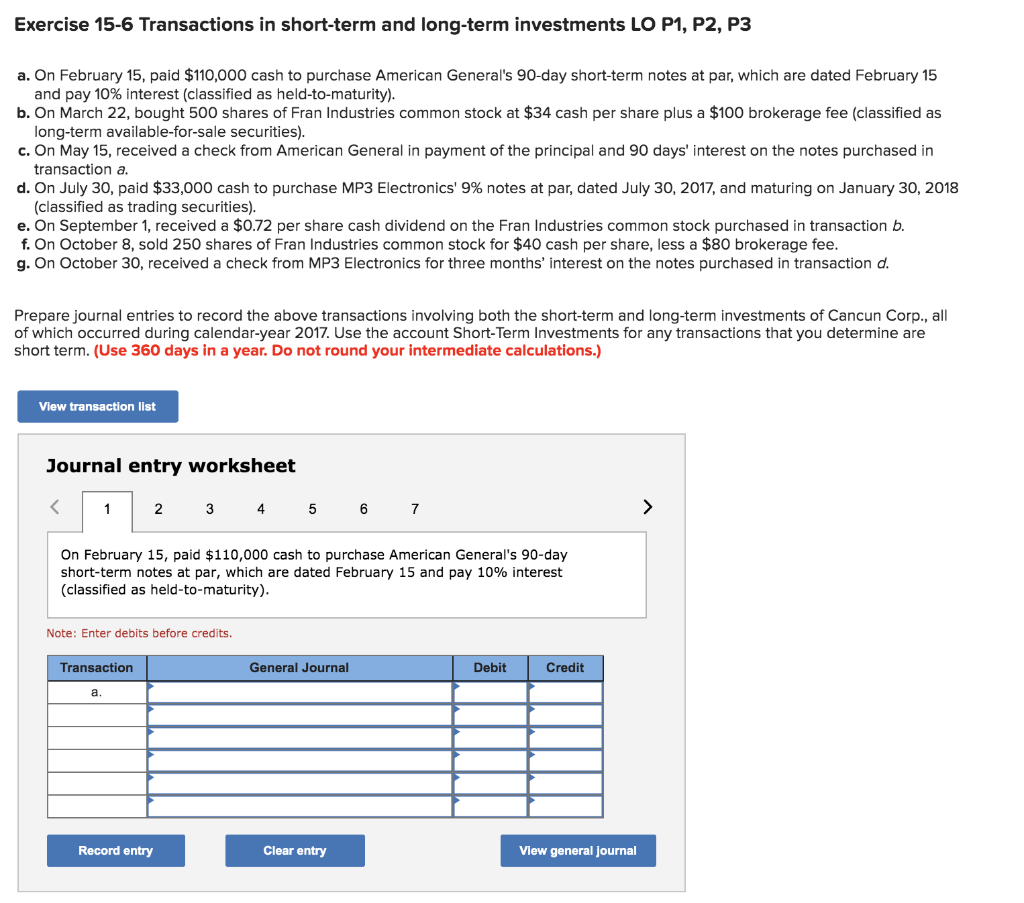

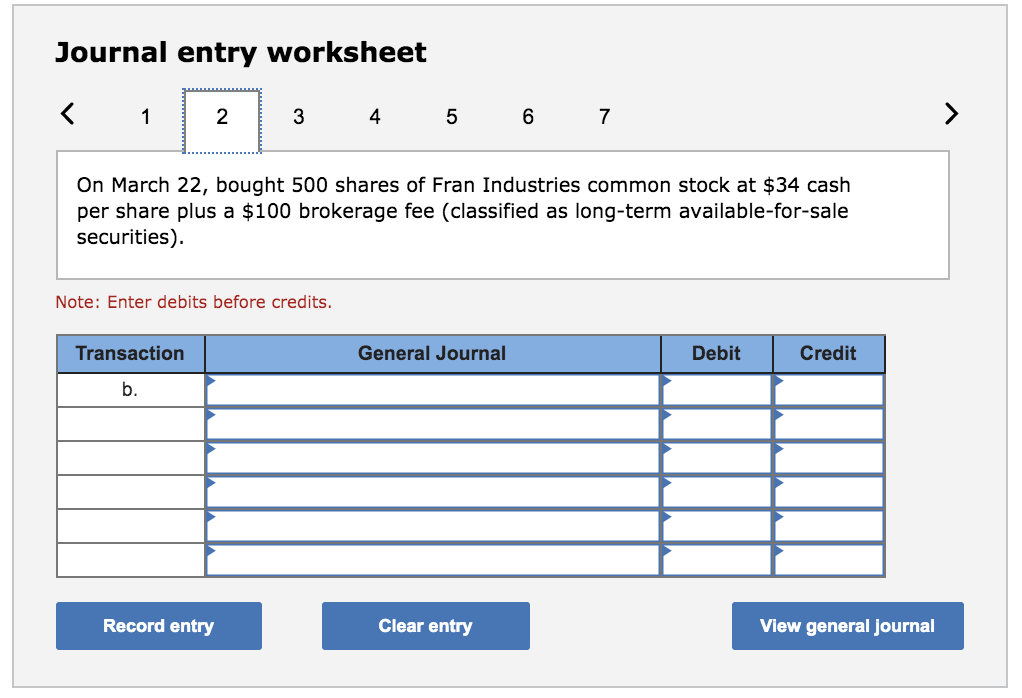

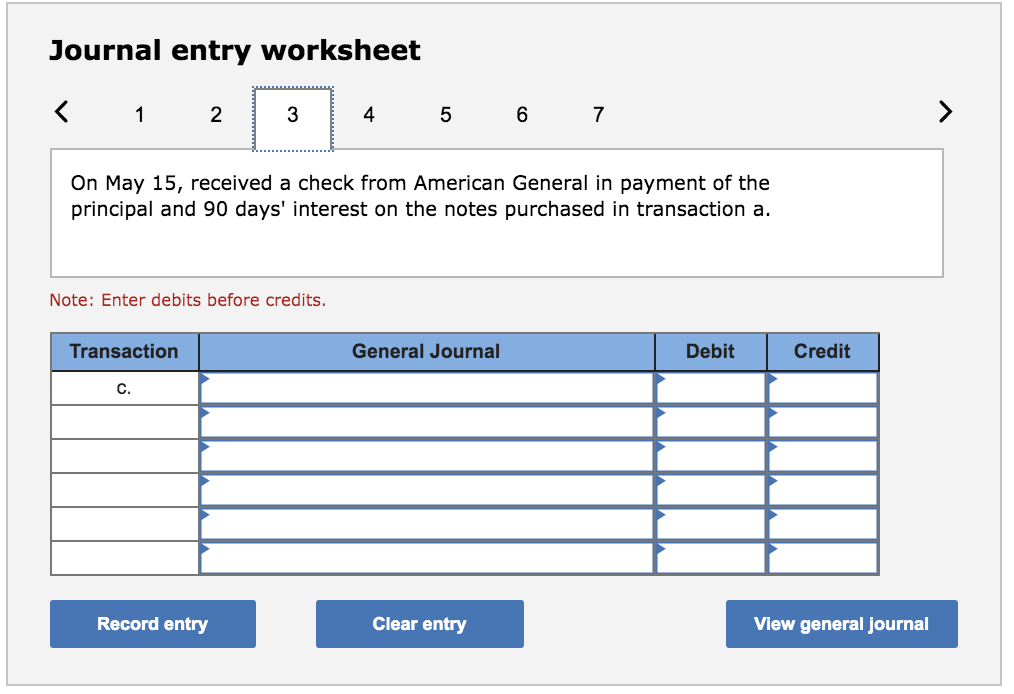

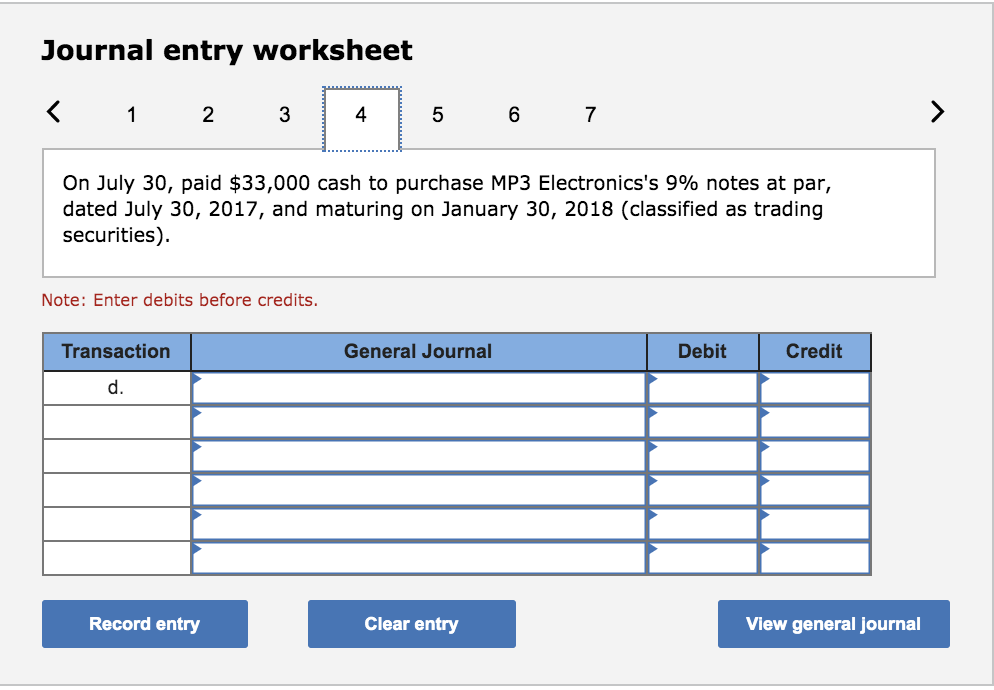

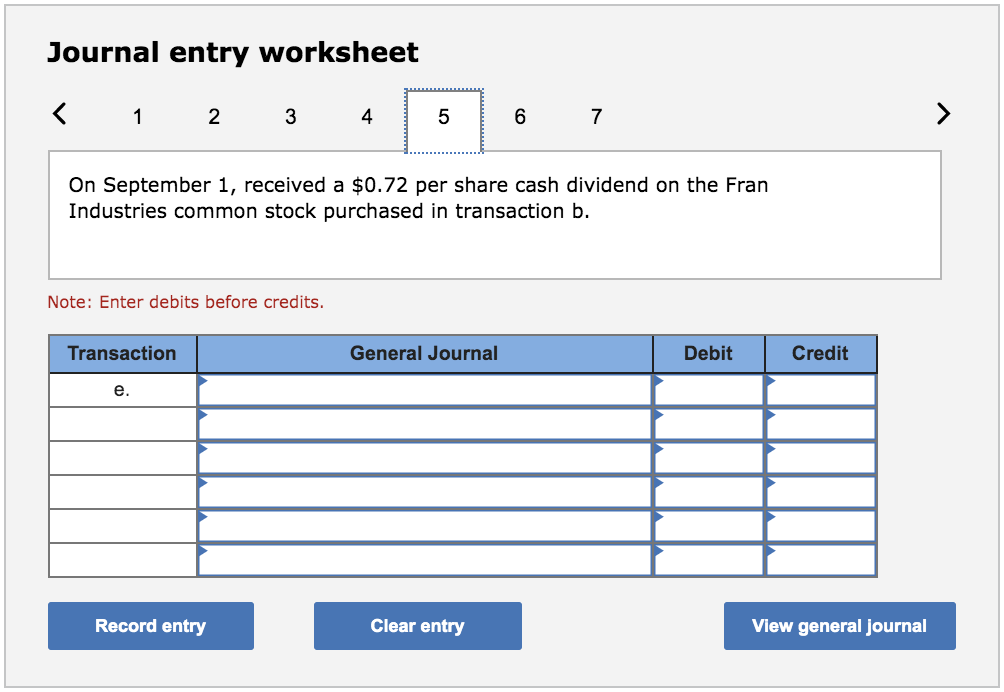

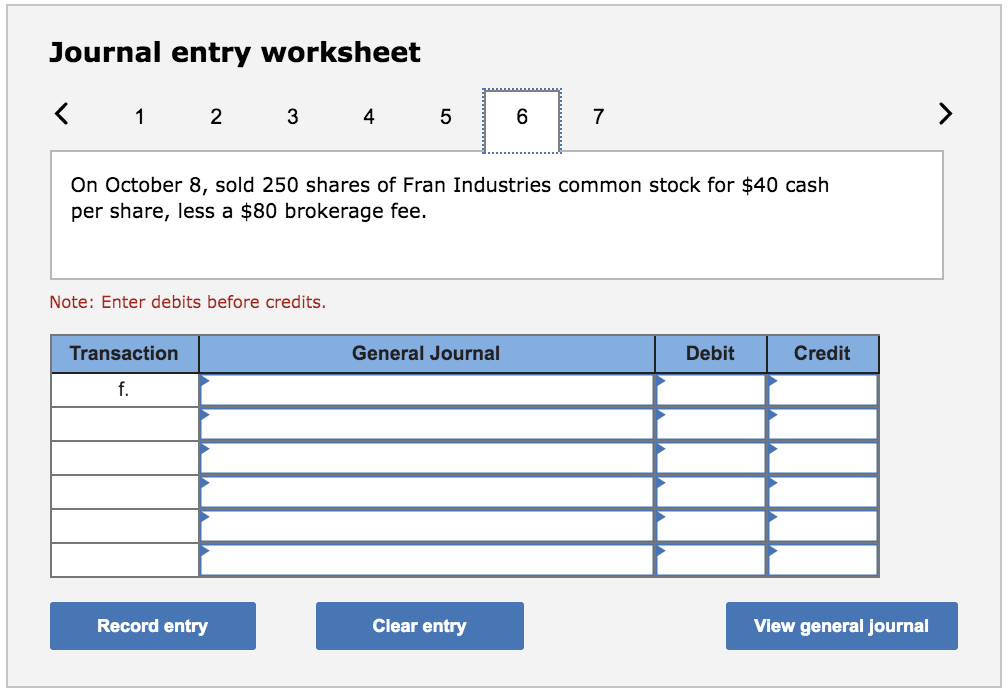

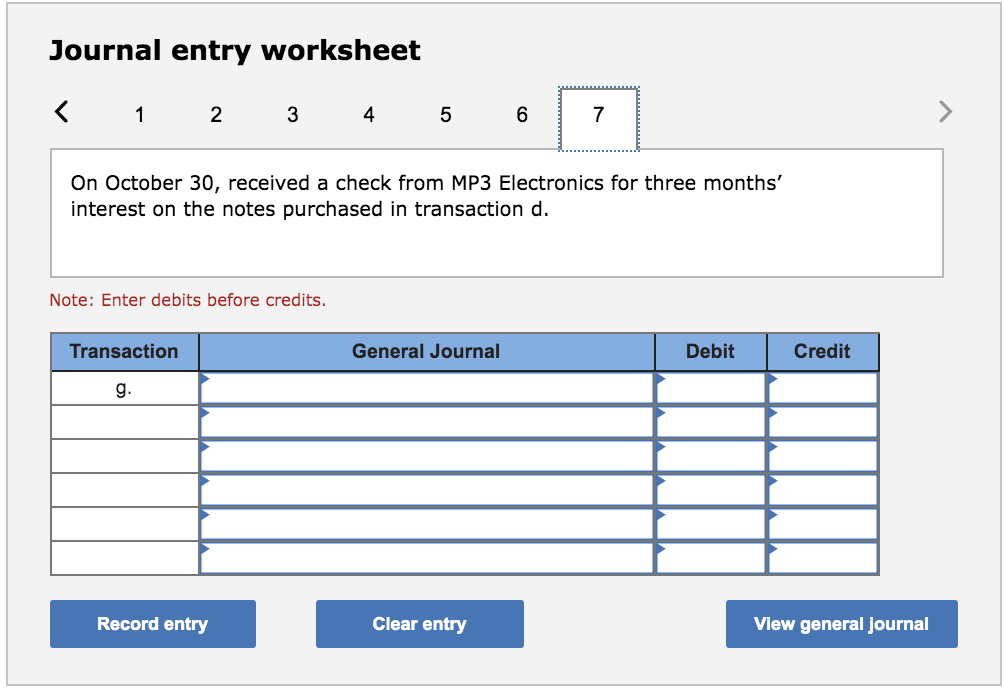

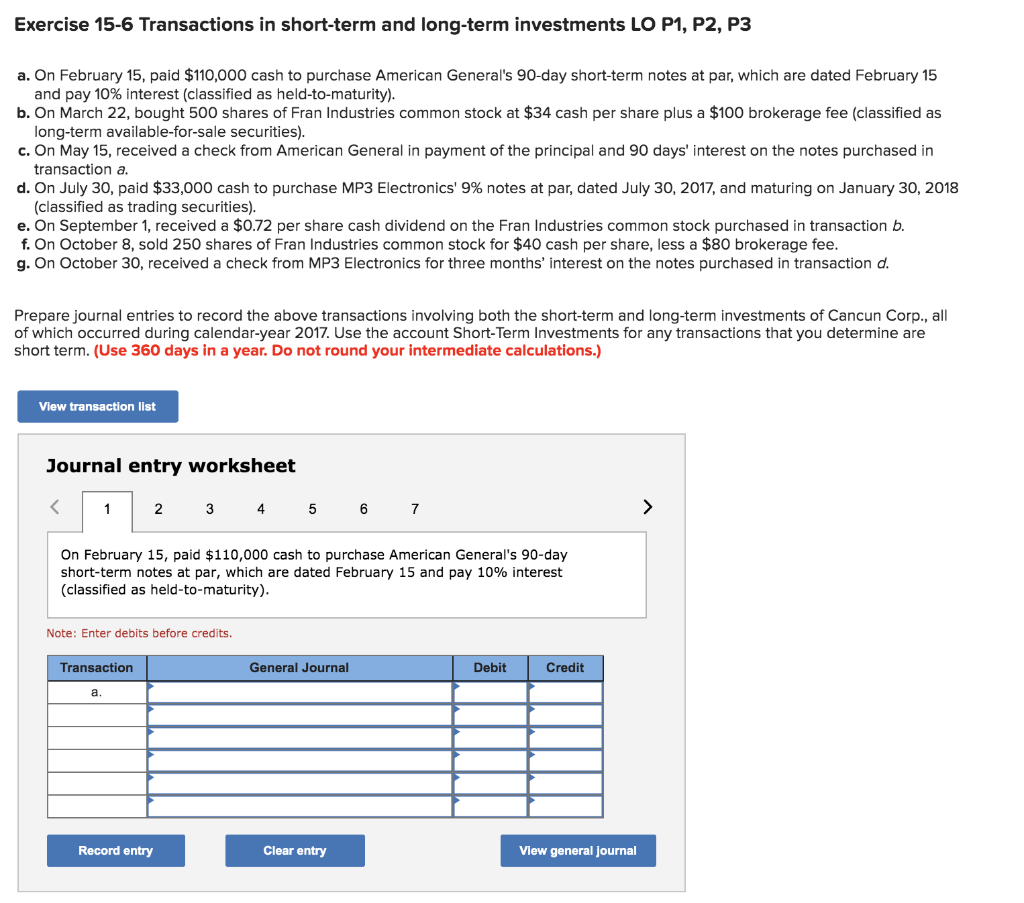

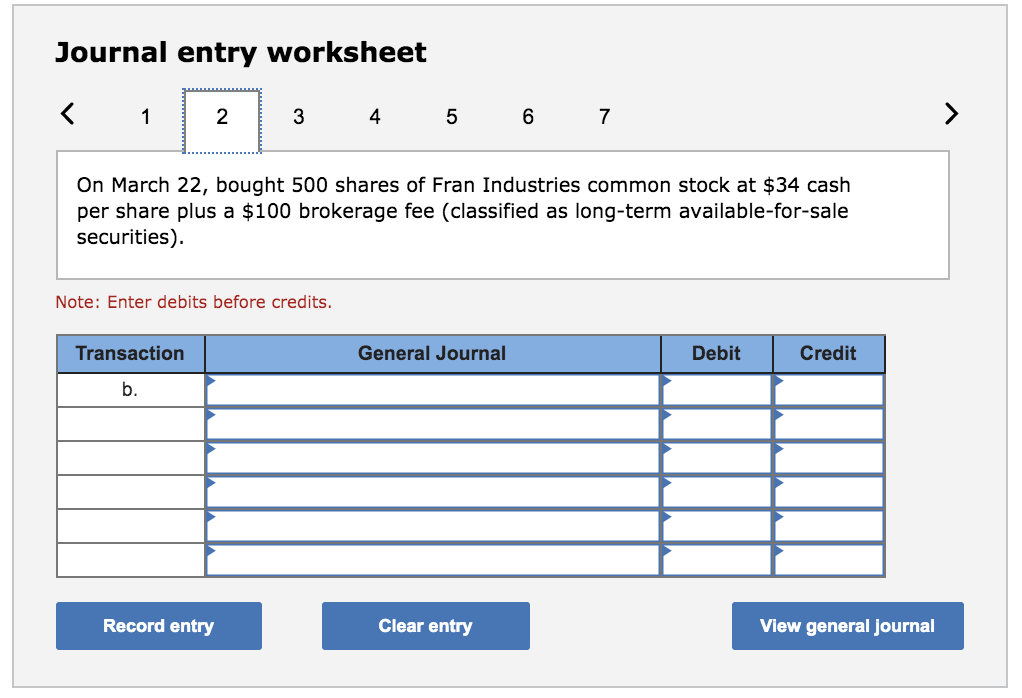

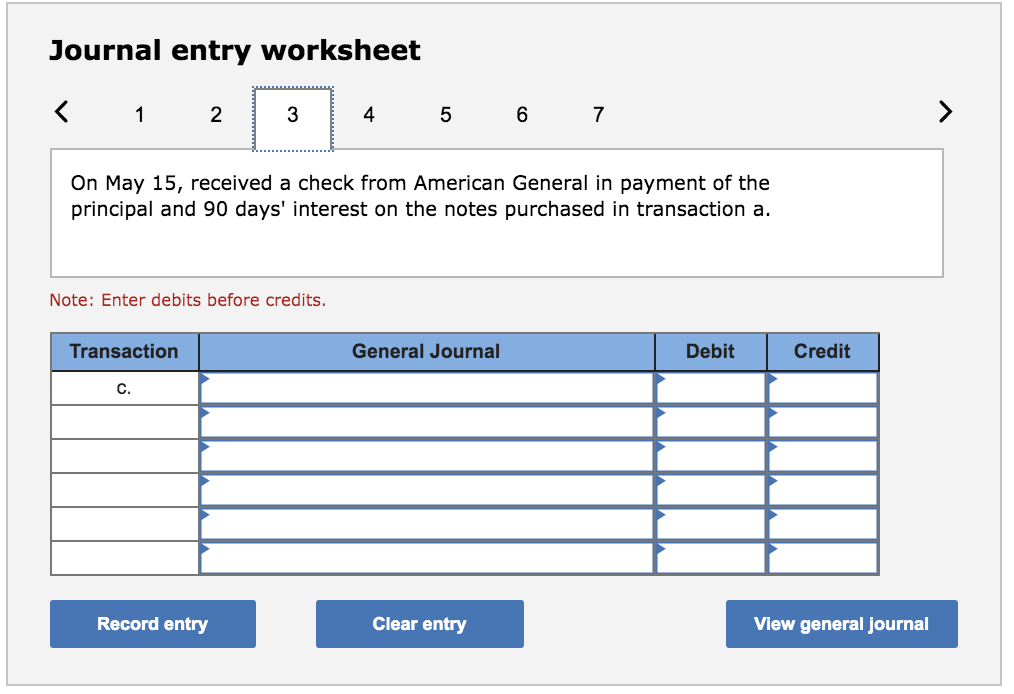

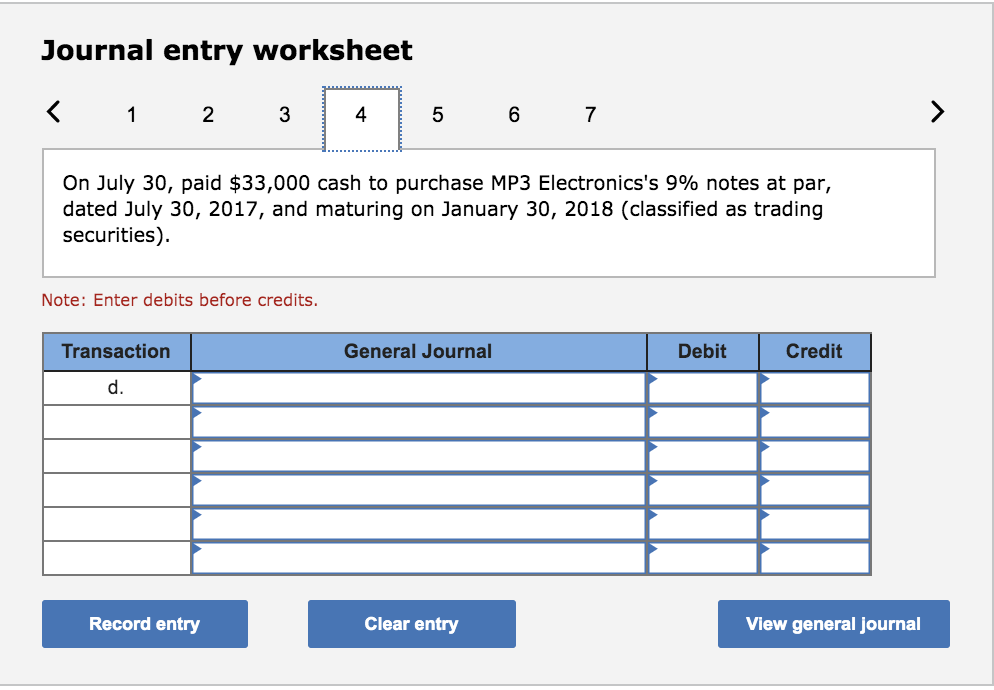

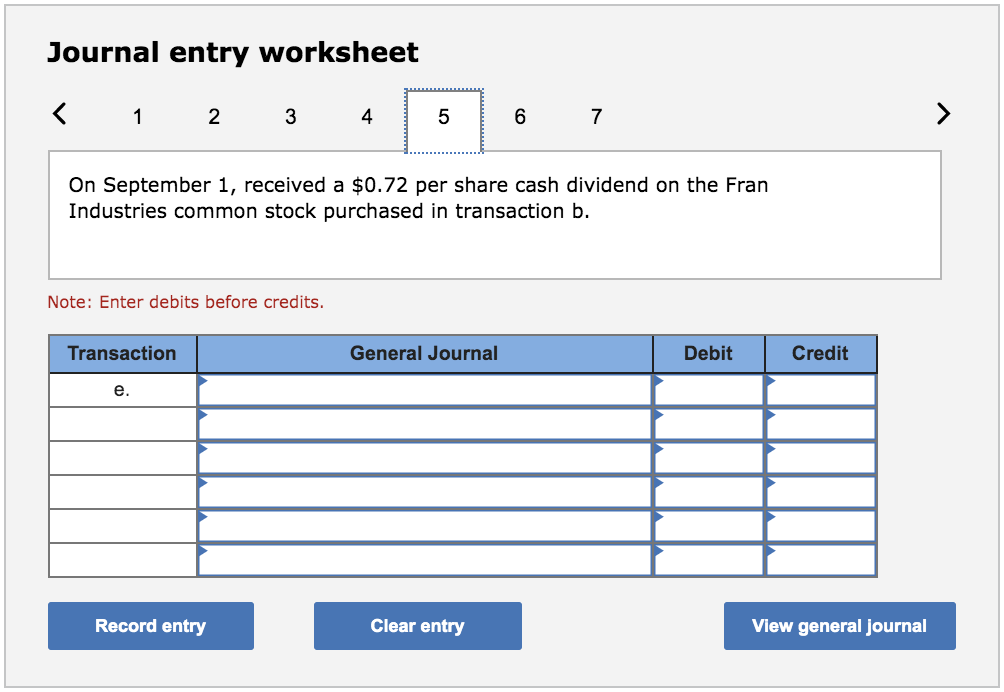

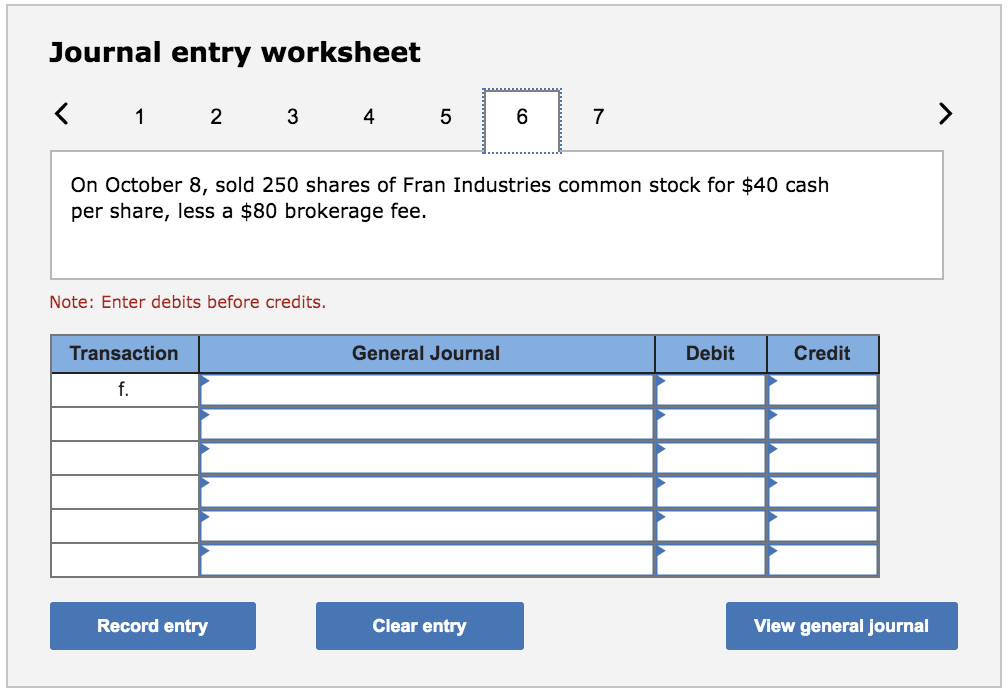

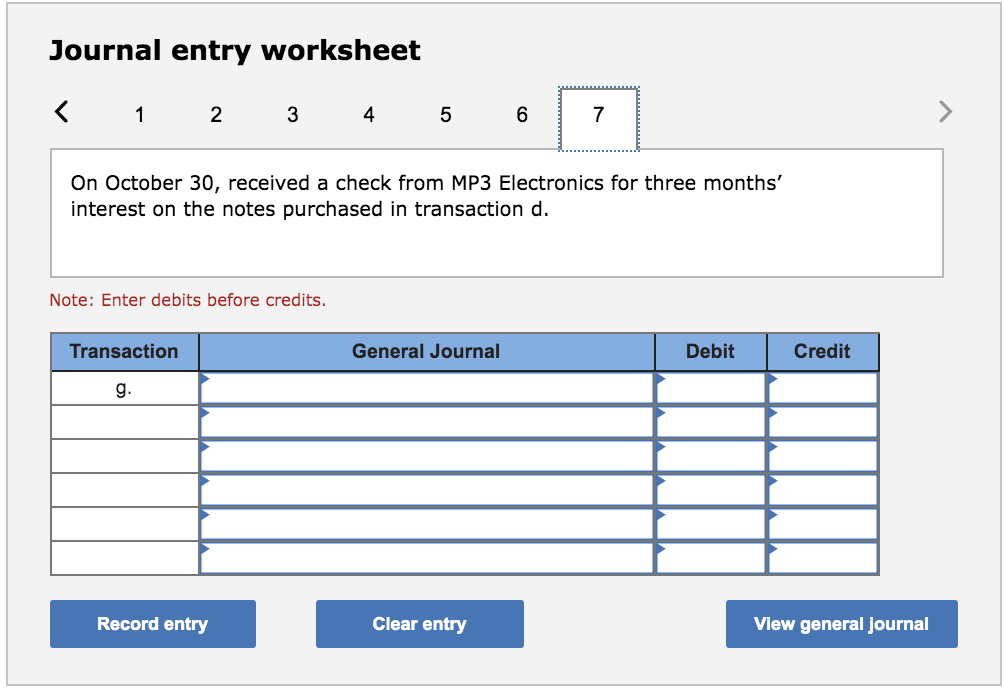

Exercise 15-6 Transactions in short-term and long-term investments LO P1, P2, P3 a. On February 15, paid $110,000 cash to purchase American General's 90-day short-term notes at par, which are dated February 15 and pay 10% interest (classified as held-to-maturity). b. On March 22, bought 500 shares of Fran Industries common stock at $34 cash per share plus a $100 brokerage fee (classified as long-term available-for-sale securities). c. On May 15, received a check from American General in payment of the principal and 90 days' interest on the notes purchased in transaction a. d. On July 30, paid $33,000 cash to purchase MP3 Electronics' 9% notes at par, dated July 30, 2017, and maturing on January 30, 2018 (classified as trading securities). e. On September 1, received a $0.72 per share cash dividend on the Fran Industries common stock purchased in transaction b. f. On October 8, sold 250 shares of Fran Industries common stock for $40 cash per share, less a $80 brokerage fee. g. On October 30, received a check from MP3 Electronics for three months' interest on the notes purchased in transaction d. Prepare journal entries to record the above transactions involving both the short-term and long-term investments of Cancun Corp., all of which occurred during calendar-year 2017. Use the account Short-Term Investments for any transactions that you determine are short term. (Use 360 days in a year. Do not round your intermediate calculations.) View transaction list Journal entry worksheet On February 15, paid $110,000 cash to purchase American General's 90-day short-term notes at par, which are dated February 15 and pay 10% interest (classified as held-to-maturity). Note: Enter debits before credits. Transaction General Journal Debit Credit a. Record entry Clear entry View general Journal Journal entry worksheet On March 22, bought 500 shares of Fran Industries common stock at $34 cash per share plus a $100 brokerage fee (classified as long-term available-for-sale securities). Note: Enter debits before credits. Transaction General Journal Debit Credit b. Record entry Clear entry View general journal Journal entry worksheet