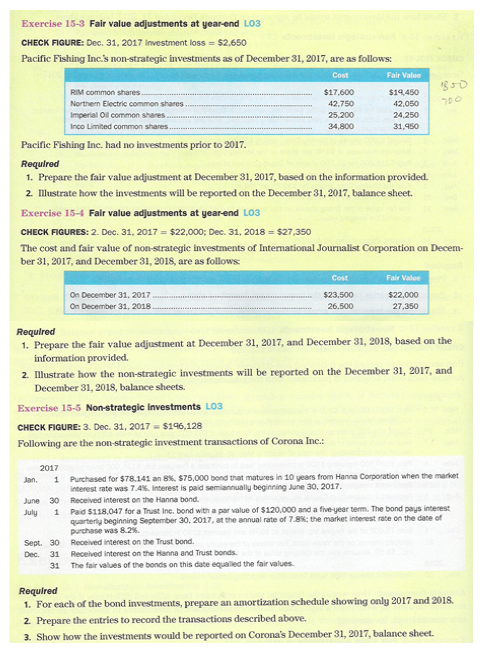

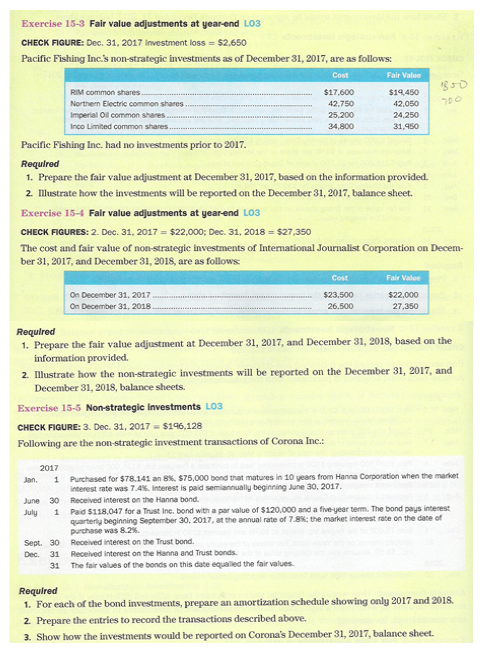

Exercise 15-3 Fair value adjustments at year-end LO3 CHECK FIGURE: Dec. 31, 2017 investment loss $2,650 Pacific Fishing Inc.'s non-strategic investments as of December 31, 2017, are as follows: Cost Fair Value $17,600 $19,450 RIM common shares 42.750 42.050 Northern Electric common shares Imperial Oil common shares 25.200 24,250 34,800 31,950 Inco Limited common shares Pacific Fishing Inc. had no investments prior to 2017. Required 1. Prepare the fair value adjustment at December 31, 2017, based on the information provided. Illustrate how the investments will be reported on the December 31, 2017, balance sheet. 2. Exercise 15-4 Fair value adjustments at yearend LO3 CHECK FIGURES: 2. Dec. 31, 2017 $22,000; Dec. 31, 2018 $27,350 The cost and fair value of non-strategic investments of International Journalist Corporation on Decem- ber 31, 2017, and December 31, 2018, are as follows Fair Value Cost $23.500 On December 31, 2017 $22.000 On December 31, 2018 26.500 27,350 Required 1. Prepare the fair value adjustment at December 31, 2017, and December 31, 2018, based on the information provided. reported on the December 31, 2017, and 2. Illustrate how the non-strategic investments will be December 31, 2018, balance sheets. Exercise 15-5 Non-strategic investments LO:3 $196,128 CHECK FIGURE: 3. Dec. 31, 2017 Following are the non-strategic investment transactions of Corona Inc.: 2017 Purchased for $78.141 an 8%, $75,000 bond that matures in 10 uears from Hanna Corporation when the market Jan. 1. interest rate was 7.4%. Interest is paid semiannually beginning June 30, 2017. 30 Received interest on the Hanna bond. June Paid $118.047 for a Trust Inc. bond with a par value of $120,000 and a five-uear tem. The bond paus interest quarterly beginning September 30, 2017, at the annual rate of 7.8%: the market interest rate on the date of purchase was 8.2 % July Sept. 30 Received interest on the Trust bond. Dec. 31 Received interest on the Hanna and Trust bonds. The fair values of the bonds on this date equaled the fair values 31 Required 8 1. For each of the bond investments, prepare an amortization schedule showing only 2017 and 201 Prepare the entries to record the transactions described above. 2. 3. Show how the investments would be reported on Corona's December 31, 2017, balance sheet