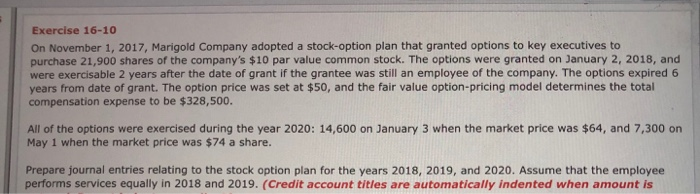

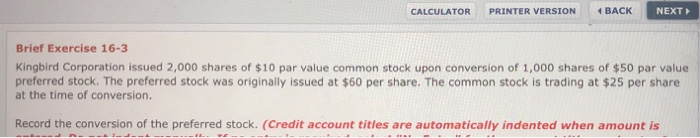

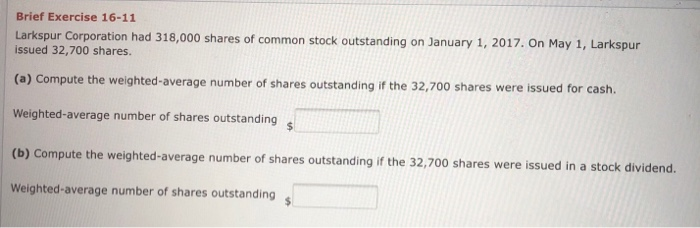

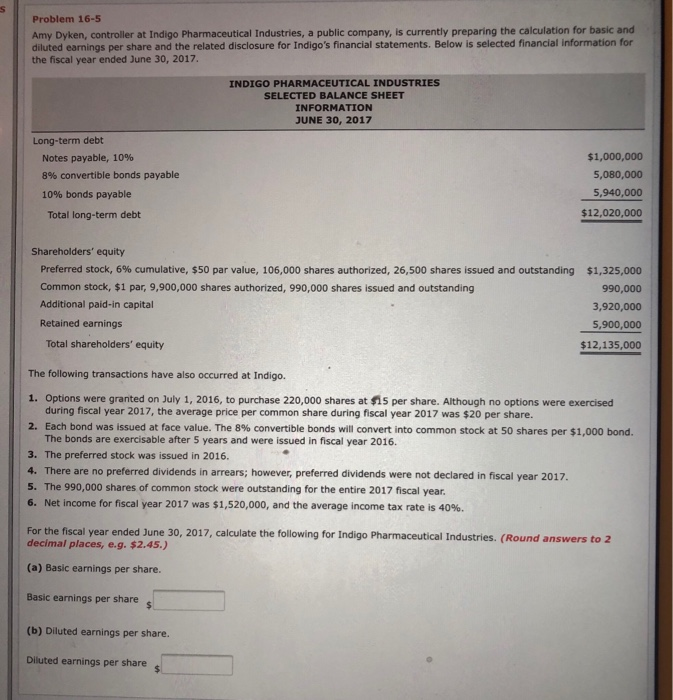

Exercise 16-10 On November 1, 2017, Marigold Company adopted a stock-option plan that granted options to key executives to purchase 21,900 shares of the company's $10 par value common stock. The options were granted on January 2, 2018, and were exercisable 2 years after the date of grant if the grantee was still an employee of the company. The options expired 6 years from date of grant. The option price was set at $50, and the fair value option-pricing model determines the total compensation expense to be $328,500. All of the options were exercised during the year 2020: 14,600 on January 3 when the market price was $64, and 7,300 on May 1 when the market price was $74 a share. Prepare journal entries relating to the stock option plan for the years 2018, 2019, and 2020. Assume that the employee performs services equally in 2018 and 2019. (Credit account titles are automatically indented when amount is CALCULATOR PRINTER VERSION 4 BACK NEXT Brief Exercise 16-3 Kingbird Corporation issued 2,000 shares of $10 par value common stock upon conversion of 1,000 shares of $50 par value preferred stock. The preferred stock was originally issued at $60 per share. The common stock is trading at $25 per share at the time of conversion. Record the conversion of the preferred stock. (Credit account titles are automatically indented when amount is Brief Exercise 16-11 Larkspur Corporation had 318,000 shares of common stock outstanding on January 1, 2017. On May 1, Larkspur issued 32,700 shares. (a) Compute the weighted-average number of shares outstanding if the 32,700 shares were issued for cash. Weighted-average number of shares outstanding (b) Compute the weighted-average number of shares outstanding if the 32,700 shares were issued in a stock dividend. Weighted-average number of shares outstanding Problem 16-5 Amy Dyken, controller at Indigo Pharmaceutical Industries, a public company, is currently preparing the calculation for basic and diluted earnings per share and the related disclosure for Indigo's financial statements. Below is selected financial information for the fiscal year ended June 30, 2017. INDIGO PHARMACEUTICAL INDUSTRIES SELECTED BALANCE SHEET INFORMATION JUNE 30, 2017 Long-term debt Notes payable, 1096 8% convertible bonds payable 10% bonds payable $1,000,000 5,080,000 5,940,000 $12,020,000 Total long-term debt Shareholders' equity Preferred stock, 6% cumulative, $50 par value, 106,000 shares authorized, 26,500 shares issued and outstanding $1,325,000 990,000 3,920,000 5,900,000 $12,135,000 Common stock, $1 par, 9,900,000 shares authorized, 990,000 shares issued and outstanding Additional paid-in capital Retained earnings Total shareholders' equity The following transactions have also occurred at Indigo. 1. Options were granted on July 1, 2016, to purchase 220,000 shares at $i5 per share. Although no options were exercised during fiscal year 2017, the average price per common share during fiscal year 2017 was $20 per share. 2. Each bond was issued at face value. The 8% convertible bonds will convert into common stock at 50 shares per $1,000 bond. The bonds are exercisable after 5 years and were issued in fiscal year 2016. 3. The preferred stock was issued in 2016. 4. There are no preferred dividends in arrears; however, preferred dividends were not declared in fiscal year 2017. 5. The 990,000 shares of common stock were outstanding for the entire 2017 fiscal year. | 6. Net income for fiscal year 2017 was $1,520,000, and the average income tax rate is 40%. For the fiscal year ended June 30, 2017, calculate the following for Indigo Pharmaceutical Industries. (Round answers to 2 decimal places, e.g. $2.45.) (a) Basic earnings per share. Basic earnings per share (b) Diluted earnings per share. Diluted earnings per share s