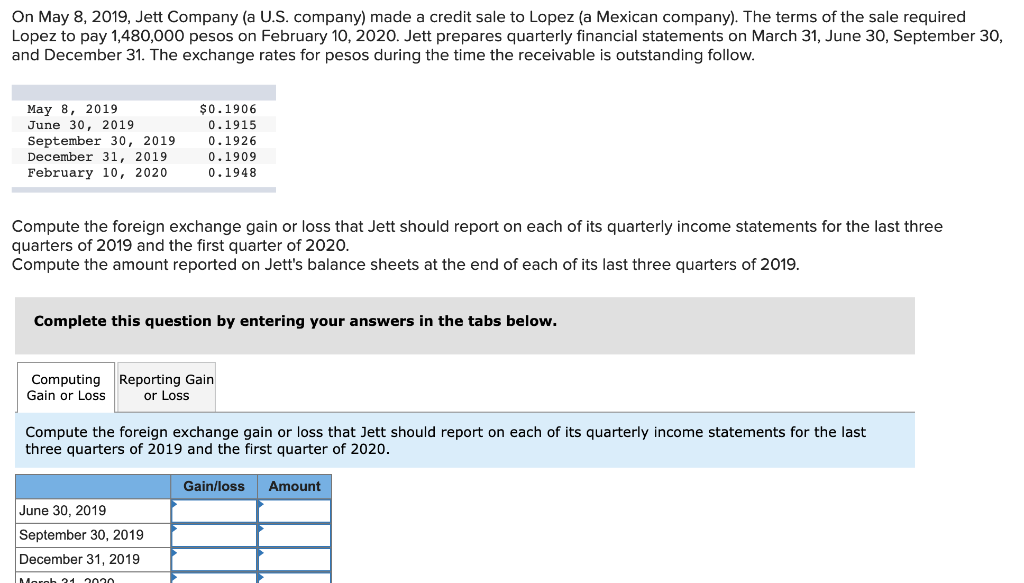

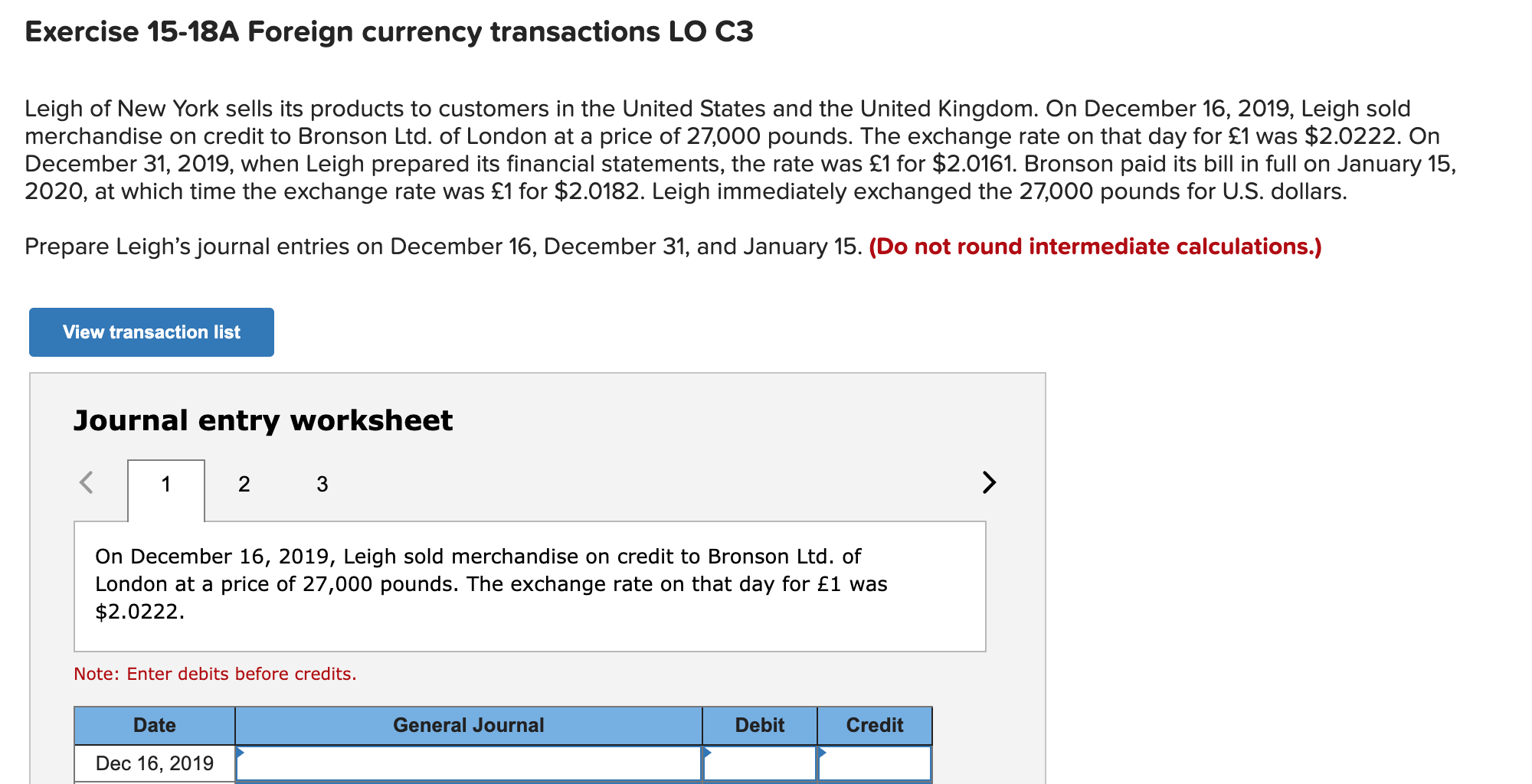

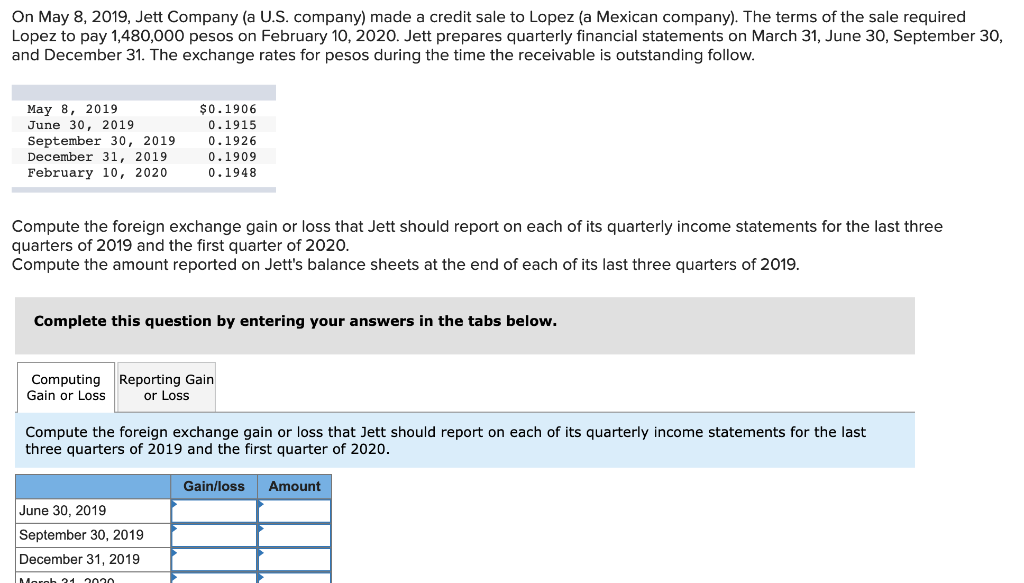

Exercise 15-18A Foreign currency transactions LO C3 Leigh of New York sells its products to customers in the United States and the United Kingdom. On December 16, 2019, Leigh sold merchandise on credit to Bronson Ltd. of London at a price of 27,000 pounds. The exchange rate on that day for 1 was $2.0222. On December 31, 2019, when Leigh prepared its financial statements, the rate was 1 for $2.0161. Bronson paid its bill in full on January 15, 2020, at which time the exchange rate was 1 for $2.0182. Leigh immediately exchanged the 27,000 pounds for U.S. dollars. Prepare Leigh's journal entries on December 16, December 31, and January 15. (Do not round intermediate calculations.) View transaction list Journal entry worksheet 1 2 3 On December 16, 2019, Leigh sold merchandise on credit to Bronson Ltd. of London at a price of 27,000 pounds. The exchange rate on that day for 1 was $2.0222. Note: Enter debits before credits. Date General Journal Debit Credit Dec 16, 2019 On May 8, 2019, Jett Company (a U.S. company) made a credit sale to Lopez (a Mexican company). The terms of the sale required Lopez to pay 1,480,000 pesos on February 10, 2020. Jett prepares quarterly financial statements on March 31, June 30, September 30, and December 31. The exchange rates for pesos during the time the receivable is outstanding follow. May 8, 2019 June 30, 2019 September 30, 2019 December 31, 2019 February 10, 2020 $0.1906 0.1915 0.1926 0.1909 0.1948 Compute the foreign exchange gain or loss that Jett should report on each of its quarterly income statements for the last three quarters of 2019 and the first quarter of 2020. Compute the amount reported on Jett's balance sheets at the end of each of its last three quarters of 2019. Complete this question by entering your answers in the tabs below. Computing Reporting Gain Gain or Loss or Loss Compute the foreign exchange gain or loss that Jett should report on each of its quarterly income statements for the last three quarters of 2019 and the first quarter of 2020. Gain/loss Amount June 30, 2019 September 30, 2019 December 31, 2019 Moroh 21 2070