Question

Exercise 16-18 (Algo) Change in tax rates; calculate taxable income [LO16-2, 16-6] Arnold Industries has pretax accounting income of $64 million for the year ended

Exercise 16-18 (Algo) Change in tax rates; calculate taxable income [LO16-2, 16-6]

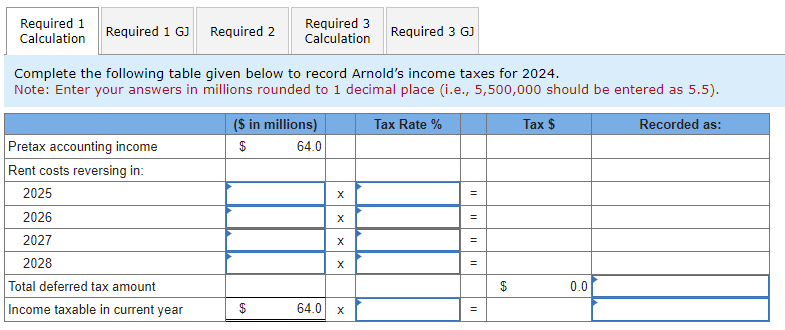

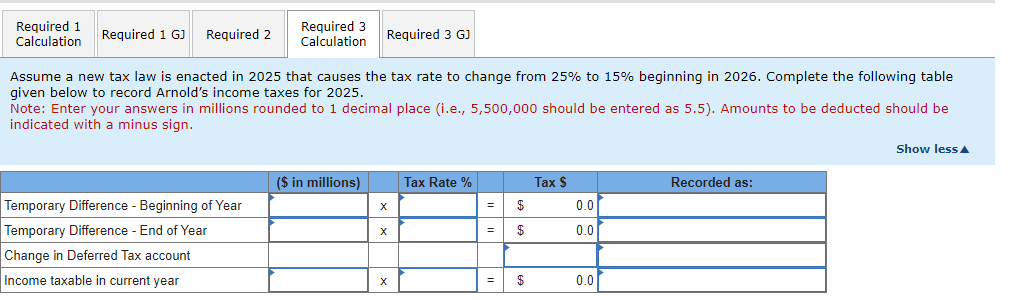

Arnold Industries has pretax accounting income of $64 million for the year ended December 31, 2024. The tax rate is 25%. The only difference between accounting income and taxable income relates to an operating lease in which Arnold is the lessee. The inception of the lease was December 28, 2024. An $40 million advance rent payment at the inception of the lease is tax-deductible in 2024 but, for financial reporting purposes, represents prepaid rent expense to be recognized equally over the four-year lease term.

#1:

#2: Record the income taxes for 2024.

#3: Record 2025 income taxes

#4:

#5: Record income taxes for 2025

#5: Record income taxes for 2025

Complete the following table given below to record Arnold's income taxes for 2024 . Note: Enter your answers in millions rounded to 1 decimal place (i.e., 5,500,000 should be entered as 5.5). Assume a new tax law is enacted in 2025 that causes the tax rate to change from 25% to 15% beginning in 2026. Complete the following table given below to record Arnold's income taxes for 2025. Note: Enter your answers in millions rounded to 1 decimal place (i.e., 5,500,000 should be entered as 5.5 ). Amounts to be deducted should be indicated with a minus sign

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started