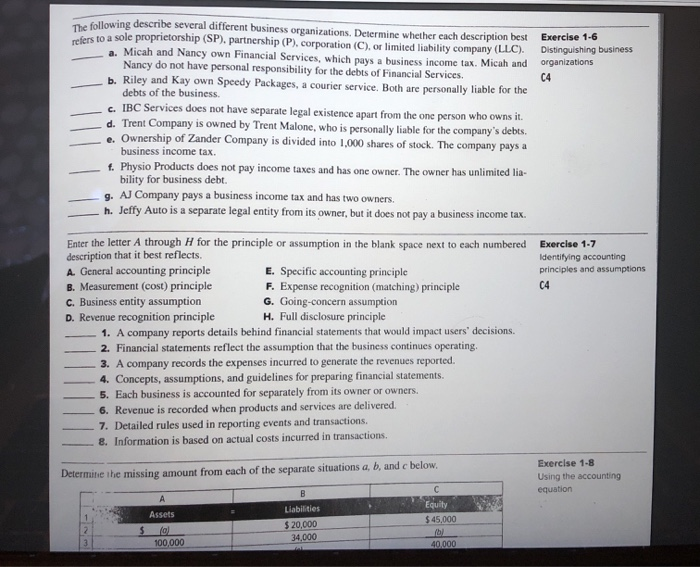

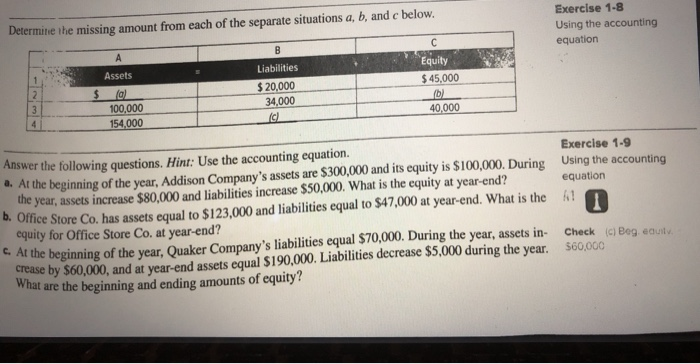

Exercise 1-6 Distinguishing business organizations The following describe several different business organizations. Determine whether cach description best refers to a sole proprietorship (SP), partnership (P), corporation (C), or limited liability company (LLC). a. Micah and Nancy own Financial Services, which pays a business income tax. Micah and Nancy do not have personal responsibility for the debts of Financial Services. b. Riley and Kay own Speedy Packages, a courier service. Both are personally liable for the debts of the business. c. IBC Services does not have separate legal existence apart from the one person who owns it. d. Trent Company is owned by Trent Malone, who is personally liable for the company's debts. e. Ownership of Zander Company is divided into 1,000 shares of stock. The company pays a business income tax. f. Physio Products does not pay income taxes and has one owner. The owner has unlimited lia- bility for business debt. 9. AJ Company pays a business income tax and has two owners. h. Jeffy Auto is a separate legal entity from its owner, but it does not pay a business income tax. Exercise 1-7 Identifying accounting principles and assumptions Enter the letter A through H for the principle or assumption in the blank space next to each numbered description that it best reflects. A. General accounting principle E. Specific accounting principle B. Measurement (cost) principle F. Expense recognition (matching) principle C. Business entity assumption G. Going-concern assumption D. Revenue recognition principle H. Full disclosure principle 1. A company reports details behind financial statements that would impact users' decisions. 2. Financial statements reflect the assumption that the business continues operating 3. A company records the expenses incurred to generate the revenues reported 4. Concepts, assumptions, and guidelines for preparing financial statements. 5. Each business is accounted for separately from its owner or owners. 6. Revenue is recorded when products and services are delivered 7. Detailed rules used in reporting events and transactions. 8. Information is based on actual costs incurred in transactions Determine the missing amount from each of the separate situations a, b, and c below. Exercise 1-8 Using the accounting equation Assets Liabilities $ 20,000 34.000 Equity $ 45,000 100,000 40,000 Determine the missing amount from each of the separate situations a, b, and c below. Exercise 1-8 Using the accounting equation Assets Equity Liabilities $ 20,000 34,000 100,000 154,000 $ 45,000 D 40,000 Answer the following questions. Hint: Use the accounting equation. Exercise 1-9 At the beginning of the year, Addison Company's assets are $300,000 and its equity is $100,000. During Using the accounting the year, assets increase $80,000 and liabilities increase $50,000. What is the equity at year-end? equation . Office Store Co. has assets equal to $123.000 and liabilities equal to $47,000 at year-end. What is the 41 equity for Office Store Co, at year-end? At the beginning of the year, Quaker Company's liabilities equal $70,000. During the year, assets in Check icBog out crease by $60,000, and at year-end assets equal $190,000. Liabilities decrease $5,000 during the year. $60,000 What are the beginning and ending amounts of equity? Exercise 1-6 Distinguishing business organizations The following describe several different business organizations. Determine whether cach description best refers to a sole proprietorship (SP), partnership (P), corporation (C), or limited liability company (LLC). a. Micah and Nancy own Financial Services, which pays a business income tax. Micah and Nancy do not have personal responsibility for the debts of Financial Services. b. Riley and Kay own Speedy Packages, a courier service. Both are personally liable for the debts of the business. c. IBC Services does not have separate legal existence apart from the one person who owns it. d. Trent Company is owned by Trent Malone, who is personally liable for the company's debts. e. Ownership of Zander Company is divided into 1,000 shares of stock. The company pays a business income tax. f. Physio Products does not pay income taxes and has one owner. The owner has unlimited lia- bility for business debt. 9. AJ Company pays a business income tax and has two owners. h. Jeffy Auto is a separate legal entity from its owner, but it does not pay a business income tax. Exercise 1-7 Identifying accounting principles and assumptions Enter the letter A through H for the principle or assumption in the blank space next to each numbered description that it best reflects. A. General accounting principle E. Specific accounting principle B. Measurement (cost) principle F. Expense recognition (matching) principle C. Business entity assumption G. Going-concern assumption D. Revenue recognition principle H. Full disclosure principle 1. A company reports details behind financial statements that would impact users' decisions. 2. Financial statements reflect the assumption that the business continues operating 3. A company records the expenses incurred to generate the revenues reported 4. Concepts, assumptions, and guidelines for preparing financial statements. 5. Each business is accounted for separately from its owner or owners. 6. Revenue is recorded when products and services are delivered 7. Detailed rules used in reporting events and transactions. 8. Information is based on actual costs incurred in transactions Determine the missing amount from each of the separate situations a, b, and c below. Exercise 1-8 Using the accounting equation Assets Liabilities $ 20,000 34.000 Equity $ 45,000 100,000 40,000 Determine the missing amount from each of the separate situations a, b, and c below. Exercise 1-8 Using the accounting equation Assets Equity Liabilities $ 20,000 34,000 100,000 154,000 $ 45,000 D 40,000 Answer the following questions. Hint: Use the accounting equation. Exercise 1-9 At the beginning of the year, Addison Company's assets are $300,000 and its equity is $100,000. During Using the accounting the year, assets increase $80,000 and liabilities increase $50,000. What is the equity at year-end? equation . Office Store Co. has assets equal to $123.000 and liabilities equal to $47,000 at year-end. What is the 41 equity for Office Store Co, at year-end? At the beginning of the year, Quaker Company's liabilities equal $70,000. During the year, assets in Check icBog out crease by $60,000, and at year-end assets equal $190,000. Liabilities decrease $5,000 during the year. $60,000 What are the beginning and ending amounts of equity