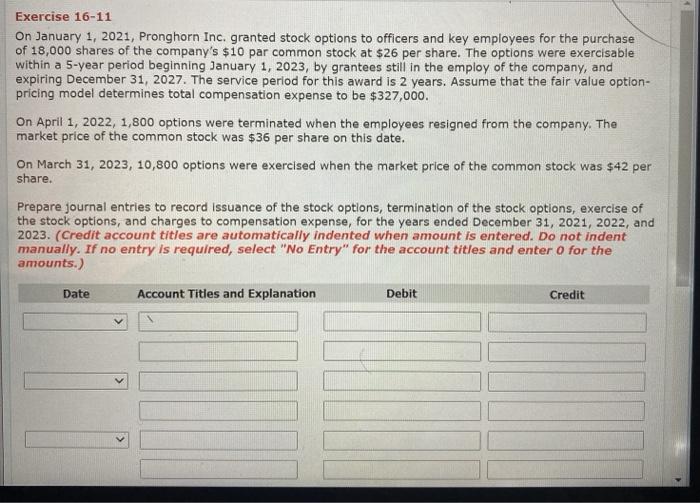

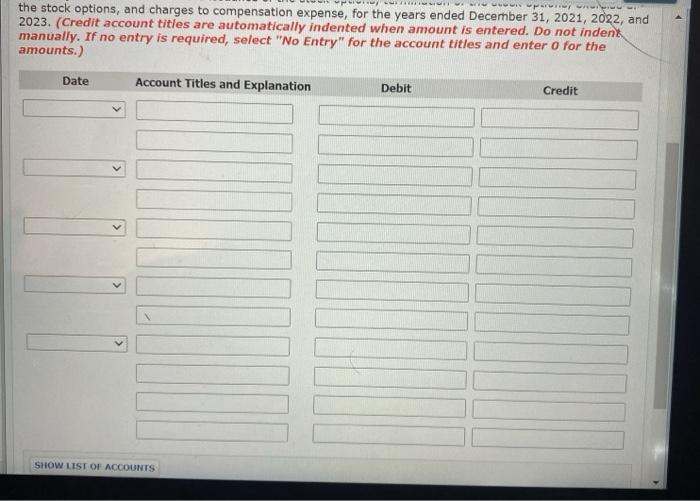

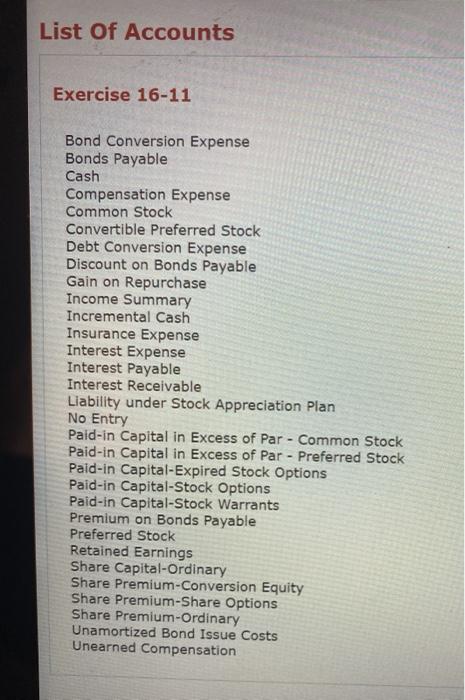

Exercise 16-11 On January 1, 2021, Pronghorn Inc. granted stock options to officers and key employees for the purchase of 18,000 shares of the company's $10 par common stock at $26 per share. The options were exercisable within a 5-year period beginning January 1, 2023, by grantees still in the employ of the company, and expiring December 31, 2027. The service period for this award is 2 years. Assume that the fair value option- pricing model determines total compensation expense to be $327,000. On April 1, 2022, 1,800 options were terminated when the employees resigned from the company. The market price of the common stock was $36 per share on this date. On March 31, 2023, 10,800 options were exercised when the market price of the common stock was $42 per share. Prepare journal entries to record issuance of the stock options, termination of the stock options, exercise of the stock options, and charges to compensation expense, for the years ended December 31, 2021, 2022, and 2023. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter o for the amounts.) Date Account Titles and Explanation Debit Credit MA the stock options, and charges to compensation expense, for the years ended December 31, 2021, 2022, and 2023. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter o for the amounts.) Date Account Titles and Explanation Debit Credit SHOW LIST OF ACCOUNTS List of Accounts Exercise 16-11 Bond Conversion Expense Bonds Payable Cash Compensation Expense Common Stock Convertible Preferred Stock Debt Conversion Expense Discount on Bonds Payable Gain on Repurchase Income Summary Incremental Cash Insurance Expense Interest Expense Interest Payable Interest Receivable Liability under Stock Appreciation Plan No Entry Paid-in Capital in Excess of Par - Common Stock Paid-in Capital in Excess of Par - Preferred Stock Pald-in Capital-Expired Stock Options Paid-in Capital-Stock Options Paid-in Capital-Stock Warrants Premium on Bonds Payable Preferred Stock Retained Earnings Share Capital-Ordinary Share Premium-Conversion Equity Share Premium-Share Options Share Premium-Ordinary Unamortized Bond Issue Costs Unearned Compensation