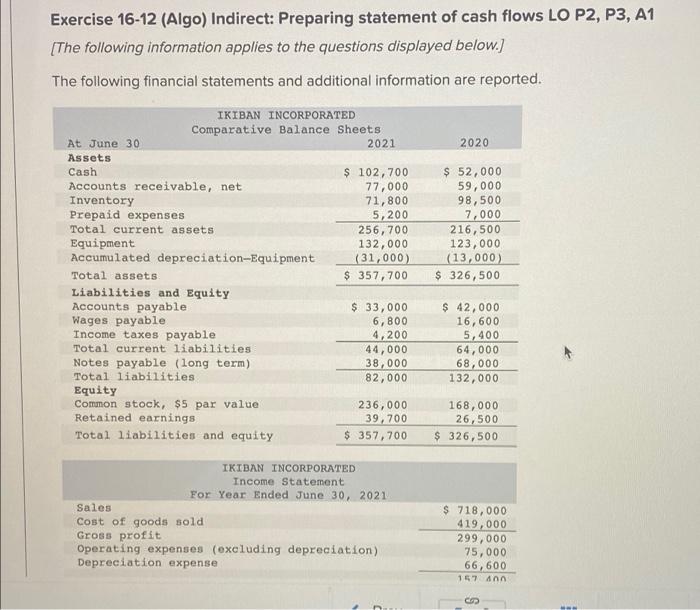

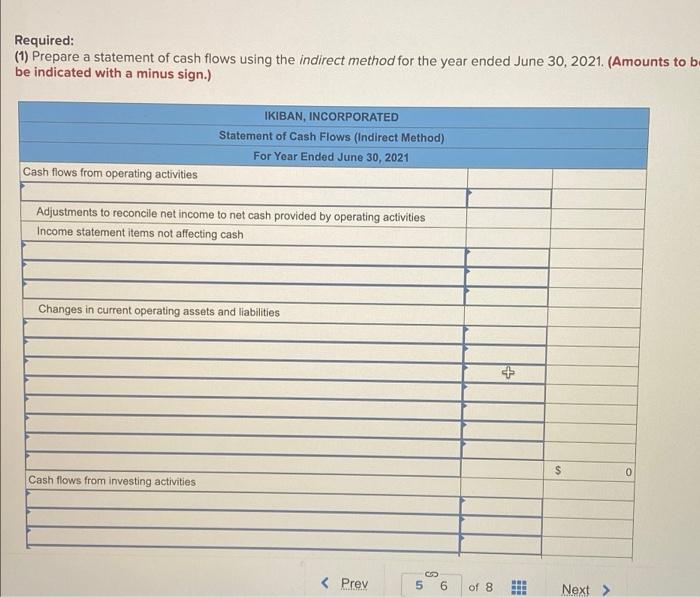

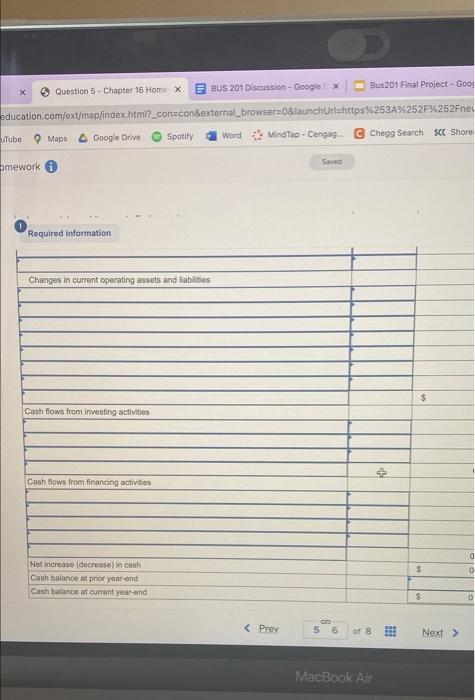

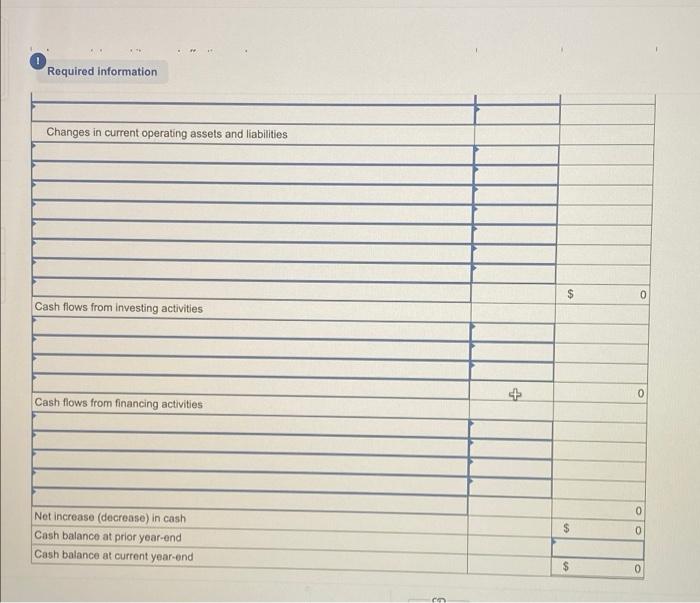

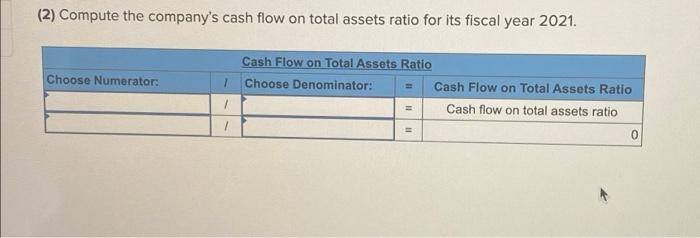

Exercise 16-12 (Algo) Indirect: Preparing statement of cash flows LO P2, P3, A1 (The following information applies to the questions displayed below.) The following financial statements and additional information are reported. 2020 IKIBAN INCORPORATED Comparative Balance Sheets At June 30 2021 Assets Cash $ 102,700 Accounts receivable, net 77,000 Inventory 71,800 Prepaid expenses 5,200 Total current assets 256, 700 Equipment 132,000 Accumulated depreciation-Equipment (31,000) Total assets $ 357,700 Liabilities and Equity Accounts payable $ 33,000 Wages payable 6,800 Income taxes payable 4,200 Total current liabilities 44,000 Notes payable (long term) 38,000 Total liabilities 82,000 Equity Common stock, $5 par value 236,000 Retained earnings 39,700 Total liabilities and equity $ 357, 700 $ 52,000 59,000 98,500 7,000 216,500 123,000 (13,000) $ 326,500 $ 42,000 16,600 5,400 64,000 68,000 132,000 168,000 26,500 $ 326,500 IKIBAN INCORPORATED Income Statement For Year Ended June 30, 2021 Sales Cost of goods sold Gross profit Operating expenses (excluding depreciation) Depreciation expense $ 718,000 419,000 299,000 75,000 66,600 157 Ann Required: (1) Prepare a statement of cash flows using the indirect method for the year ended June 30, 2021. (Amounts to be be indicated with a minus sign.) IKIBAN, INCORPORATED Statement of Cash Flows (Indirect Method) For Year Ended June 30, 2021 Cash flows from operating activities Adjustments to reconcile net income to net cash provided by operating activities Income statement items not affecting cash Changes in current operating assets and liabilities + $ 0 Cash flows from investing activities OD Question 5 - Chapter 16 Home X BUS 201 Discussion - Google Bus201 Final Project - Goog education.com/ext/map/index.html?_con=con&external_browser=0&launchuriahttps%253A%252F%252Fnel Tube Maps Google Drive Spotify Word MindTap-Cengag chegg Search sc Shore Saved pmework Required information Changes in current operating assets and liabilities $ Cash flows from investing activities Cash flows from financing activities $ 0 Net increase (decreaso) in cash Cash balance at prior year-end Cash balance at current year-end S MacBook Air Required information Changes in current operating assets and liabilities $ 0 Cash flows from investing activities 0 Cash flows from financing activities 0 Not increase (decrease) in cash Cash balance at prior year-end Cash balance at current year-end 0 $ 0 en (2) Compute the company's cash flow on total assets ratio for its fiscal year 2021. Choose Numerator: Cash Flow on Total Assets Ratio Choose Denominator: Cash Flow on Total Assets Ratio Cash flow on total assets ratio 11 0 Exercise 16-12 (Algo) Indirect: Preparing statement of cash flows LO P2, P3, A1 (The following information applies to the questions displayed below.) The following financial statements and additional information are reported. 2020 IKIBAN INCORPORATED Comparative Balance Sheets At June 30 2021 Assets Cash $ 102,700 Accounts receivable, net 77,000 Inventory 71,800 Prepaid expenses 5,200 Total current assets 256, 700 Equipment 132,000 Accumulated depreciation-Equipment (31,000) Total assets $ 357,700 Liabilities and Equity Accounts payable $ 33,000 Wages payable 6,800 Income taxes payable 4,200 Total current liabilities 44,000 Notes payable (long term) 38,000 Total liabilities 82,000 Equity Common stock, $5 par value 236,000 Retained earnings 39,700 Total liabilities and equity $ 357, 700 $ 52,000 59,000 98,500 7,000 216,500 123,000 (13,000) $ 326,500 $ 42,000 16,600 5,400 64,000 68,000 132,000 168,000 26,500 $ 326,500 IKIBAN INCORPORATED Income Statement For Year Ended June 30, 2021 Sales Cost of goods sold Gross profit Operating expenses (excluding depreciation) Depreciation expense $ 718,000 419,000 299,000 75,000 66,600 157 Ann Required: (1) Prepare a statement of cash flows using the indirect method for the year ended June 30, 2021. (Amounts to be be indicated with a minus sign.) IKIBAN, INCORPORATED Statement of Cash Flows (Indirect Method) For Year Ended June 30, 2021 Cash flows from operating activities Adjustments to reconcile net income to net cash provided by operating activities Income statement items not affecting cash Changes in current operating assets and liabilities + $ 0 Cash flows from investing activities OD Question 5 - Chapter 16 Home X BUS 201 Discussion - Google Bus201 Final Project - Goog education.com/ext/map/index.html?_con=con&external_browser=0&launchuriahttps%253A%252F%252Fnel Tube Maps Google Drive Spotify Word MindTap-Cengag chegg Search sc Shore Saved pmework Required information Changes in current operating assets and liabilities $ Cash flows from investing activities Cash flows from financing activities $ 0 Net increase (decreaso) in cash Cash balance at prior year-end Cash balance at current year-end S MacBook Air Required information Changes in current operating assets and liabilities $ 0 Cash flows from investing activities 0 Cash flows from financing activities 0 Not increase (decrease) in cash Cash balance at prior year-end Cash balance at current year-end 0 $ 0 en (2) Compute the company's cash flow on total assets ratio for its fiscal year 2021. Choose Numerator: Cash Flow on Total Assets Ratio Choose Denominator: Cash Flow on Total Assets Ratio Cash flow on total assets ratio 11 0